Week in review: Bitcoin revisits April lows and a major Cloudflare outage

Bitcoin fell to $82,000; Cloudflare’s outage exposed Web3 risks; Nvidia beat forecasts.

The leading cryptocurrency slipped to $82,000, Cloudflare glitches spotlighted Web3 vulnerabilities, Nvidia’s quarterly results beat forecasts, and other events of the week.

Six-month low

Over the past seven days bitcoin accelerated its decline, testing levels last seen in April.

On Monday the asset opened near $95,000, then ebbed lower in waves. By Thursday prices had already fallen below $85,000.

On Friday, 21 November, the correction hit bottom around $81,700 — the lowest since April.

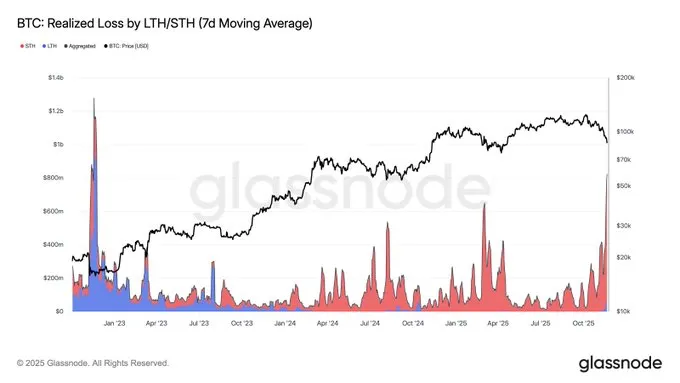

That day, 24-hour crypto liquidations exceeded $2bn. Realised losses simultaneously reached levels unseen since the FTX collapse.

By Sunday evening, digital gold had recovered to $86,500. The weekly drop was about 10%.

The asset’s market capitalisation fell to $1.72trn, with the overall crypto market at $3.04trn.

As bitcoin dominance remains high (56.8%), other coins followed its lead. All ten largest cryptocurrencies fell by 7-10%.

Ethereum sank to $2,800, briefly touching $2,600. BNB trades around $850, Solana at $130.

The Fear and Greed Index stands at 13, signalling extreme fear.

Kronos Research’s chief investment officer Vincent Liu noted the correction was tied to stronger-than-expected US jobs data for September. It was due for release in early October but delayed by the government shutdown.

The country added 119,000 new jobs — the biggest jump since December. Unemployment rose to 4.4%, explained by growing labour supply.

