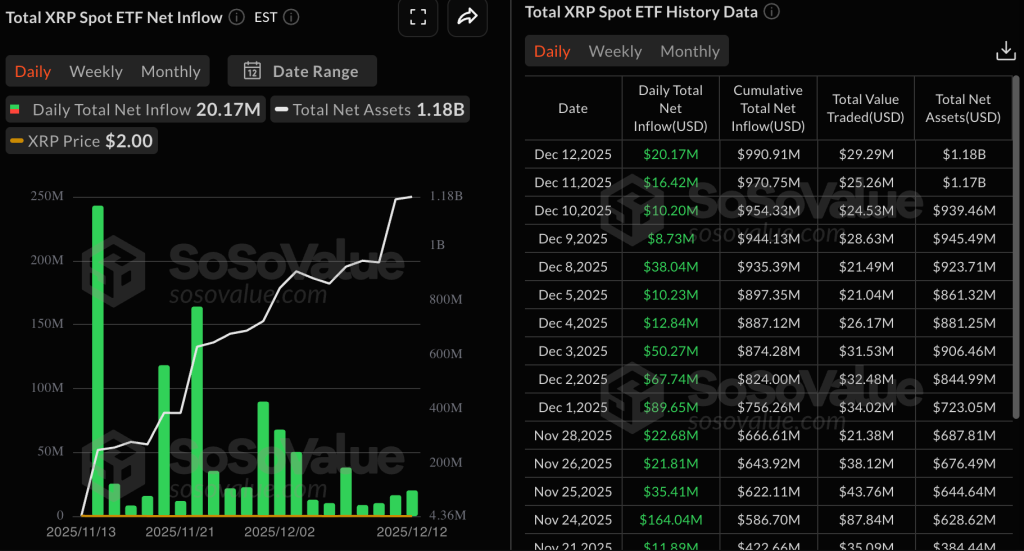

XRP ETFs See $1 Billion Inflows in One Month

Spot XRP ETFs have logged 30 straight days of inflows, pulling in $990m since mid-November.

Since their mid-November launch, spot XRP—ETFs have recorded net inflows for 30 consecutive days. Over the month, the funds drew $990m, according to SoSoValue.

The segment comprises five products from Canary (XRPC), 21Shares (TOXR), Grayscale (GXRP), Bitwise (XRP) and Franklin Templeton (XRPZ). They manage $1.1bn in assets — 0.98% of Ripple’s total supply.

Ripple chief executive Brad Garlinghouse noted that the funds based on the asset reached $1bn in AUM in under four weeks. That was the second-fastest result after the launch of ETH ETFs in the US.

👀<4 weeks, and XRP is now the fastest crypto Spot ETF to reach $1B in AUM (since ETH) in the US. With over 40 crypto ETFs launched this year in the US alone, a few points are obvious to me: 1/ there’s pent up demand for regulated crypto products, and with Vanguard opening up…

— Brad Garlinghouse (@bgarlinghouse) December 8, 2025

On 12 December, trading volume in the segment totalled $29.2m.

XRPC leads with $374m. GXRP, XRP and XRPZ have taken in $218m, $212m and $184m, respectively.

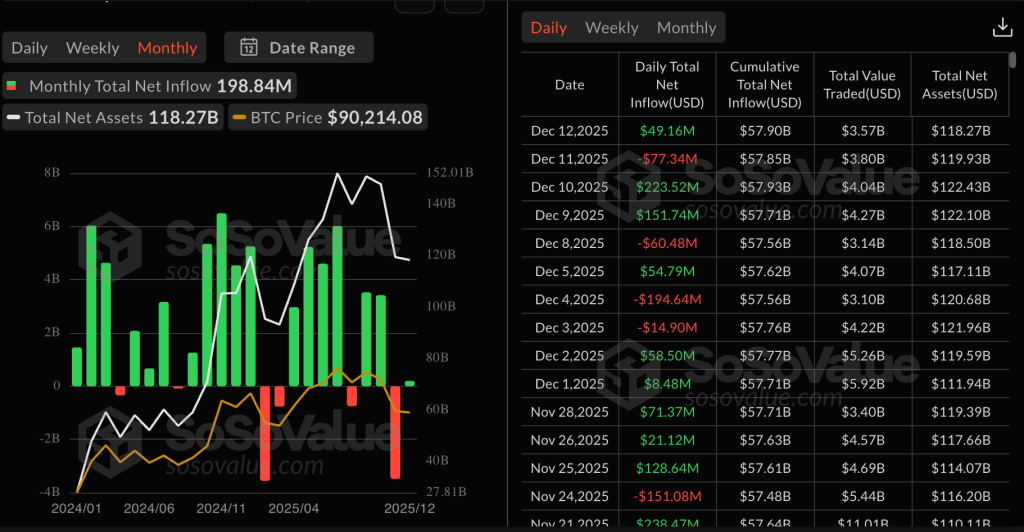

XRP ETF flows contrast with those around bitcoin and Ethereum funds. In November, bitcoin products lost $3.4bn in total, and since the start of December have attracted only $198m.

