Week in Review: US passes infrastructure bill without crypto amendments, while ParaSwap runs an atypical airdrop

US President Joe Biden signed a $1.2 trillion infrastructure law with no crypto amendments, DeFi-project ParaSwap created a precedent in the governance-token airdrop and other events of the week.

Bitcoin price slips below $60,000

Having peaked at $69,000 last week, Bitcoin quotes retraced through the week, first reaching $59 000, and on Friday, 19 November, a local low of $55,600. The drop was accompanied by liquidations of a large number of positions in the derivatives market.

As of writing, the first cryptocurrency was trading near $59 700.

Analysts at Glassnode did not find signs of panic among whales in the wake of the Bitcoin price drop, though a small portion of investors began to take profits.

The founder of SkyBridge Capital, Anthony Scaramucci stated that digital gold could easily reach a price of $500,000, citing its limited supply and the potential number of wealthy investors.

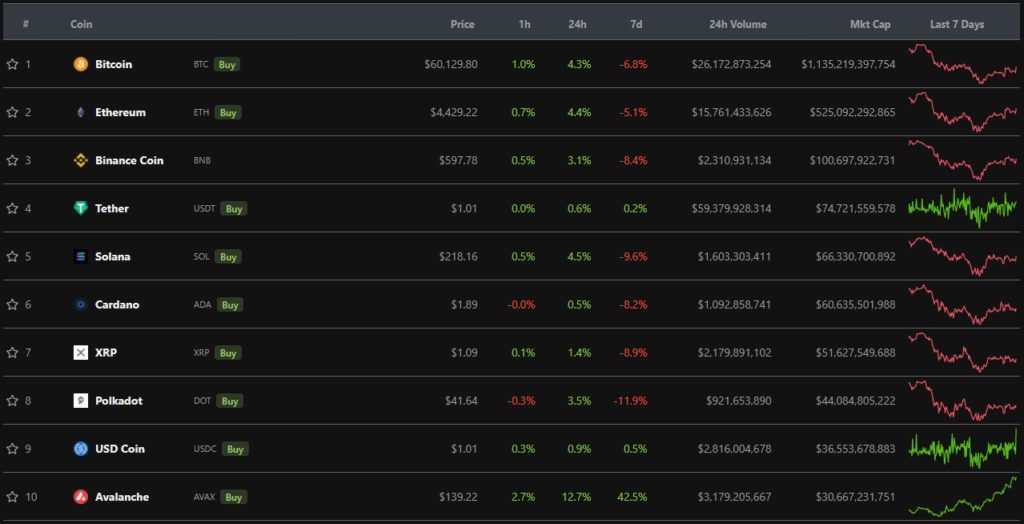

Most digital assets in the top 10 by market cap closed the week in the red. Despite negative overall market dynamics, the native token of the Avalanche blockchain reached a new all-time high above $144.

Over the week, the AVAX price rose 42.5%. The token entered the top ten by market capitalization.

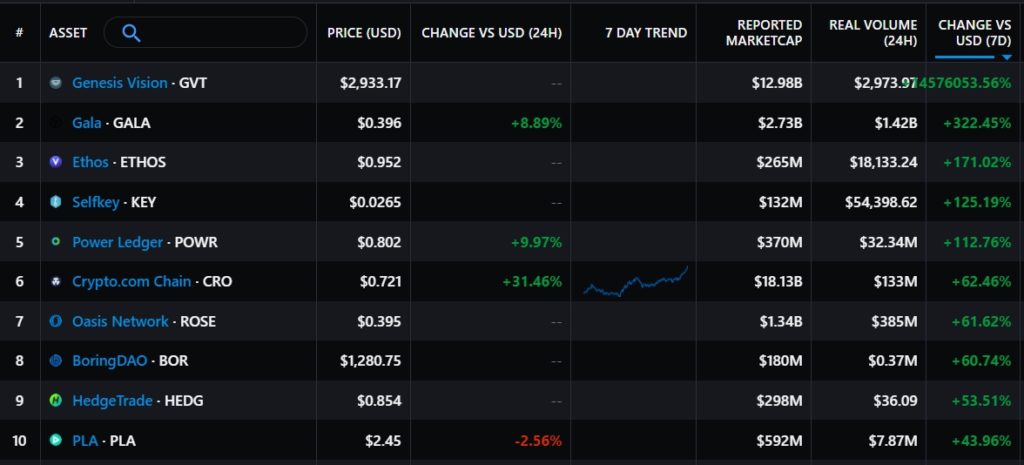

According to Messari, the week saw the largest percentage increase in Gala Games’ token price. GALA rose by more than 322%, with a market cap of $2.37 billion.