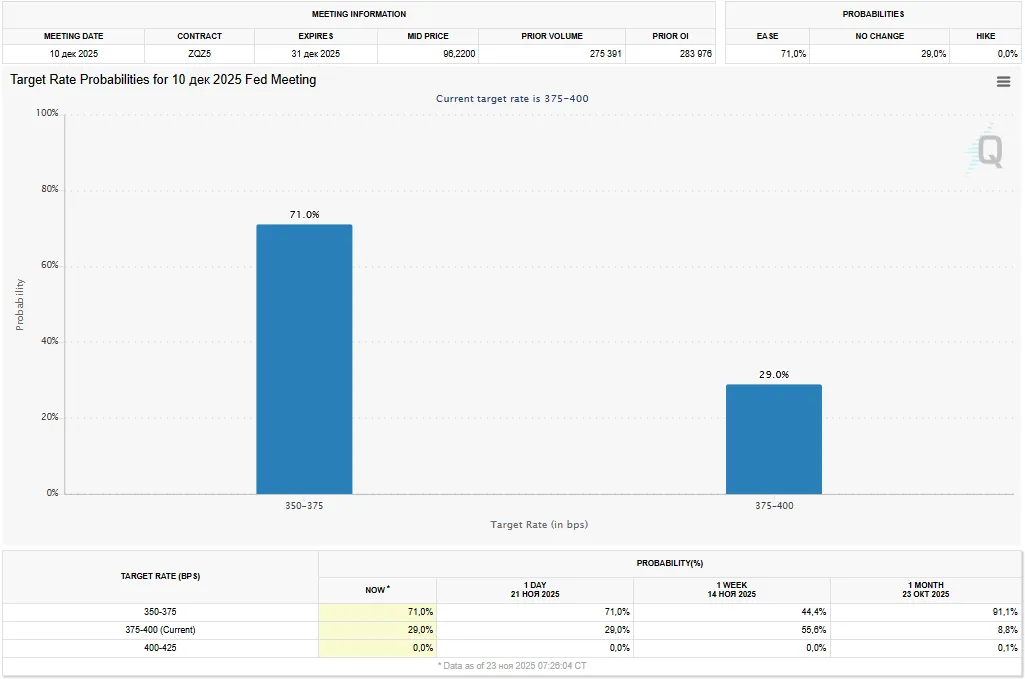

The report dented bullish expectations for the Fed in December. The regulator will have to decide based on less current data — October and November fell out of the statistics.

Investors put the odds of continued easing at 71%. At the start of the month, that stood at 98%.

An internet outage

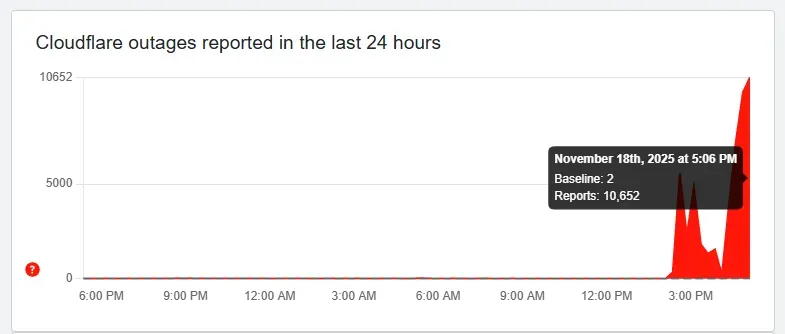

On 18 November a major outage occurred at provider Cloudflare. The incident disrupted numerous sites and apps, crypto-related ones included.

Among those affected were social network X, OpenAI’s website, music service Spotify, Amazon Web Services, ride-hailer Uber, video game League of Legends and others. At least 20% of all internet traffic was affected.

In crypto, problems hit exchange Coinbase, L2 network Base, online broker Robinhood and trading platform BitMEX.

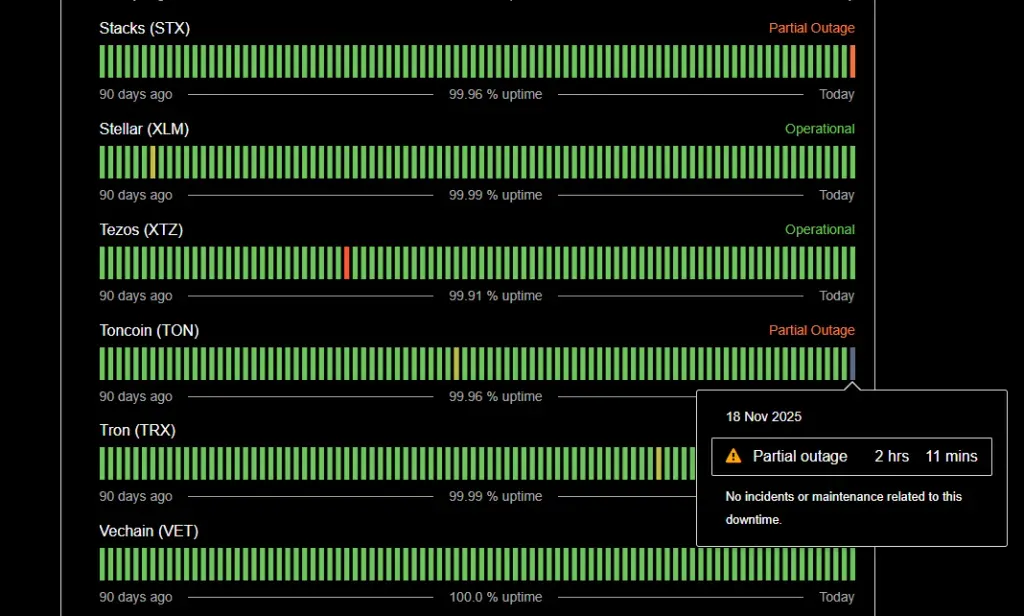

Wallet provider Ledger and its services also ran into issues. According to the company’s analytics resource, the situation affected several blockchains, including TON, Cardano and Filecoin.

