A Kaleidoscope of Events: What 2020 Left in the History of Cryptocurrencies

The year 2020 proved, in every respect, to be unprecedented. The global crisis triggered by the coronavirus pandemic affected all aspects of human activity, including the cryptocurrency industry. Although it did not end up the worst for it, and despite a hesitant start, the year can even be described as fairly successful.

We outline the main events and trends of the departing year in one piece.

New Bitcoin Records

The leading cryptocurrency has traditionally served as a yardstick by which the rest of the market is largely guided. From the start of the year Bitcoin’s price rose from around $7,300 to a record high of $24 225 in December, and its market capitalisation rose from about $130 billion to nearly $450 billion.

But the path to new heights was far from smooth. Many will remember the events of March 12–13, when, amid a market crash, Bitcoin’s price fell to $3,800, losing more than 50% of its value in a day.

By April, Bitcoin had returned to its early-year levels, and in the ensuing months it breached the $10,000 mark several times.

A modest dip in September proved only a prelude to a powerful rally in November, during which the barrier at $15 000 was breached, and the culminating moment in December, when the price first surpassed $20 000, and by 30 December, repeatedly setting new records, rose to $29 000.

BTC/USD chart. Data: TradingView.

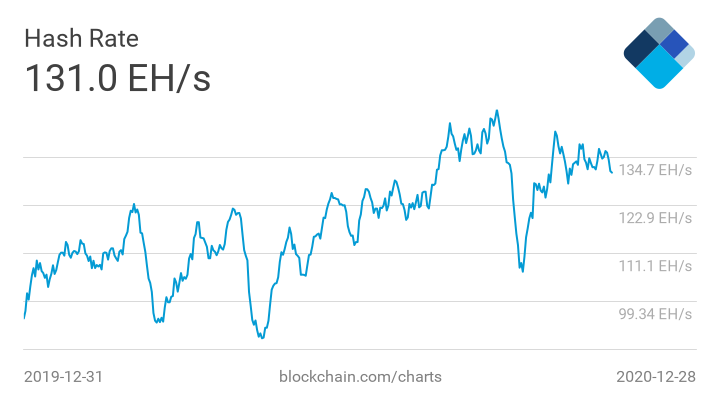

Hash rate chart of the Bitcoin network. Data: Blockchain.com.

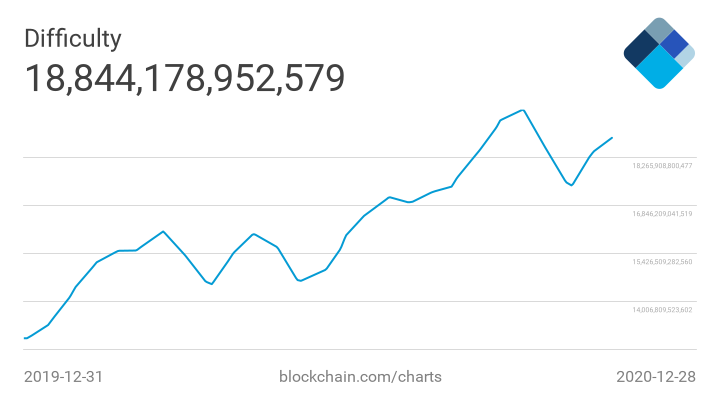

Bitcoin mining difficulty chart. Data: Blockchain.com.

Many experts believed that the rally would be inevitable after the halving, but not everyone shares this view, arguing that the causes lie in fiat currency inflation and the development of institutional infrastructure.

Institutional Adoption

The 2020 rally is indeed markedly different from 2017, when amid hype around ICOs Bitcoin first rose to $20,000. This time the rise was supported by substantial interest from institutional players – large corporations not only did not skimp on investments in the industry, but began to view Bitcoin as a tool for portfolio diversification.

Statements that cryptocurrency as a store of value has every chance to surpass gold were heard throughout the year, and investments aimed not only at cryptocurrencies as a class of assets but also at building a brand-new infrastructure, including in the decentralised finance (DeFi) sector.

Why Bitcoin Is Rising: Fundamental Reasons, Opinions, Forecasts

The unprecedented interest from institutional investors even earned the nickname “the MicroStrategy effect” — in honour of the eponymous company, which spent the second half of the year repeatedly in the headlines, announcing new investments in Bitcoin.

