Dissecting the “Black Saturday” Market Meltdown

How ADL amplified crypto’s ‘black Saturday’—and what comes next.

Every market crash in crypto reliably sets off a wave of conjecture and pronouncements from the “enlightened”. Some hunt for “co-ordinated attacks” and hidden manipulators; others blame bots, liquidity or supposed leaks of insider information.

In reality, markets often collapse under their own weight—leverage, liquidations and brittle trust. They move like a single living organism.

October’s sharp reversal was no exception. After a rapid climb the market overheated, and a chain of liquidations quickly turned into an avalanche.

In this article we examine how автоделевериджинга worked, why it should be taken seriously, and what analysts say about the chances of the rally resuming.

The fragility of an overheated market

Early October fit the so‑called “Uptober narrative”: bitcoin’s price marched toward fresh highs, setting a record above $125,000.

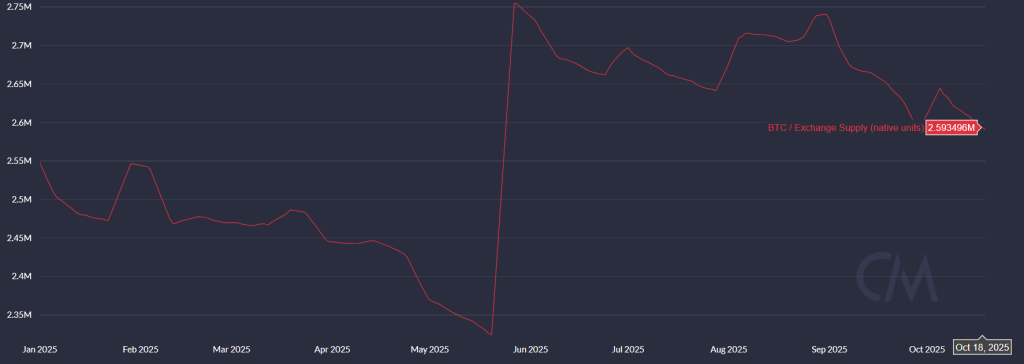

Industry experts spoke in unison about an acute shortage of coins on exchanges, “healthy dynamics” and other preconditions for the first cryptocurrency to climb to $200,000.

The correction was sudden. On the night of October 10–11, bitcoin fell below $111,000, recording for the first time a $20,000 daily candle — on the largest crypto exchange, Binance, the price briefly dropped to $102,000.

Liquidations across crypto exceeded $19bn, the largest on record. The total market capitalization of digital assets fell by almost $660bn in a day.

Ethereum dipped below $3,500, and less‑trafficked altcoins faced even stiffer pressure—many shed tens of percent.

After the industry’s record liquidation tally, the market sentiment indicator fell to 22, signalling “extreme fear” among participants. Similar readings were last seen in April, when the price of the first cryptocurrency fell below $80,000.

Notably, even after prices recovered above $110,000 the gauge has struggled to reach 30, still implying “fear”.

As sentiment soured, steady inflows into bitcoin ETFs turned into outflows.

Many experts linked the panic to a post by US president Donald Trump on Truth Social. In an October 10 post he said 100% tariffs on Chinese imports could be introduced from November 1.

Equity markets reacted first: the Nasdaq and S&P 500 fell by 3.5% and 2.7% respectively, before the gloom spilled into cryptocurrencies.

There were casualties

On October 11 police in Kyiv’s Obolonskyi district found the body of a 32‑year‑old man with a gunshot wound to the head in his car.

It later emerged the deceased was a well‑known crypto blogger, trader and CEO of Cryptology, Kostya Kudo (real name—Konstantin Hanich). The leading theory is suicide amid the crypto‑market crash.

The body was found in his Lamborghini Urus. A firearm registered to the blogger lay nearby.

“On the eve of his death, the man told relatives he was depressed because of financial difficulties and sent them a farewell message,” the police statement said.

In his last Instagram post on September 27, Kudo wrote about the illusory well‑being of peers, stressing that many in fact face severe financial difficulties due to debt and a “desire to match the pretty picture”.

