Halving, corporate war and the reshaping of influence: how mining changed in 2020

This year, the third Bitcoin halving and the corporate war between Bitmain co-founders Micree Zhan and Jihan Wu exerted enormous influence on mining. Against this backdrop, China began losing share of the hashrate to other regions. Here’s what defined the year for the crypto-mining industry.

- The third Bitcoin halving took place — the block reward fell to 6.25 BTC.

- Miner revenue had already surpassed pre-halving levels.

- Demand for equipment exceeded supply, but manufacturers reported losses.

- China’s share of Bitcoin’s hashrate declined.

- Inflows of institutional investment into the sector rose.

The halving has occurred. Miners weathered it and emerged stronger

In 2020, one of the most anticipated and discussed events for the mining industry was the third halving. There was no shortage of forecasts about how it would affect the sector.

Analysts at CoinShares outlined five main scenarios, one of which, albeit unlikely, was a ‘death spiral’. It was proposed that a gradual price decline would force miners to switch off equipment. This would lead to network stagnation: a fall in hashrate and a slowdown in block generation. In theory, such a cycle could repeat until a full stop.

On May 11, at block #630,000, the halving occurred. The block reward halved—from 12.5 BTC to 6.25 BTC.

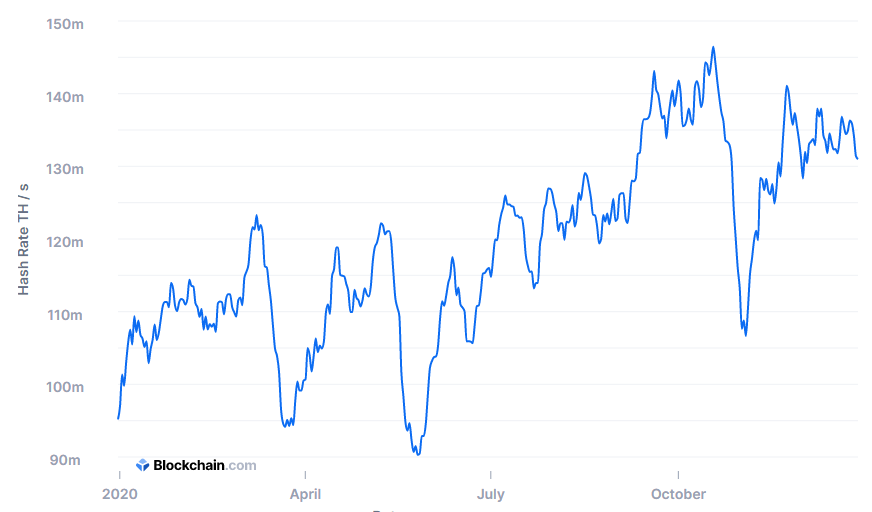

In the following 24 hours, Bitcoin’s hashrate collapsed by 16%, and miner revenue by more than 40%.

The drop in hashing power continued until May 26, when the measure from the pre-halving level of 121 EH/s fell to 90.3 EH/s (according to Blockchain.com).

But the metric recovered fairly quickly. Experts explained it this way:

- The start of shipments of new-generation ASIC miners Antminer S19 and Whatsminer M30 from Bitmain and MicroBT respectively;

- The deployment of equipment moved to the Sichuan province during the rainy season, whose start in 2020 was delayed;

- The recovery of Bitcoin’s price, which allowed older-generation miners, including the legendary Antminer S9, back into operation.

According to Blockchain.com, the hashrate had reached an all-time high by August. According to another service — Bitinfocharts — this occurred as late as the end of July.