As of 30 December, the value of the cryptocurrency the analytics software provider purchased this year was estimated at $1.985 billion with total outlays of $1.125 billion.

Among other large Bitcoin investments include:

- Ruffer Investment — $744 million;

- One River Asset Management — $600 million;

- SkyBridge — $182 million;

- Stone Ridge Holdings Group — $114 million;

- MassMutual — $100 million;

- Billionaire Paul Tudor Jones — $100 million;

- Square — $50 million;

- Billionaire Stanley Druckenmiller (net worth $5.83 billion) — amount not disclosed;

- Mexican billionaire Ricardo Salinas Pliego (net worth $11.7 billion) — 10% of liquid portfolio;

- Mode Global Holdings — 10% of capital;

- NexTech AR Solutions — $2 million.

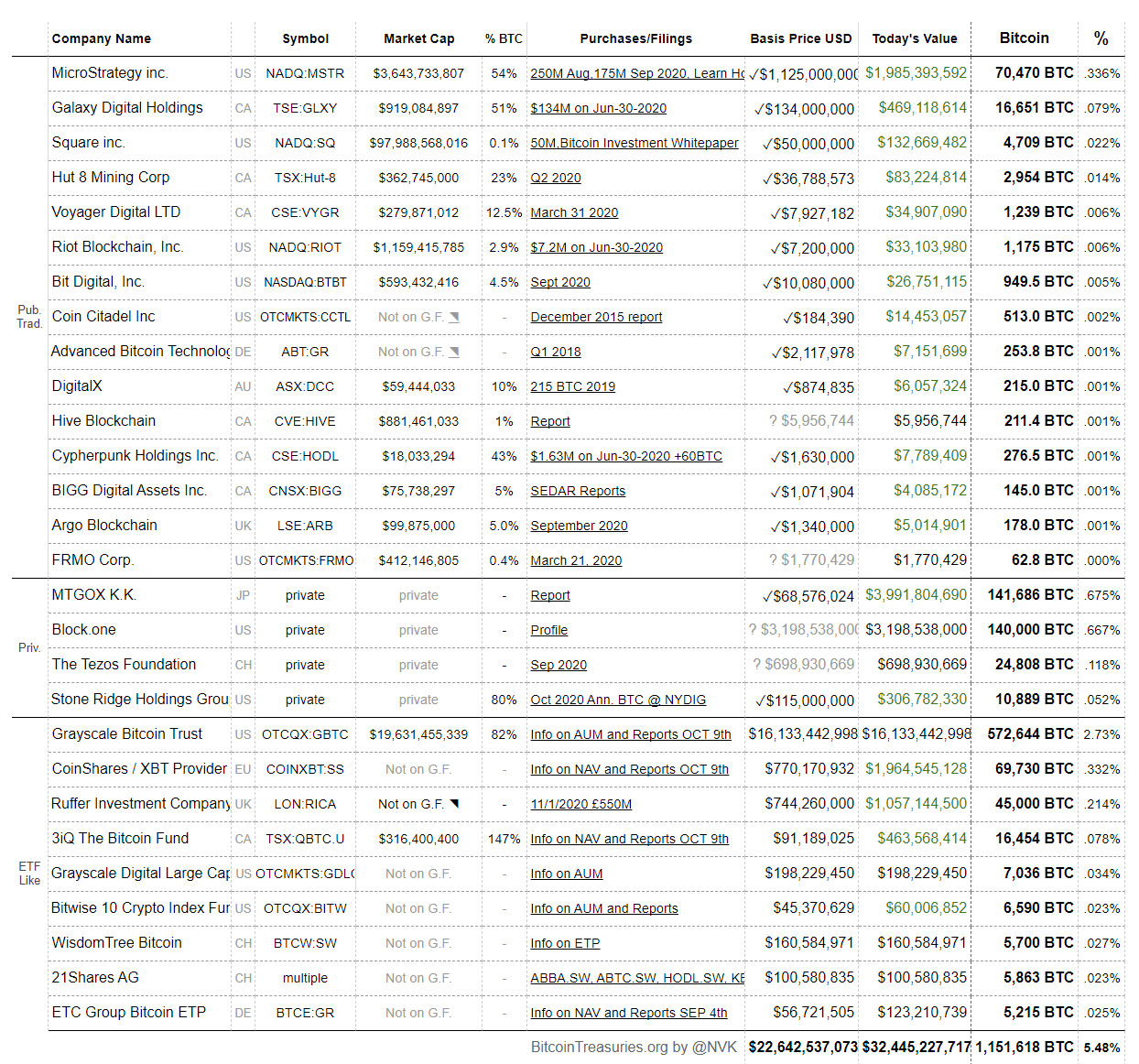

Another important channel for attracting large capital into cryptocurrencies was Grayscale Investments. Its flagship funds work with Bitcoin (GBTC) and Ethereum (ETHE), and both came under the oversight of the U.S. Securities and Exchange Commission (SEC) this year.

