Week in review: Putin calls for compromise on cryptocurrency regulation as Bitcoin hits July 2021 low

Vladimir Putin urged the government and the Bank of Russia to find a compromise on cryptocurrency regulation, Bitcoin’s price touched the end-July low, the meme token Grimacecoin surged by 259,000% after a McDonald’s joke, and other events of the week.

Bitcoin price fell below $33,000

On Monday, January 24, the price of the leading cryptocurrency at one point fell to $32,917. The subsequent rebound allowed quotes to climb above $37,000.

As of writing, the digital gold was trading around $37,977.

Bloomberg noted, that Bitcoin had reached a record correlation with US tech-sector stocks. In Glassnode concluded, that the market had entered a bear cycle.

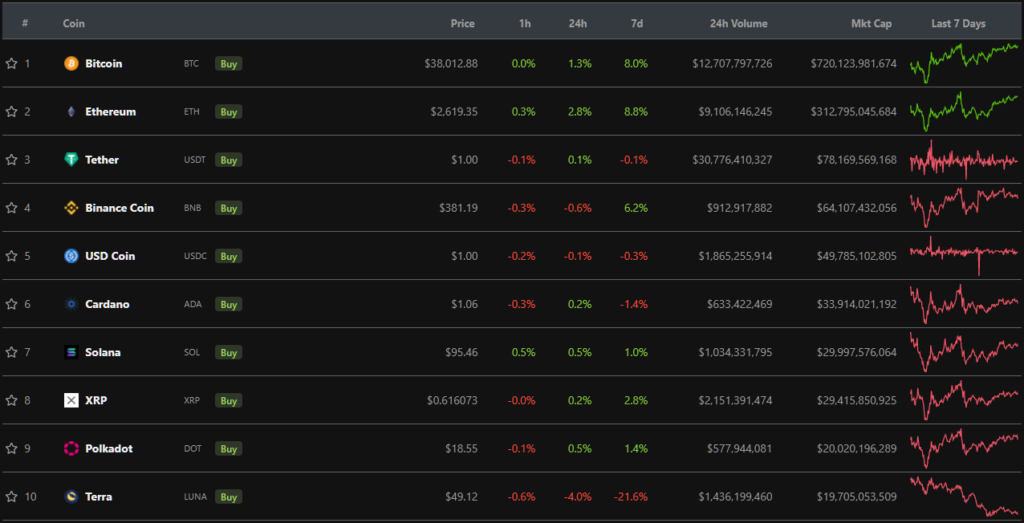

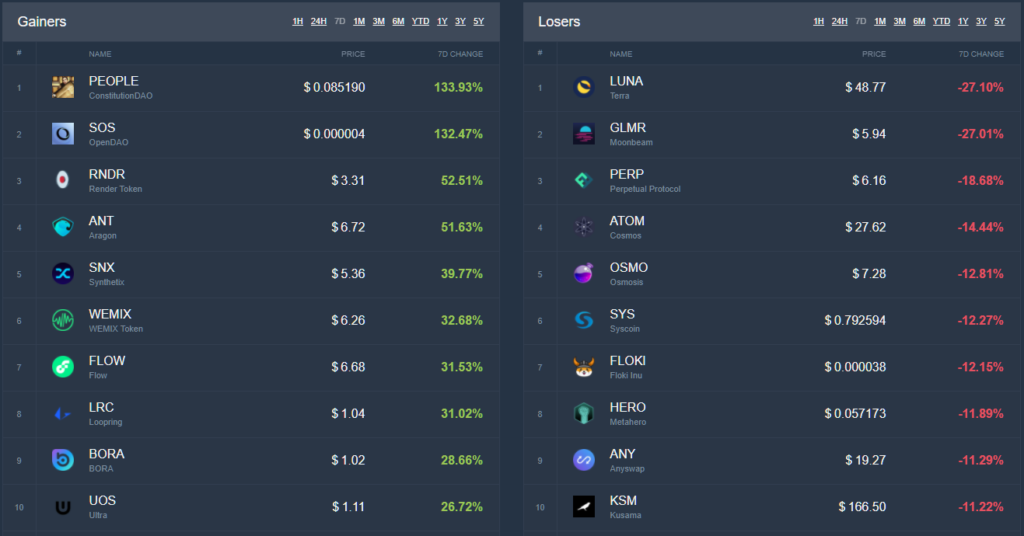

Against the backdrop of a partial market rebound, most top-10 assets by market capitalization were in the green. The exceptions were Cardano (ADA) and Terra’s native token (LUNA). The latter fell 21.6% over the week, according to CoinGecko.

