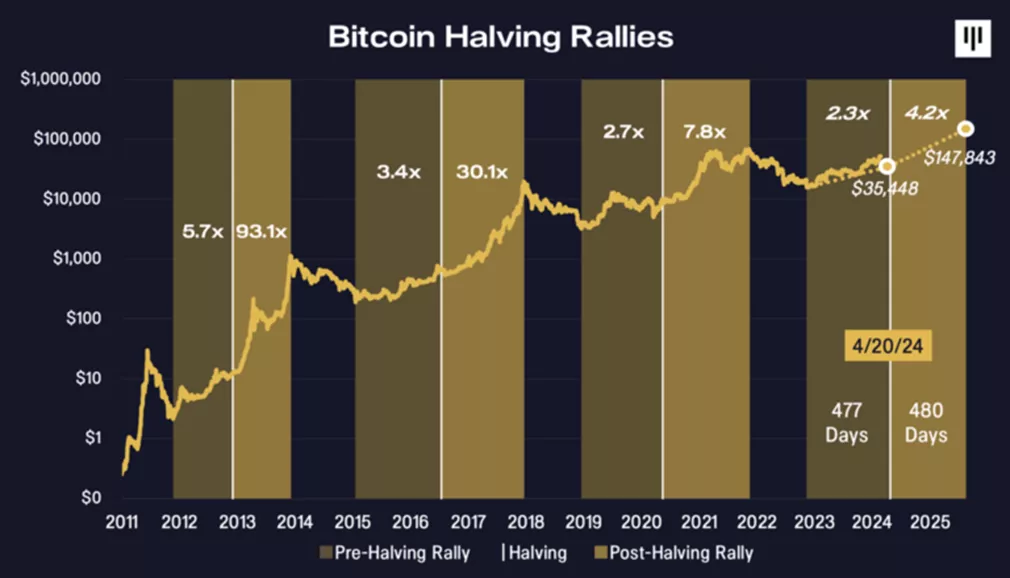

Pantera Capital Predicts Bitcoin Surge to $147,000 by 2025

- Bitcoin is projected to rise to $147,000 by 2025.

- The DeFi ecosystem based on digital gold could reach a value of $72-450 billion.

Based on previous halving cycles, Bitcoin’s price is expected to drop to $35,448 in April 2024, followed by a rise to $147,000 in 2025, according to forecasts from Pantera Capital.

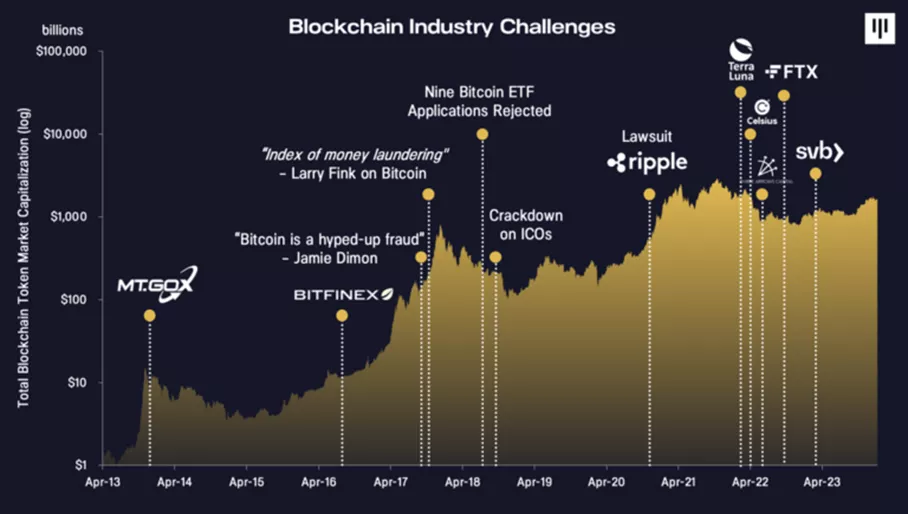

With all the negative things that happened in 2022 and 2023, an important theme now is the absence of bad things.