This largely legitimised the company in the eyes of traditional investors. Thus, a plan to purchase $500 million of GBTC shares was announced by the Wall Street powerhouse Guggenheim Partners.

As of 28 December, assets under management at Grayscale Investments stood at $19 billion.

12/28/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $19.0 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/qfB5IFfMC4

— Grayscale (@Grayscale) December 28, 2020

Another notable development was PayPal’s opening of access to Bitcoin and several other cryptocurrencies to its users.

The company is working on integrating it with merchants, and its CEO Dan Schulman is convinced that, against the backdrop of the global shift away from cash, cryptocurrencies will soon become a commonplace payment instrument.

As of 30 December, under the management of private and public companies and crypto-focused funds, 1.151 million BTC were held, worth more than $32.4 billion.

Data: Bitcoin Treasuries.

Finally, one cannot overlook the plans of the largest U.S. cryptocurrency exchange Coinbase to go public. The California-based company filed for an initial public offering in December, two years after the first whispers of such a move. Some analysts already estimate Coinbase’s potential market capitalisation at $28 billion.

The Year’s Biggest Venture Deals

The COVID-19 pandemic led to a 61% contraction in funding in the first and second quarters, but venture investment remained steady throughout 2020. By year-end, total venture funding in the crypto industry was estimated at $3.1 billion across 774 deals.

Notable among them:

- Bakkt — $300 million;

- Paxos — $142 million;

- Chainalysis — $100 million + $13 million;

- Bitso — $62 million;

- Bitpanda — $52 million;

- BlockFi — $50 million;

- Fireblocks — $30 million;

- NEAR — $21.6 million.

The Year’s Largest M&A Deals:

- Binance / CoinMarketCap — undisclosed (roughly $300 million–$400 million);

- FTX / Blockfolio — $150 million;

- Coinbase / Tagomi — undisclosed (roughly $70 million–$100 million);

- ConsenSys / JP Morgan / Quorum — undisclosed ($50 million);

- Kraken / Bit Trade — undisclosed.

Vopreki pandemii i krizisu: kak bitcoin-industriya privlekala-investitsii v 2020 godu

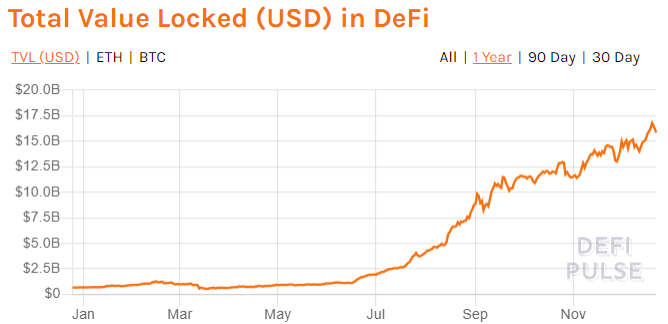

DeFi Fever

DeFi became one of the hottest trends in 2020, and the figures bear it out: at the start of the year the total value locked (TVL), held in smart contracts of protocols, stood at $675 million; by December this figure had risen to a record $16.67 billion.

Data: Defi Pulse.

June and July saw a surge of activity catalysed by token distributions to Compound users and the yield-farming phenomenon, as vast sums began flowing into the sector.

How DeFi service Compound caught up with and overtook rivals

As a result, project tokens began to rise in value. MakerDAO, previously dominant in the space, briefly ceded the lead, while Yearn.Finance, Aave, Uniswap and Curve Finance moved to the forefront.

Toward year-end MakerDAO again led in TVL, narrowly ahead of the tokenised Bitcoin, WBTC, sometimes described as “Bitcoin on Ethereum.”

Even though the prices of most tokens had corrected by December and trading volumes on decentralised exchanges (DEX) had noticeably declined, the sector’s growth is nonetheless impressive.

