Analysts dispute the influence of ‘old whales’ on Bitcoin’s price

Sell orders by ‘new investors’ at around the $30,000 level became the primary factor in halting Bitcoin’s rally. Rumors about Mt.Gox clients’ sales, the US government and the revival of the ‘ancient’ 3,200 BTC led only to volatility, Glassnode said.

This week, the market experienced a sharp sell-off, following what turned out to be false rumors related to distributions by the Mt. Gox Trustee, and the US Government.

Add to this the revival of 3.2k ancient #BTC, and the market found itself amidst serious volatility.

Discover… pic.twitter.com/mvTBpgqemR

— glassnode (@glassnode) May 1, 2023

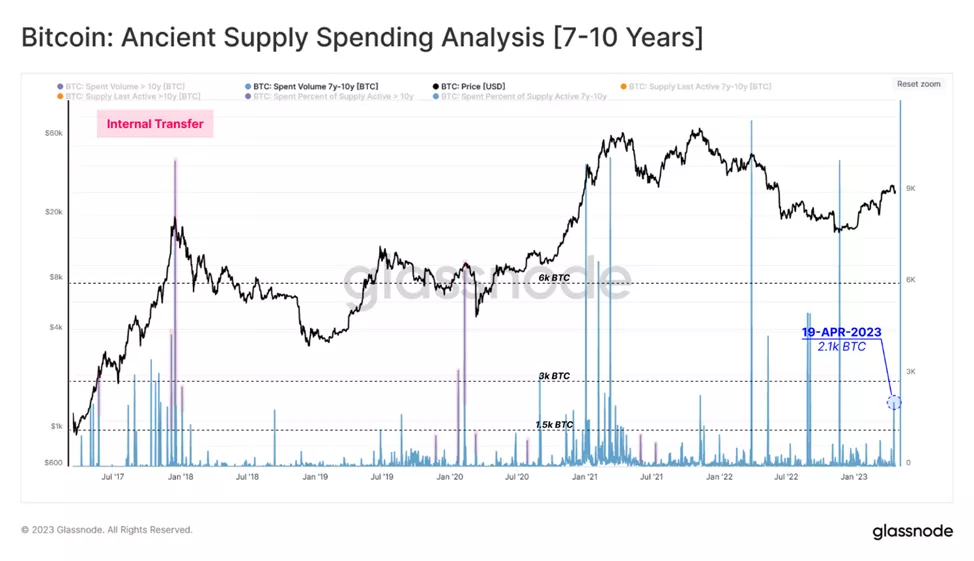

Experts last week recorded the transfer of 2,100 BTC aged seven to ten years. After filtering, specialists ruled out internal transfers. Based on comparisons of similar events in the past, they concluded that this time the price impact was not particularly large.

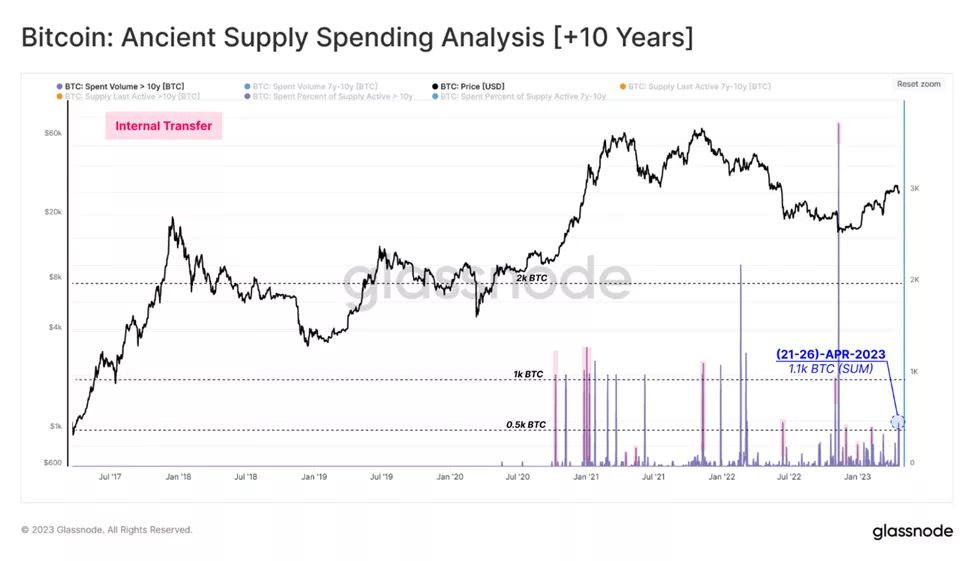

This also applies to the 1,100 BTC that were moved to wallets dating back to 2013.

