Solana Node Operator Reveals Beneficiaries of Meme Coin Frenzy

- Solana, Jito, and Raydium are the main beneficiaries of the meme coin hype.

- The most profitable strategy is the long-term provision of liquidity to the “funny coins” market.

- The meme coin market is experiencing a “second cycle” with increased competition and risks.

Providing liquidity to the meme coin market is more profitable than it might seem. This opinion was shared by a Solana node operator and Jito project contributor named Leo, also known as IQX, in an interview with Wu Blockchain.

Solana, Jito, and Raydium: Beneficiaries of Meme Coin Hype

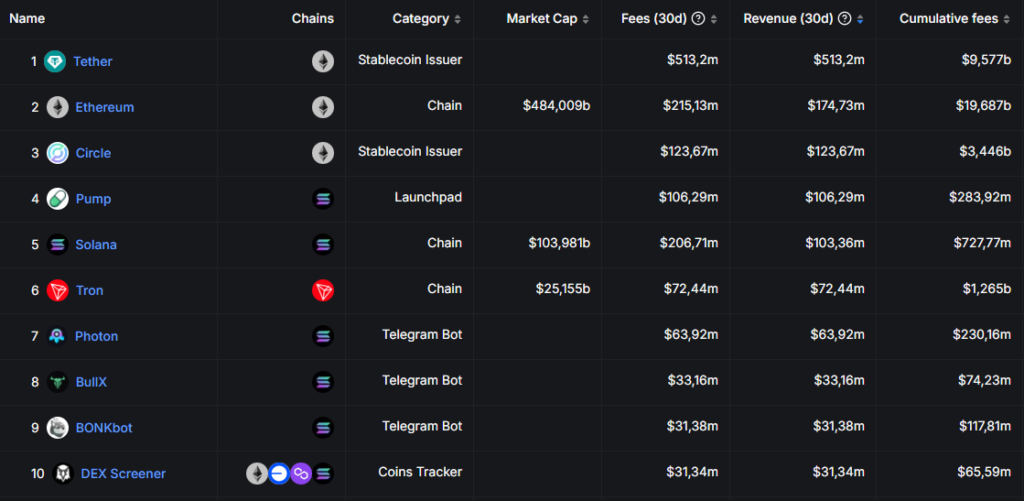

According to Leo, Solana, Jito, and Raydium capture most of the profits from the meme coin frenzy. They almost always rank among the top five leaders according to DeFi Llama data and often earn more than the total gas fees on Ethereum.

“These are the three main players quietly making the most profit,” the expert noted.

He also highlighted the role of RPC nodes—”relays” that do not directly participate in maintaining consensus but forward client requests to validators in the network. According to Leo, these nodes form the infrastructure for many Telegram bots used in high-frequency trading.

“As for Jito, it is the largest provider of liquid staking (LST) on Solana, with a market share of about 43%. What people might not know is that about 80% of Solana validators use Jito’s client software,” the specialist noted.

He emphasized that Jito offers a mechanism for sorting and “packing” transactions for submission to validators with added “tips” for processing. The extra payment is necessary to avoid frontrunning.

Liquidity Provision for Meme Coins on Solana

Leo noted that a liquidity provider’s profit primarily depends on whether the fees cover their impermanent losses:

“I saw a report discussing that providing liquidity on Ethereum is generally unprofitable because transaction fees do not even come close to covering impermanent losses.”

According to him, this is why a significant portion of trading in the ecosystem of the second-largest cryptocurrency by market cap occurs on centralized platforms. On-chain liquidity providers become “arbitrage tools between CEX.”

“Many say that AMMs on Ethereum have absorbed a lot of ‘toxic liquidity.’ This means people buy cheaply on CEX and sell expensively on AMM, or vice versa, resulting in traffic on platforms mainly coming from arbitrage traders. Good traffic is mostly on centralized exchanges, not on-chain,” the specialist emphasized.

Leo explained that those looking to buy $100 worth of tokens will simply go to Binance and not pay even more for gas on Ethereum. On Solana, transaction costs are significantly lower.

“I remember during the first meme coin cycle, around the first quarter of 2023, someone in a Telegram group was talking about making a lot of money by switching from Ethereum to Solana. He said he was making 100x on Solana, while earnings on Ethereum didn’t even cover the gas,” he noted.

In 2023, Leo provided liquidity for the meme coin MOTHER. According to him, initially, the APR was over 19,000%, and the APY was 36,500%.

“In just one day, I earned 50% on transaction fees. Of course, over time, the yield decreased, but during this period, I invested a couple of thousand dollars and ended up earning almost $20,000 in fees,” the expert explained. “This is probably twice as much as I would have earned just holding the assets.”

He emphasized that providing liquidity to meme coin markets on Solana is a profitable endeavor. The optimal strategy is long-term asset holding:

“The meme coin market on Solana offers many opportunities for high-frequency trading. However, if you provide liquidity in the short term—say, 12 or 48 hours—it’s hard to cover impermanent losses with transaction fees alone.”

Leo noted that this is a very volatile market. Many assets peak and then their price drops significantly. Tokens that recover afterward bring significant profits.

“If the meme coin community is active, with frequent updates on Twitter and constant management, then providing liquidity can be very profitable,” he believes.

The Second Cycle of Solana Meme Coins

According to Leo, the meme coin market on Solana is currently going through a second cycle. The first cycle, he believes, occurred between February and April 2024.

“The second cycle is more chaotic, but it also provides opportunities for many venture capitalists and project teams. They have the resources to enter the market and potentially make short-term profits,” he explained.

With the arrival of new players, competition and risks in the market increase, and meme coins like Popcat already have numerous liquidity pools.

Leo also noted that he currently earns mainly from WIF and Popcat tokens.

“Thanks to concentrated liquidity trading, my daily yield remains between 0.5% and 3%. This is the ideal yield for a liquidity provider on Solana, which would be practically impossible on Ethereum,” the specialist emphasized.

Culture in Solana and Meme Coins

Leo noted that one of the important factors that attracted him to the Solana ecosystem was the culture within its community.

He highlighted an incident in 2022 when the network suffered from the collapse of FTX:

“I noticed that the main developers of the ecosystem didn’t leave; instead, they encouraged each other. […] That’s when I realized that Solana’s core strength hadn’t dissipated, and the community remained cohesive.”

The specialist also emphasized the importance of culture in meme coins.

“I’m not someone who can make high-risk trades every day, but I believe in the culture of meme coins. […] I think only the top tokens have a real culture, and the rest are essentially just junk assets,” he explained.

In Leo’s opinion, the Solana ecosystem will remain the leader in the “funny coins” niche:

“While other networks may have hot trends or even new competitors, the most popular meme coins are likely to still be in the Solana ecosystem.”

Back in early December, Solana founder Anatoly Yakovenko explained the benefits of meme coins for the network.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!