Week in review: Bitcoin’s slide to $60,000 and billion‑dollar losses for crypto treasuries

Bitcoin hit $60k, miners squeezed, crypto treasuries logged big paper losses, WLFI drew scrutiny.

Bitcoin tested a local bottom near $60,000, mining difficulty fell 11%, crypto treasuries posted sizeable “paper” losses, reporters uncovered a secret Trump deal, and other developments of the week.

Two‑year lows

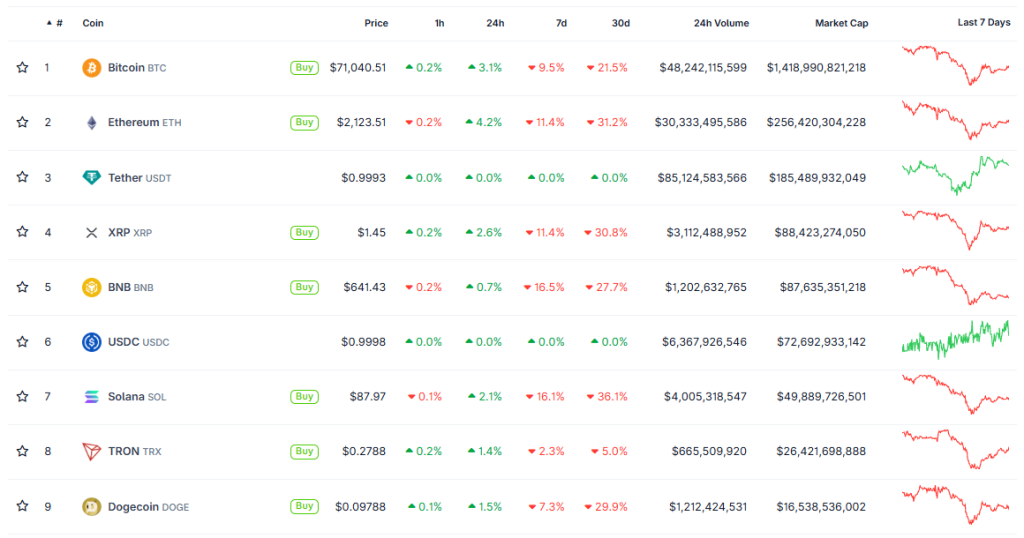

Over the past seven days the crypto market probed lows last seen in September 2024. As recently as Monday, bitcoin traded just below $80,000, before a sharp correction set in by Wednesday.

On 3 February the first sharp drop took BTC from $78,000 to $73,000. The next day the sell-off intensified — the price plunged to $70,000.

On Friday, 5 February, came the week’s deepest flush: the leading cryptocurrency tumbled from $73,000 to $60,000.

At the time of writing, bitcoin had recovered to $70,000, down 9.5% on the week.

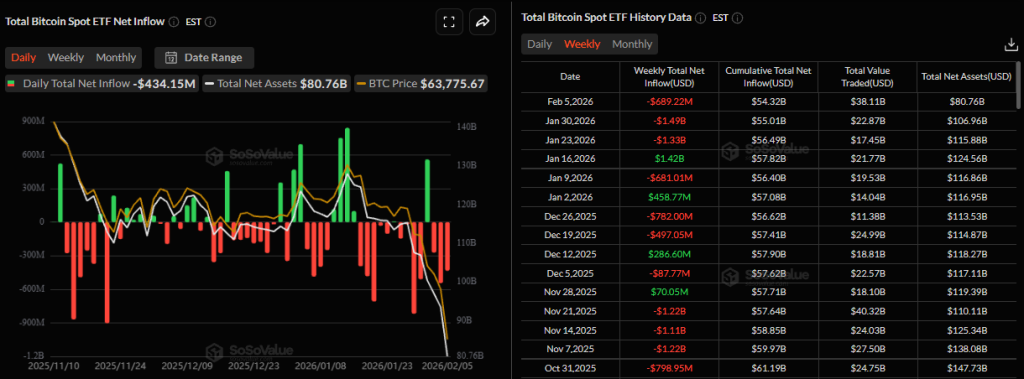

The market rout came with billions of dollars in liquidations and outflows from ETFs. Over the trading week, investors pulled $689m from spot bitcoin funds.

At the same time the crypto Fear & Greed Index sank to extreme lows below 10.

Most large-cap coins bled red alongside the bellwether. Ether lost a key psychological level, dropping below $2,000. It has since rebounded to $2,100 (-11.5% on the week).

In parallel, XRP slid to $1.45 (-11%), BNB to $650 (-16.5%), and SOL to $90 (-16%).

