Traders set their sights on $100,000 bitcoin

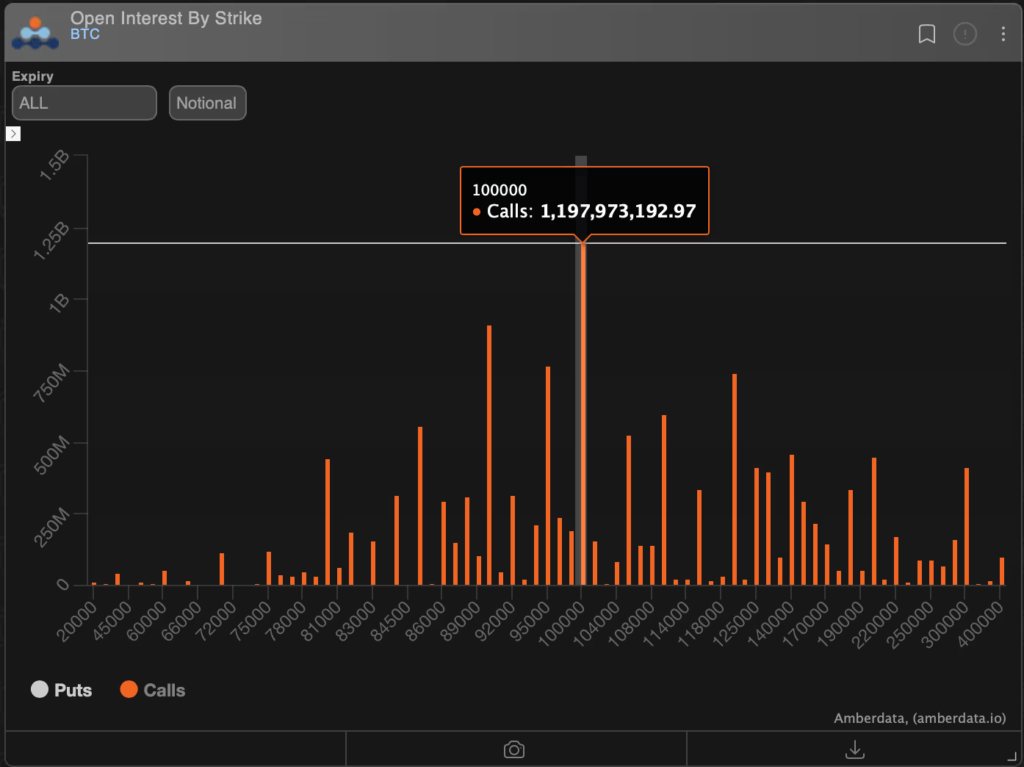

Call options on bitcoin struck at $100,000 have become the most popular position on Deribit, with nearly $1.2bn in open interest, CoinDesk Markets editor Omkar Godbole noted.

