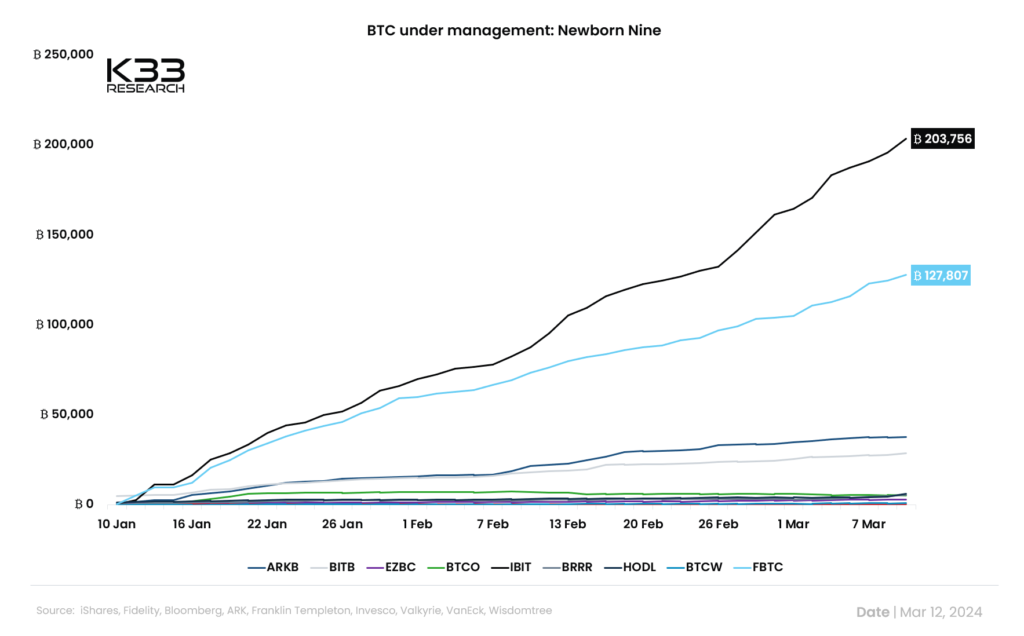

BlackRock’s Spot Bitcoin ETF AUM Surpasses 200,000 BTC

Just two months after the launch of the first spot Bitcoin ETFs in the US, the assets under management of BlackRock’s IBIT fund have exceeded 200,000 BTC ($14.6 billion).

The combined figure for the nine “new” ETFs (excluding Grayscale’s “converted” GBTC) is about 420,000 BTC, roughly 2% of the total issuance of digital gold.

Second in AUM among the “new” products is Fidelity’s FBTC with over 128,000 BTC, followed by Ark Invest’s ARKB with approximately 38,000 BTC.

[2/4] Same data in BTC terms pic.twitter.com/fTQZCC0QVl

— BitMEX Research (@BitMEXResearch) March 12, 2024

Last week, IBIT surpassed MicroStrategy in AUM, a firm renowned for its steadfast position on the leading cryptocurrency. However, the company founded by Michael Saylor acquired an additional 12,000 BTC, bringing its “digital balance” to 205,000 BTC.

“However, IBIT is likely to soon surpass the business analytics company in Bitcoin assets,” experts at The Block suggested.

Bloomberg analyst James Seyffart noted that the AUM of Bitwise’s BITB fund recently surpassed the $2 billion mark.

We now have five US spot #bitcoin ETFs over $2 billion in assets with $BITB joining the club

Out of ~3,500 US ETPs there are only 445 with over $2 billion in assets

Going a step further — only 157 have more than $10 Billion. $GBTC & $IBIT are there. $FBTC is getting close https://t.co/Yc7N3OBquH

— James Seyffart (@JSeyff) March 11, 2024

Declining GBTC Dynamics

Over two months, GBTC’s assets fell by 37% — from 619,000 BTC to 388,000 BTC, likely due to higher management fees. Now, Grayscale’s spot Bitcoin ETF AUM is slightly less than the combined figure of its competitors.