Analysts note signs of investor capitulation, while technical gauges point to deep oversold conditions. Correlations with mainstream indices, including the NASDAQ100 and S&P 500, have strengthened.

Opinions diverged on the path ahead: some participants suggest a local bottom is in, others expect a deeper drawdown.

Total crypto market capitalisation fell to $2.5trn. Bitcoin’s dominance is 57%, ether’s 10.3%.

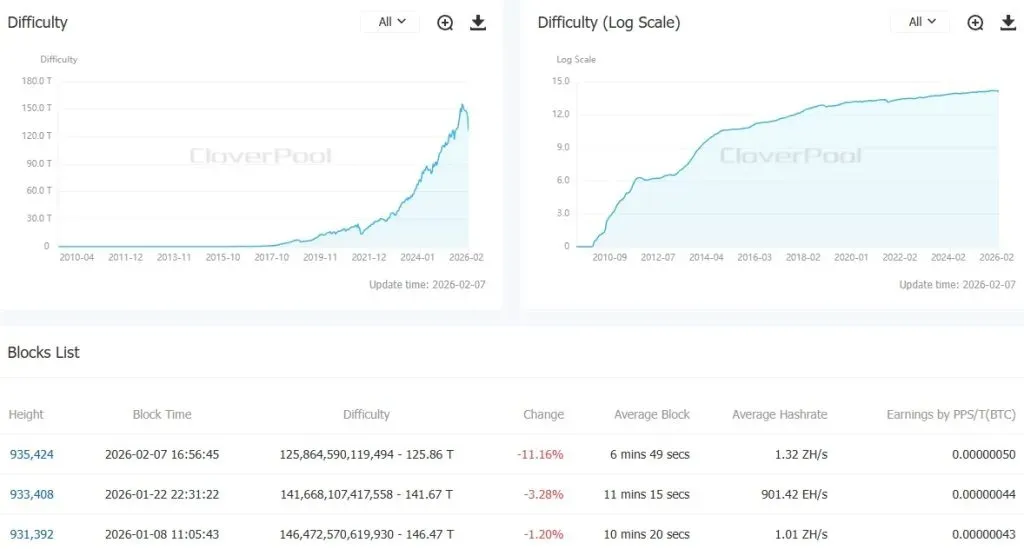

Difficulty drops and miners power down

On 7 February bitcoin’s mining difficulty plunged 11.16% to 125.86 T — the steepest decline since China’s 2021 mining ban.

After the difficulty adjustment, the hashrate on the network jumped to 1.3 ZH/s, and the average interval shortened to roughly seven minutes.

At the same time the bitcoin-mining profitability gauge fell to a record low. Mining companies began switching off equipment en masse amid the price slump and rising power tariffs.

Revenue per unit of compute fell to 3 cents per terahash. For comparison, in 2017 the figure was $3.5.

Moreover, many ASIC machines have turned unprofitable. Antminer S19 XP+ Hydro, WhatsMiner M60S and Avalon A1466I are near breakeven. While bitcoin is below $86,000 they do not generate profits.

Newer units such as Antminer S21 have break-even thresholds in the $69,000–$74,000 per BTC range. The most resilient models now are U3S23H and S23 Hydro, which remain profitable with the bitcoin price above $44,000.

The sell-off hit public miners’ stocks. On 5 February alone, CleanSpark fell 10%, MARA 11%, TeraWulf 8.5%, and Riot 4.8%.

What to discuss with friends?

- SpaceX merged with xAI into a $1.25trn company.

- Vitalik Buterin: as Ethereum scales, the need for L2s wanes.

- Tether released an open operating system for bitcoin mining.

- Media reported a possible BitRiver bankruptcy.