The plunge in LUNA’s price has been linked to the scandal around the DeFi protocol Wonderland. Earlier it emerged that the project’s co-founder known as 0xSifu is the co-founder of the bankrupt Canadian crypto exchange QuadrigaCX, Michael Patryn.

Another Wonderland co-founder, Daniele Sestagalli, is also behind the lending protocol Abracadabra. The latter allows users to borrow in the stablecoin Magic Internet Money (MIM). To collateralize loans you can use Terra’s algorithmic stablecoin UST.

According to CoinCodex, over the week among mid-cap digital assets the token of the decentralized autonomous organization ConstitutionDAO rose the most. Over the week the PEOPLE token rose by nearly 134%.

Total market capitalization stood at $1.8 trillion. Bitcoin’s dominance index rose to 39.8%.

Vladimir Putin urged the government and the Bank of Russia to find a compromise on cryptocurrency regulation

In the State Duma stated that the central bank’s stance toward cryptocurrencies risks turning Russia into a laughing stock, and among the working group members none of the authorities supported bans. Regulators countered that the initiative is aimed at preventing capital flight.

President Putin urged the government and the Bank of Russia to find a compromise. He noted that the central bank is not standing in the way of technological progress, and is itself implementing digital technologies. According to the head of state, Russia has competitive advantages in mining—a surplus of electricity and a well-trained workforce.

Deputy head of the State Duma committee on security and anti-corruption Andrey Lugovoy opposed that the FSB is applying pressure on the central bank and forecast that cryptocurrency regulation in Russia will be approved by the end of 2023. He said that the proposed bill foresees mandatory investor testing for operations totaling more than 600,000 rubles per year.

In the Russian Ministry of Finance they too spoke out against banning cryptocurrencies. The ministry proposed its regulatory concept, with which Rosfinmonitoring agreed, but the Central Bank criticized it. The monetary regulator also flagged additional risks from legalising mining and noted its negative impact on the environment and the country’s energy sector.

Against the backdrop of active discussions, the head of the Republic of Tatarstan’s Ministry of Digital Development, Ayrat Khairullin proposed making Kazan a pilot zone for testing the market’s regulation capabilities.

At the end of the week, media reported that Deputy Prime Minister Dmitry Chernyshenko approved a road map for cryptocurrency regulation through the end of 2022, designed to align with FATF standards. The document provides:

- definition of market participants and their activities, and appointment of a supervisory body;

- development of a mechanism for registration and reporting for organisations through which virtual assets flow in Russia;

- introduction of administrative or criminal liability for crimes involving cryptocurrencies, in particular for illicit asset circulation and evasion of declaring information about operations with them;

- creation of a mechanism to verify the accuracy of information provided about holdings of digital currencies;

- mandatory registration of crypto platforms in Russia by analogy with internet companies.

Ethereum developers drop ETH1 and ETH2 terms

The team behind the second-largest cryptocurrency by market capitalization has abandoned the terms ETH1 and ETH2 in favour of the “execution layer” and “consensus layer,” respectively.

Both components form a single Ethereum ecosystem.

In the developers’ view, the term ETH2 creates a “misleading mental model” for new users. They wrongly believe that ETH1 will cease to exist after the transition to ETH2.

OpenSea vulnerability allowed buying NFTs at depressed prices

OpenSea users were warned about an API vulnerability — known since late 2021, but actively exploited this week.