Seyffart noted that the rise in digital gold prices offset the decline in dollar terms — the value of cryptocurrency held by GBTC remained at $28 billion, roughly matching pre-conversion levels.

~$11 billion in outflows for $GBTC since converting to an ETF. and it currently has about the same AUM that it had when it converted. ($28.6 bln vs $28 bln) Price appreciation is a helluva drug. Bull market subsidy is in full effect here.

— James Seyffart (@JSeyff) March 11, 2024

K33 Research analyst Vetle Lunde predicted a slowdown in fund outflows from Grayscale.

Encouraging Inflows

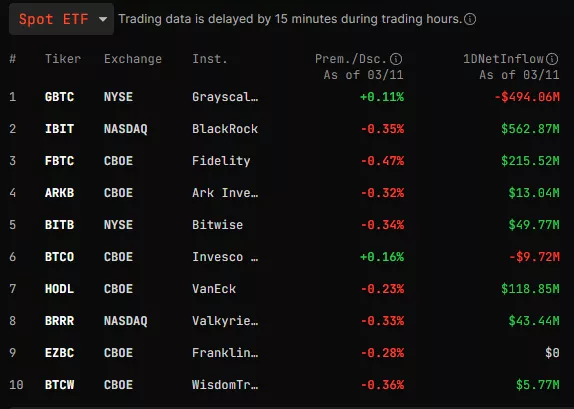

As of March 11, net inflows into US spot Bitcoin ETFs amounted to $505.5 million, despite $494.1 million outflows from GBTC.

Largest inflows:

- IBIT — $562.9 million;

- FBTC — $215.5 million;

- HODL — $118.9 million.

VanEck representatives introduced a zero management fee for ETF investments until March 31, 2025, “because they strongly believe in Bitcoin.”

IMPORTANT UPDATE!

Because we believe in #bitcoin so much, starting tomorrow, you can invest in VanEck Bitcoin Trust (HODL) with no fees until March 31st, 2025.*

*During the period commencing on March 12, 2024, and ending on March 31, 2025, the Sponsor will waive the entire…

— VanEck (@vaneck_us) March 11, 2024

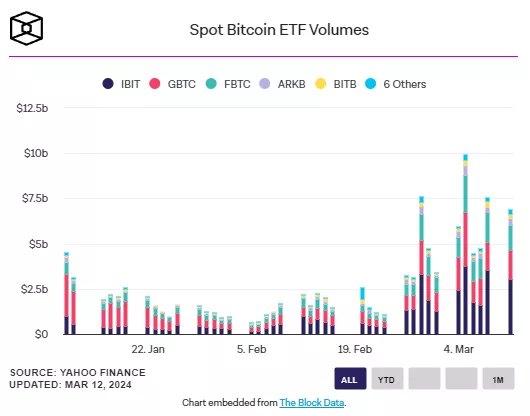

Researchers at The Block observed that daily inflows into IBIT on March 8 exceeded $10 billion for the first time; the total figure for “new” ETFs surpassed $20 billion.

High Turnover

Trading volume for new products is also significant — on March 11, it reached $6.91 billion (the fourth highest in recorded history).

The highest turnover was recorded on March 5 — $9.93 billion. At that time, Bitcoin reached a new price high above $69,000 for the first time since November 2021.

On March 11, IBIT’s share of total trading volume was $3.05 billion. GBTC and FBTC figures were $1.59 billion and $1.42 billion, respectively.

The combined market share of spot Bitcoin ETFs from BlackRock and Fidelity exceeded 60%.

At the time of writing, digital gold is trading around $70,500. Over the past seven days, it has risen by 5.5%, according to CoinGecko.

Earlier, weekly inflows into cryptocurrency investment products reached a record $2.69 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!