Standard Chartered Identifies Bitcoin as a Hedge Against Tariff Risks

Bitcoin can be viewed as a hedge against tariff risks amid increasing U.S. isolation. This was stated by Geoffrey Kendrick, head of digital asset research at Standard Chartered, according to The Block.

Following President Donald Trump’s declaration of “Liberation Day” on April 3, a massive market downturn ensued.

Kendrick believes the downturn’s impact is temporary, and digital gold could return to $84,000 unless there is a significant decline in traditional markets.

“U.S. isolationism is akin to increased risks of holding fiat, which will ultimately benefit Bitcoin,” Kendrick stated.

The key support level, according to the expert, is $76,500 — the upper boundary of the daily candle on November 6, 2024, formed the day after the U.S. elections.

Kendrick acknowledged the market decline but noted that Bitcoin continues to outperform key tech stocks, including those in the Mag 7 index, trailing only Microsoft and Google.

The Mag 7 includes quotes from the so-called tech “Magnificent Seven” — Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla.

The researcher suggested viewing the leading cryptocurrency as a hedge not only against U.S. isolation but specifically against tariff risks.

Federal Reserve Rate

Bob Michele, head of fixed income at JPMorgan, shared with Bloomberg his opinion that the Fed is likely to cut rates, despite statements from the regulator’s head Jerome Powell.

The Fed chair stated he would carefully monitor the effects of tariff policy before making decisions.

Michele commented on this statement, noting that the current decline in stock indices is comparable to the crises of 1987, 2008, and 2020, when the Fed invariably moved to emergency monetary easing.

On March 7 at 18:30 (MSK/Kyiv), the Fed will hold an unscheduled meeting.

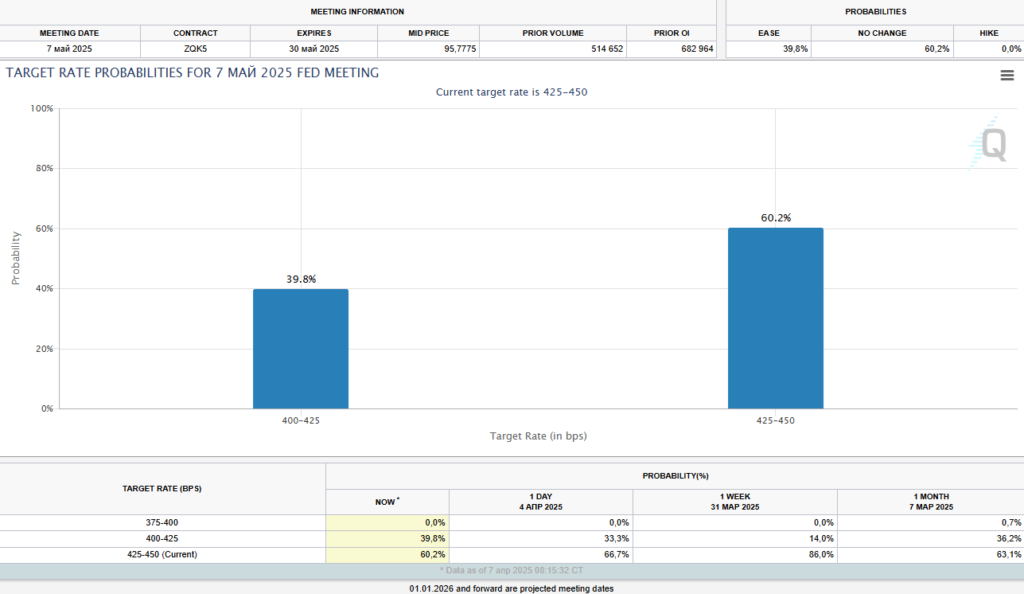

According to the CME FedWatch Tool, 60.2% of traders believe the agency will not change the key rate at the upcoming meeting on May 7. 39.8% expect a 25 basis point cut.

At the time of writing, Bitcoin is trading at $77,351 (-6.4% for the day), according to CoinGecko.

From March 29 to April 4, clients of cryptocurrency investment funds withdrew $240 million following an inflow of $226 million the previous week, CoinShares analysts reported.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!