Ethereum Surpasses Bitcoin in Growth Rate for the First Time Since 2024

The second-largest cryptocurrency by market capitalization has emerged as the leader in value growth among major cryptocurrencies, according to The Block.

Since the beginning of the year, Ethereum’s price has risen by 29%, reaching $4286 at the time of writing. During the same period, Bitcoin increased by 28% to $118,408, as reported by CoinGecko.

Why is Ethereum Growing?

The growth of Ethereum is driven by demand from corporate treasuries. Public companies are following Michael Saylor’s strategy, but instead of digital gold, they are accumulating the second-largest cryptocurrency by market cap.

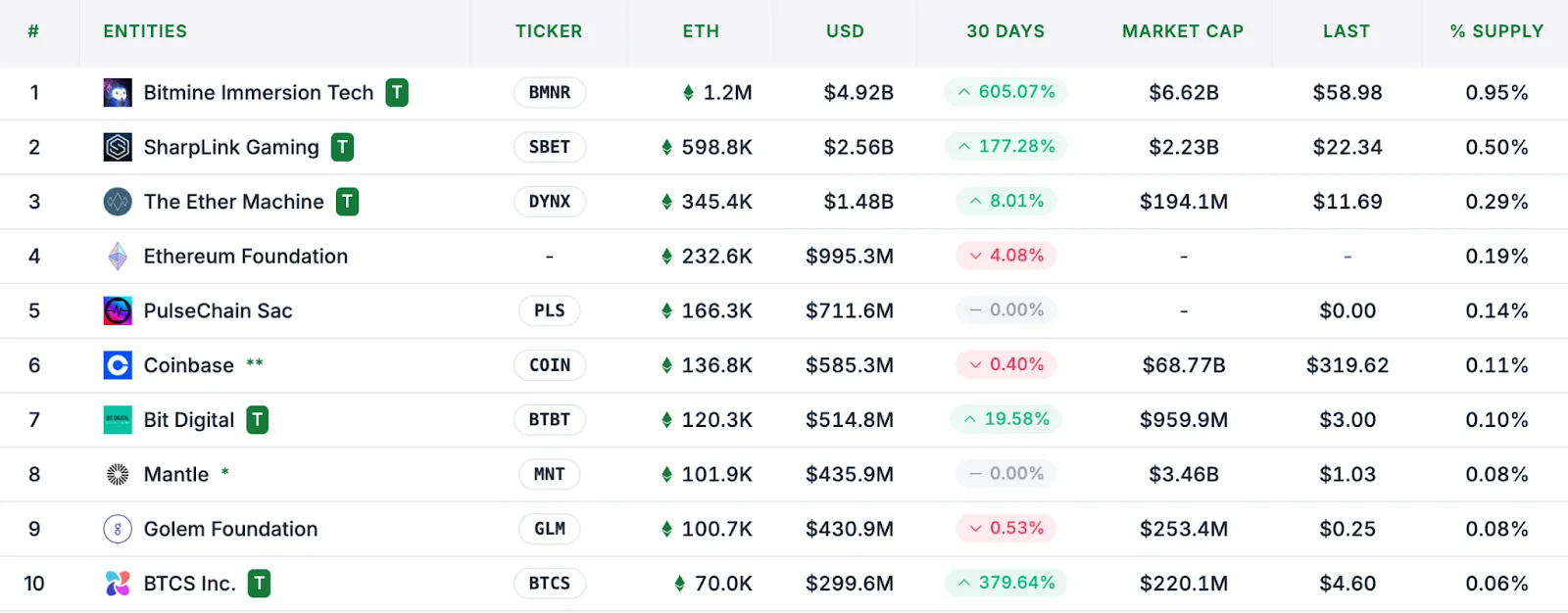

In the past week alone, firms have acquired 304,000 ETH worth $1.3 billion. They currently manage 3.4 million ETH valued at $14.9 billion, with the largest holder being BitMine Immersion Technologies.

