Week in review: higher US inflation lifts bitcoin; Trump pardons CZ

Bitcoin tops $113,000; Trump pardons CZ; miners’ debt up 500%.

Digital gold rose above $113,000; Donald Trump pardoned Changpeng Zhao; miners’ debt is up 500% since the start of the year—and other highlights of the week.

A firm market

On Monday the leading cryptocurrency opened at $108,000; by Tuesday it had tested $114,000.

The cheer was short-lived, with a mild pullback through the workweek. But Friday’s data showing higher US inflation bolstered investor confidence.

In September the consumer price index increased by 0.3%, down from 0.4% a month earlier. Year on year, unadjusted, the reading rose to 3.0%.

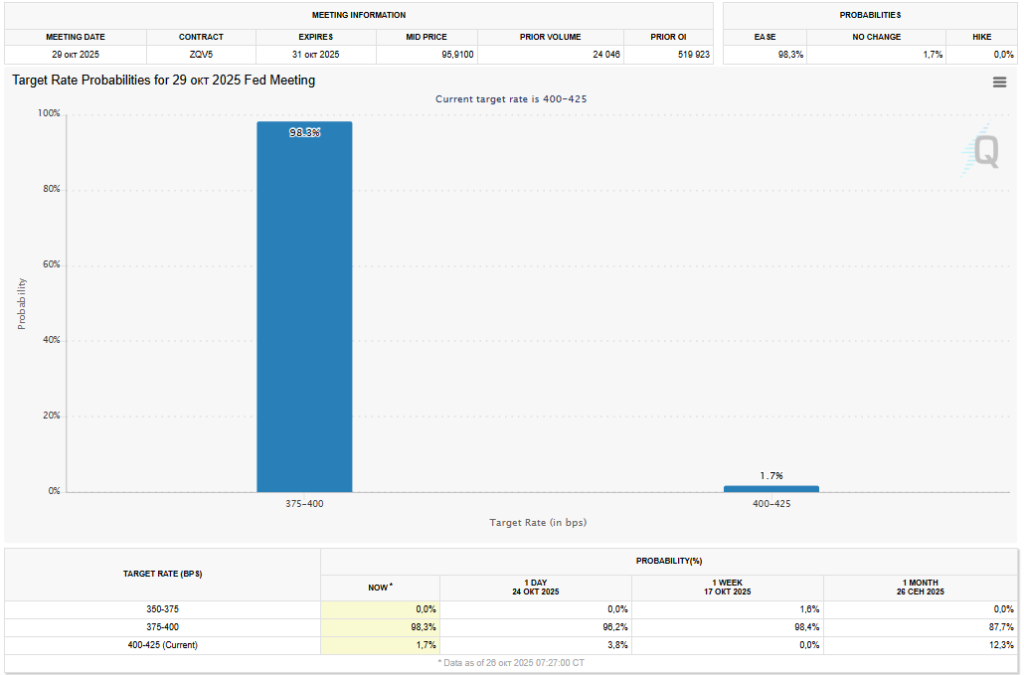

Traders put the odds of the Fed lowering the target range for the key rate to 3.75–4% at its 29 October meeting at 98.3%.