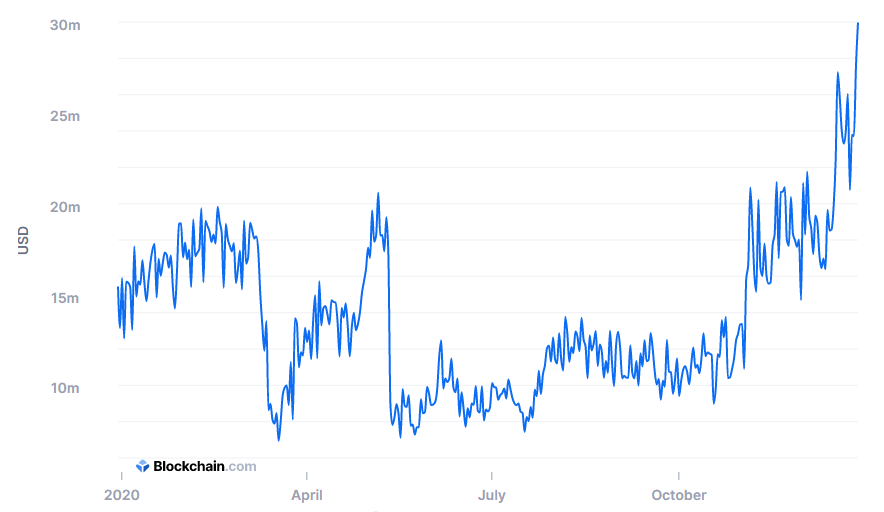

However miner revenue had returned to the pre-halving level only in early November amid Bitcoin’s autumn rally.

For November, Bitcoin miners’ revenue amounted to about $521 million. The figure was almost 48% higher than in the previous month and set a yearly high.

The December surge in Bitcoin’s price to a new all-time high allowed miners to push revenue even higher.

Hashrate, according to BitOoda’s forecast, will continue rising and by mid-2021 reach 260 EH/s. They expect millions of new devices on the market and miners to fully switch to the latest-generation gear.

This ‘pie’ remains to be shared among the leading ASIC-miner manufacturers.

The ASIC miner market — not all players prospered in the race for technology

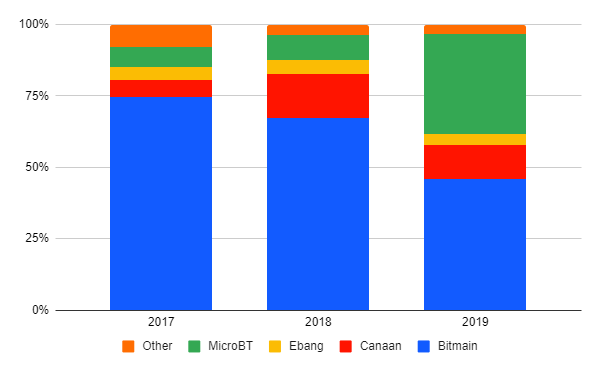

BitMEX Research’s assessment shows Bitmain’s dominance in the ASIC-miner market continuing to decline. In 2019 the company’s share had already fallen to 46%.

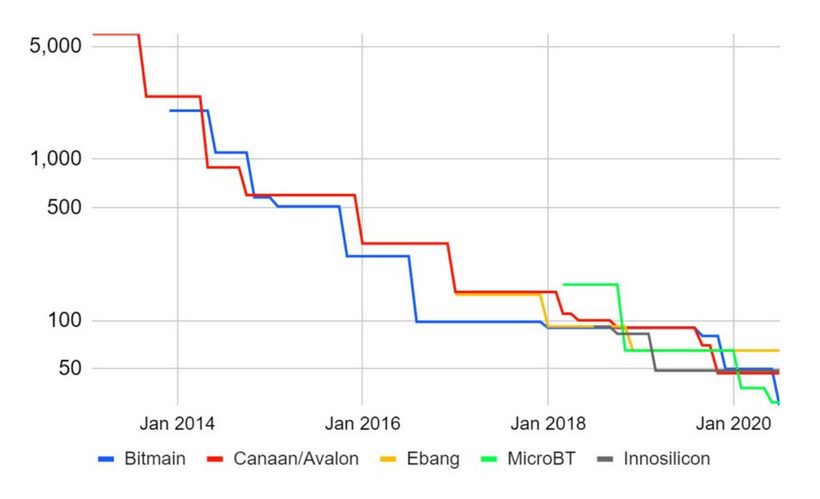

In 2020 Bitmain reasserted technological leadership with the Antminer S19 line. In recent years the company had consistently had to catch up with rivals, including Canaan, Ebang, MicroBT and even Innosilicon.

