How Celsius, 3AC and stETH Problems Could Shape Ethereum’s Price and the Crypto Market

The dust had just settled after the Terra collapse, and Celsius and the hedge fund Three Arrows Capital (3AC) are in the spotlight. Some experts say these big players are close to bankruptcy, which could affect the entire crypto market.

Alameda Research adds fuel to the fire. Alongside Celsius and 3AC, the firm is actively selling the stETH token, which has long since diverged from parity with Ethereum’s price.

All of this unfolds against a backdrop of a deep market correction , record-low readings of the Fear Index and mass layoffs at major crypto firms.

What connects Celsius, 3AC and stETH? How would their potential bankruptcy and the possible crash of the “staking Ether” affect the market? ForkLog investigates.

- Some experts observe that Celsius used high-risk investment strategies, allocating user funds into “experimental” DeFi protocols.

- Three Arrows Capital and Alameda Research exerted significant pressure on the stETH token, whose parity with Ethereum was shaken by Terra’s collapse.

- Further falls in the price of staking Ether could trigger cascades of liquidations that would weigh on the DeFi sector and the market at large.

The Celsius Snowball

The centralized crypto‑lending service Celsius in recent days has become the subject of heated debate. The platform paused withdrawals, exchanges and transfers between accounts, citing “extreme market conditions.”

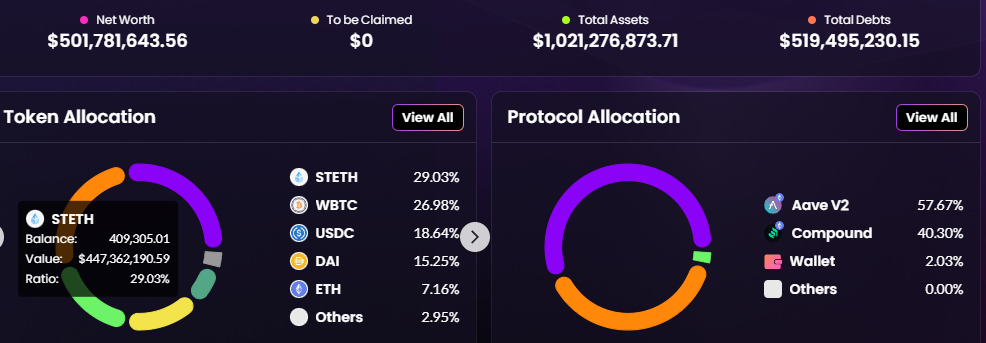

According to Ape Board, a tracker from Nansen, the firm holds 409,305 stETH in its wallet worth about $447 million.

Beyond “staking Ether,” a substantial portion of the portfolio (27% or $415 million) is allocated to the tokenized Bitcoin, WBTC.

More than half of Celsius’s assets under management are deployed in the DeFi protocol Aave. On another lending platform — Compound — 40% of total assets are deployed.

Analysts Johnny Lowey and Andy Hu of Huobi Research noted that Celsius had previously lost almost $71 million from staking stETH on the Swiss staking platform StakeHound after a private-key incident. In June 2021 the latter accused Fireblocks of loss of access.

“News outlets reported last week that, upon learning that investments were at risk, Celsius users began to redeem their positions. The withdrawal rate was high, around 50,000 ETH per week, which forced Celsius to sell other assets, such as stETH (in Lido staking), on secondary markets like Curve to obtain more liquidity.”

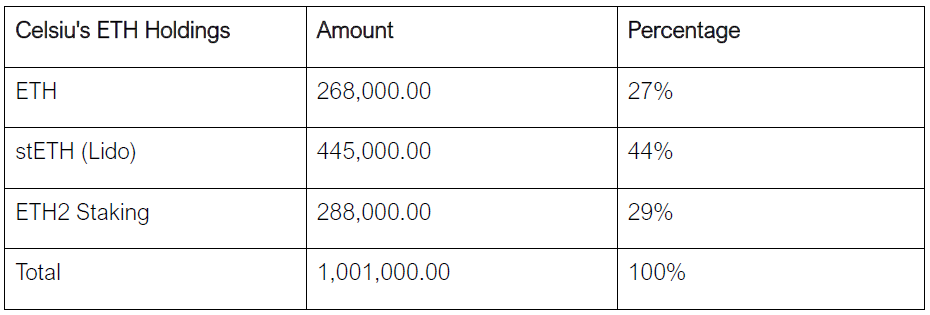

Researchers from Huobi Research claim that only 27% of the ETH in Celsius’s total holdings are liquid.

