Week in Review: Bahamian authorities arrest Sam Bankman-Fried, and Bitcoin corrects after the Fed meeting

Authorities in the Bahamas arrested FTX founder Sam Bankman-Fried; Binance clients began withdrawing assets amid media attacks on the platform; the price corrected as the Fed raised rates and other events dominated the past week.

Bitcoin fell below $18,000 as the Fed raises rates

On Wednesday, December 14, the US Federal Reserve raised the federal funds rate range by 50 basis points—to 4.25-4.5% per year. This marked the highest level since 2007.

The Fed’s decision was broadly expected by market participants and the seventh rate increase this year. The Fed slowed the pace of tightening—after four consecutive 75bp hikes.

Bitcoin’s price reacted with volatility and a correction below $18,000. At the time of writing, the leading cryptocurrency was trading near $16,687.

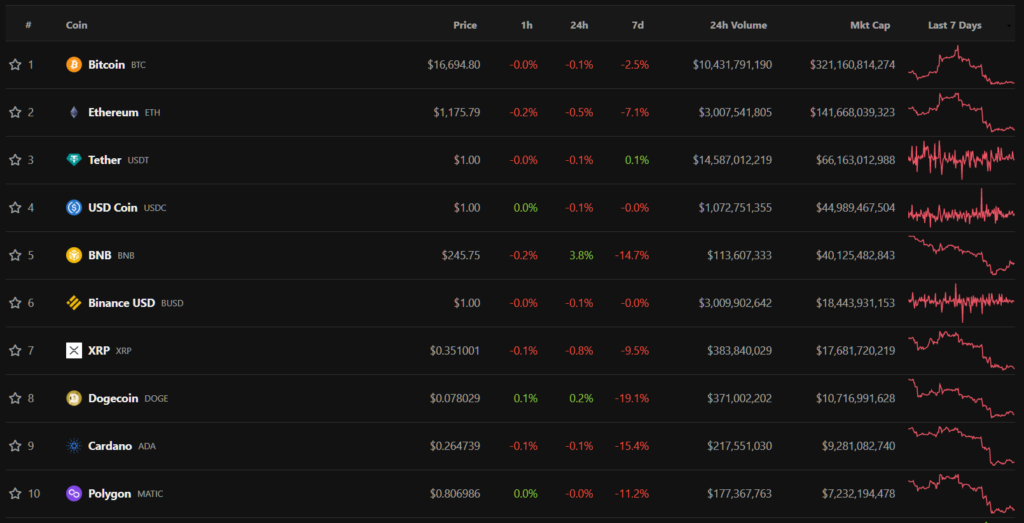

Across the week, all top-10 assets by market cap finished in the red. The worst performers were Dogecoin (-19.1%) and Cardano (-15.4%).

Total market capitalization stood at $840 billion. Bitcoin’s dominance fell to 38.2%.

In the Bahamas, FTX founder Sam Bankman-Fried was arrested

On December 12, Bahamian authorities arrested the founder of FTX, Sam Bankman-Fried (SBF), at the request of the US government.

The US Securities and Exchange Commission brought charges against SBF for deceiving FTX investors and for misusing customer funds belonging to the trading platform. The agency contends that Bankman-Fried remained the person making decisions at Alameda Research even after Caroline Ellison and Sam Trabucco were appointed co-leaders of the company.

The lawsuit was also filed by the US Commodity Futures Trading Commission. The regulator charged the former FTX CEO with violations of the Commodity Exchange Act.

Indictment later grew to eight counts, carrying a total potential sentence of up to 115 years. This is how he looked after the court hearing — according to the order, Bankman-Fried will remain in custody until February 8, 2023, in Fox Hill, the Bahamas’ sole prison, notorious for its poor conditions.

Meanwhile, SBF will spend an indefinite period in the medical wing, as he suffers from depression, insomnia, attention-deficit syndrome and often takes medications.

The Bahamian court denied the founder’s bid for a $250,000 bail, citing a high risk of flight.

According to Reuters, Bankman-Fried does not intend to contest extradition to the United States.

Other FTX News

Earlier this week, new FTX chief John Ray accused former executives of storing private keys unencrypted. Court documents also showed that Ryan Salame, head of FTX’s Bahamas unit, warned a local regulator about potential fraud at the crypto exchange two days before filing for bankruptcy.

Later, FTX filed a court motion seeking the sale of several entities within the group, including LedgerX (FTX US Derivatives), FTX Japan, FTX Europe and Embed Business.

What’s going on with Binance?

Media FUD persists—the WSJ-sourced experts cast doubt on Mazars’ conclusions about Binance’s Bitcoin reserves. Among other things, they noted a lack of transparency in the company’s corporate structure and said the audit offered no insight into the quality of internal controls, including accounting accuracy.

