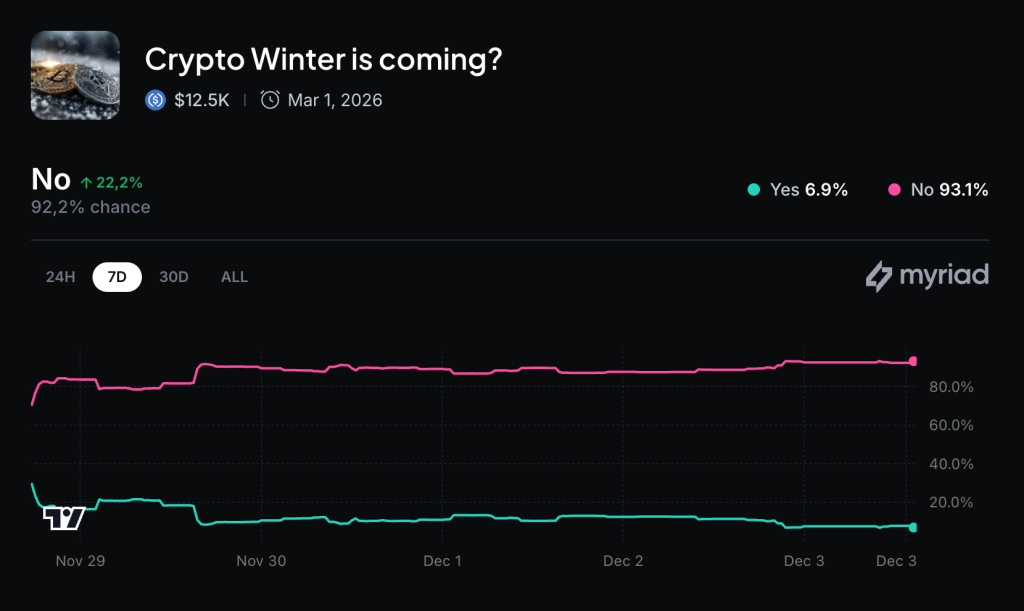

Traders Price “Cryptowinter” Risk at 7%

Myriad bettors put the chance of a new crypto winter at 6.9%.

Traders are sceptical that a prolonged slump is imminent in crypto. On prediction market Myriad, the odds stand at 6.9%.

Myriad deems a protracted downtrend to have begun if three of four conditions are met:

- Bitcoin falls to $35,000;

- Ethereum trades at $1,000;

- Strategy shares hit $50;

- total market capitalisation drops to $350bn.

The previous deep freeze lasted from late 2021 to 2023. It was triggered by the bursting of the COVID-era bull run, and compounded by the collapses of Terra/Luna and FTX.

Digital gold plunged by roughly 75% — from an all-time high near $69,000 to $16,000.

As Bitcoin slid to $85,000 on news from Asia, the probability of a “crypto winter” was put at 30%. A rebound above $93,000 helped steady sentiment.

After the 10–11 October rout, when liquidations hit a record $19bn, many said a bear market had begun.

Earlier, economist Timothy Peterson noted an alarming resemblance between Bitcoin’s path in the second half of this year and the bear phase in the prior cycle.

Faint glimmers of optimism

Early December has been difficult for crypto. On Monday, prices slumped after Strategy CEO Phong Le said the firm could sell bitcoins if mNAV fell below 1.

Later the company announced a $1.4bn reserve for “stable and continuous” dividend payments to shareholders. Some saw the move as a bearish signal.

Strategy is preparing for a full BEAR market, and you are out here making price bottom calls. pic.twitter.com/tiPHkdqOQg

— Julio Moreno (@jjcmoreno) December 1, 2025

On Tuesday, however, the mood flipped. Two factors helped lift prices:

- SEC chairman Paul Atkins pledged to unveil details of an “innovation exemption” for crypto firms.

- Vanguard Group allowed trading on its platform of ETFs and other funds focused on digital assets.

Chris Beauchamp, chief market analyst at IG, also noted in comments to Bloomberg that rising risk appetite in equities supported the rebound. US stock futures are edging higher as investors expect the SEC to cut the policy rate at the 10 December meeting.

According to FxPro’s Alex Kuptsikevich, the developments created “a set of vital signs of an emerging uptrend”. Caution persists, however.

“We don’t see a ton of buyers on the way up. Sentiment is still fragile,” emphasised Sean McNulty, head of derivatives at FalconX.