“Celsius was merely offloading stETH to buy ETH on the market to satisfy client demand,” said Noel Acheson of Genesis Global Trading in a conversation with CoinDesk.

Withdrawals and mass sales occurred during the Bitcoin price decline to around $20,000 and a fall in market capitalization to January 2021 levels.

Against this backdrop, Celsius’s native token CEL briefly fell to $0.09.

Shortly after, however, the price stabilized above $0.20, and then unexpectedly rebounded to around $0.50. In commenting on CEL’s rebound, the DeFiyst analyst noted that Celsius has reduced risk on debt positions on key lending platforms.

In MakerDAO they managed to push the liquidation price down to $14,000 per WBTC by repaying part of the debt in DAI.

Celsius also increased the ETH collateral on their stETH assets in the Aave protocol and repaid a debt of $2.4 million USDC.

DeFiyst noted the platform’s significant positions on Compound: 14,000 BTC and 87,000 ETH (about $420 million total). Meanwhile, the centralized crypto-lending service accounts for 47% of all borrowed DAI in the protocol and 25% of USDC.

According to The Wall Street Journal, Celsius hired lawyers from Akin Gump Strauss Hauer & Feld for a possible restructuring. However, initially the platform is seeking “possible capital-raising options from investors.”

Some reports indicate Celsius also turned to assistance from Citigroup. The financial conglomerate is reportedly advising Celsius on financing options but does not intend to provide funds from its balance sheet.

The banking giant is said to be studying an offer from rival lending platform Nexo. Earlier, the latter stated readiness to buy Celsius’s loan portfolio. The offer is valid until June 20.

Georgetown University law professor Adam Levitin gave the view that Celsius’s bankruptcy is virtually inevitable. He believes that sooner or later the platform’s management will have to decide to sell liquid assets to reimburse users’ funds. It has also emerged that investment firm WestCap and pension fund Caisse de dépôt et placement du Québec will refrain from new investments in Celsius.

Origins of Instability

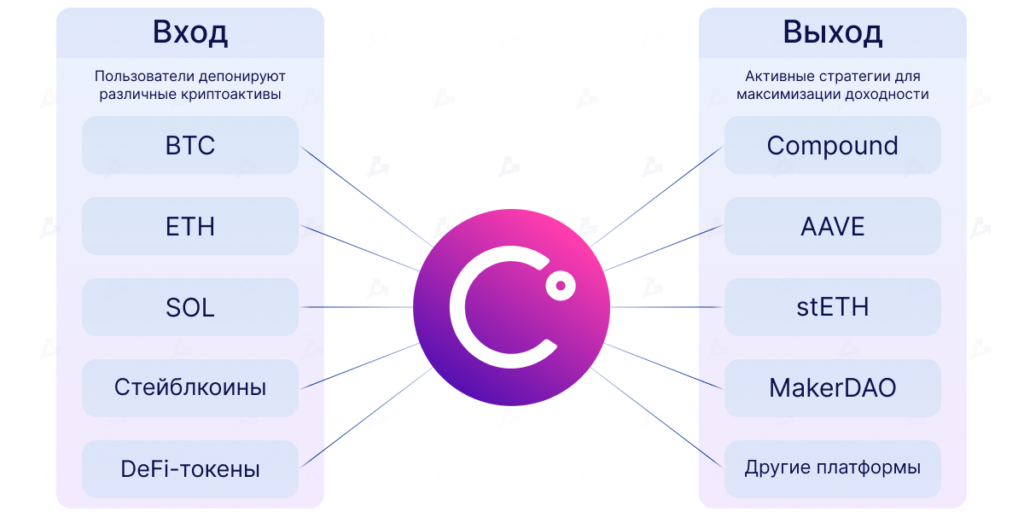

Coin Metrics researcher Lucas Nuzzi noted that Celsius presents itself as a “network” or “lender.” But in reality the platform resembles a hedge fund using highly leveraged strategies.

“Their business model is about placing user funds into DeFi protocols to maximise yields,”

If the objective is to maximise yield, risks must be controlled effectively.

2\ Fundamentally, when the ultimate goal of your product is to maximize yield, you need to have a solid risk framework.

You need to be able to determine when a risk is not worth the marginal yield, especially when user funds are at stake.

Pretty reasonable, right?

— Lucas Nuzzi (@LucasNuzzi) June 14, 2022

“You must be able to identify scenarios where risk is not worth the additional yield, especially when user funds are at stake.”

