Week in Review: Putin wary of digital assets, as Musk steps into the NFT spotlight

The President of Russia drew the Prosecutor General’s Office’s attention to digital financial assets, Vitalik Buterin proposed accelerating the transition to ETH2, Elon Musk listed it for sale as an NFT, WEX clients uncovered stolen funds, and other events from the week gone by.

Bitcoin fails to hold above $60,000

After the weekend saw a a new all-time high above the $61,000 level, the price of the leading cryptocurrency began the week with a decline. By Tuesday, March 16, the price approached $54,000.

On Thursday the price of digital gold tested the $60,000 mark, but could not hold it. An attempt to break the level on Saturday proved unsuccessful.

BTC/USD price chart on Bitstamp. Data: TradingView.

As of writing, the market-leading asset trades around $57,000, keeping a market capitalization above $1 trillion.

Analyst Willy Woo argues that on-chain metrics show investors accepting a new price level, and the asset’s total market value is likely not to fall below the notable level again. This would occur if the price falls below $53,590.

URPD: «7.3% of bitcoins last moved at prices above $1T»

This is pretty solid price validation; $1T is already strongly supported by investors. I’d say there’s a fair chance we’ll never see Bitcoin below $1T again. pic.twitter.com/bf8uXkht16

— Willy Woo (@woonomic) March 21, 2021

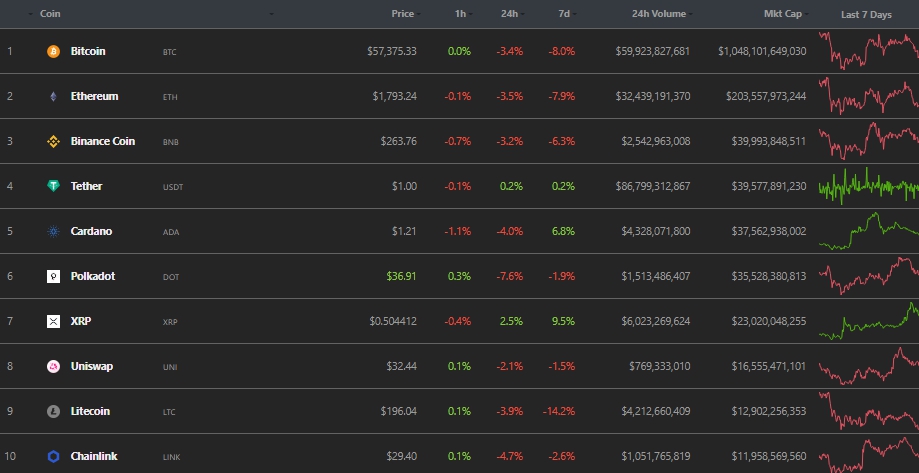

Over the past seven days, among leading cryptocurrencies only Cardano and XRP remained in the green (per CoinGecko). The price of the Ripple token rose 9.5% on the back of asset-positive news from the hearings in the SEC lawsuit against the company.

Data: CoinGecko.

The Chiliz token price corrected by roughly 5% after a six-fold surge last week. The token remains 37th in the market by capitalization.

The aggregate crypto market capitalization exceeds $1.8 trillion, with Bitcoin’s dominance index at 58.8%.

Putin orders the General Prosecutor’s Office to halt illegal cross-border transfers of digital assets

The President of Russia, Vladimir Putin ordered to take additional steps to curb illegal cross-border transfers of digital financial assets.

«Criminal elements are increasingly and increasingly using these digital financial assets, and this, without a doubt, needs to be given the closest attention, in coordination with colleagues from other agencies, including Financial Monitoring,» the Russian president told a meeting of the Prosecutor General’s Office.

The State Duma contemplates changing the threshold for declaring crypto transactions

A threshold for annual turnover on crypto-asset operations, above which owners must report holdings of digital currencies to the tax authorities, could be revised. This stated by Anton Gorelkin, a member of the State Duma Committee on Information Policy.