In February, Bitmain unveiled the new-generation Antminer S19 Pro with an energy efficiency of 30 J/TH.

MicroBT released its own ‘answer’ only in April. The flagship model of the new line, Whatsminer M30S++, slightly lags behind the S19 Pro with an efficiency of 31 J/TH.

In June, Canaan Creative introduced AvalonMiner 1146 Pro and 1166 Pro, whose efficiency was roughly 40% lower than that of Bitmain and MicroBT miners.

The firm managed to close the gap to the tech leaders only in September with AvalonMiner A1246 — 38 J/TH.

We’re excited to show our A1246. The average hashrate achieved 90.96TH/s with stable running~ Message Us sales@canaan.io #BTC #bitcoinmining

Learn more: https://t.co/IFDKnAramH pic.twitter.com/Wn5oSx7xfn

— Canaan (@canaanio) September 23, 2020

Ebang International, meanwhile, was selling gear whose release dates back to 2019. Its flagship, the Ebit E12, trails the competition with an efficiency of 57 J/TH.

In June the company conducted an IPO on Nasdaq, issuing 19.3 million shares at $5.23 each for a total of $101 million. Ebang’s market value stood at $658 million. The firm became the second-largest mining-equipment manufacturer after Canaan, which had gone public.

Shares of Canaan, listed on Nasdaq at $9 last year, slid to a record low of $1.79 in July. By December 29 the stock traded at $4.18.

Ebang’s stock rose briefly after the listing but then slipped; by September it peaked at $10.59. On December 28 the close was $4.86, with growth expectations.

Canaan and Ebang are required to disclose financial results that indirectly reflect the sector’s health.

Net loss for Canaan in Q1 was $5.6 million, in Q2 it fell to $2.38 million, and in Q3 it jumped to $12.7 million.

The company noted that, compared with the previous year, it reduced equipment sales measured in EH/s and lowered the price per EH/s.

For 2019 overall, Canaan posted a net loss of $114.6 million.

Ebang reported a net loss of $6.96 million for the first half of the year. Revenue fell 50.6% year on year.

In September, Chinese media reported that miners faced equipment shortages — leading manufacturers had sold out their stock. In November it emerged that pre-orders for the latest-generation devices from Bitmain and MicroBT had been snapped up through spring 2021. Both companies raised prices.

Industry journalist Colin Wu noted that Canaan reported a $45 million prepayment for Q3. In September Fidelity Investments (FMR LLC) became a shareholder of the company.

Canaan, first listed mining machine company, announced its Q3 financial report. Although the data has declined, it has revealed an advance payment of $45million and is ready to move forward to crypto. In the past two months, Canaan’s stock has risen by 200%, FMR has re-held pic.twitter.com/v9XEBndin4

— Colin Wu(Wu Blockchain) (@WuBlockchain) November 30, 2020

According to Ebang’s site, its flagship is delivered three and a half months after payment.

BitMEX Research analysts say the industry is consolidating, and ultimately two to three mining-equipment manufacturers will survive.

By year end, Bitmain and MicroBT look likeliest to prevail. Moreover, Bitmain appears to be moving toward an exit from the intra-corporate conflict, while MicroBT’s founder Yang Zuoxing reportedly resolved legal issues with authorities, according to Colin Wu.

Zuoxing posted his first WeChat message since 2019 in December, the journalist notes.

“However, I am back,” — said the founder of MicroBT.

