Week in review: Bitcoin ends nine-week losing streak as Optimism conducts native token airdrop

Bitcoin ended a nine-week losing streak, the Optimism team carried out a native token airdrop, the New York State Senate backed a mining moratorium, and other developments from the week just past.

Bitcoin breaches the $32,000 level but fails to sustain above it

On May 29, Bitcoin registered a record nine-week run of declines. However, the following day prices surpassed the $32,000 level.

The first cryptocurrency could not hold above this mark. As of writing, the asset was trading near $29,800.

Analysts at Glassnode noted that the Terra collapse pushed some long-term Bitcoin investors to realise losses, but many hodlers used the drop below $30,000 to add to positions.

The co-founder of crypto derivatives exchange BitMEX, Arthur Hayes expressed the view, that Bitcoin and Ethereum had already bottomed in the current cycle, though a reversal in the market trend should be anticipated when Federal Reserve stops raising the policy rate.

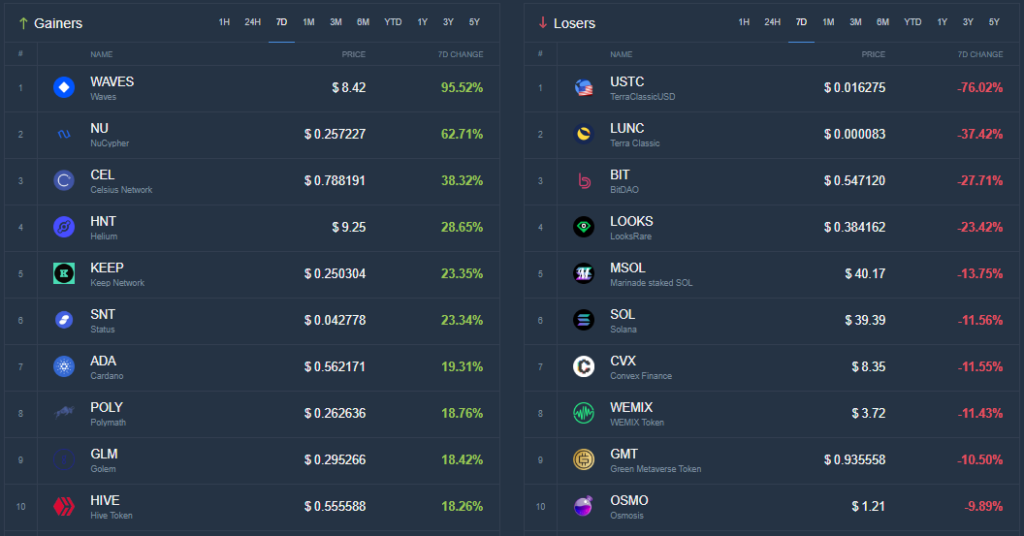

According to CoinCodex, for the week among mid-cap digital assets the native token of the Waves blockchain rose the most. WAVES price rose by 95%.

In the leaders of decline remain the algorithmic stablecoin USTC and Terra Classic’s LUNA. Their price fell by 76% and 38% respectively.

Total market capitalisation of the crypto market stood at $1.28 trillion. Bitcoin’s dominance index rose to 44.2%.

Media reported the detention of former WEX head Dmitry Vasilyev in Croatia

Former WEX head Dmitry Vasilyev was detained at Zagreb Airport on entry to Croatia, local media reported.

Detention occurred on Wednesday, 25 May, on the basis of an Interpol red notice issued by Kazakhstan. Authorities suspect Vasilyev of embezzling more than $20 million and are pursuing his extradition.

Vasilyev denies all charges.

The court orders seizure of crypto wallet of the alleged Hydra administrator, but cannot access it

The Moscow court ordered the seizure of Dmitry Pavlov’s cryptocurrency wallet, accused of administering the Hydra darknet marketplace.

All phones and computers were reportedly seized, and Pavlov cooperates with investigators. However the suspect refused to provide the password to the wallet. Investigators believe the address may hold hundreds of millions of dollars in Bitcoin.

Hacker drained $90 million from the Mirror protocol. Discovered seven months later

The Terra-based Mirror DeFi protocol fell victim to an exploit of more than $90 million. It was discovered by analyst FatMan, and confirmed by cybersecurity firm BlockSec.

To open a short position on a synthetic stock in Mirror Protocol, you must lock collateral (UST, LUNA Classic and mAssets) for at least 14 days. After the operation is completed, the tokens can be withdrawn back to a wallet.

To establish asset ownership, a contract-generated identifier was used. Because of the vulnerability the protocol could not block multiple withdrawals by the same user. In October 2021 this was discovered by an unknown actor, who inflicted losses totaling $90 million — hundreds of times larger than the collateral locked.

Developers rehearse the Ethereum network merge on the Ropsten testnet

The «dress rehearsal» of the merge between PoW and PoS on the Ethereum testnet Ropsten will run from June 2 to June 8, according to developer Tim Beiko.

