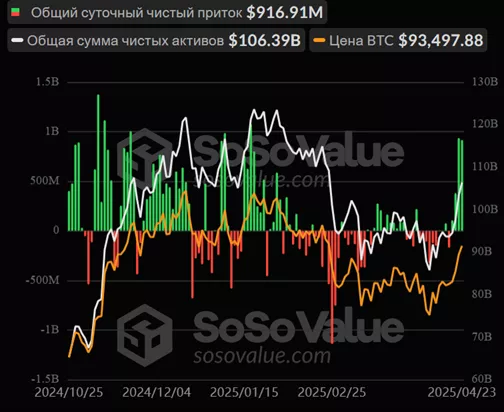

Bitcoin Spot ETFs Witness $2.34 Billion Inflow Over Four Days

On April 23, investors funneled $916.9 million into spot ETFs based on digital gold, with a total of $2.342 billion over the past four days.

The previous day, the funds received a record $936.4 million since January 21.

The cumulative inflow increased to $37.61 billion. AUM reached $106.39 billion.

On April 23, the positive trend was significantly influenced by:

- IBIT from BlackRock — $643.2 million;

- ARKB from ARK Invest & 21 Shares — $129.5 million;

- FBTC from Fidelity — $124.4 million.

In a conversation with The Block, LVRG’s Director of Research, Nick Ruck, predicted continued growth for Bitcoin alongside gold prices.

“The dynamics of BTC-ETF indicate a revival of investor confidence in positioning the first cryptocurrency as a store of value,” he explained.

Previously, BitMEX co-founder Arthur Hayes predicted that the value of digital gold would rise above $100,000 due to the U.S. Treasury’s buyback of government bonds.

Earlier, journalists learned of Cantor Fitzgerald’s plans to launch a $3 billion Bitcoin fund.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!