«It is currently envisaged that transactions with digital currencies should be declared if annual turnover from them exceeds 600,000 rubles. But this is a matter of discussion: the threshold could be changed», he noted.

Elon Musk lists a song about NFTs as an NFT, but later changes mind

The Tesla and SpaceX chief executive Elon Musk released a techno-track about non-fungible tokens (NFTs) and said that he listed it for sale. The digital artwork bears inscriptions HODL, “Never sleep computers” and a Shiba Inu dog.

«I’m selling this song about NFT in the form of an NFT», Musk wrote.

The digital artist Beeple, whose NFT painting “Everydays: The First 5000 Days” recently sold for a record $69 million, offered Musk a similar sum. In reply, the head of Tesla demanded 420 million DOGE — about $24 million.

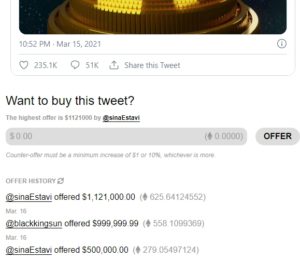

Immediately after the post, Musk’s tweet was put up for sale on the Valuables platform. At the time of writing, the highest bid was from Sina Estavi, founder of Bridge Oracle — $1.121 million.

Data: Valuables.

The man himself later said that he backtracked from selling the NFT, deeming it the “wrong endeavour”.

Among other recent developments in the fast-evolving sector:

- The NFT buyer of Beeple for $69 million unmasked himself.

- Mark Cuban listed for sale his quote as an NFT.

- Sotheby’s will hold the first NFT auctions.

- The ‘Satoshi-dollars’ were put up for sale as NFTs.

- DC Comics urged its artists to refrain from selling NFTs — the company intends to monetise intellectual property in-house.

Wex clients discover stolen funds totaling more than $250 million

Wex, the cryptocurrency exchange’s found stolen funds totaling more than $250 million across hot and cold wallets on the platform.

During its own investigation, the victims’ coordination centre audited the exchange’s transactions. It also identified accounts through which part of the funds were laundered.

«All information has been forwarded to the investigation and formally attached to the case materials, which will allow the necessary investigative actions and will be evidence in court,» the initiative group said.

Coordinators are now seeking other affected Wex clients, including foreign ones, to file civil suits.

Ethereum developers present a compromise for miners: EIP-3368

Ethereum presented EIP-3368. The proposal envisages increasing miners’ reward per block to 3 ETH and lowering it to 1 ETH after the London hard fork EIP-1559, which envisages burning part of the transaction fees.

Miners opposed EIP-1559, and the Ethermine pool launched in beta software for implementing the Maximal Extracted Value (MEV) arbitrage strategy. It would compensate miners after the contested upgrade is activated.

According to the pool, the solution would lift its revenues by 1-10%, 80% of which would be distributed among participants. Over the past year the technology has generated an additional $334 million.

Against the miners’ threats to “show power” over EIP-1559, Ethereum co-founder Vitalik Buterin proposed accelerating the transition to ETH2.

BitMEX co-founder bailed out at $20 million, former CEO approves plan to surrender

BitMEX co-founder Ben Delo voluntarily surrendered to US authorities on March 15 he appeared remotely before a court on charges of violating the Bank Secrecy Act.

He pleaded not guilty. The court released him on a $20 million bail and allowed him to return to the United Kingdom before the proceedings.

Arthur Hayes, the former BitMEX CEO, and his lawyers also agreed with US authorities on the terms of his voluntary surrender. Hayes will appear in a Hawaii court on April 6, and will be released on a $10 million bail, secured by $1 million in cash and his mother’s pledges, after which he will return to Singapore.

Oleg Tinkov: cryptocurrencies are about people who want to hide something

Oleg Tinkov, founder of Tinkoff Bank, said during a Clubhouse discussion that he supports progress, but does not fully understand why cryptocurrencies are needed.