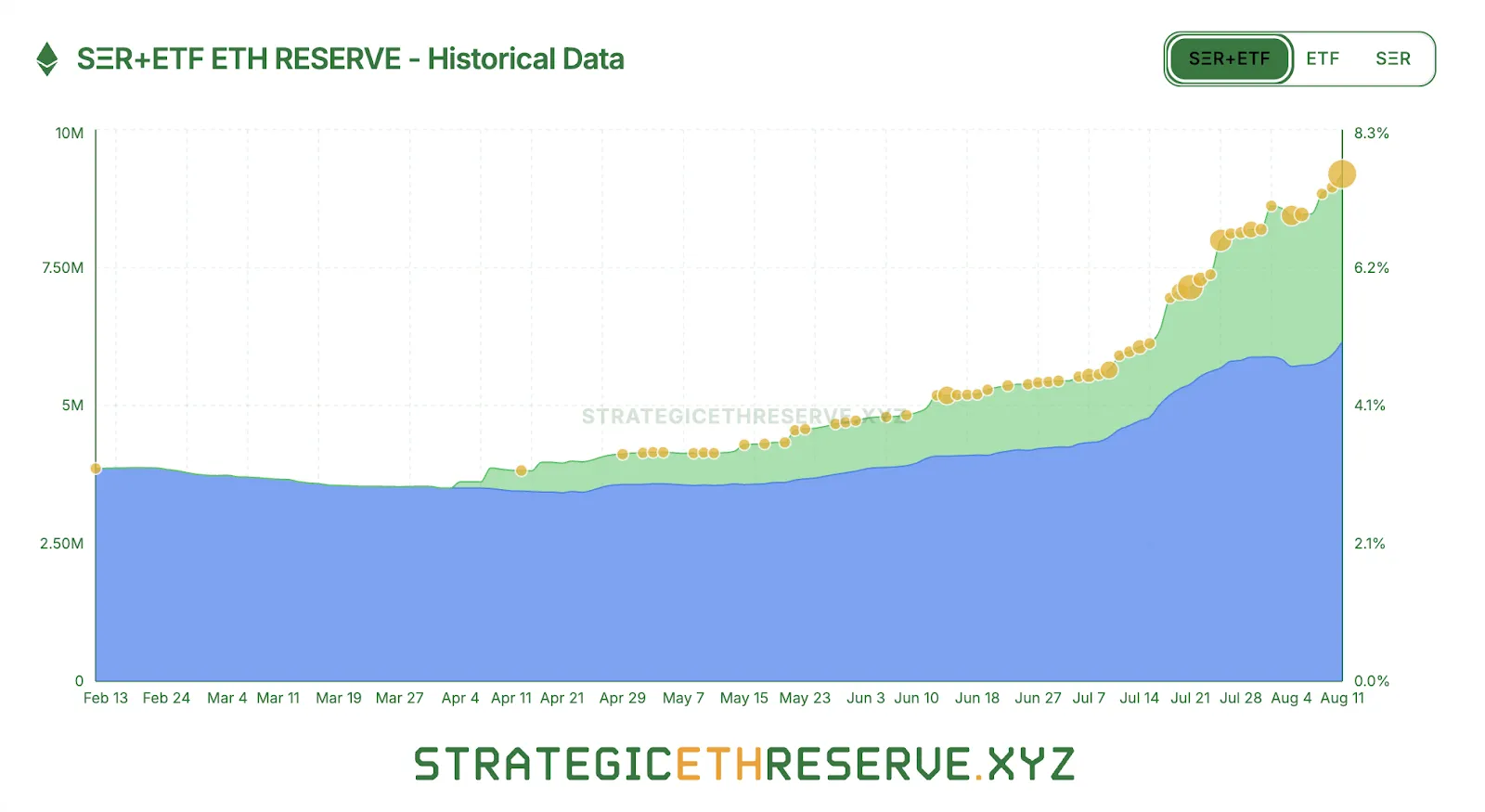

Another driver is spot Ethereum ETFs, which continue to show steady inflows and even surpass Bitcoin-based funds.

During the last trading session, Ethereum-based instruments attracted a record $1.02 billion. The total assets under management of ETH-ETFs have grown to $25.71 billion.

Corporate treasuries and exchange-traded funds now account for nearly 8% of the total supply of the second-largest cryptocurrency by market cap.