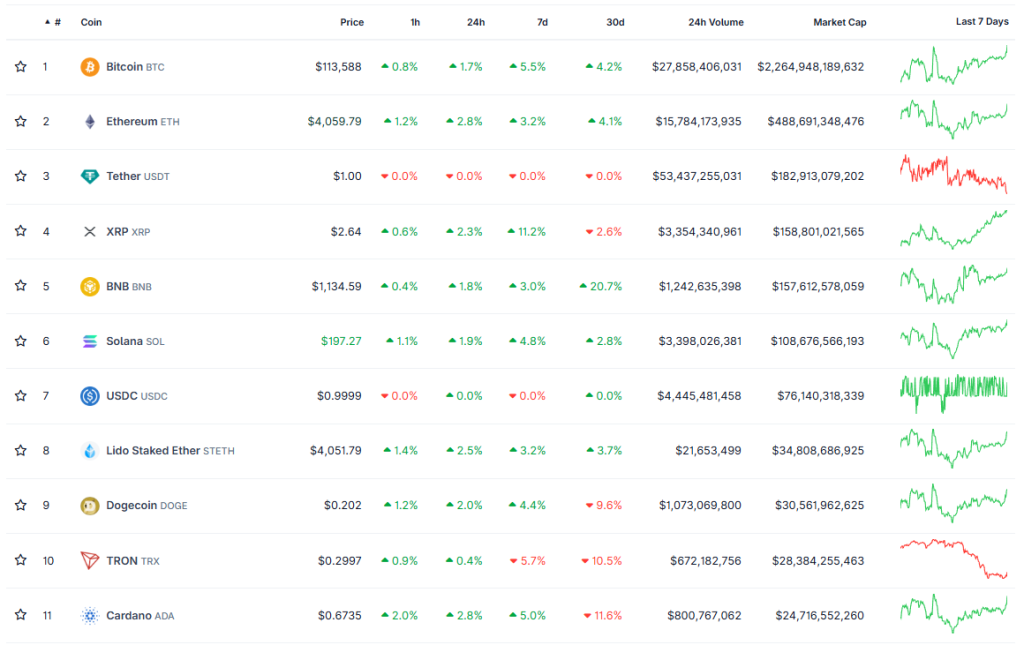

By Sunday evening bitcoin was back above $113,000. The asset added 5.5% over the week, with market capitalisation reaching $2.26 trillion.

The broader crypto market followed suit. Ethereum hovered around $4,000, and BNB around $1,100.

Among the top ten by market value, XRP stood out, adding 11% over seven days.

Total crypto market value reached $3.92 trillion. Bitcoin’s dominance is 55.7%, Ethereum’s 12.4%.

Crypto Fear and Greed Index stands at 40, up from 29 last week.

CZ’s pardon

On 22 October US President Donald Trump signed an order pardoning Binance founder Changpeng Zhao (CZ).

Answering reporters’ questions, Mr Trump also noted that many had supported CZ and had long urged that the charges be dropped.

— CZ 🔶 BNB (@cz_binance) October 24, 2025

“President Trump exercised his constitutional authority, pardoning Mr. Zhao, who was prosecuted by the [Joe] Biden administration as part of their war on cryptocurrencies,” said White House press secretary Karoline Leavitt.

CZ himself thanked the president and pledged to support the United States in developing the crypto industry.

Most of the community welcomed the news, though there were dissenters. Representatives of the US Democratic Party criticised the decision, and Congresswoman Maxine Waters accused Mr Trump of corruption.

Senator Elizabeth Warren joined in. She stressed that CZ was pardoned for lobbying the president’s crypto projects.

The entrepreneur pushed back, noting that Warren “cannot get the facts straight when making a public statement about the charges brought against a person”.

Zhao was released from prison in 2024 after serving a four-month sentence. Under an agreement with the Justice Department he agreed to pay a $50 million fine and step down as Binance’s CEO.

The exchange permanently barred CZ from management, but current CEO Richard Teng noted that Zhao remains the platform’s largest shareholder. Now, however, journalists have raised the prospect of the founder returning to the company’s leadership and reviving its American arm.

What to discuss with friends?

- A solo miner mined a bitcoin block and earned $347,455.

- Gamers, get ready: World and Eightco have set their sights on you.

- DeFi Llama reinstated Aster but called its data a “black box”.

- Coinbase spent $25 million to relaunch the UpOnly podcast.

