Monetary policy has broken bitcoin’s historical cycles, says Arthur Hayes

Arthur Hayes says bitcoin’s four-year cycle is dead; central banks now drive prices.

Former BitMEX CEO Arthur Hayes says the crypto market’s four-year cycle is no longer relevant. In his view, price action is driven by central banks’ monetary policy rather than historical patterns linked to the halving.

“Long Live the King!” an essay on why the $BTC 4yr cycle is dead.

— Arthur Hayes (@CryptoHayes) October 9, 2025

The expert argues that traders are wrongly expecting the bull market to end by referencing past cycles. He maintains that earlier uptrends ended because monetary conditions tightened, not “on schedule”.

According to Hayes, the current cycle differs in several respects:

- The US Treasury continues to pump liquidity into markets via issuance of government bonds;

- measures to ease bank regulation to stimulate lending are under discussion;

- the Fed has resumed cutting interest rates despite inflation running above target.

He recalled how monetary policy influenced the market in the past:

- First cycle. The rally coincided with the Fed’s quantitative easing and credit expansion in China. It ended when both central banks slowed money creation in late 2013.

- Second cycle (“ICO boom”). It was driven mainly by a “borrowing surge” in China. The market collapsed after lending in China slowed and dollar conditions tightened.

- Third cycle (“COVID-19”). The market rose exclusively on dollar liquidity. The trend ended amid Fed tightening in late 2021.

In Hayes’s view, China will not be the main driver of the rally this time, but neither will it hinder it. The authorities are shifting from restraint to a neutral or moderately stimulative stance. That removes an obstacle that could have interrupted the cycle.

“Listen to our monetary masters in Washington and Beijing. They are clearly saying that money will become cheaper and more available. Therefore bitcoin keeps rising in anticipation of that future,” he concluded.

The Fed’s influence

The price of the first cryptocurrency stabilised after the publication of the minutes of the Fed’s September meeting. The document showed that most officials support further cuts to the policy rate.

Roughly half of the committee favours two more easings by year-end. Analysts say this strengthens expectations of more benign financial conditions in the fourth quarter.

“The global liquidity cycle is changing. Central banks are shifting from tightening to easing,” — said BRN’s head of research, Tim Misir.

He added that markets now assign a 90% probability to a Fed cut in October. According to Misir, such synchronised easing has historically supported risk assets and bitcoin bull cycles.

At the time of writing, bitcoin trades around $123,400, up 0.5% over 24 hours, according to CoinGecko.

Inflows into crypto funds remain positive. From 26 September to 4 October, investors allocated a record $5.95 billion to ETF.

“Inflows into exchange-traded instruments are the cleanest signal of institutional interest,” said the CEO of the startup Function, Thomas Chen.

Wincent’s Paul Howard added that the recent inflows “helped cement a new price floor ahead of a year-end rally”.

Community forecasts

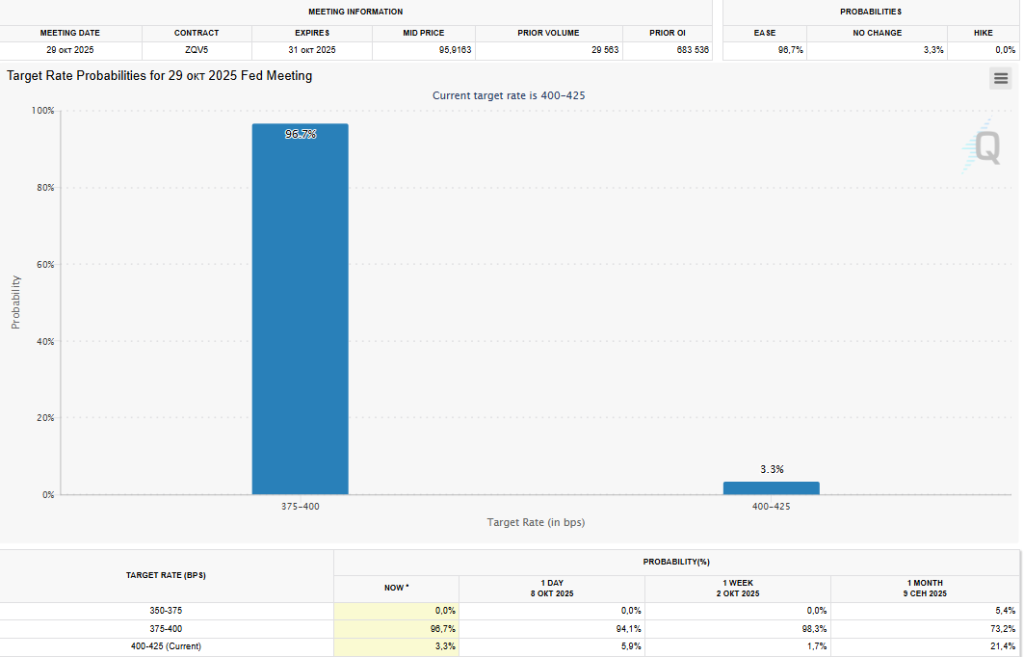

According to CME FedWatch, market participants put the probability of a cut to the key rate at 96.7%.

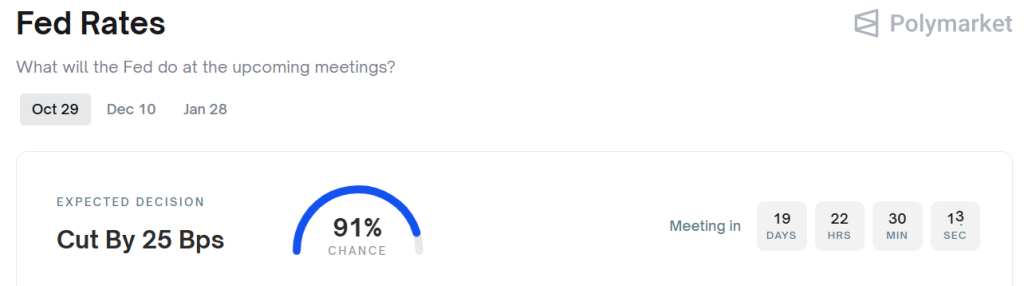

Traders on the Polymarket platform put a 91% probability on a 25-basis-point cut at the 29 October meeting.

Analysts see a short-term range for digital gold at $121,000–126,000. A decisive break above the upper bound would open the way to $130,000.

Open interest in bitcoin options exceeds $50 billion.

Further price action depends on the pace of Fed easing and sustained demand from ETFs.

Earlier, K33 analysts said that the historical regularities that used to define the first cryptocurrency’s trajectory are no longer relevant.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!