Ropsten is one of the oldest PoW testnets, its conditions of operation are closest to the real network. The event will test the system’s readiness ahead of the full transition to Ethereum 2.0. Similar updates are expected for the Goerli and Sepolia testnets. After this, developers’ focus will shift to the mainnet.

Elon Musk criticises Dogecoin co-founder over a ‘snippet of bad Python code’

The Dogecoin co-founder Jackson Palmer faced criticism from Elon Musk, who had previously called him a fraud.

In an interview with Crikey, Palmer said how several years ago he provided Musk with a script to combat spam on Twitter. According to him, the billionaire could not figure out how to run it because he “poorly knows the code.”

Palmer also called the head of Tesla and SpaceX a fraud and a pretender, criticising his activity in the crypto space and his plans to acquire Twitter.

«You falsely claimed that this snippet of bad Python code would help solve the bots problem, — replied Musk to the tweet about the interview. — My children wrote code better when they were 12».

What to discuss with friends?

- Kalush Orchestra sold the Eurovision-2022 trophy to a crypto exchange.

- A startup presented a “clone” of STEPN: instead of running — sex.

- In the UAE investors who lost $30 million robbed a crypto expert.

- The anonymous creator of Shiba Inu deleted all posts on Twitter and Medium.

Optimism team conducted a native token airdrop

Optimism developers distributed the native token OP among 232,000 users of the Layer-2 solution for Ethereum.

Participants received 231,928,234 OP — 5.4% of the initial supply. In total, including subsequent rounds, 19% of the 4.29 billion tokens will be distributed among users.

Owners of the tokens will be able to delegate their voting rights to a community member or participate in voting themselves.

Central Bank of Russia allows international settlements in cryptocurrencies

The Russian central bank softened its stance on cryptocurrencies — regulators now do not object to their use in international settlements and international financial infrastructure. This was stated by first deputy chair Ksenia Yudaeva.

She noted that the central bank still believes that using digital currencies domestically creates significant risks for citizens.

Solana outage caused by a niche-transaction processing error

On Wednesday, June 1, the Solana network for more than four hours did not produce new blocks due to a bug in processing “durable transaction nonces,” which led to a disruption of consensus. Developers disabled this type of operation and asked validators to restart the blockchain.

Durable transaction nonces are mainly used by cryptocurrency exchanges. The feature is designed for token holders who employ advanced automatic signing setups, which can make it difficult to prepare transactions quickly for on-chain registration.

New York Senate backs mining moratorium

On June 3, the New York State Senate approved a two-year moratorium on cryptocurrency mining using electricity generated from carbon-based sources.

Existing operators or those seeking permits to mine digital assets will be allowed to continue. Authorities plan to study the environmental impact of PoW mining.

The initiative was criticised by Ethereum founder Vitalik Buterin, Castle Island Ventures’ managing partner Nick Carter, and other members of the community.

Japan adopts law on stablecoins

The Japanese parliament adopted a bill recognising stablecoins as digital money.

According to the document, stablecoins must be pegged to the yen or another legal tender and guarantee holders the right to redeem them at face value. This means that issuers of stablecoins can be only banks with licenses, money-transfer providers, and trust companies.

The law will come into force in the summer of 2023.

Changpeng Zhao says Binance did not profit from Terra collapse

Binance could have earned $1.6 billion from investments in Terraform Labs and has always prioritised user protection. This, in an interview with Fortune, said the head of the bitcoin exchange, Changpeng Zhao.

This week one of Terra 2.0’s ecosystem validators also shared a potential roadmap for the project’s development over the next three months. He did not rule out the launch of a new algorithmic stablecoin.

Also on ForkLog:

- Snoop Dogg announced a NFT-dessert store.

- Hackers hacked Discord servers of the Bored Ape Yacht Club project.

- Justin Sun discussed a model of USDD stability from Tron.

- Zcash developers activated the Network Upgrade 5 update.

What to read and watch next?

The Terra ecosystem collapse triggered a prolonged market correction, and the market cap of the stablecoins sector declined to $157 billion. We analysed the main on-chain metrics and DeFi dynamics in the May 2022 analytical report.

We released a series of educational cards: about the Polygon network, the Coinbase exchange, the Ethereum Name Service, deepfakes and the Terra 2.0 airdrop.

In traditional digests we collected the key events of the week in cybersecurity and artificial intelligence.

The DeFi sector continues to attract heightened attention from crypto investors. ForkLog has gathered the most important events and news of recent weeks in a digest.

In ForkLog Live we discussed whether the inflow of venture capital will help bring the DeFi ecosystem back to normal. Guests were VeleroDAO founder Dmitry Kryshtal and Broxus CEO Vladislav Ponomarov.

In a special ForkLog report we explain what stablecoins are, what kinds they come in, and why TerraUSD collapsed.

Read ForkLog’s Bitcoin news in our Telegram — news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!