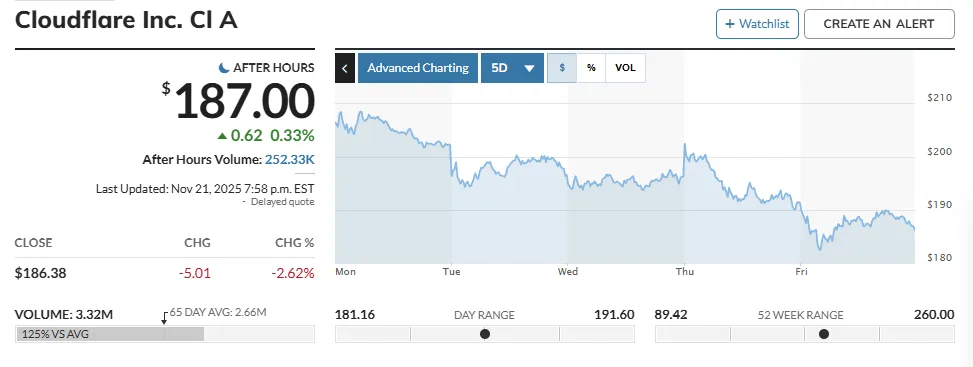

In the wake of the outage, Cloudflare Inc (NET) shares fell from $208 to $187 over the week.

According to an EthStorage representative, the provider’s malfunction highlighted crypto projects’ dependence on centralised internet infrastructure.

He argued the incident proved the need for end-to-end decentralisation — from blockchain to user interface and data storage. Many projects rely on centralised DNS, API and cloud storage, making infrastructure vulnerable.

“Decentralising blockchains through consensus, a robust validator set and smart contracts is necessary, but it represents only one side of the equation. True resilience requires rethinking the entire stack, not just the distributed-ledger layer,” the expert noted.

The Filecoin blockchain team said the Cloudflare outage “demonstrated how much traffic passes through a handful of centralised networks”.

What to discuss with friends?

- Bitcoin advocate Robert Kiyosaki sold coins worth $2.25m.

- Experts predicted rising laptop and smartphone prices amid the AI boom.

- Mt.Gox moved $953m in bitcoin.

- Kraken raised $800m at a $20bn valuation ahead of an IPO.

95% mined

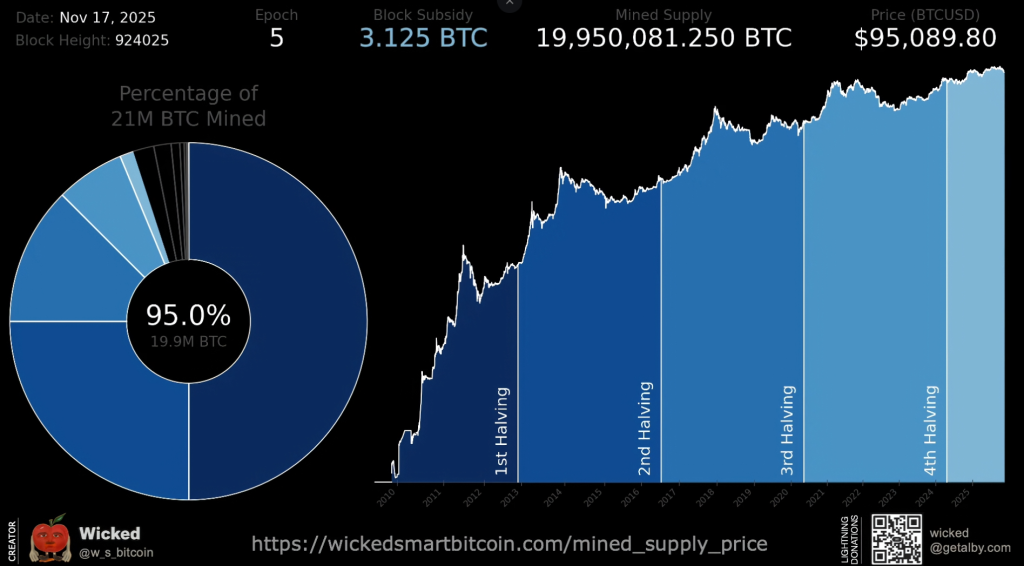

On 17 November, bitcoins mined surpassed 19.95m BTC — 95% of the programmed limit of 21m BTC.