The hard forks Dencun and Pectra have also positively impacted Ethereum’s dynamics.

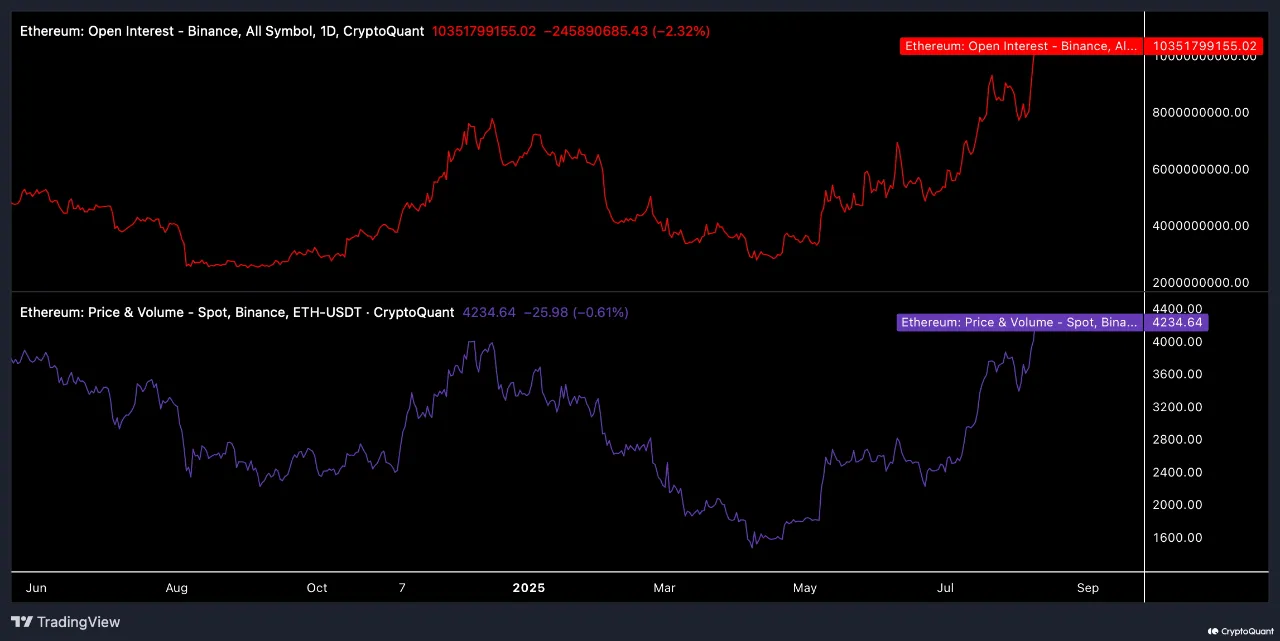

CryptoQuant analyst oininen_t reported that open interest in Ethereum-based instruments on Binance has reached $10 billion. Since November 2024, the volume of short positions has increased by 500%. In his view, if the current trend continues, it could lead to a sharp price increase.

Potential Correction

Analysts at Glassnode noted that short-term Ethereum holders are realizing profits more actively than long-term investors. They suggest this indicates increased expectations of a price pullback.

$ETH profit realization (7D SMA) peaked at $771M/day in July, above Dec ‘24 levels, and is now ramping up again at $553M/day. Profits from long-term holders match Dec ‘24 levels, but short-term investors are realizing far more gains, driving the current wave. pic.twitter.com/fsoBOrUTyF

— glassnode (@glassnode) August 11, 2025

Speculators are earning significant profits. The daily realized profit (7D SMA) reached $533 million, mainly due to short-term investors.

Long-term holders, who have not moved their Ethereum for more than 155 days, are realizing profits at December 2024 levels.

The cumulative metric remains 39% below the peak, which occurred in July when Ethereum’s price was around $3500.

According to Santiment, news of large institutional purchases could trigger FOMO. This, in turn, could temporarily slow Ethereum’s growth and reduce its value.

As reported, Bernstein analysts identified the main beneficiary of Ethereum’s growth.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!