Week in Review: SEC Sues Binance and Coinbase, Do Kwon Released on Bail

The U.S. Securities and Exchange Commission (SEC) filed in court against the bitcoin exchanges Binance and Coinbase; Atomic Wallet was hacked for more than $35 million; a court in Montenegro released Terraform Labs (TFL) co-founder Do Kwon on bail, and other events of the past week.

Bitcoin declines on news of SEC lawsuits against Binance and Coinbase

On June 5, the SEC filed in court against the bitcoin exchange Binance and its CEO Changpeng Zhao. The regulator brought 13 charges, including unregistered offers and sales of BNB and BUSD tokens, Simple Earn products and BNB Vault and staking.

Media noted that the claims are analogous to the charges brought against the collapsed cryptocurrency exchange FTX and its subsidiary Alameda Research. Binance representatives stated they are prepared to resist the regulator’s pressure. On Wednesday the SEC called for freezing the digital assets held in custody at Binance.US. On Friday the latter announced a halt to US dollar deposits and urged clients to withdraw fiat by June 13.

The regulator’s charges affected Coinbase shares — trading on June 5 closed down 9.1%. However, the next day the securities fell further amid the SEC’s case against the Bitcoin exchange head Brian Armstrong. The regulator accused the company of violating securities laws.

After the Binance filing, Bitcoin fell from above $26,800 to near $25,500. The downward move continued on June 6, but by the end of the day the price began to recover. On Saturday Bitcoin fell below $26,000 again.

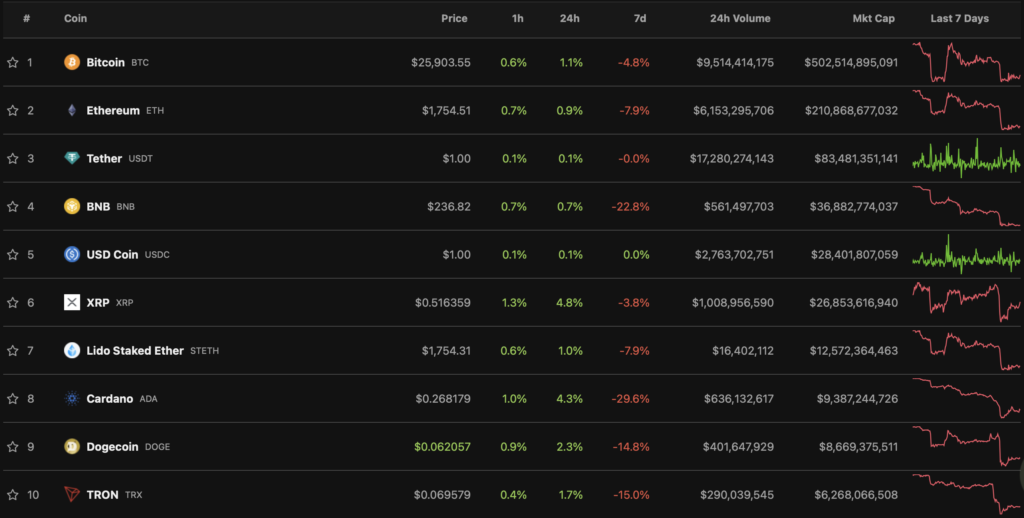

At the time of writing the first cryptocurrency was trading around $25,900. Over the past week the asset had fallen 4.8%.

All top-10 assets by market cap finished the week in the red. The biggest losers were Cardano (-29.6%) and BNB (-22.8%).

The total market capitalization stands at $1.1 trillion. Bitcoin dominance index stands at 49.06%.

Losses from Atomic Wallet breach exceed $35 million

On-chain researcher nicknamed ZachXBT calculated that users of the Atomic Wallet lost at least $35 million in digital assets as a result of the breach.

Five largest losses account for $17 million, with one user having $7.95 million stolen. According to the expert, victims’ losses could exceed $50 million as he continues to identify more victims.

According to Elliptic, the attacker sent the stolen assets to the cryptocurrency mixer Sinbad.io, used by the North Korean hacking group Lazarus Group.

Do Kwon released on bail in Montenegro

Co-founder Do Kwon and former chief financial officer Han Chang-joon were released on bail after Montenegro’s prosecutor’s office appeal was denied.