At the end of the week, the CryptoQuant analytics platform commented on the report. Experts said that Binance’s liabilities data were broadly in line with expectations and accurate.

Changpeng Zhao denied rumors of liquidity problems on the platform and said that Binance has enough digital assets to allow all customers to withdraw them in full if needed.

On December 16, Mazars paused work with all crypto-industry clients.

Media also stated there are disagreements within the US Department of Justice over charges against Binance leadership in the 2018 case. It concerns alleged violations of anti-money laundering laws and US sanctions.

A sequence of attacks led to a bank run — in 24 hours users withdrawed stablecoins worth more than $7 billion. The inflow of “stablecoins” over the same period stood at about $4 billion (net outflow of $3 billion). According to Glassnode, Bitcoin outflow amounted to 39 637 BTC (~$700m).

Against this backdrop, the exchange paused withdrawals of USD Coin (USDC) on the Tron, BNB Chain and Ethereum networks. Because U.S. banks were closed, Binance could not actively convert USDC, but the problem was resolved the same day. The restrictions did not affect USDT and BUSD. Additionally, Tether helped the platform transfer 3 billion USDT from Tron to Ethereum.

Zhao warned colleagues that the infamous crypto-winter is not over, and the coming months will be tough. In his words, the industry is currently going through a “historic moment.” At the same time, Binance’s financial strength is enough to “weather any crypto-winter.”

At the end of the week, during a hearing of the US Senate Banking Committee, investor Kevin O’Leary, who received $15 million for promoting FTX, named Binance implicated in Bankman-Fried’s platform collapse.

Republican US Senator Bill Hagerty stated Binance’s ties to the Chinese government. These same concerns were raised by Democratic Senator Mark Warner.

Gemini reports data breach, followed by prolonged maintenance

On December 15, the cryptocurrency exchange Gemini reported a data breach following a series of phishing attacks — unknown actors gained access to email addresses and partial phone numbers of users. The platform stated that customer funds remain secure.

The next day Gemini paused operations due to planned maintenance. The timelines for resuming services were pushed back several times.

What to discuss with friends?

- WhiteBIT announced a partnership with FC Barcelona.

- Terraform Labs founder Do Kwon is hiding in Serbia.

- A US Senator said there is no justification for cryptocurrencies.

- Chainalysis compared investor losses from Terra’s collapse and FTX’s downfall.

Toncoin nears top-20 amid a series of announcements

On December 14, TON quotes rose by more than 20%, and for the week the gain was about 50%. The rise was driven by the Fragment platform’s auctions for selling random numbers. The bid on them is floating and rises every three hours to a peak of 99 TON, after which the number is removed from sale.

The project also announced the launch of a new decentralized platform, DeDust. Bitget announced full support for TON deposits and withdrawals on the mainnet, and Gate added TON-based futures.

Number of law-enforcement requests to Coinbase jumped 66% year on year

The leading US exchange Coinbase received 12,320 requests from law enforcement and regulatory bodies for customer information over the year. About 57% of requests came from outside the United States — up 6%. The majority came from the United Kingdom, Germany, Spain and France.

3Commas denies API-key leak claims

The crypto trading platform 3Commas rejected claims of API-key theft by employees and described social-media reports as a targeted attack.

Founder Yuri Sorokin noted that log screenshots differ from the actual software UI.

Trust Wallet adds cross-chain swaps via THORChain

The Trust Wallet team added cross-chain swaps to a non-custodial wallet through THORChain integration. This should make cross-chain transfers safer and easier to execute. There will be no fees for such transfers.

The project also announced that central bank digital currency (CBDC) work is progressing in Kazakhstan; the National Bank published a white paper on the digital tenge, explaining the need for a CBDC.

Real users and merchants participated in testing the digital tenge. By October 2022, more than 3,500 transactions with the token had been completed. Users sent funds via a dedicated app.

Also on ForkLog:

- The head of Binance explained the delisting of Mithril.

- OneCoin co-founder admitted guilt in fraud and money laundering.

- In Chainalysis they compared investor losses from Terra’s collapse and FTX’s downfall.

- UNHCR and Stellar began distributing USDC to Ukrainian refugees

What else to read?

ForkLog spoke with Yagub Zamаnov, director of the Department of Financial Technology at the Astana International Financial Centre (AIFC) for financial services regulation, about new regulations for Bitcoin exchanges in Kazakhstan, the development of local startups and the FTX collapse.

ForkLog also summarizes key events in cybersecurity and artificial intelligence in its weekly digest.

Read ForkLog’s bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!