Although most of the cryptocurrency is already in circulation, the last 5% (about 1.05m BTC) will be mined slowly — roughly 115 years, until 2140.

Bitcoin’s issuance slows with every halving. The next reward cut for miners will occur roughly in April 2028.

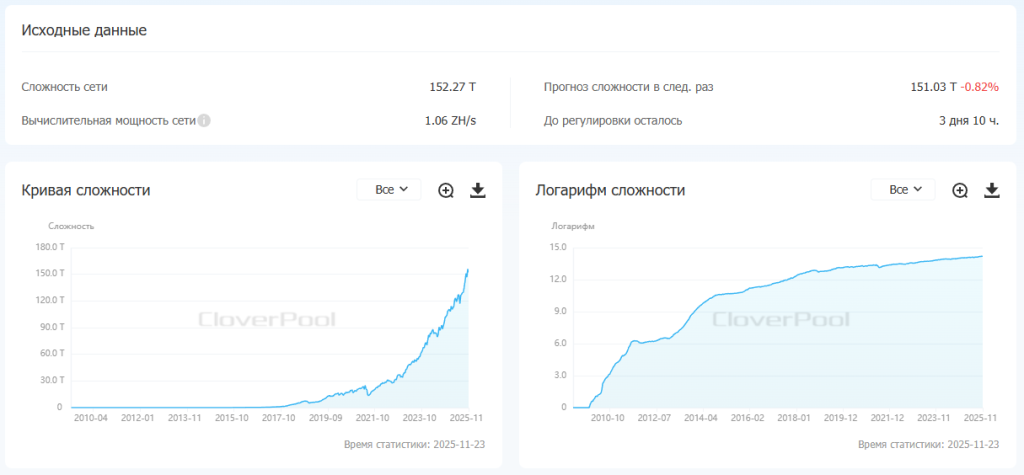

Structural change has already shown up in mining metrics. Its difficulty sits near all-time highs. At the latest retarget on 12 November, the figure reached 152.27 T.

Experts explain the importance of digital gold’s “coming of age” and mining’s role in it in our feature.

Meanwhile, bitcoin miners’ fee income fell to a 12-month low.

The metric slid to $300,000 per day — 1% of miners’ total revenue. The bulk comes from the 3.125 BTC block reward.

On-chain data show the network’s main use remains value transfers, which limits the potential for high fee generation.

Uniting Ethereum

The non-profit Ethereum Foundation disclosed details of the upcoming launch of the Interop Layer (EIL) — a protocol meant to knit together the fragmented second‑layer ecosystem into a “single chain”.

The solution takes a “wallet-centric” approach, where a user signs a single transaction for trustless cross-network operations. It is built on account abstraction and principles of the “Trust Manifesto”.

“Our vision is for the user to interact with the entire L2 ecosystem as a single Ethereum network. No convoluted bridges, multiple chain names or fragmented balances. EIL is designed to restore a sense of unity without sacrificing decentralisation and security,” the blog says.

The protocol aims to make the wallet a single access point to the ecosystem with automatic support for new compatible networks. Use cases include:

- moving USDC from Arbitrum to Base in one click;

- minting an NFT on Linea with automatic consolidation of balances across networks;

- automatic coin swaps using liquidity on Optimism.

EIL is likened to the HTTP protocol of the early internet — just as browsers unified disparate servers, the solution would unite L2 networks into one space.

Also this week, Ethereum co-founder Vitalik Buterin said there are two threats to the blockchain’s development.

The first is a developer exodus, potentially exacerbated by parts of the community being unwilling to work with Wall Street.