Yet claims of a genuinely community-driven push to build a new financial system based on transparency and decentralisation are only partly true. The growth in user numbers lags the inflows of capital, and the sector’s hype bears some similarities to the ICO mania of 2017, when the priority was quick profits rather than real innovation.

A serious obstacle lies in the flaws of the smart contracts themselves and, as a result, frequent cases of theft of funds and exit scams, as well as the emergence of previously unknown attack types, such as those using flash loans.

“Black Thursday” for DeFi: how skilled hackers drained $8 million from MakerDAO amid the market collapse

A direct consequence of DeFi’s rising popularity was the revival of the stablecoins market. By year-end their aggregate market capitalization approached $27.5 billion, of which more than $20.5 billion was Tether (USDT). The status of the second-most-popular stablecoin was firmly established by USD Coin (USDC).

The Year’s Biggest DeFi Venture Deals

Interest in the DeFi sector is evidenced by investments from major players:

- Compound — $25 million;

- Aave — $25 million;

- 1inch — $12 million + $2.8 million;

- Argent — $12 million.

Ethereum 2.0 and the Battle for Staking Leadership

Most DeFi tokens are built on Ethereum, the second-largest cryptocurrency by market cap. Its creators also pursue long-term plans, notably moving away from the current Proof-of-Work toward Proof-of-Stake. The goal is to resolve the network’s limited throughput and to improve scalability.

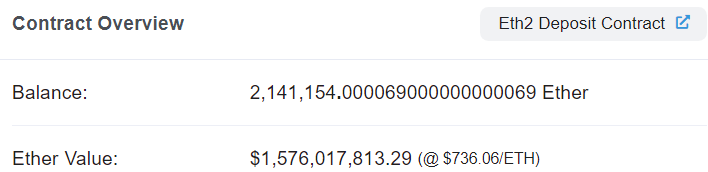

On 1 December, the launch of Ethereum 2.0 Phase Zero took place— an upgrade during which the final transition to the new consensus mechanism is expected to occur, and the network’s native asset will also serve as a store of value.

Data: Etherscan.

All these developments had a positive effect on ETH’s price — the native token of the platform ended the year above $750, a level last seen in May 2018.

ETH/USD chart from TradingView.

Analysts even expect that the February 2021 launch of Ethereum futures on the Chicago Mercantile Exchange (CME) indicates that institutional preferences will extend to this cryptocurrency as well.