Read our Feb Blockchain Letter:

— Revisiting Bitcoin Programmability

— Protocols With Fundamental Traction

— Bitcoin Halving Impact

and more.https://t.co/AMRLt8OVV8— Pantera Capital (@PanteraCapital) February 20, 2024

Experts estimate that the cryptocurrency market has entered the early phase of a major bull cycle, which could last 18–24 months.

Specialists noted a shift from a phase of “terribly bad events,” such as the collapse of several centralized organizations, to a gradual recovery of the industry. This recovery was facilitated by favorable rulings for Ripple and Grayscale in legal battles against the SEC, as well as the launch of spot Bitcoin ETFs.

Bitcoin as a Unique Asset

Analysts highlighted the uniqueness of digital gold as a financial asset, evidenced by the following characteristics:

- Market capitalization exceeds $900 billion, 60% more than Visa;

- Daily trading volume is $26 billion—250% higher than Apple;

- Annualized volatility of 50%—20% lower compared to Tesla;

- Owned by over 220 million people worldwide (only six countries have a larger population);

- Hashrate is 500 times greater than the most powerful computer.

The organization predicted the global spread of the first cryptocurrency in Latin America, Africa, and Asia.

“If Wall Street’s financial system is not built for Bitcoin, then Bitcoin will have to take on this task,” specialists emphasized.

The Time for Bitcoin DeFi Has Come

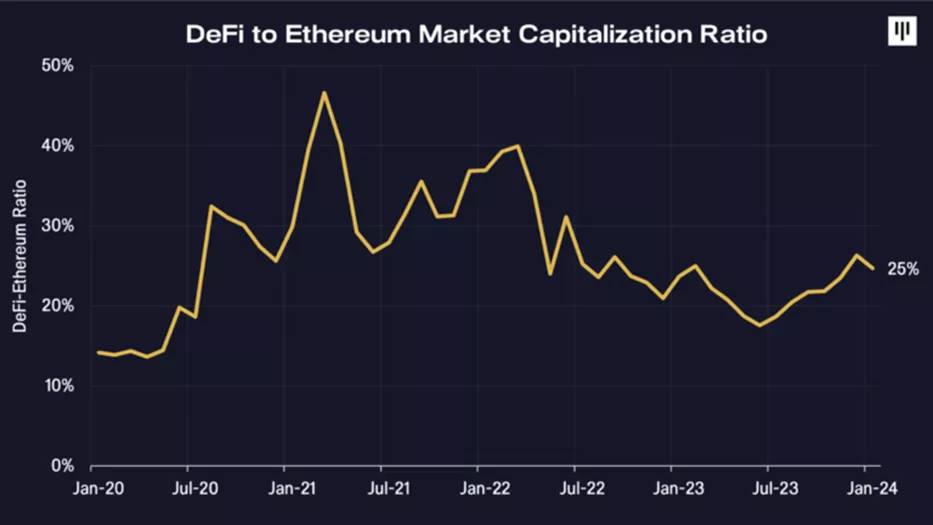

One of the drivers will be the formation of a DeFi ecosystem based on the first cryptocurrency. Analysts estimate its capacity could reach $72–450 billion.

This figure is based on extrapolating the total value of DeFi protocols on the Ethereum network, equivalent to 8–50% of its capitalization. Calculations were made before Bitcoin’s jump to $52,000.

Improved market conditions could spur the development of services.

“Technological breakthroughs and macroeconomic trends are bringing DeFi closer to a breakthrough moment in Bitcoin. Now is the time to take advantage of this,” the report states.

Experts predicted the end of the current “era of neglect.”

Reasons for Interest

Previously, Pantera Capital attributed the lack of developer activity to the “inflexible” nature of the blockchain.

The situation changed with:

- the 2021 Taproot update;

- Ordinals;

- BRC-20.

Analysts noted signs of activity formation in DeFi and NFT on the Bitcoin network, similar to Ethereum in 2016-2017.

The trend’s development could be driven by weakened trust following the collapse of several centralized services.

“A decentralized financial system may finally emerge based on Bitcoin. Its potential is similar to or even greater than DeFi on Ethereum today, although it follows a different evolutionary path,” specialists concluded.

In January, Pantera Capital revealed the prospects for altcoins in a bull market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!