DAT-company losses

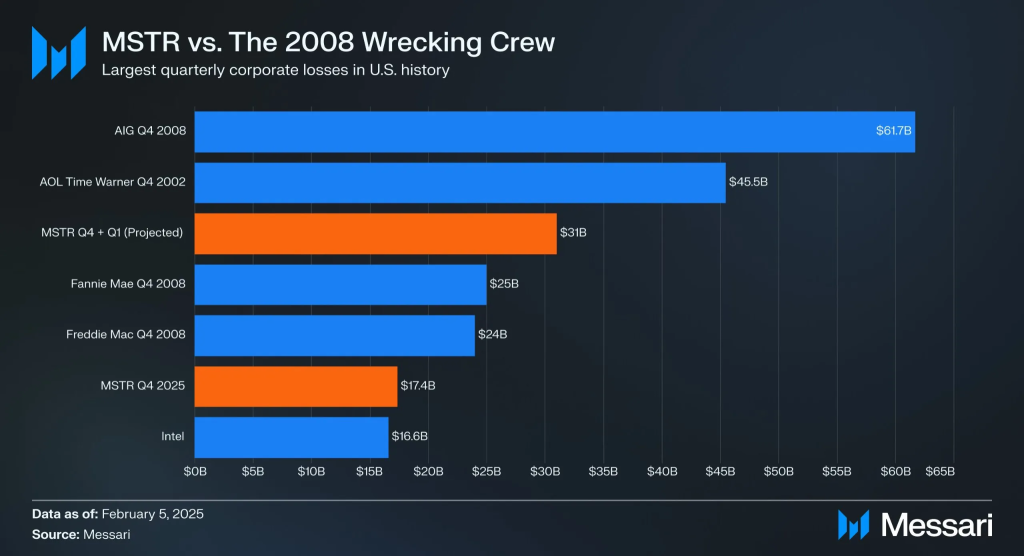

The market slump affected not only miners but also firms with digital-asset treasuries (DAT).

Operating loss at the segment’s largest player — Strategy — hit $17.4bn, driven largely by unrealised losses on bitcoin reserves. Net loss came in at $12.6bn versus $671m a year earlier.

Just four months ago the treasury giant’s paper profit reached $31bn.

According to Messari, Strategy’s current loss is comparable to those of AIG, Fannie Mae and Freddie Mac during the 2008 crisis.

As of early February the company holds 713,502 BTC. The average purchase price is around $76,000.

Strategy’s stock is also in a rough patch: MSTR is down 54% year-on-year.

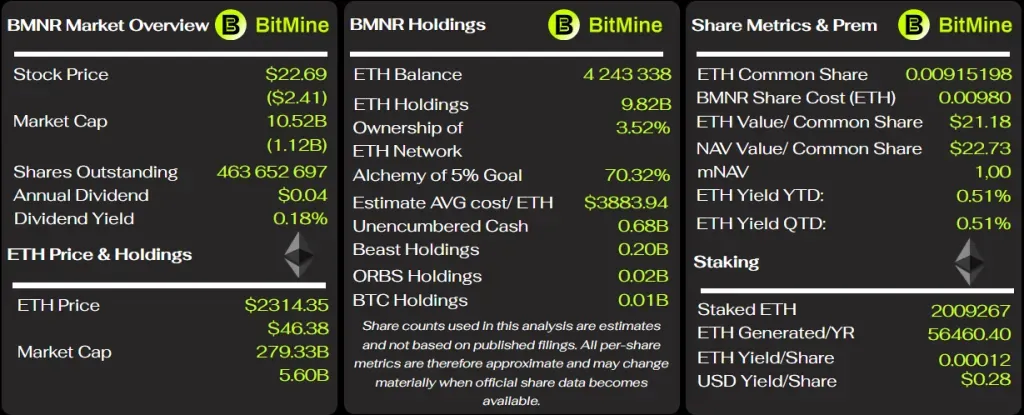

Other DAT companies face similar difficulties. The largest corporate holder of ether — BitMine — has lost $6.95bn in unrealised value.

It bought coins at an average of $3,883, while the current price has fallen to $2,240.

The second-largest treasury firm, SharpLink Gaming, lost $1.09bn on its ether investment. Its average entry price was $3,609.

Hong Kong’s Trend Research recorded a $747m loss on its ether treasury, selling almost all of its coins.