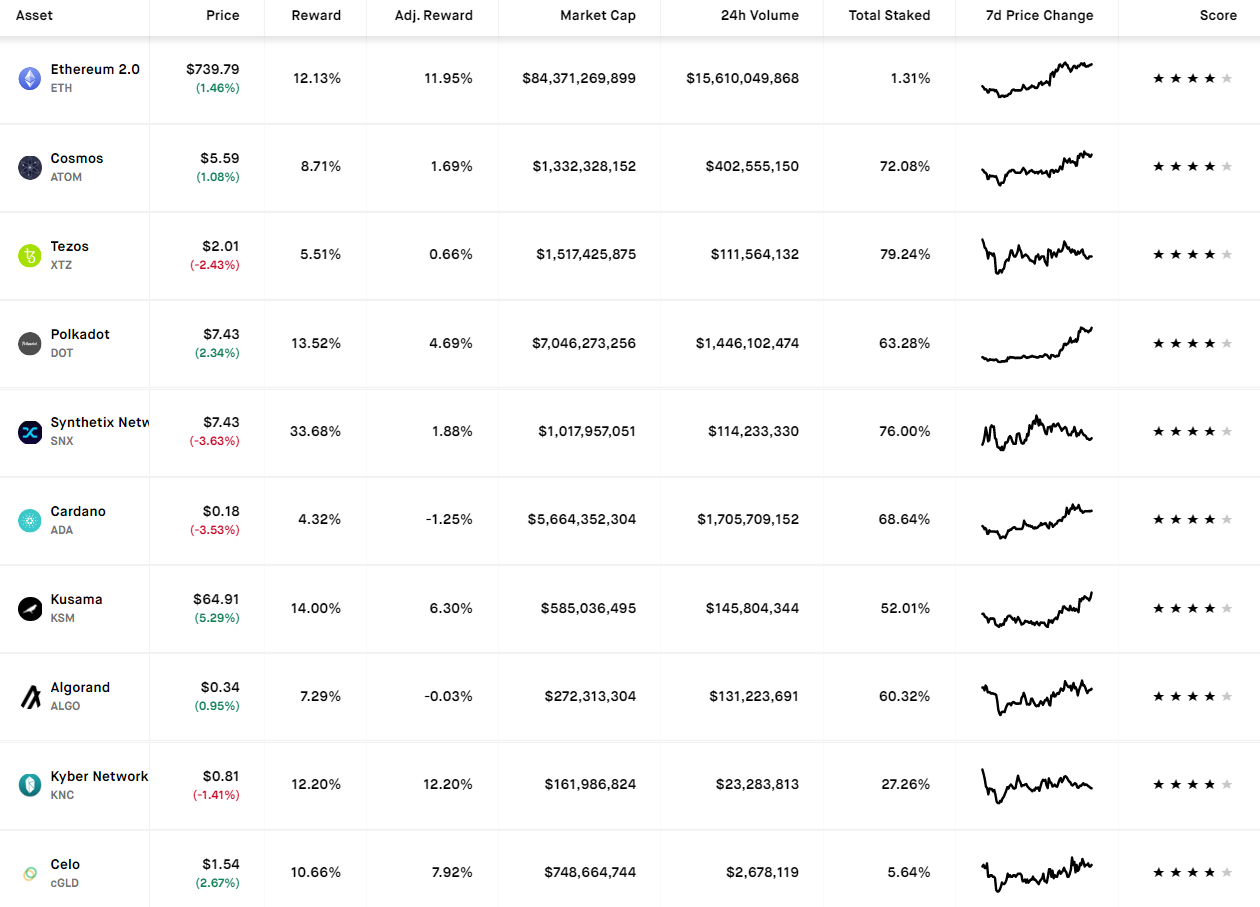

However, while Ethereum remains the clear favourite, the staking market offers rivals that will undoubtedly compete: Tezos, Cosmos (ATOM), Cardano (ADA), Algorand, Kyber Network and Waves, as well as newly launched projects such as Polkadot and Avalanche.

The most popular staking projects as of 30.12.2020. Data: Stakingrewards.

The launch of new projects was another hallmark of 2020 (for example, the aforementioned NEAR or the projects Filecoin and Dfinity that are not in the PoS segment).

The Dawn of Central Bank Digital Currencies (CBDCs)

Developments around CBDCs are seen as one of the most important trends in the monetary sphere and could radically change the world of money over the next decade. CBDCs are expected to raise stability and competition in finance as banks compete with tech firms and crypto.

If in 2017–2018 central bankers’ public statements about digital currencies were largely negative, especially regarding retail CBDCs, by the end of 2018 the rhetoric began to shift.

Over 2019 the number of central banks willing to issue a CBDC within the next six years doubled. As of January 2020, more than 80% of central banks were involved in R&D in this area, according to the Bank for International Settlements (a BIS paper).

What Is a Central Bank Digital Currency (CBDC)?

The coronavirus pandemic merely accelerated this process, and China’s digital yuan has attracted the most attention, given that China is the second-largest economy in the world.

In the summer of 2020, pilot testing of the digital yuan (officially the Digital Currency Electronic Payment, or DCEP) began in several Chinese cities for small purchases by residents in catering, retail, and education (the test involves more than 20 companies and four state banks). DCEP is also planned for large commercial transactions and in taxi services.

Judging by the course of the pilot, the digital yuan could become a full-fledged replacement for cash. All the conditions are in place: China is currently the world’s largest market for mobile payments, with more than a billion users.

How China Got to the Forefront of Monetary Innovation with the Digital Yuan (DCEP)

In October, Shenzhen authorities distributed digital yuan for the first time among residents. Applications for one of the 50,000 “red envelopes” were submitted by almost 2 million people. The winners spent 88% of the distributed funds, completing 62,788 transactions totalling 8.8 million yuan (about $1.3 million). In total, across four pilot cities, users completed over 4 million transactions worth more than 2 billion yuan (about $299 million).

Pressure on CBDC development in 2020 also gained momentum in the European Union. It is expected that the European Central Bank (ECB) will begin drafting a plan to launch a digital euro in mid-2021. However, officials note that this is still a phase of theoretical discussion, not a concrete step (a policy decision) toward issuance.