He pointed to flows in spot bitcoin ETFs, which took in $59m in the latest session. McNulty called the sum “weak”.

“This rebound is no more than a technical bounce. However, bitcoin can regain some momentum. Now is an opportune moment for those who have not yet deployed positions to consider entering the market,” added QCP Group CEO Melvin Deng.

At the time of writing, the leading cryptocurrency trades around $93,400.

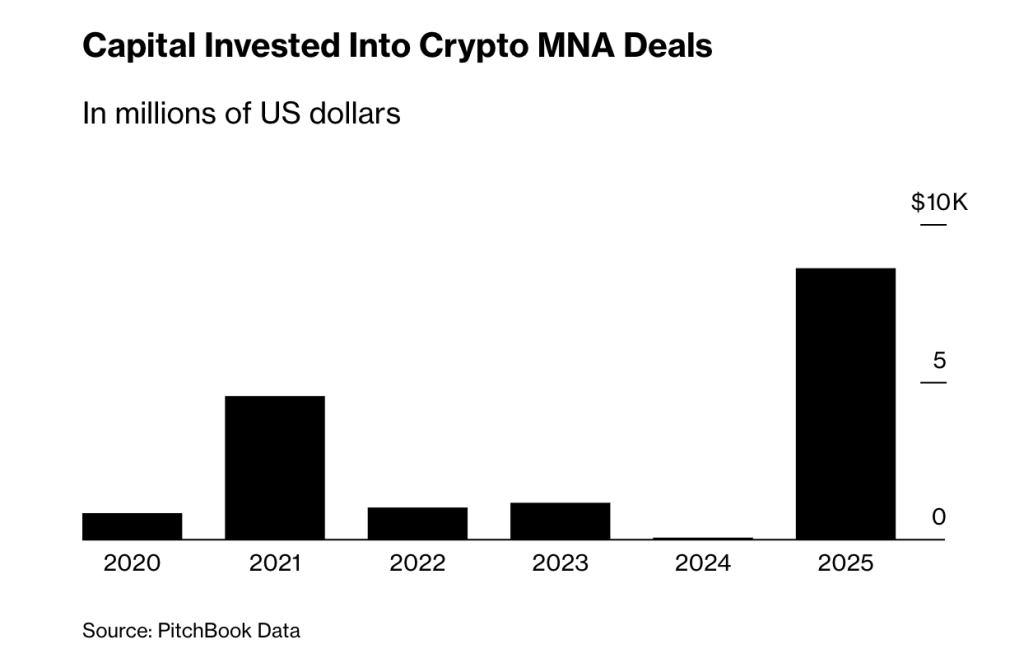

A boom in crypto M&A

Bloomberg also reported that in 2025 mergers and acquisitions (M&A) in digital assets hit a record $8.6bn, exceeding the combined total of the previous four years.

“Large crypto firms have become much more active in acquisitions. Lower rates, regulatory clarity and a bull market earlier in the year switched them into aggressive growth mode,” said PitchBook analyst Ben Riccio.

The surge was driven by deals involving exchanges Coinbase and Kraken, as well as blockchain firm Ripple Labs. But activity peaked before the October crash, which erased more than $1trn in market value.

Among the year’s key acquisitions:

- Coinbase bought options exchange Deribit for $2.9bn;

- Kraken acquired retail futures platform NinjaTrader for $1.5bn;

- Ripple acquired prime broker Hidden Road for $1.25bn.

These deals helped 2025 surpass the previous sector record set in 2021 ($4.6bn). According to PitchBook, Coinbase is the clear leader in M&A activity. Since 2020 the exchange has participated in 24 deals, eight of them in the past 12 months.

Deal count also set a record in 2025 — 133, versus 107 in 2022.

The boom was aided by the policies of US President Donald Trump’s administration, which fuelled euphoria and soaring prices. In October bitcoin hit an all-time high above $126,000, after which a crash followed.

Since October, sentiment has turned. The bear trend has weighed on listed firms across the sector. Coinbase has shed a fifth of its market value this quarter, while shares of American Bitcoin, a miner linked to the Trump family, have slumped 70%.

“It remains to be seen how deal activity and valuations change in the coming months if cryptoasset prices stay under pressure. We are already hearing about some agreements being cancelled due to market uncertainty,” the specialists at Architect concluded.

Earlier, Grayscale analysts suggested bitcoin could rise despite the four-year cycles.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!