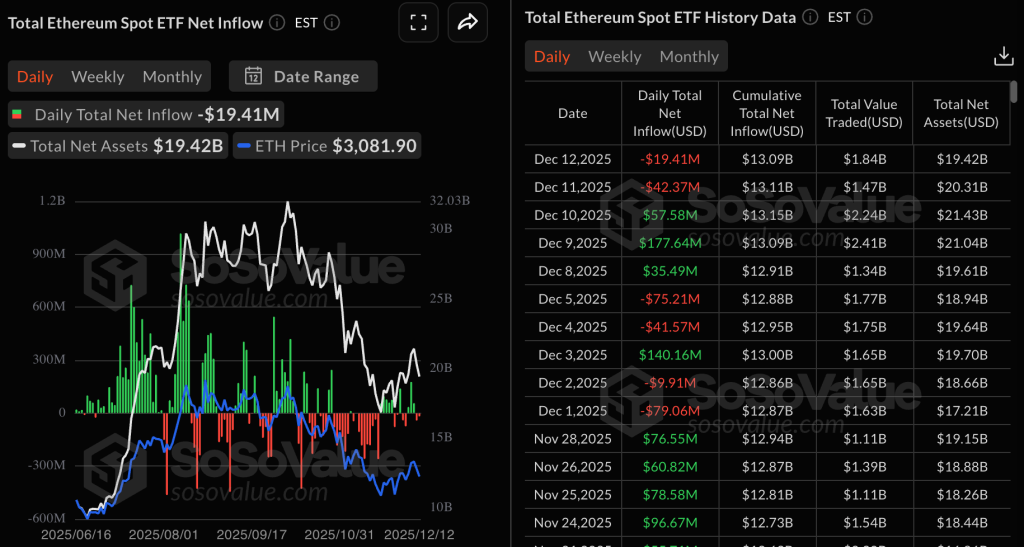

Ethereum-focused instruments lost $1.4bn last month. As of 12 December they had brought in $143m.

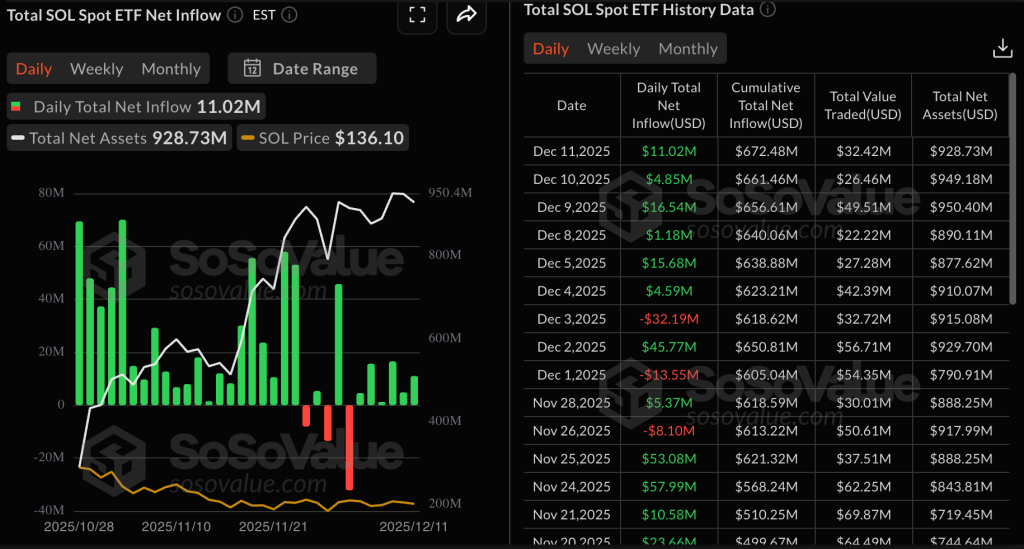

Spot Solana ETFs have also seen softer demand. Since launching in late October they have attracted $674m and logged several days of net outflows.

XRP price action

Over the past month, Ripple’s cryptocurrency has fallen 12.3%. At the time of writing the asset trades around $2 — near a key resistance level.

A trader using the handle Noman__peerzada described the current phase as a “bearish consolidation”. For now, sellers remain in control.

#XRP — Major Distribution Complete, Price Holding Weak Base (Bearish Bias)

XRP has completed a full distribution cycle after the parabolic move toward the 3.60+ region and is now trading near the 2.00 psychological level. The structure shows clear lower highs and sustained… pic.twitter.com/LSKj1g7lUH

— Noman__ peerzada (@Noman__peerzada) December 15, 2025

In his view, the bearish scenario remains in play until the $2.15–$2.20 resistance zone is breached. A close above $2.20 would invalidate it.

Another trader, Ace of Trades, said the key barrier is $2–$2.01, where significant liquidity is concentrated. Repeated absorption of buy orders at this level has made it strong resistance.

$XRP price is in a clear intraday downtrend, marked by a series of lower highs and lower lows with persistent aggressive sell imbalances, shown by repeated large red bubbles driving price lower. The heatmap highlights heavy resting liquidity and prior acceptance above… pic.twitter.com/3XkyPhcFxe

— Ace of Trades (@acethebullly) December 14, 2025

A sustained break above $2 is needed to reverse the trend, he said.

Earlier, Santiment analysts pointed to rising bullish sentiment around XRP on social media.

📊 XRP’s bulls and bears continue to battle, and the asset is hanging on to a $2.00 market value for now. Sentiment is showing bullishness across social media.

📉 Ethereum, on the other hand, is now -35% in the past 12 weeks. After sky-high sentiment dominated the summer, the… pic.twitter.com/PvnhW7wDyF

— Santiment (@santimentfeed) December 12, 2025

In December, European AMINA Bank integrated Ripple’s payment solution. At the same time, the fintech company received conditional approval to establish a national trust bank.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!