In any case, regulators view the digital euro as a supplement to cash, though news of a possible launch of the stablecoin Diem (formerly Libra) in January 2021 could accelerate research.

In October, the Bank of Russia presented a report on a digital ruble. The regulator’s plan is that the new asset, while reducing the costs of cashless payments, will complement existing forms of money tied to the national currency. The Bank believes the digital ruble will help clients of banks move away from “payment slavery” and address the caps in the Faster Payments System.

But major states are only thinking about it while tiny Bahamas has moved from words to action and has launched a national digital currency. The Sand Dollar is pegged to the Bahamian dollar, which in turn is pegged to the US dollar. The coin can be used via mobile phones, which 90% of residents on the archipelago own.

Tightening Regulation

The launch of CBDCs signals an inevitable revision of the regulatory framework, which will almost certainly affect cryptocurrencies and providers of related services.

Regulators’ attention in 2020 extended even to digital currencies—before now, authorities tended to view crypto as a risk for money laundering, terrorist financing and other crime, but now the emphasis has shifted toward threats to financial stability and market integrity.

- In April, the Financial Stability Board (FSB) under the G20 issued ten recommendations for a coordinated international approach to regulating stablecoins.

- In May, the ECB highlighted the need to close significant gaps in the regulation of global stablecoins before such projects are approved.

- In September, the European Commission proposed rules regulating cryptocurrencies and stablecoins.

- In November, Hong Kong’s Securities and Futures Commission (SFC) announced plans to extend regulatory requirements to all Bitcoin exchanges. The purchase of digital assets via crypto ATMs could also be banned.

- In December, the U.S. Congress introduced a bill requiring stablecoin issuers to obtain banking licences and regulatory approval.

- Also in December, the U.S. FinCEN published a controversial proposal regulating cryptocurrency transactions conducted through users’ own wallets.

That is only a subset of the statements and steps taken by regulators worldwide. Approaches vary by country, but almost all rely in some form on the FATF’s 2019 recommendations. The FATF itself also issued a number of notable statements this year, expressing concern at the growing popularity of stablecoins and the incomplete implementation of its recommendations.

Into this backdrop sits the lawsuit, filed in October by the U.S. Commodity Futures Trading Commission (CFTC) against the BitMEX derivatives exchange. The company and its owners were charged with operating an unregistered trading platform and violating KYC/AML procedures. In addition, the U.S. Department of Justice charged the exchange’s leadership with violations of the Bank Secrecy Act.

Not all was negative: the Office of the Comptroller of the Currency (OCC) within the U.S. Treasury allowed national banks to custody cryptographic keys for digital wallets and to hold reserves for stablecoin issuers, too.

Much credit here goes to the current head of the OCC, Brian Brooks, formerly of Coinbase. He nevertheless still faces a fight with the establishment: in December the U.S. House of Representatives stated that the incoming Biden administration should roll back OCC decisions already made.

Separately, Russia’s 1 January 2021 law on Digital Financial Assets (DFA) comes into force. Amendments to it are largely prohibitive.

Ukraine is preparing to adopt its own Law on Virtual Assets, regulating cryptocurrency operations. The community greeted the document critically, but in December, after a series of amendments, the Verkhovna Rada approved it in the first reading.

The All-Powerful SEC

The SEC has traditionally remained one of the year’s top newsmakers. In May, the regulator’s hard line led to the shutdown of Telegram’s TON project, which had been in development for two and a half years.

The Telegram blockchain platform was intended to surpass Bitcoin and Ethereum in speed and scalability, while preserving decentralisation. The head of the messenger, Pavel Durov, had argued that TON integration with Telegram would revolutionise payments and information exchange, but the hurdle proved to be the SEC, which believed that the distribution and subsequent sale of Gram tokens would breach federal securities laws.

In two rounds of a private ICO in February and March 2018, TON raised $1.7 billion from 175 investors in the U.S. and abroad, including entities linked to billionaire Roman Abramovich and Mikhail Abyzov. In June TON returned $1.2 billion to investors, and Durov said the Telegram team planned to pursue other projects and hoped regulatory climate for blockchain in the U.S. would become more permissive for developers in the future.

On 23 December, the SEC filed suit against Ripple, CEO Brad Garlinghouse and co-founder Chris Larsen. The agency alleges that over seven years the company sold unregistered securities to retail investors in the form of XRP tokens, raising $1.3 billion over that period.