An AI browser

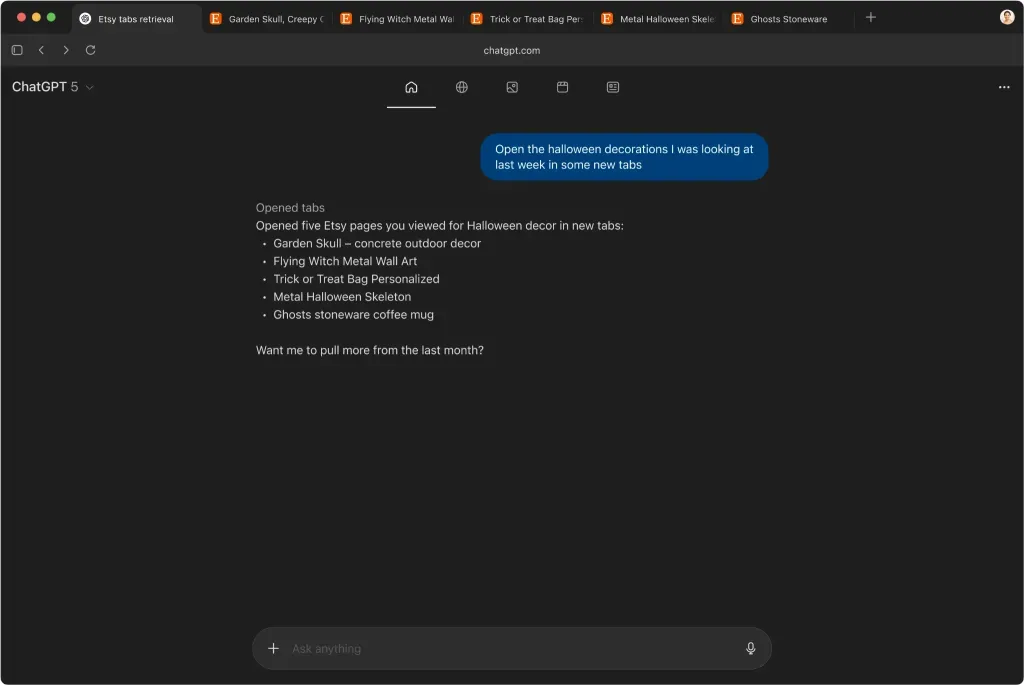

Another headline of the week was the launch of OpenAI’s Atlas AI browser. The product includes a built-in ChatGPT chatbot and virtual assistants.

The app is already available for download but for now supports only macOS.

Atlas is built on the Chromium stack, allowing imports from Chrome or Safari of history, bookmarks, saved passwords and even open tabs.

Its signature feature is an “Ask ChatGPT” button. It lets users query the AI about the contents of the active tab.

An Atlas memory function remembers which sites and topics a user has viewed.

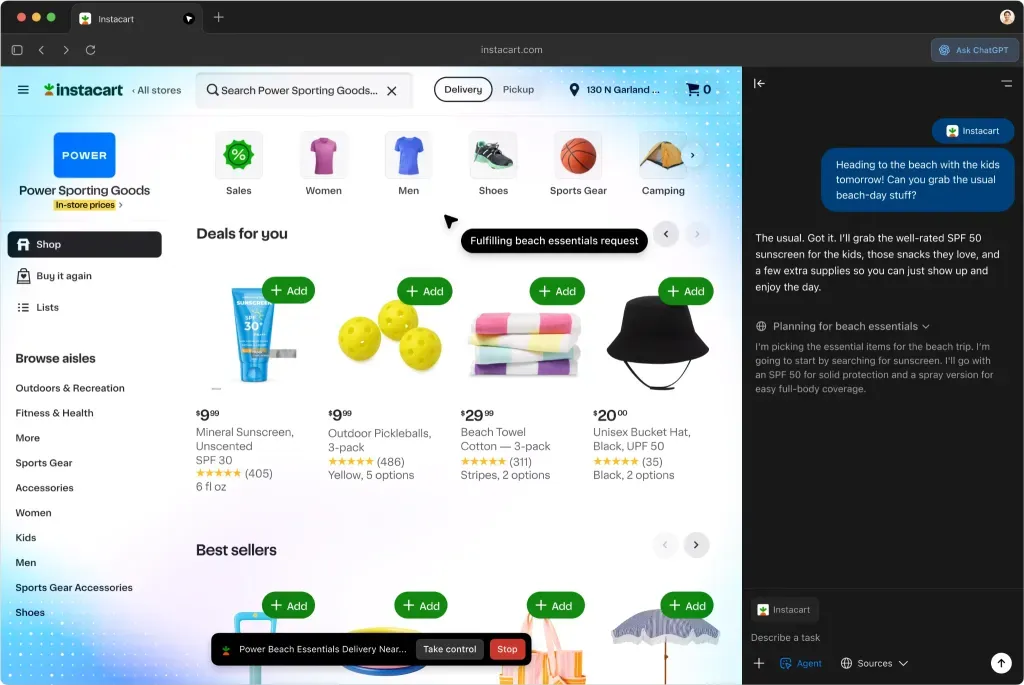

The tool can also switch to assistant mode to perform tasks autonomously. For example, the AI can book a hotel or place an order in an online shop.

In a separate article ForkLog tested Atlas and reviewed early feedback.

Miners’ debts

In September the profitability of mining the leading cryptocurrency fell by more than 7%. Daily revenue per 1 EH/s of hashrate slid from $56,000 to $52,000.

Jefferies analysts cited a 2% monthly dip in bitcoin’s price and roughly a 9% increase in network computing power among the main drivers.

Following the broad market correction on 11 October, hashprice has held below $49 per PH/s per day.

Despite lower mining margins, miners’ shares are surging. By mid-October the market capitalisation of the 15 largest US industry players reached $90 billion. Since 15 September Bitfarms has risen 162%, Canaan 149% and CleanSpark 125%.