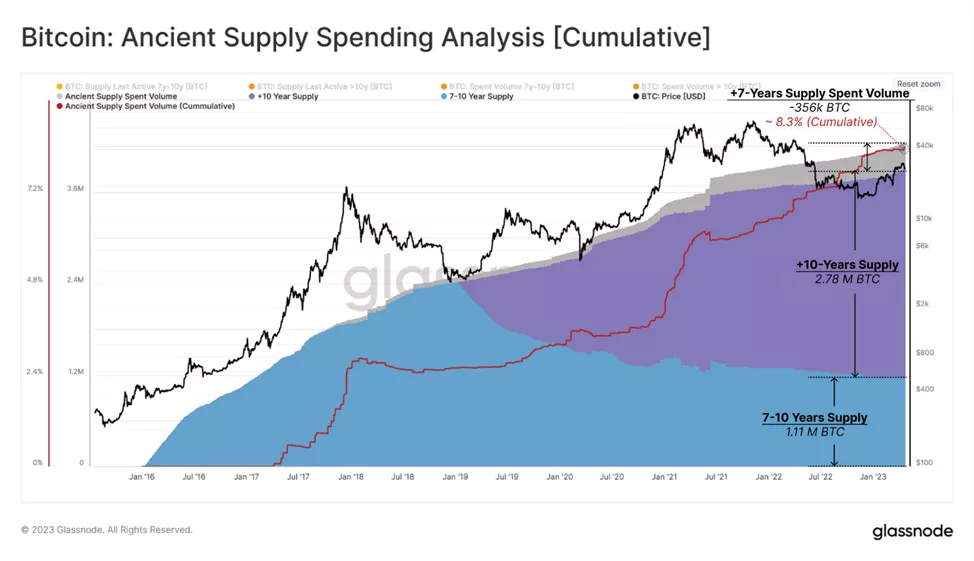

In total, the ‘ancient’ category (over seven years old) reached 4.25 million BTC. Of these, only 356,000 BTC have ever been spent, equivalent to 8.3% of the total supply. The remaining 3.9 million BTC may remain in the ‘sleeping’ state due to likely ‘loss’.

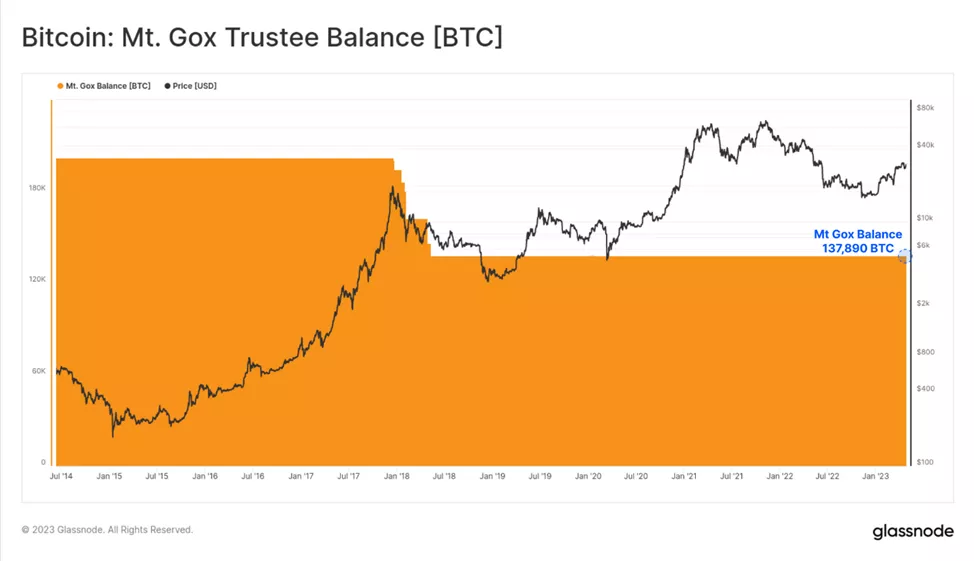

Last week’s rumors about the trustee distributing Mt.Gox funds to users are unfounded. Since 2018, the wallet balance of 137,890 BTC has not changed. They are expected to be distributed later—in 2023.

A similar situation surrounds the 205 541 BTC held by the US government. After 7 March, when the authorities sold 9,861 BTC on Coinbase, no new movements were recorded.