The SEC claims that Ripple paid for various services with tokens, including market making, and its on‑demand liquidity (ODL) payments network attracted only 15 money‑transfer businesses, none of which were banks. The case will be heard in a federal court in the Southern District of New York. The SEC seeks an injunction against further sales, the return of all raised funds with damages and civil penalties.

The U.S. court set a date for preliminary hearings in the SEC’s case against Ripple

In addition, during 2020 the SEC closed the books on a number of other ICO-funded projects. In its November 2020 annual report, the agency said it had collected a record $4.68 billion in penalties and fines. Besides Telegram’s ICO, other token sales were included.

Regulatory posture could shift if Elad Roisman is confirmed as the new chair, having temporarily replaced Jay Clayton who left in December.

Alexander Vindman Sentenced to Five Years in Prison

In early December the long-running case dating from mid-2017 concluded: in Greece, at the request of U.S. authorities, the former operator of the BTC-e exchange, Alexander Vindman, was arrested.

He was suspected of $4 billion in laundering, extortion and creating the Locky ransomware. The French court later dropped the extortion allegations, but nonetheless sentenced the Russian to five years in prison and fined him €100,000.

The prosecution argued that Vindman acted with others, describing him as a “very smart and capable pirate” and the “conductor of the orchestra” and sought a 10-year sentence.

Requests for Vindman’s extradition were also filed by the United States and Russia, but Greek authorities decided to extradite him to France.

The Battle for Privacy

In response to regulators’ hard-line rhetoric, developers of crypto projects and infrastructure solutions have taken steps to enhance user privacy.

Focus has turned to updates to improve privacy and scalability in Bitcoin via BIP-340, BIP-341 and BIP-342 — including Schnorr signatures, Taproot and Tapscript — which in October were incorporated into Bitcoin Core. Activation date remains open, but as of the end of December, 91.5% of the network’s total hash power signalled readiness to support Taproot.

The new Bitcoin Core (v0.21) will also add support for V3 Tor Network addresses.

In September the Monero team published details of a new algorithmic innovation called Triptych. The development responds to CipherTrace’s tool for monitoring XMR transactions and promises even greater privacy through obfuscation of information.

Ricardo Spanyi: cryptographers will always stay ahead of regulators

That the tracking of Monero transactions genuinely concerns authorities is underlined by the IRS, which even ran a special competition, selecting Chainalysis and Integra FEC as contractors.

Users are paying heightened attention to privacy. According to Crystal Blockchain’s December report, in 2020 Bitcoins sent to mixers totalled $1.4 billion, up $0.5 billion from the previous year.

On the other hand, there was a troubling trend of delistings of anonymous coins. In November ShapeShift ceased supporting Zcash, Monero and Dash, citing regulatory risks.

Restrictions imposed by South Korea’s Financial Services Commission will affect the same Zcash, Monero and Dash and will come into effect in March 2021.

Also in 2020, the value of the first cryptocurrency earned by dark‑net operators rose by $300 million to $1.6 billion. A separate Chainalysis report shows that darknet marketplaces’ crypto revenues topped $1.5 billion, excluding December.

On a more positive note, Roskomnadzor unblocked the Telegram messenger in Russia in June. In its ruling, the agency noted the service’s cooperation in combating the spread of information banned in Russia. Earlier, Pavel Durov published a post about improving anti-terrorism measures while “keeping full privacy of correspondence.”

But Russia remains far from smooth: on 24 December the State Duma approved in the first reading a bill introducing fines for non‑compliance with the so‑called Runet isolation law.

The document introduces administrative liability for telecom operators and owners of traffic exchange points who refuse to provide Roskomnadzor with full information about the numbers and network addresses of their autonomous systems, the locations of connected infrastructure, and the routes of messages and network infrastructure.

How the pandemic is killing internet freedom: Freedom House report

A possible answer to such steps could come from NYM Technologies, which is developing a mixed network (mixnet) on a blockchain. It is intended to provide heightened privacy for internet users amid the spread of digital surveillance under the pretext of fighting the coronavirus.

*****

New hopes, bitter disappointments and almost daily new challenges. The departing year was truly eventful for cryptocurrencies, and it is not possible to list them all in a single article, but there is no doubt about one thing: it laid the groundwork for a new cycle in the industry’s evolution. We will find out very soon what shape it will take.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!