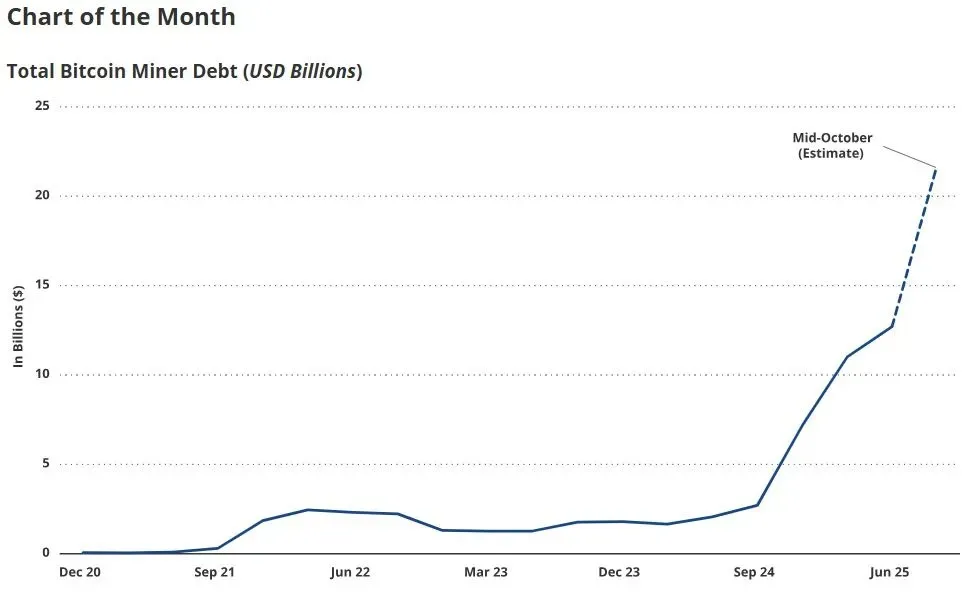

At the same time, VanEck experts recorded a 500% year-on-year jump in bitcoin miners’ debt—from $2.1 billion to $12.7 billion—owing to investment needs for mining equipment and fulfilling AI-related orders.

Even so, the firm argues that miners’ expansion into AI does not threaten the security of bitcoin’s blockchain. In its view, “priority consumption of electricity for artificial intelligence ultimately benefits bitcoin”.

“Mining digital gold remains a straightforward way to rapidly monetise surplus electricity in remote or developing markets, effectively subsidising the development of data centres initially designed to be convertible for AI and HPC needs,” they added.

Also on ForkLog:

- Bitcoin of discord: the consequences of recognising cryptocurrency as marital property for Russians.

- Researchers identified Sora 2’s tendency to create deepfakes.

- The Bitwise CIO explained bitcoin’s underperformance versus gold.

- In less than a month, trading volume on perp-DEX exceeded $1 trillion.

Millions of USDT users

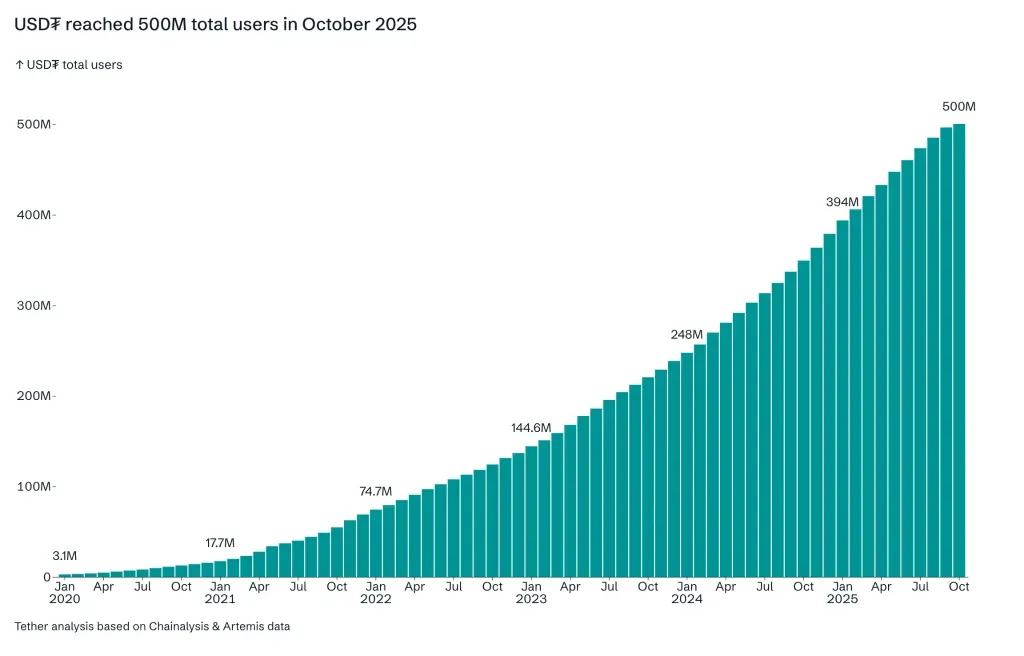

Tether reported a milestone: the number of USDT users has surpassed 500 million.