Nuzzi is convinced Celsius did not have a robust risk-management framework, but rather a desire to deploy millions into experimental DeFi protocols. He cites $120 million losses linked to the BadgerDAO breach.

“Many at the time were surprised Celsius would place WBTC in such a young protocol,”

The expert also notes that, during Terra’s “death spiral,” Celsius withdrew at least half a billion dollars from Anchor.

5\ Last month, in the midst of the Terra fiasco, Celsius pulled at least half a billion dollars out of Anchor, Terra’s lending protocol.

This means Celsius was exposed to UST and we all know what happened to that asset.https://t.co/5ZypEg4Xpz

— Lucas Nuzzi (@LucasNuzzi) June 14, 2022

“That means Celsius was a UST holder. We all know what happened to that asset.”

A few days later, Celsius CEO Alex Mashinsky blamed Wall Street sharks for the crypto market’s downturn, the tether depeg, and the Terra collapse.

Nuzzi notes that Celsius controls the largest WBTC custody in MakerDAO.

“Sharp chart moves reflect rising liquidity. As you can see, by adding funds Celsius has been trying to avert liquidation on this loan,”

He added that a potential liquidation of such a large debt position could further shake the market.

Long before the crisis, information emerged that the U.S. Securities and Exchange Commission is examining Celsius Network and other platforms such as Gemini and Voyager for compliance related to paying interest on deposits in digital assets.

In April 2022 Celsius paused payments of Earn yields to new U.S. customers. Thus regulator pressure could cost Celsius a substantial portion of its client base. In June, regulators in five U.S. states began investigating the freezing of Celsius accounts.

Three Arrows Capital and Terra Reverberations

Months before Terra’s collapse, the Luna Foundation Guard raised $1 billion. Among large buyers of the token LUNA was the crypto hedge fund Three Arrows Capital (3AC), which co‑led the token sale alongside Jump Crypto.

In June, PeckShield analysts noted large swaps by wallets allegedly linked to 3AC. Two transactions swapped more than 56,000 stETH for ETH.

In a conversation with CoinDesk, Nansen analyst Andrew Thurman noted that in May the hedge fund withdrew ETH and stETH from Curve totaling around $400 million. Rumors circulated of 3AC’s insolvency. On June 15, co‑founder Su Zhu wrote the following:

“We are in talks with the relevant parties and fully committed to fixing this problem.”

Some in the community speculated that 3AC faced a situation similar to Celsius.

A trader with the alias MoonOverlord dubbed Three Arrows Capital the “largest stETH dumper.” He noted that the founders had remained quiet for several days, Zhu removed cryptocurrency mentions from his Twitter profile and deleted his Instagram account, and the company “dumped 30,000 stETH and closed all positions in AAVE.”

Analyst alias OnChainWizard stated that an address labeled by Nansen as linked to 3AC is aggressively repaying an Aave loan. According to EthHub co‑founder Anthony Sasano, the Ethereum liquidation price for the hedge fund’s $245 million position stands at $1,034.

The Block, citing informed sources, reported that 3AC is attempting to settle with creditors and other counterparties that are forcing it to close positions. People familiar with the matter said total liquidations amounted to $400 million.

Subsequently researchers found liquidations of 8,000 ETH on Compound, presumably related to 3AC.

On June 16, Danny Yuan of 8 Blocks Capital said 3AC used $1 million from a Hong Kong-based company on managed accounts to cover margin calls. He added that representatives of the hedge fund were not responding to outreach attempts.

Block’s editor Frank Chaparro stressed that 3AC positions were forcibly liquidated by a top-tier exchange, not merely by decentralized lenders. He said the hedge fund leadership never got in touch with counterparties.

Soon after, reports emerged that BlockFi liquidated part of the hedge fund’s positions.

“We accelerated the repayment of the loan and fully liquidated or hedged the related debt. Client funds were not harmed,”

FatMan, a trader, reported that 3AC has a “large debt” to BitMEX.

The 3AC crisis reverberates across the industry, given that many major projects have links to the hedge fund.

The stETH Factor and Alameda Research

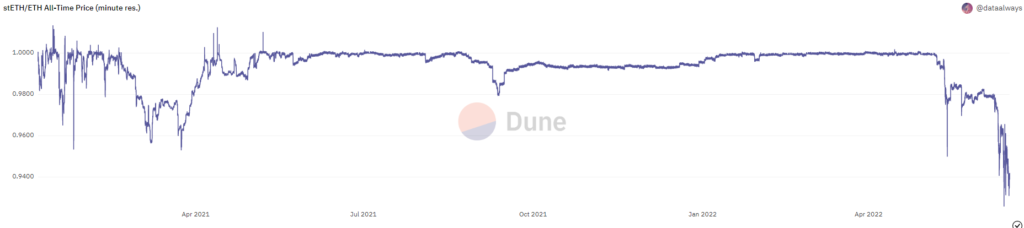

Mass selling of stETH could not help but affect the price of the Ethereum derivative.