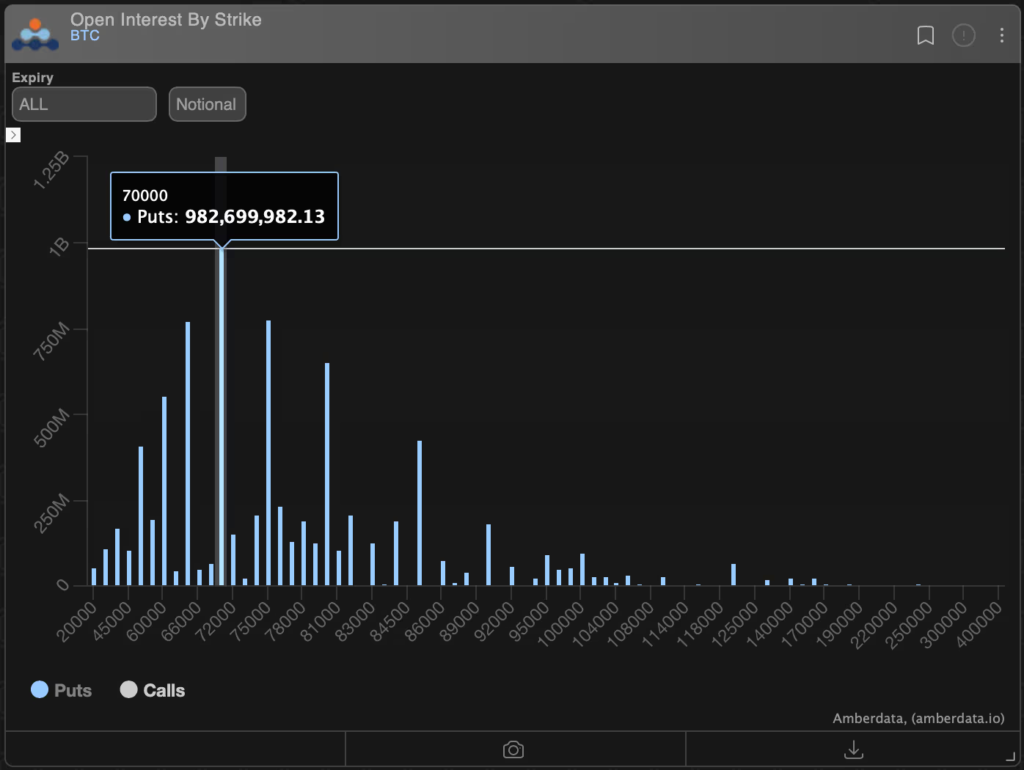

“The bond market crisis caused by [Donald] Trump’s cancellation of tariffs switched the rhetoric from aggression to capitulation, and markets from capitulation to an aggressive rebound. Defensive/bearish play. Put options with a $75,000–78,000 strike were dumped, and call options at $85,000–100,000 were cancelled, as BTC rose from $75,000,” the Deribit market review said.

On Friday, April 11, the US administration announced exempting key technology products such as smartphones from the 125% tariff for China and the base 10% levy. Hours later, Trump denied the report, clarifying that the duty would be 20%.

Bitcoin continued to recover against this backdrop. At press time, the leading cryptocurrency is trading around $84,800.

Call options at $100,000 and $120,000 were popular with traders early in the year. The March market rout, driven by expectations of Trump’s “liberating” tariffs, pushed the $80,000-strike put to the top of the board, Godbole noted.

In the analyst’s view, the current shift in sentiment towards expecting higher prices is reflected in derivatives demand. The gauge moved towards put options, rising above zero from the deeply negative readings seen just a week ago. The seven-day timeframe is the exception, though even there the metric has climbed well above the recent -14%.

Call positioning is concentrated in the $95,000–120,000 range. Meanwhile, the $70,000 strike in puts is the second-most popular, with $982m in open interest.

Investor doubles bullish bet on bitcoin to $200m

Mechanism Capital founder Andrew Kang opened a $200m long position in the leading cryptocurrency. Expected profit or loss stands at $6.8m, Arkham noted.

ANDREW KANG’S BIG LONG

Andrew Kang just doubled his Bitcoin position.

He is now long $200M of $BTC with a PnL of $6.8 MILLION pic.twitter.com/uydZtiXpYq

— Arkham (@arkham) April 12, 2025

On April 9, the investor placed a $100m bet with 40x leverage on a rise in digital gold. According to Arkham, this came immediately after Trump said it was “a good time to buy.” Kang quoted his post, declaring the arrival of a “Trump Put.”

A few hours later, the White House announced a 90-day delay in the introduction of “reciprocal” duties for all trading partners except China.

Trade war causing capitulation and Trump Put coming in are the perfect combination for $BTC to reverse a multi month downtrend

Send it https://t.co/rSBO1eG1xa

— Andrew Kang (@Rewkang) April 12, 2025

“The trade war that led to capitulation and the emergence of the Trump Put are the perfect combination for bitcoin to break a multi-month downtrend,” the investor later said.

In comments under the post about Kang doubling his long bet on bitcoin, users called it a signal.

“When big players pile in, it’s worth paying attention,” one wrote.

However, CryptoQuant flagged a renewed outflow from spot BTC ETFs. In the firm’s view, a sharp drop in fund assets signals institutional investors exiting the market.

ETF demand is cooling.

A sharp drop in Bitcoin spot ETF assets signals institutional outflows.

Watch this trend closely. pic.twitter.com/IVVNL1kPYy

— CryptoQuant.com (@cryptoquant_com) April 14, 2025

“Watch this trend closely,” they warned.

Earlier, the analyst known as Capo Of Crypto predicted a fresh capitulation of bitcoin investors in the coming weeks and the onset of a bear phase in the autumn.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!