PayPal licence, a DFA tied to a diamond, and other crypto-industry developments

We round up the week’s most important crypto-industry news.

- FCA has added Bitfinex to the list of unauthorised firms.

- PayPal has obtained a licence to provide crypto-related services in Britain.

- BitGo has received a BaFin licence to custody digital assets.

- In Russia, a DFA tied to a diamond was issued.

FCA adds Bitfinex to list of unauthorised firms

The Financial Conduct Authority (FCA) has added Bitfinex to the list of firms prohibited from promoting financial services in the country without approval.

“Over the past four months the platform has held extensive discussions with the FCA. The company has taken steps to meet the regulator’s requirements, including notifying all clients of the actions taken,” — the blog said.

Specifically, for visitors from Britain, the organisation blocked several sections of the website.

“This includes Bitfinex partner pages, staking, credit/debit cards, Lending Pro, Bitfinex Borrow, ‘How to buy’ guides and the information page for the mobile app,” — the firm added.

PayPal has obtained a licence to provide crypto-related services in Britain

The regulator approved PayPal UK Limited as an authorised electronic money institution and consumer lending firm, as well as registration as a business selling crypto assets. This enables residents’ accounts to be moved from PayPal Europe to the British entity,” explained a company spokesman.

PayPal became the fourth licenced organisation this year after Interactive Brokers, Bitstamp and Komainu.

HashKey launches app focused on retail users

The Hong Kong crypto exchange HashKey launched the app, aimed at retail users. Plans include the releaseutility token with its subsequent listing in 2024.

The app will also be available to professional investors. This follows from the local SFC.

Starting from July, the company has been in close dialogue with the regulator and has gone through several rounds of providing additional materials for review.

On 28 August, HashKeylaunched trading of Bitcoin and Ethereum for retail clients.

BitGo has received a BaFin licence to custody cryptocurrencies

Germany’s Federal Financial Supervisory Authority (BaFin) issued a licence to BitGo to custody digital assets.

Since 2019 the firm had been carrying out such activity under supervision of the regulator.

In 2021 the firmNYDFS.

In August BitGo closed a financing round of $100 million, valuing the crypto custodian at $1.75 billion.

In Russia, a DFA tied to a diamond was issued

«Expobank» issued digital financial assets (DFA) whose value depends on the price of a diamond. This was told to Vedomosti by representatives of the bank and the blockchain platform Masterchain, through which the issue was implemented.

A total of 5,000 DFAs were issued, each valued at 1,975 rubles, i.e., 1/5,000 of the price of a diamond (about 10 million rubles). The ability to purchase such an asset is available only to qualified investors.

What’s on the exchanges?

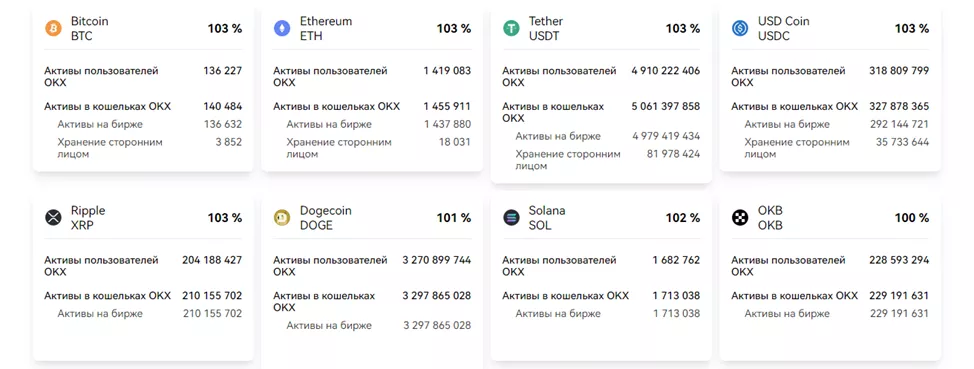

The OKX exchange published its 12th monthly proof-of-reserves report, showing $12.5 billion in Bitcoin, Ethereum and Tether’s USDTUSDT.

Over the past month the platform has boosted its crypto reserves by $1.3 billion.

The report covers 22 digital assets, including USD Coin (USDC), Dogecoin (DOGE), XRP from Ripple, Solana (SOL) and others. According to the exchange, customer funds are backed by more than 100%.

To audit balances, the platform takes snapshots and uses a Merkle tree-based encryption system to guard against unauthorised access.

Bitget also presented a monthly reserve report — assets backed at 199%. According to CoinMarketCap as of 3 November, the total reserves of the exchange exceeded $1.54 billion.

Representatives of the platforms recalled the creation of a $300 million fund as additional user protection. It is intended to cover losses incurred in case of account hacks, asset losses or other unforeseen risks.

Another crypto exchange — Bybit — announced the listing of Memecoin (MEME) and TokenFi (TOKEN). To participate in the promotions you must complete a KYC procedure and meet a number of conditions.

Also on ForkLog:

- Coinbase launched trading of crypto futures for US residents.

- SEC began an investigation into PayPal’s stablecoin.

- MicroStrategy increased its bitcoin reserves to 158,400 BTC.

- Media: Binance will shut down the Advcash fiat gateway.

- Tether reported reserves of $72.6 billion in US Treasuries.

- Media: Jump Trading is poised to become the market maker for BlackRock’s ETF.

What to read this weekend?

ForkLog looked at what impact the potential adoption of a spot ETF would have on Bitcoin. Besides influencing the price of digital gold, it also considers the industry’s reaction from the collective investments sector.

In News+ we covered the jury decision in the case against FTX founder Sam Bankman-Fried and the industry’s reaction.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!