The greatest decline among digital assets was in Sentinel. SENT fell by nearly 40%, and its market cap dropped to $126 million.

The market capitalization of the cryptocurrency market stood at $2.81 trillion. Bitcoin’s dominance index fell to 40.3%.

ParaSwap governance token airdrop

The ParaSwap governance token PSP released and launched an airdrop of 150 million tokens across 20,000 wallets. Yet the tokens were received by only 0.015% of all addresses.

The project team explained that its aim is to build a community, so during the airdrop engagement was prioritized, filtering users step by step:

- The first and largest group included those who used the product regularly since the protocol’s founding in 2019;

- The second category included wallets with a transaction history on ParaSwap, on‑chain activity with other projects/blockchains, and a nonzero wallet balance. The developers also excluded the path of the origin address — ParaSwap — origin address;

- In the third group, swaps with partner projects integrated with ParaSwap were considered.

The economist Alex Kruger noted that liquidity mining tokens issued within mining programs are often used inefficiently — most DeFi investors seek to offload them quickly.

Biden signs infrastructure bill without crypto amendments

The US president Joe Biden signed the bipartisan $1.2 trillion infrastructure bill into law without crypto-industry amendments.

The document contains an expanded definition of the term “broker.” Depending on interpretation, miners and node operators in blockchains, wallet developers, liquidity providers in DeFi protocols and other noncustodial players could be obliged to report user activity to the IRS.

Senator Ted Cruz has proposed a bill to roll back these provisions. A bipartisan group of House members also introduced a bill, “Keep Innovation in the United States,” which contains proposals to adjust crypto-related definitions of “broker.”

The first Polkadot parachain auction ends. Acala wins

The Parachain auction for the first slot on Polkadot was won by Acala, which locked up over 32.5 million DOT (~$1.33 billion). In total, participants contributed more than 87.55 million DOT (~$3.4 billion).

Jack Dorsey shares white paper for decentralized bitcoin exchange

Jack Dorsey published a link to the draft white paper for a decentralized bitcoin exchange built around his payments company Square.

The project is described as a “protocol for unlocking liquidity and exchanging assets (such as bitcoin, fiat money or real-world goods).” It is dubbed tbDEX.

The platform “utilizes decentralized networks to exchange assets, providing a basis for establishing public trust.”

Gemini attracts $400 million at a $7.1 billion valuation to compete with Meta

The parent company of the cryptocurrency exchange Gemini — Gemini Space Station, LLC — closed its first funding round, led by Morgan Creek Digital. Investors invested $400 million, valuing it at $7.1 billion.

1/ gm. Today marks a new beginning for @Gemini.

We have raised $400 million dollars at a $7 billion valuation.

This round was led by Morgan Creek (@sjaitly & @MarkYusko) and included @10TFund, @paraficapital, @NewflowPartnrs, Marcy Venture Partners, @commbank, and others.

— Tyler Winklevoss (@tyler) November 18, 2021

New details in the cases of Coyote Crypto, EggChange and Finiko

The lawyer for the founder of Bitcoin exchangers Coyote Crypto and EggChange, Denis Dubnikov, said that his client is suspected of laundering $400,000 for Ryuk ransomware operators. Later it emerged that Dubnikov’s arrest was extended.

The founder of Finiko, Kirill Doronin gave testimony against 44 of his associates. Among them were “top leaders,” “stars,” as well as regional and federal opinion leaders.

Foundry mining pool tops the hash rate

The Foundry mining pool, a subsidiary of Digital Currency Group founder Barry Silbert, rose to the top by hash rate. At one point its share of the total Bitcoin network hashrate exceeded 21%.

As a result of another difficulty adjustment, Bitcoin mining difficulty rose by 4.69% — to 22.67 trillion.

El Salvador to issue $1 billion in bitcoin bonds on the Liquid Network

The government of El Salvador struck a deal with Blockstream and iFinex (the parent company of Bitfinex and Tether) to issue $1 billion in bitcoin bonds on the Liquid Network.

Half of the proceeds will fund bitcoin mining infrastructure using geothermal energy. The other half will be used to purchase digital gold for the state treasury.

Zcash developers unveil roadmap to 2025

Electric Coin Company published a roadmap for the Zcash (ZEC) peer-to-peer payment system to 2025. The team described the plan as “ambitious, but achievable.” It includes three key points: a move to the Proof-of-Stake consensus algorithm, interoperability and an official wallet.

ConsenSys raises $200 million at a $3.2 billion valuation

The wallet-maker ConsenSys closed a fundraising round of $200 million. Investors, including HSBC, Marshall Wace and Coinbase Ventures, valued it at $3.2 billion.