To avoid paying delisting fees for NFTs, users move tokens to external wallets and back. As a result they stop appearing in the platform’s interface, but remain available for purchase via the API, which platforms like API use, including Rarible.

Several community members exploited this — one participant earned up to 347 ETH.

To address the issue, OpenSea launched several new features, including a service to view and cancel listings. The company also compensated affected users. In total it paid 750 ETH (~$1.95 million at the time of writing), according to Bloomberg.

The Grimacecoin meme token price jumped 259,000% after McDonald’s joke

The latest Bitcoin correction sparked a wave of jokes about investors forced to apply for work at McDonald’s. On January 25, the corporation responded to the ironic posts on Twitter.

Elon Musk did not miss the opportunity to mention his favourite cryptocurrency. He promised to eat a Happy Meal on air if McDonald’s starts accepting Dogecoin. In response the company proposed that Tesla sell electric cars for the fictional Grimacecoin token (a nod to a character from a 1970–1990s marketing campaign).

Following the tweet, the eponymous coin appeared on the market — within hours of launch it rose by more than 259,000%.

IMF urged El Salvador to drop Bitcoin as legal tender

The IMF staff recommended that El Salvador remove Bitcoin as legal tender on its soil.

IMF officials noted that the Chivo wallet could improve financial inclusion, but stressed the need for strict regulation of digital gold. The organisation also expressed concerns about plans to issue Bitcoin bonds worth $1 billion.

El Salvador’s President Nayib Bukele replied to the IMF on Twitter:

Bloomberg reports Diem project by Meta may be collapsing

Bloomberg, citing its own sources, reported that Meta-backed stablecoin project Diem (formerly Libra) is collapsing under regulatory pressure, and that the Diem Association is considering selling intellectual property and other assets to “return capital to member investors”.

Later the WSJ named a potential buyer — Silvergate Bank, previously chosen as the issuer of the Diem USD stablecoin. According to the paper, Meta allegedly reached a deal with it to acquire the project’s assets and intellectual property for $200 million.

India anti-COVID fund returned part of Vitalik Buterin’s donations

The Crypto Relief fund focused on fighting COVID-19 in India returned part of the funds that Vitalik Buterin donated to the organization in May 2021.

The parties decided that the Ethereum co-founder could operate more flexibly since he is not bound by local law. Buterin will direct the funds to finance scientific and charitable projects to fight the pandemic. To manage the assets he created Balvi.

Also on ForkLog:

- The third solo Bitcoin miner this month mined a block.

- YouTube will consider integrating non-fungible tokens.

- FTX US raised $400 million at a valuation of $8 billion.

- The U.S. Treasury will again consider verifying Bitcoin wallet users.

What else to read and watch

We explained the features of the L2 solution, Optimistic rollups, weighed the advantages and drawbacks of the technology, and assessed Ethereum’s scalability prospects.

For ForkLog, Stepan Gershuni told how DAOs work, how to distinguish a scam from a fundamental innovation, and how to verify all these claims yourself. He also explained how to build an effective decentralized team and foster a community culture.

In ForkLog’s educational cards we looked at what natural language processing is and the Terra project (LUNA).

In traditional digests we assembled the week’s key events in cybersecurity and artificial intelligence.

The DeFi sector continues to attract heightened attention from cryptocurrency investors. ForkLog has compiled the most important events and news from recent weeks in a digest.

On January 24, in a ForkLog LIVE broadcast, we met Binance’s new general managers for Russia and Ukraine — Vladimir Smerkis and Kirill Khomyakov. The meeting also included Binance’s director for Eastern Europe, Gleb Kostarev.

The guests discussed regulation and answered questions from viewers.

On January 25, in Moscow, the first open dialogue among global market leaders and regulators took place at RBC’s conference “Crypto assets: all you need to know about regulation, but were afraid to ask.”

We took the opportunity to gather comments from the conference’s main speakers and prepared an exclusive edition that answers the main question: what lies ahead for us — prohibition or regulation?

Read Bitcoin news from ForkLog in our Telegram — cryptocurrency news, rates and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!