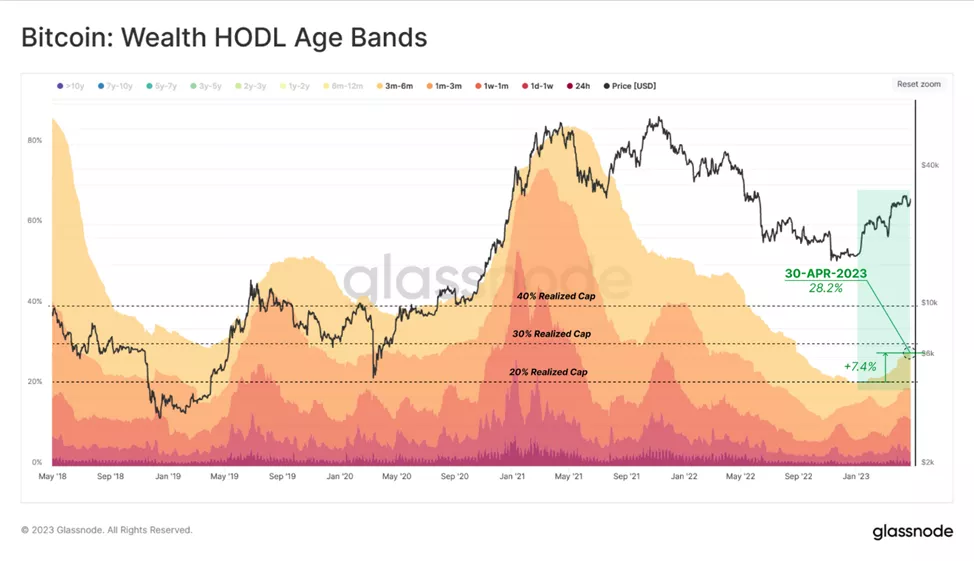

Analysts calculated that since the start of 2023, the monthly pace of coins moving from hodlers to speculators (holding period up to six months) reached 366,000 BTC. In dollar terms, they accounted for 28.2% of the total supply. The indicator rose 7.4% over the period.

Experts noted that the 40% threshold observed in previous bull markets has not yet been reached.

“This indicates that the influx of new demand remains relatively weak, but supply continues to be predominantly held by hodlers”, they explained.

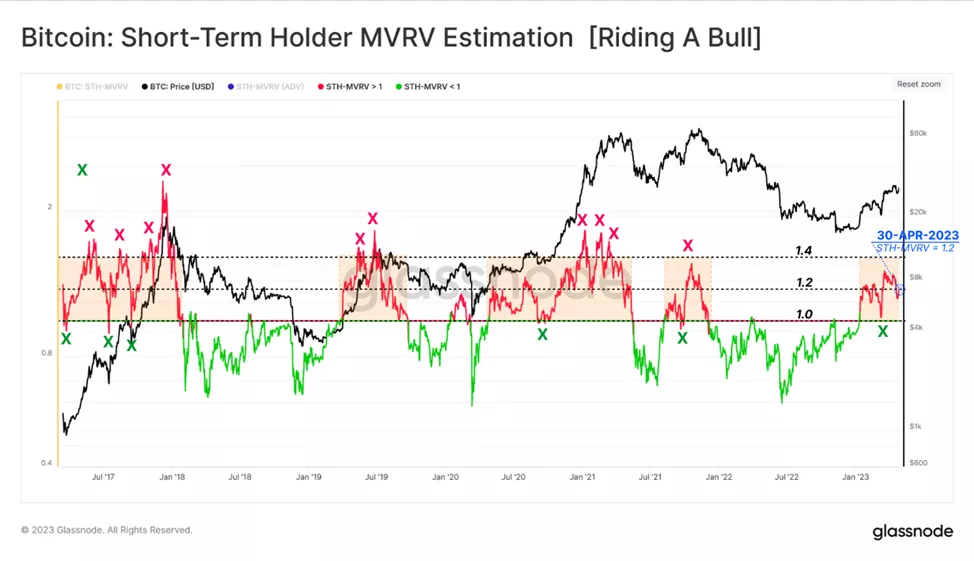

Based on the MVRV indicator applied to speculators, analysts noted no overheating in the market. Historically this stage occurred when the metric exceeded 1.4. On April 30, when Bitcoin tested $30,000, STH-MVRV rose only to 1.33.

A value of 1 for the indicator would correspond to a spot price of $24,400. This level can be seen as support for the current uptrend, the analysts explained.