«This is a very cool thing, as we know, probably. But what is missing for a person when they go into crypto? It seems to me that this is about people who want to hide something from someone. At the same time there’s no reason not to push for progress; youth clearly desires this,» he said.

Roskachnadzor signals possible Twitter block in Russia

Roskachnadzor will block Twitter in Russia if the social network does not remove prohibited content. The agency has given the company a month, said deputy head Vadim Subbotin.

«We’ve taken a month and we are monitoring Twitter’s response to removing prohibited information. After that, depending on the administration’s action, appropriate decisions will be taken,» he said.

Visa chief reveals crypto-strategy details

The payments company Visa aims to harness the opportunities associated with new technologies and payment methods. This stated by its CEO Alden KilIy.

«We are trying to accomplish two tasks. First — to enable the purchase of the first cryptocurrency through accounts in the payments system. Second — to work with Bitcoin wallets so as to convert coins to fiat and spend them at any of the 70 million locations around the world that accept Visa,» KilIy said.

The head of the company noted the substantial potential for cryptocurrencies to become a payment instrument, particularly in developing economies.

Media: Morgan Stanley to give clients access to Bitcoin funds

Morgan Stanley will become the first of America’s big banks to offer clients access to Bitcoin-based investment funds.

According to reports, these are two funds from Galaxy Digital’s Mike Novogratz and a jointly launched vehicle by NYDIG and FS Investments.

Analysts at Bank of America, meanwhile, argued that Bitcoin is useless as a store of value or a payment instrument. The only reason to own it is its rising price.

On Binance, a $5 million Filecoin deposit duplicated

Filestar developers and blockchain explorer Filfox found that FIL tokens worth about $5 million were deposited on Binance twice for unknown reasons.

The specialists initially speculated the incident involved a double-spend, reporting to several Chinese media outlets.

Soon after, crypto exchanges Binance and OKEx paused FIL deposits as a precaution.

The California-based Filecoin developer Protocol Labs said the issue did not lie in a double-spend and there was no “serious bug,” as some media outlets reported. Project experts said the problem lay with Binance.

Grayscale launches five new trusts

Grayscale Investments announced the launch of five investment products. The total number of crypto trusts under the company’s management has reached fourteen.

The new products allow investment in Basic Attention Token, Chainlink, Decentraland, Filecoin and Livepeer without direct ownership of the digital assets.

ForkLog also wrote:

- The Nvidia driver allowed the mining-protection of the GeForce RTX 3060 to be bypassed.

- AMD will not deliberately limit the hash rate of GPUs due to miners.

- Indian authorities proposed prison terms for Bitcoin holders.

- A Chinese-listed company increased its investments in Bitcoin and Ethereum to $89 million.

- Coinbase will float 114.9 million shares in a Nasdaq direct listing.

- The custodian Fireblocks, backed by Paradigm and Galaxy Digital, raised $133 million.

- The messenger Signal began accepting cryptocurrency donations.

What else to read and watch?

In a new feature, ForkLog explored why DeFi users are actively moving to Binance Smart Chain, despite its high centralisation and whether this trend is sustainable.

Also, the magazine found out how crypto regulation stands in Central Asian countries — Kazakhstan, Kyrgyzstan, Uzbekistan, Tajikistan and Turkmenistan.

For the week’s most notable cybersecurity and artificial intelligence developments, read the usual digests. The overview of the biggest crypto investment deals covers a longer horizon.

On 18 March, in a live ForkLog broadcast, Ukraine’s Deputy Minister for Digital Transformation IT development Alexander Borniakov and Max Demyanyuk from the ministry’s expert group on virtual assets joined. Together with Max Bit they discussed strategies for IT and crypto industry development in Ukraine, the sector’s business, and possible options for integrating digital assets into the country’s ecosystem.

Subscribe to Forklog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!