As of 16.06.2022 the discount relative to the original token stood at more than 5%.

On the next chart, parity with stETH and ETH remained relatively stable for a long period. The balance shifted with Terra’s collapse in early May.

“The collapse of LUNA and UST certainly caused fear and selling pressure in the market. People lost confidence, and the price of stETH slid,” said Huobi Research analysts.

Market participants noted that on June 8 around 50,000 stETH were reportedly sold by Alameda Research.

As shown above, these transactions significantly shook the price of stETH, deepening the parity gap.

“Alameda Research’s sales added downward pressure on stETH on secondary markets, potentially triggering sales by other large holders,”

Declining base-asset prices and thinning stETH liquidity could further pressure the price of the derivative. According to Curve, at the time of writing the pool holds about 20% ETH to 80% stETH, complicating swaps.

Since May, the total value of assets in the ETH/stETH liquidity pool fell from $4.5 billion to about $620 million. Kaiko data show that Curve’s liquidity pool handles up to 98.5% of trading volume in staking Ether.

Industry analysts noted that in early June Amber raises withdrew about $160 million, Alameda Research sold $88 million of stETH. In May 3AC bought 400,000 ETH and stETH from the protocol.

The market cap of staking Ether since Terra’s collapse has fallen more than 60%, from roughly $10 billion to $3.69 billion (as of 16.06.2022).

For retail investors, the only real exit from stETH is Curve, whose pool is shrinking by 10,000–15,000 ETH per day. If the pace persists, it will be exhausted within two weeks.

The stability of stETH’s price depends largely on when ETH can be withdrawn from the Beacon Chain, which will happen after The Merge—expected in August—when PoW and PoS blockchains merge.

To sustain debt positions, major players like Celsius must sell large volumes of stETH. Given its liquidity relative to Ethereum, the price of staking Ether is highly sensitive to whale actions.

Huobi Research, however, argues that stETH does not necessarily need to trade in a 1:1 ratio with the underlying asset.

“stETH represents a share in ETH 2.0 staking and trades at a market price determined by supply and demand in secondary markets. If we look at other similar tokens, we can conclude that a 1:1 ratio is not guaranteed.”

On the other hand, there are serious risks associated with using stETH in complicated strategies. For example:

- Users may stake stETH in Aave to secure ETH against their collateral;

- Borrow ETH in Lido to obtain more stETH, and so on.

Looping such operations creates a leveraged feedback loop in lending protocols.

“This is a major risk for both stETH and ETH. Further declines in stETH’s price could trigger a cascade of liquidations for leveraged positions,”

Collateral being liquidated is sold on secondary markets, adding to the pressure on asset prices.

From this situation, experts draw several conclusions:

- In the short term, stETH will face considerable selling pressure. Market turbulence is likely to persist in the near term.

- The discount could spur demand for staking Ether. The cheaper the stETH, the greater the profits for arbitrageurs when ETH withdrawal from the deposit contract becomes possible.

- As The Merge activation approaches, the price is likely to rebound. But if technical issues arise during the upgrade, investors may lose confidence in the project, adding to pressure on stETH and triggering liquidations of lending positions.

Conclusion

With proper risk management, high‑risk strategies can pay off in rising markets, but they are unlikely to succeed in downturns and periods of turbulence. The Celsius saga and other major crypto platforms underline the need for thoughtful risk controls and careful project selection.

The current problems are far from resolved. They have exposed vulnerabilities in the DeFi ecosystem, and demonstrated that large centralized platforms can influence it.

Many users of lending protocols employ leveraged positions. This can unleash massive liquidations that accelerate asset-price declines.

Some say macroeconomic conditions have shaped the crypto market more than Celsius’s problems. Against the backdrop of the Fed’s tightening and even merely expectations of rate hikes, many investors are fleeing high‑risk assets. Liquidity for many tokens, including stETH, is therefore being eroded, making prices more sensitive to whale selling. In the near term, the situation remains fragile. Yet it is possible that Bitcoin and Ethereum have already reached a bottom, and that the much‑anticipated The Merge upgrade will restore investor confidence and act as a driver for a rebound.

Read ForkLog’s Bitcoin news in our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!