“Programmable money is the highest form of social network. A peer-to-peer ecosystem that transmits both information and value at the same time,” added the issuer’s CEO, Paolo Ardoino.

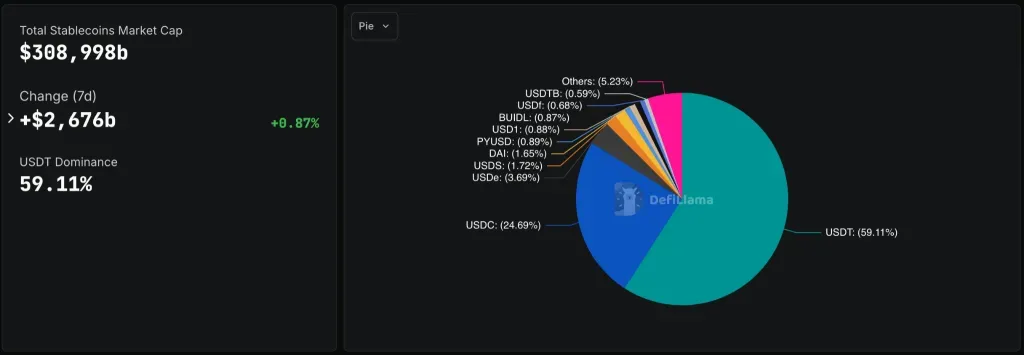

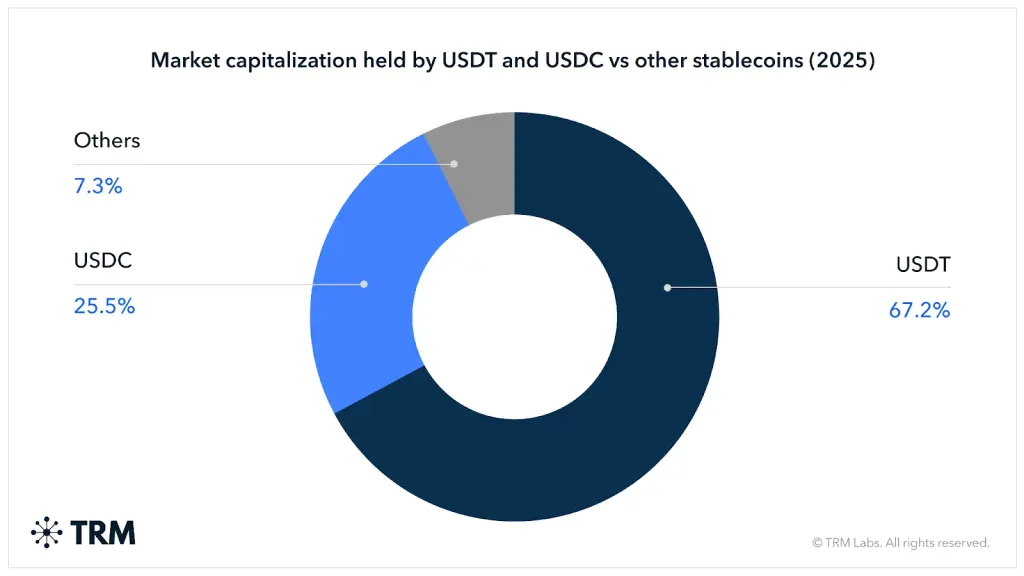

USDT’s market capitalisation now exceeds $182 billion, giving it roughly 59% of the market. Its nearest rival—Circle’s USDC—stands at around $76 billion.

Amid a growing user base, Tether continues its global expansion. The firm plans to enter the US market with a new stablecoin that meets local requirements.

Meanwhile, from January to September, the volume of global retail transactions with digital assets increased by 125%, according to TRM Labs.

Stablecoins continue to play the leading role in global crypto adoption, accounting for 30% of digital-asset transaction volume.

What else to read?

ForkLog examined the key digital-ID initiatives launched recently by governments around the world.

How the auto-deleveraging mechanism works, why it should be taken seriously, and what analysts say about the prospects for a renewed rally.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!