Active users of the MetaMask wallet surpassed 21 million. Analysts at Delphi Digital found that ConsenSys this year earned twice as much in commissions from MetaMask as Curve and SushiSwap combined.

Tokyo court approves Mt.Gox creditor-restitution plan

The Tokyo District Court approved the civil rehabilitation plan for the bankrupt Bitcoin exchange Mt. Gox. The trustee Nobuaki Kobayashi said he would disclose the timing and amounts of payments, as well as procedural details, later.

U.S. to sell crypto to compensate BitConnect investors

The U.S. Department of Justice and the Southern District of California will sell crypto worth $56 million seized from former director and promoter of the BitConnect scheme, Glenn Arcaro. Proceeds will go to compensate affected investors. Arcaro faces up to 20 years in prison.

VanEck bitcoin futures ETF trading begins

On Tuesday, November 16, trading for VanEck’s bitcoin futures ETF on the Chicago Board Options Exchange (CBOE) began. The ETF is labeled ETF.

On day one, trading volume reached about $5 million. Bloomberg analyst Eric Balchunas noted that this would be a decent debut were it not for the results of ProShares (nearly $1 billion) and Valkyrie Investments ($78 million) in a similar space.

$XBTF traded about $5m on Day One. Normally that would be pretty good, prob Top 10% of launches this year. It’s just shadowed by the absurd $1b $BITO laid down, not to mention $78m that $BTF did. pic.twitter.com/bjqrUnThzr

— Eric Balchunas (@EricBalchunas) November 16, 2021

Arcane Research: L2 solutions for Ethereum cut transaction costs by 90–99%

Analysts note that layer-2 solutions based on Optimistic rollups, Arbitrum and Optimism reduce transactional costs by as much as 90–99% and will enable mass Ethereum adoption without compromising decentralization or security.

The CEO of Singaporean venture capital Three Arrows Capital, Su Zhu stated that high gas fees deter newcomers from using Ethereum. He also noted that the situation could be improved by teams building layer-2 scaling solutions.

This week, Polygon unveiled a scaling solution for Ethereum based on ZK-Rollups, Miden, and Binance announced the integration of Arbitrum One for Ethereum deposits.

Crypto.com struck a $700 million deal for naming rights to the Clippers and Lakers arenas

The cryptocurrency platform Crypto.com reached a deal to rename the Staples Center to Crypto.com Arena. The contract runs for 20 years.

The platform’s native token CRO surged to a new all-time high above $0.70.

Binance discusses fruits of regulator cooperation; US unit eyes IPO

Against a backdrop of tighter KYC, the bitcoin exchange Binance shed only 3% of users, and regulator cooperation is already bearing fruit, said CEO Changpeng Zhao .

Also this week Binance purchased an advertising space in the Financial Times. The exchange published a compendium “10 Fundamental Rights of Crypto Users.” The document is meant to be a basis for discussion and regulatory development in the industry.

Meanwhile, the US arm of the exchange is preparing to raise “several hundred million” in a funding round within one to two months.

Subdivision of Tether to develop Bitcoin services on the Lightning Network

The issuer of the stablecoin USDT — Tether Holdings Limited — launched a subsidiary, Synonym Software, focused on developing an “alternative” internet economy built on Bitcoin and the Lightning Network. The project is based on the concept of an “atomic economy.”

Also on ForkLog:

- The founder of the Ukrainian bitcoin exchange Kuna stated that he is under surveillance.

- Norway, following Sweden, will consider banning Bitcoin mining.

- “Barcelona” and “Manchester City” declined to collaborate with two crypto projects.

- A 14-year-old American artist earned over $1 million in 10 hours from NFTs.

What else to read and watch

ForkLog’s educational cards explained the features of the Shiba Inu project.

The DeFi sector continues to attract heightened attention from crypto investors. ForkLog has compiled the most important events and news of recent weeks in this digest.

On 14 November, the activation of the long-awaited Taproot upgrade occurred in the Bitcoin blockchain. In the latest episode of the podcast we discussed the soft fork that the whole world had waited for four years.

On Monday, in a live ForkLog LIVE broadcast, we discussed central bank digital currencies. The guests were:

- Sergey Bondarenko — crypto enthusiast, teacher and populariser of crypto technologies, consultant, certified information systems auditor (CISA), member of the expert group on virtual-asset legislation.

- Dmitry Nikolayevsky — lawyer, member of the National Bar Association of Ukraine, participant in the expert group developing virtual-asset legislation.

Читайте биткоин-новости ForkLog в нашем Telegram — новости криптовалют, курсы и аналитика.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!