After more than a year, Yang Zuoxing, the founder of Whatsminer, posted on his wechat. Although the content is running, «I am back» implies that the problem is solved and fully returned. Interestingly, Yang’s old rival, Bitmain, Micree, was also back in this week. pic.twitter.com/8Z9QoTw6Qg

— Colin Wu(Wu Blockchain) (@WuBlockchain) December 19, 2020

Yang Zuoxing founded MicroBT after leaving Bitmain in 2016, when its founders Jihan Wu and Micree Zhan refused him a stake. They subsequently initiated litigation against the former engineer behind the success of the S7 and S9 flagship ASIC miners for IP infringement. The court ruled in Zuoxing’s favour, invalidating Bitmain’s patent.

In December last year, Zuoxing was arrested in China on charges of misappropriating 100,000 yuan (about $14,300). According to Colin Wu, Zuoxing’s post suggests he is out of custody.

However, Canaan has closed the gap to the leaders in technology, and Ebang also has its cards. The latter diversifies its business, and has obtained an exclusive license for the patent on the AsicBoost Bitcoin-mining acceleration method in South Korea. Colin Wu noted that this could spell trouble for MicroBT, which uses mining chips from South Korea’s Samsung.

Bitmain’s co-founders fought all year, but a light at the end of the tunnel was already flickering

In November of the previous year, Jihan Wu, with shareholder support, ousted co-founder Micree Zhan from all positions. As later revealed, this marked the start of a prolonged conflict.

According to documents Bitmain filed for its 2018 Hong Kong IPO, Zhan owned 36.5% of the shares, Wu about 21%.

Late in 2019 Micree Zhan convened a shareholders’ meeting proposing to remove all directors and restore him as sole head of the company. The majority rejected the proposal.

Below is a chronology of the 2020 standoff:

- In early May, Zhan, acting as the company’s legal representative, obtained a business license from the Beijing Bureau of Industry and Commerce. In the building itself, the license papers were taken by a group led by Wu’s associate Liao Lu—the man Wu. The latter was later arrested by the police;

- Subsequently, the authorities suspended the license due to the conflict;

- June 3, Zhan, with the help of private security, regained control of Bitmain’s Beijing office. Media reported that he also controlled the Shenzhen manufacturing unit and blocked shipments of miners routed through Wu’s Hong Kong entity;

- At the end of June the sides discussed settlement but could not agree;

- Shortly after, Zhan attempted to change the company’s settlement account in his favour to seize control of finances;

- In response, Wu founded a Hong Kong subsidiary to engage with semiconductor suppliers and device manufacturing;

- In September Wu reinstated himself as the company’s legal representative and became CEO, while Zhan remained as general manager;

- In December the sides agreed that Jihan Wu will depart from the company, receiving a compensation package. It includes $600 million, plus the BTC.com pool with the BitDeer cloud platform and mining farms outside China.

- On December 28, Bitmain’s shareholders approved the agreement reached by the co-founders. The settlements are due to be completed by the end of January 2021.

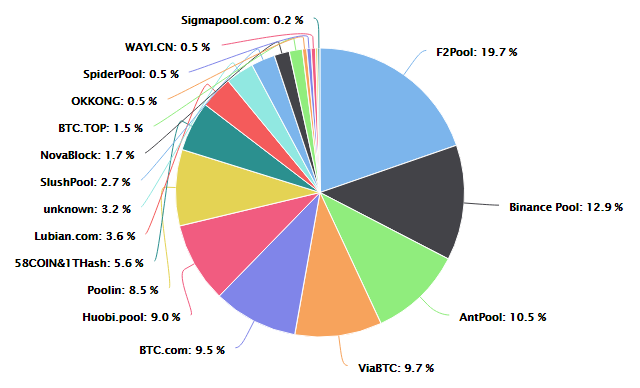

Analyst Karim Helmi of Coin Metrics argues that splitting BTC.com and AntPool between different entities would benefit Bitcoin’s decentralisation in practice.

Splitting up @BITMAINtech, with @btccom_official falling one side and @AntPoolofficial on the other, is probably the best thing that could happen for Bitcoin’s substantive decentralization.

