Standard Chartered Raises Ethereum Forecast to $7500

By the end of this year, Ethereum is expected to rise to $7500, and by 2028 it could reach $25,000, according to analysts at Standard Chartered, reports The Block.

Jeffrey Kendrick, head of digital asset research, is confident that the altcoin will surpass its ATH of $4866 in the current quarter. He highlighted several factors contributing to the altcoin’s growth.

Ethereum Drivers

According to Kendrick, since June, corporate treasuries and ETFs have accumulated 3.8% of Ethereum’s market supply. This pace is nearly double that of Bitcoin over the same period.

Companies BitMine Immersion and SharpLink Gaming acquired about 2.3 million ETH (1.9% of the supply). The rest was accounted for by spot exchange-traded funds. On August 12, daily inflows into these structures reached a record $1.02 billion.

A significant event for Ethereum was the signing of the GENIUS Act in July, which established federal rules for stablecoins. More than half of existing stablecoins operate on Ethereum and generate 40% of all network fees.

Kendrick believes the adoption of the GENIUS Act will increase activity in the ecosystem of the second-largest cryptocurrency by market capitalization. Standard Chartered forecasts that the capitalization of stablecoins will reach $2 trillion by 2028.

The analyst highlighted technical progress in Ethereum’s development. In particular, he pointed to developers’ plans to increase the main network’s throughput. The next major update, Fusaka, is scheduled for early November.

Trend Towards Ethereum Treasuries

The cryptocurrency fund Pantera Capital invested $300 million in companies operating under the DAT model. The flagship asset was shares of BitMine, which holds 1.2 million ETH worth over $5.3 billion. The firm aims to accumulate 5% of Ethereum’s total supply.

Pantera’s partners praised BitMine’s business model, which focuses on maximizing the number of tokens per share (EPS). According to them, the company employs several strategies for this:

- issuing shares at a premium to NAV;

- convertible bonds;

- staking and DeFi income;

- mergers and acquisitions.

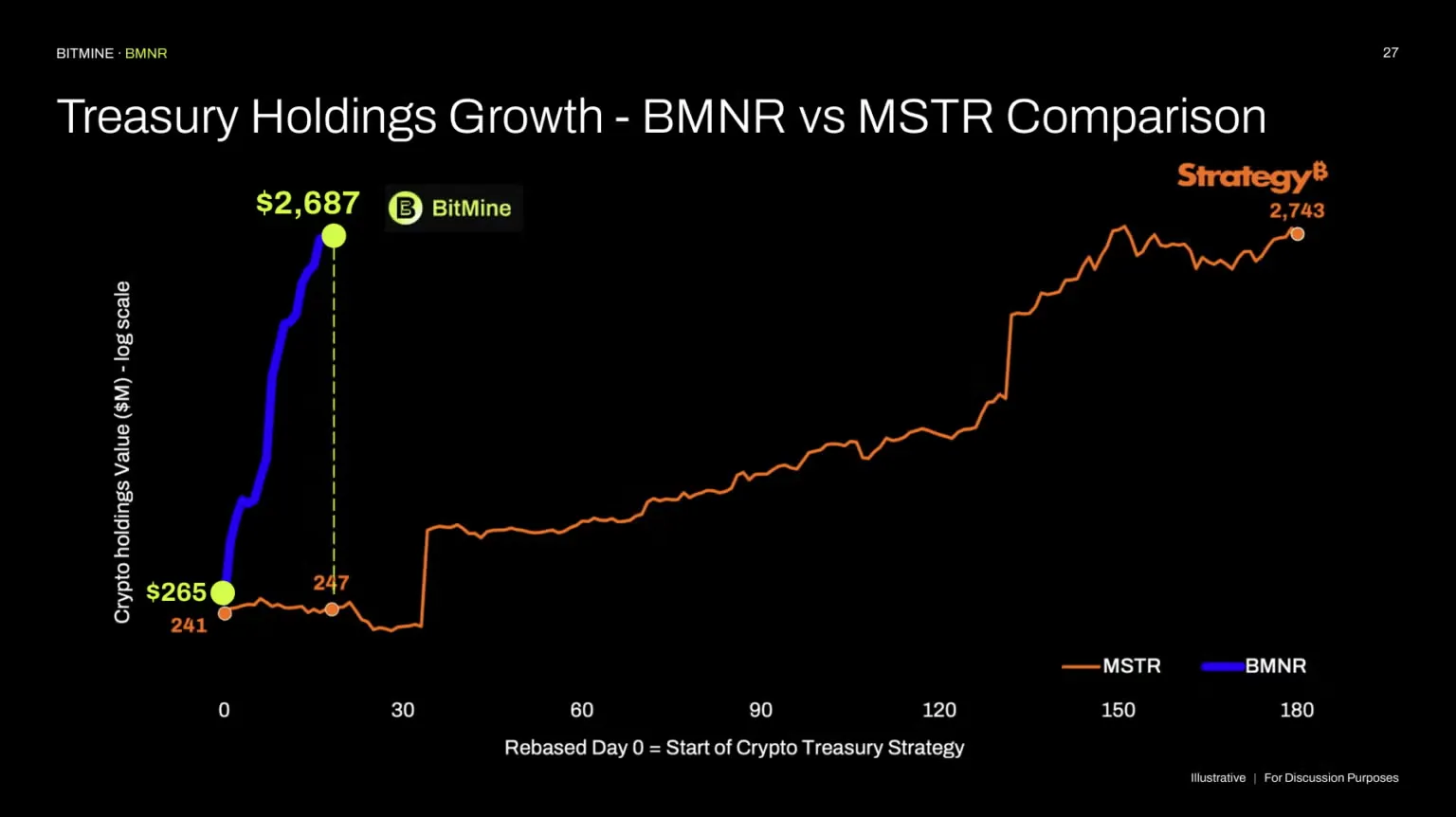

In one month, the firm accumulated more than Strategy did in its first six months, experts noted.

“At the end of June, BMNR shares traded at $4.27 each, approximately 1.1 times their NAV of $4 per share after the initial capital raising through DAT. Just over a month later, the closing price was $51, or about 1.7x the estimated NAV of $30 per share. This represents a 1100% increase in just one month,” calculated Pantera.

Besides BitMine, the fund also invested in firms investing in Bitcoin, Solana, BNB, TON, Hyperliquid, Sui, and Ethena.

Back in August, Vitalik Buterin endorsed the trend of accumulating Ethereum. However, he noted that excessive use of leverage by companies could turn this into a “dangerous game.”

On August 12, Ethereum outpaced Bitcoin in growth rates for the first time since 2024. The following day, the cryptocurrency’s price surpassed the $4600 level, approaching its ATH.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!