The Trumps’ secret deal

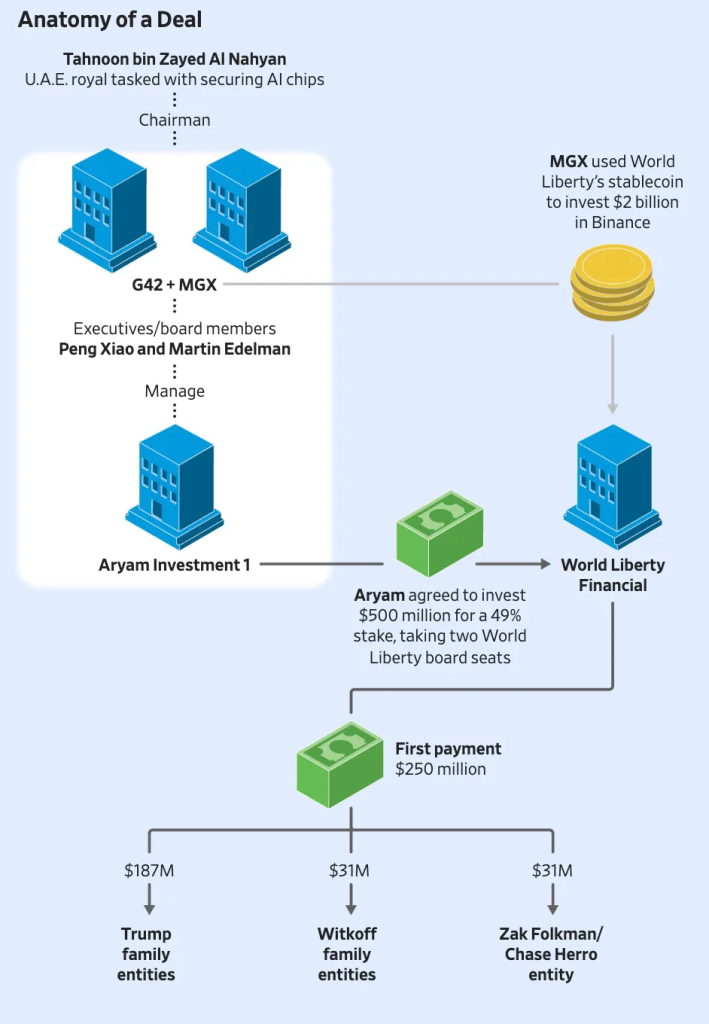

Beyond the correction, the community actively discussed a deal by the Trump family tied to World Liberty Financial (WLFI). According to The Wall Street Journal, an investment fund linked to UAE Sheikh Tahnoun bin Zayed Al Nahyan secretly acquired 49% of the company.

The deal was signed by the US president’s son Eric Trump in January 2025 — just four days before his father’s inauguration. It was not publicly announced.

Abu Dhabi’s Aryam Investment 1 paid half of the $250m up front. Around $187m went to Trump family companies (DT Marks DEFI LLC and DT Marks SC LLC), with at least $31m directed to firms linked to project co-founder Steve Witkoff.

Mr Witkoff was appointed US special envoy to the Middle East, and his son Zach is World Liberty Financial’s chief executive.

Reporters also revealed that, weeks before the Trump administration announced a UAE AI-chip agreement, Sheikh Tahnoun’s firm MGX invested about $2bn on Binance in WLFI’s USD1 stablecoin. These moves effectively made the asset’s launch possible.

After publication, Donald Trump said he was unaware of WLFI investments from the Abu Dhabi entity.

“My sons are handling it, my family is handling it… I have my hands full right now with Iran, Russia and Ukraine,” he said.

Later, Representative Ro Khanna sent a formal request to World Liberty Financial’s leadership. Authorities are examining the crypto project’s foreign ties and a potential conflict of interest.

Lawmakers want details on the $187m sent to companies tied to the president’s family and on payments to WLFI co-founders. The role of the USD1 stablecoin in MGX’s $2bn Binance investment is also under scrutiny.

Also on ForkLog:

- A marketplace appeared where AI agents can hire people.

- Pavel Durov criticised Spain’s plans to police the internet.

- Bhutan’s government withdrew $22m in bitcoin from reserves.

- Reporters learned of ongoing disagreements over the Clarity Act.

Bithumb’s error

On 6 February the South Korean exchange Bithumb mistakenly paid out huge sums in bitcoin to some users.

Researcher AB Kuai.Dong first drew attention to the situation. According to him, the platform erroneously credited “hundreds” of clients with 2,000 BTC (~$141.6m) instead of 2,000 won (~$1.4) as a reward.

Some recipients managed to sell the coins and cash out, briefly knocking the BTC/KRW rate on Bithumb down by 22%.

Media tied the incident to a “Random Box” promotion. Roughly 700 users received the transactions and about 240 accounts spotted them. The amount withdrawn after selling the coins totalled ~3bn won (~$2.1m).

The exchange managed to recover up to 400,000 BTC. In a separate press release Bithumb acknowledged mistakenly paying some clients “abnormally large amounts” of bitcoin.

According to the statement, Bithumb’s control system quickly recognised unusual transactions and blocked the account that initiated them. The cryptocurrency’s price “returned to normal” within five minutes, and the cascade‑liquidation prevention mechanism averted mass position closures.

“We want to make it clear that this incident is unrelated to any external hacking or security breaches and poses no threat to our systems or the management of user assets,” the statement said.

What else to read?

AI agents and the future of power in Web3 — who runs the bots?

Elena Vasilieva explains what is happening in the traditional precious‑metals market and why crypto investors should care.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!