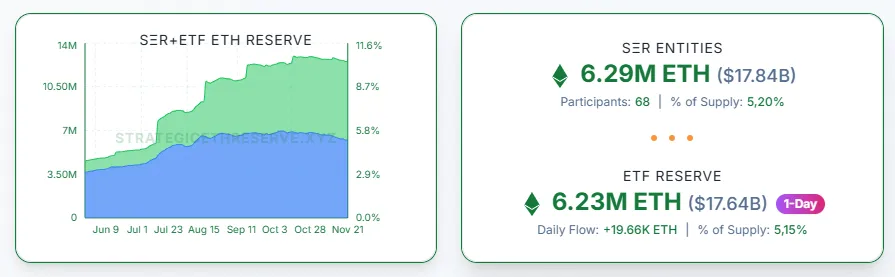

Today nine financial giants, including BlackRock, manage $17bn via exchange-traded funds. A similar amount is held on balance sheets by several dozen treasury companies. In all, these market participants have amassed 10.35% of the coin’s supply.

The second risk is pressure on technical development. Investors may lobby for base‑protocol changes that suit them but harm ordinary users.

As a solution, Buterin urged focusing on Ethereum’s unique advantages:

“We need to focus on things that would otherwise be lacking: a global, neutral and censorship‑resistant protocol.”

Also on ForkLog:

- Peter Schiff called Strategy’s business model “fraudulent” and challenged Michael Saylor to a debate.

- Scientists created an AI model to discover physical laws.

- Crypto loan volumes hit a record $73.6bn.

- An expert criticised the Coinbase‑backed x402 micropayments protocol.

A tonic from Nvidia

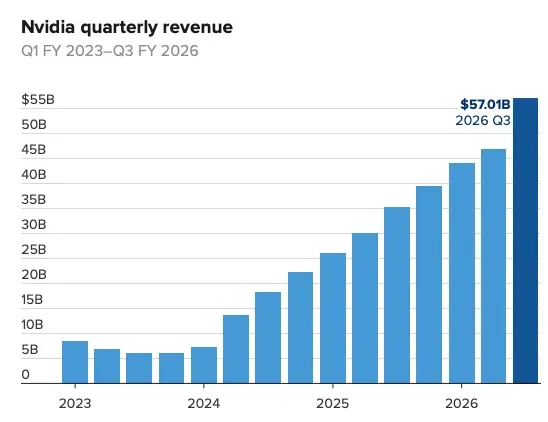

For the third quarter, Nvidia posted $57bn in revenue, up 62% year on year.

Net profit reached $32bn, up 65%. Both figures beat Wall Street forecasts.

Data‑centre business brought in $51.2bn, with the rest from gaming, visualisation and automotive.

Nvidia guided revenue higher — to $65bn in the fourth quarter.

CEO Jensen Huang said sales “exceed all expectations”. The Blackwell Ultra GPU unveiled in March proved especially popular.

“Demand for computing continues to rise in both training and inference — each is growing exponentially. We have entered a success spiral. The ecosystem is expanding rapidly — there are more and more developers of foundation models and AI startups across industries and countries. The technology is spreading everywhere, doing everything at once,” noted Nvidia’s CEO.

Investors had feared weak results from the American chipmaker would signal a bursting bubble and trigger further declines. That was largely avoided.

Nvidia’s own shares jumped from $185 to $197 after the 19 November release, but slid to $180 by week’s end.

The report also gave a lift to other AI and mining names. Cipher Mining rose by more than 10%, followed by IREN, Bitfarms, TeraWulf, CleanSpark and MARA. Nevertheless, they too slumped by Sunday.

Nvidia’s CEO offered three reasons why the AI industry is not a bursting bubble:

- Areas such as data processing, ad recommendations and search are moving to GPUs because they need AI.

- AI technologies are not only being embedded into existing apps; they also enable new products.

- The rise of agentic AI capable of reasoning and planning will drive demand for computing resources.

What else to read?

We profile the modern crypto employee — their ambitions, prospects and opportunities in Web3.

The sixth instalment of the “Silicon Tanks” series about Moxie Marlinspike, best known as the creator of the secure messenger Signal.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!