According to the case materials, each defendant must contribute €400,000 ($436,000). The amount was deemed a “sufficient guarantee of the defendants’ presence” at subsequent hearings. Until that time, Do Kwon and Han Chang-joon will remain under house arrest in the country.

Meanwhile, the leading South Korean prosecutor, Dan Sunghan said that the head of TFL faces several prison terms — in the United States and in South Korea.

Ethereum gas fees fall to two-month lows

The average daily gas payments on the Ethereum blockchain fell to April lows after the meme-token trading frenzy in May. The cost of the average transaction fee (seven-day moving average) fell to $7.09 from a peak above $20 last month.

A similar trend is seen in the gas-price metric in Gwei — the unit of payment on Ethereum. The median daily price dropped to 22 Gwei, after hitting 142 Gwei in early May.

What to discuss with friends?

- A lawyer estimated a 3% chance of the SEC winning the Ripple case.

- VanEck projected Ethereum to reach $11,800 by 2030.

- Bitcoin volatility was lower than that of Meta and Amazon shares.

- Ethereum co-founder transferred $41 million to the Kraken exchange.

Multichain developers fixed protocol fault

The vice president of the cross-chain protocol Multichain, Tung Din said that the Router 2 cross-chain bridge, which had caused network issues, is back online. Users confirmed in the project’s Telegram channel that the protocol is functioning again.

However, some users reported liquidity shortages in Arbitrum pools. The community also continues to ask when stuck transactions will be recorded on-chain. Likely the team still has to fix Router 5, which went down on May 31.

Robinhood to discontinue support for Cardano, Polygon and Solana

From June 27, the online brokerage Robinhood will discontinue support for Cardano (ADA), Polygon (MATIC) and Solana (SOL).

After that date, users’ assets will be automatically converted to fiat. The company did not explain the reason for the decision.

Until June 27, holders may buy, sell, hold and transfer ADA, MATIC and SOL.

Vitalik Buterin proposed a ‘recipe’ for sustainable Ethereum development

The Ethereum co-founder Vitalik Buterin published a roadmap outlining the main directions for the sustainable development of the second-largest cryptocurrency by market cap.

He highlighted three components pivotal to preserving Ethereum’s decentralization and permissionless properties:

- L2 scaling;

- enhanced wallet security;

- data privacy.

Buterin stressed the importance of the first component — without it Ethereum fees would rise during bull markets. Consequently, users would switch to centralized alternatives.

Bittrex plan to settle obligations meets U.S. authorities’ objections

U.S. authorities objected to Bittrex’s proposal to allow withdrawals by customers before the court-approved restructuring plan. They cited improper creditor classifications and an outstanding debt to FinCEN of $5 million.

Also on ForkLog:

- Bitcoin whale transferred $37 million after ten years of inactivity.

- Apple unveiled a mixed-reality headset.

- In Ukraine a project for taxing bitcoin operations was presented.

- Gary Gensler expressed skepticism about the necessity of cryptocurrencies.

Optimism team activated Bedrock update

The developers of the Ethereum layer-2 network Optimism completed the planned Bedrock upgrade. Among the improvements implemented:

- Fees reduced by about 10% by lowering data fees on the L1 chain toward a theoretical minimum;

- Deposit confirmation time reduced to roughly 3 minutes — down from as much as 10 minutes previously;

- Improved node throughput by enabling transactions to be executed in a single consolidated block.

Curve Finance enables crvUSD issuance backed by wstETH

The decentralized exchange Curve Finance added support for Lido’s wrapped version of stETH as collateral for the issuance and borrowing of the stablecoin crvUSD. The proposal received 100% support in a vote, with an 84.5% quorum.

What else to read?

ForkLog has prepared its traditional calendar of important events for the current month.

In new educational cards, we explain what Worldcoin and Ordinals are.

In an exclusive piece we explored whether Binance could face secondary sanctions for serving Russian citizens.

In the traditional digest, we gather the week’s main cybersecurity news.

The cryptocurrency industry is drawing more institutional players, as evidenced by new investments in infrastructure and increasing attention companies pay to Bitcoin as an asset class. The most important events of recent weeks are in the ForkLog review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!