This is crazy bullish.https://t.co/9ayEhTVOIm— karim helmy 🦌🏝 (@karimhelpme) December 20, 2020

HASHR8’s chief operating officer Tom Heller noted that this is essentially competition — according to him, Zhan has already hired the former founder of BitDeer to create its analogue in AntPool.

The founders’ clash weighed on the business, but in the first four months of the year the company raked in more than $300 million in revenue.

Bitmain acknowledged that, during this period, sales of AI-focused products—an area championed by Zhan—soared. Wu called his ideas “crazy.” He also notes that the pivot back to client-focused sales contributed to the resurgence.

In November the company unveiled modular mining hardware aimed at large-scale operations.

In September Bitmain expanded its cooperation with Foundry, which had previously become a subsidiary of Barry Silbert’s Digital Currency Group, to fund sales in North America.

To better serve customers in the region, the Chinese manufacturer selected the American firm Core Scientific as a single service centre.

Commenting on the Bitmain partnership, the company noted that the North American mining industry is growing rapidly.

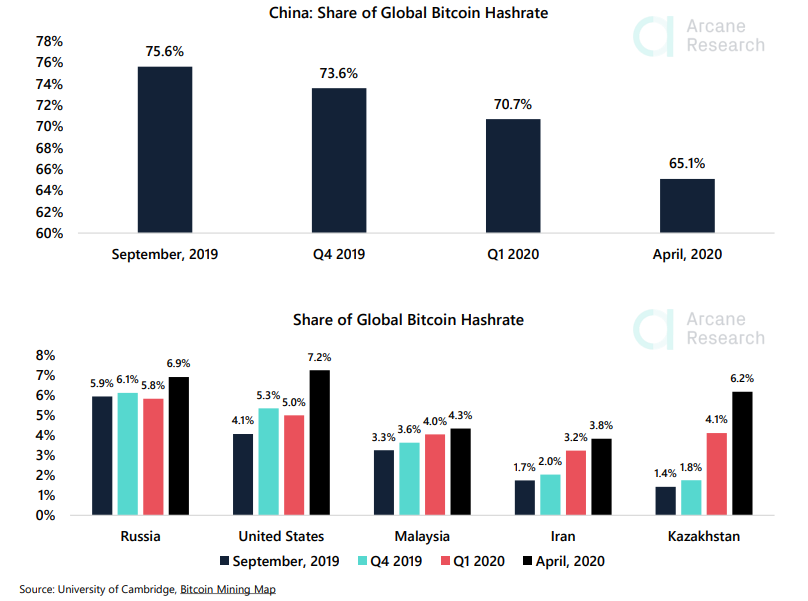

The numbers bear this out. From September 2019 to April 2020, Bitcoin’s hashrate in the United States rose by 78%, outpacing the long-time leader, China.

China loses leadership as institutional investors arrive in mining

According to the Cambridge Centre for Alternative Finance (CCAF), as of April 2020 China accounted for 65% of Bitcoin’s hashrate.

For now, China’s dominance persists, but the autumn volatility confirms the position has weakened.

After October 24, over a few days the hashrate collapsed by 27%. Analysts attributed this to the wrap-up of many hydropower contracts in Sichuan during the high-water season and the expiry of cheap tariffs.

In early November the metric rose sharply. Experts linked this to equipment moved in the days to other mining centres in China—the Xinjiang and Inner Mongolia autonomous regions.

Whoa! big jump in #bitcoin hash rate over last 10 hours (+29.7% trough to peak) Large number of machines just came online somewhere, relocated Sichuan region miners possibly? pic.twitter.com/UKahgQ37Tm

— Jason Deane (@JasonADeane) November 9, 2020

Arcane Research noted that even as of September 2019 China accounted for 75.6% of hashrate. They stressed that by April 2020 this had fallen by about 10 percentage points as mining capacity expanded in other countries, including the United States, Kazakhstan and Iran.

The technical director at Casa, Jameson Lopp, believes that the loss of China’s leadership would bring not only the emergence of cheap-energy sites outside Asia but also local production of mining chips there.