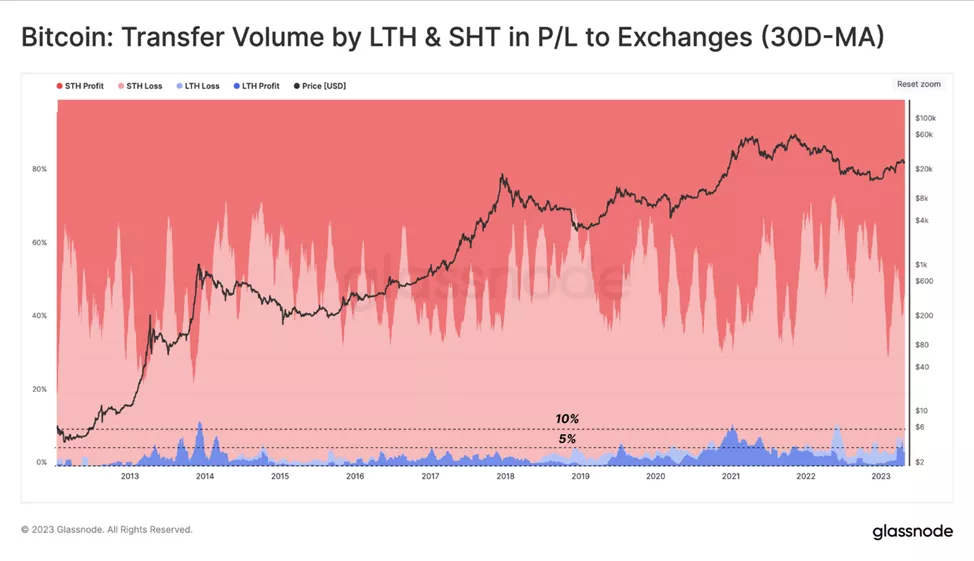

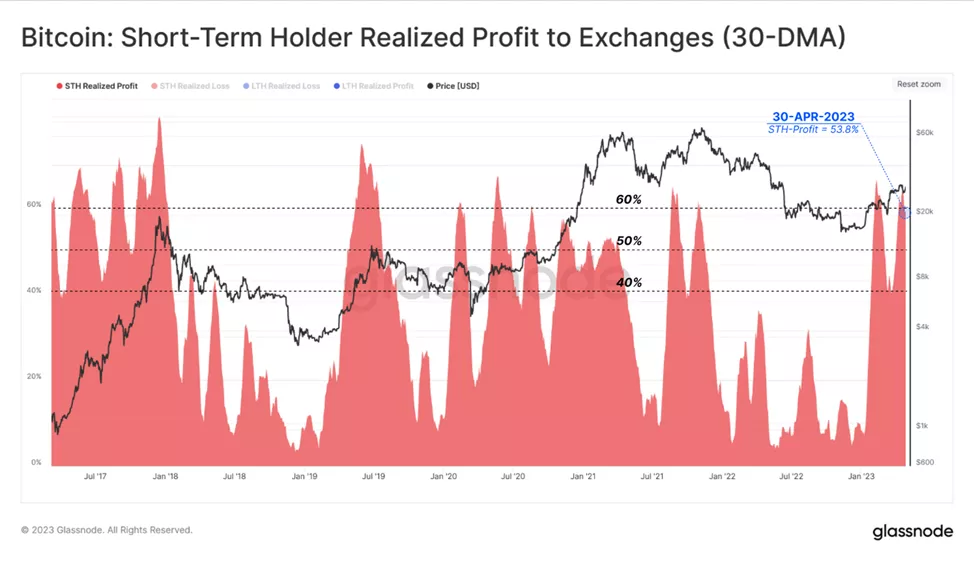

As part of the ongoing market recovery, the monthly pace of coin transfers to exchanges reached 22,300 BTC (at times over 30,000 BTC). According to analysts’ calculations, 90-95% of these transactions were by speculators. The share of profit-taking by short-term investors accounted for around 58% of all transfers.

To illustrate, specialists highlighted profit-taking by speculators and overlaid it on Bitcoin’s chart. Two waves coincided with price corrections of the first cryptocurrency.

Earlier analysts Matrixport and UBS pointed to the limited effect of Mt.Gox compensation payouts.

Bloomberg noted that the largest creditor of the bankrupt exchange intends to hold onto the returned coins.

Galaxy Digital CEO Mike Novogratz forecast Bitcoin reaching the level $40,000 after the start of a rate-cutting Fed key rate.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!