Another important factor for expanding beyond China is the regulatory climate. In 2017 Beijing banned cryptocurrency trading in the country, but it did not block mining growth—at least directly. However, 2020 saw a string of events suggesting the business continually faces indirect problems, whether from corruption or other opaque causes:

- May. Hydroelectric shortages led Sichuan authorities to forcibly disconnect some mining farms from the grid.

- June. Chinese authorities continued a campaign to freeze assets on bank accounts of off-exchange Bitcoin participants. Miners who owned mining equipment were among those affected.

- August. Inner Mongolia authorities decided to revoke the preferential electricity tariff for 21 farms identified in the region.

- October. Chinese miners faced difficulties paying electricity bills amid a crackdown on anti-money-laundering and fraud, complicating Bitcoin sales for yuan on the off-exchange market.

- December. Authorities in Baoshan, Yunnan Province, forbade power plants from serving local miners.

Against this backdrop, Core Scientific president and CEO Kevin Turner, commenting in December on the company’s large purchase of miners from Bitmain, noted:

“Since our last purchase agreement with Bitmain in June, Core Scientific has witnessed growing demand from new and existing customers, as well as a substantial institutional interest in digital-asset mining in North America.”

Throughout the year, North American firms procured substantial batches of mining equipment.

- June. Core Scientific — 17,595 Antminer S19 units.

- August. Riot Blockchain — 8,000 Antminer S19 Pro plus an additional 5,100 units.

- September. Marathon Patent Group — 10,500 Antminer S19 Pro.

- October. Riot Blockchain — another 2,500 Antminer S19 Pro. Marathon Patent Group — 10,000 Antminer S19 Pro.

- December. VBit Technologies — 3,000 Antminer S19 series. Core Scientific — over 58,000 Antminer S19 units. Marathon Patent Group — 70,000 devices of the S19 line.

The latest deal is planned to close by the end of 2021. Its value is $170 million.

On the matter of purchasing more than 58,000 S19 units, Core Scientific noted:

“With stable ownership rights, a mature rule of law, a stable regulatory landscape, independent courts and competitive electricity prices, North America has become one of the main destinations for institutional investors seeking to participate in digital-asset mining.”

Shareholders in North American mining companies have already included financial giants such as Fidelity, Vanguard and Charles Schwab.

Kazakhstan has legalised mining and expects in the coming years a flow of around $750 million of investment into the sector.

Significant industry projects are also under way in Russia. BitCluster co-founder Vitaliy Borchenko argues that the abundance of unused Soviet-era industrial buildings with ready power infrastructure creates good prospects for crypto mining in the region.

The company has operated since 2019 on two sites in Bratsk and Angarsk, converting existing industrial facilities. Low electricity tariffs in Irkutsk Region are historically tied to overcapacity generation there.

In October 2020 BitCluster opened a data centre in Norilsk. The company again took advantage of closed plant facilities, this time belonging to Norilsk Nickel.

A similar project in Siberia is being pursued by Bitriver, which buys power from the renowned Bratsk Hydroelectric Station.

https://forklog.com/bitkoiny-v-sibiri-kak-velikaya-strojka-kommunizma-pitaet-majning-kriptovalyut/

Bitriver has received permission to build a data centre with capacity up to 100 MW in Buryatia.

Gazprom Neft opened the possibility of using associated petroleum gas from a field in Khanty-Mansiysk for Bitcoin mining. Leading energy producers worldwide aim to utilise gas that is otherwise flared. The project by Gazprom Neft to use associated gas for Bitcoin mining has already been followed by Vekus.

In the US, a similar project is being pursued by Norwegian oil-and-gas giant Equinor. Its partner is the American startup Crusoe Energy. North America also hosts mining firms Upstream Data and DJ Bitwreck working on this technology.

Against this backdrop, BitOoda’s forecast of hashrate rising to 260 EH/s by July 2021 — almost doubling the December level — seems less far-fetched. They estimate roughly $4.5 billion in investments would be required, already flowing into the industry in 2020.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!