The most likely unofficial version is significant trading losses. On the eve of the tragedy he said he might have “blown” up to $1.3m but hoped to return investors’ funds. The real losses appear to have been much larger.

According to anonymous sources cited by UNIAN, the blogger may have lost all entrusted investor funds—about $7m—as well as his own capital. Other sources put the losses as high as $30m.

Suicides amid falling prices are hardly new.

In February, 23‑year‑old Arnold Robert Garro took his own life on a livestream on X, urging viewers to “make a memecoin out of [his] death”. Some suggested his act was linked to financial losses, but his family stressed he suffered from severe depression.

In July 2023, the body of Argentine businessman and crypto millionaire Fernando Pérez Algaba was found. He was known for a love of luxury and often posted images of expensive cars and a carefree life on Instagram.

His death has been linked to a conflict with a local criminal group over finances. A note on his phone said he had lost most of his crypto assets.

“Stable” coins

The crash triggered liquidations affecting more than 1.6m traders, most of whom were active on Binance and Hyperliquid. Some market participants suggested mass closures on the largest CEX were a “co‑ordinated attack” that forced prices lower.

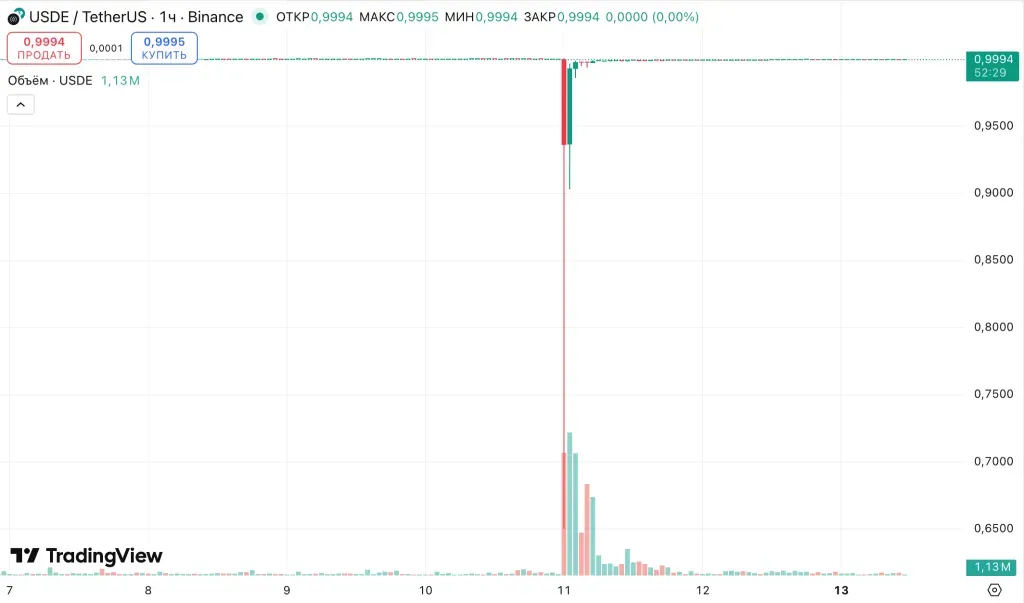

Journalist Colin Wu was among the first to argue this. He said attackers exploited a vulnerability in the Unified Account feature, which allowed using the stablecoin USDe as collateral.

Unlike other platforms, Binance valued such assets not via oracles but against its own order book. The exchange knew about this—an update was scheduled for October 14.

The attackers seized the opportunity, dumping $90m of USDe onto the market. The “stablecoin” temporarily lost its peg to the US dollar, triggering $1bn of liquidations. bnSOL and wBETH were also hit.

Binance acknowledged that part of the liquidations was linked to the temporary loss of peg in USDe, bnSOL and wBETH. The company pledged compensation and on October 13 announced payouts totalling $283m.

Representatives of the platform denied any connection between the de‑peg and the broader sell‑off. Analysts also dispute claims of a co‑ordinated attack.

Wu cited observations by analyst Jian Zhu’er, who stressed USDe’s loss of its dollar peg followed the initial price drop. He pointed to wBETH’s thin liquidity as the primary cause.

Whale collusion or market mechanics?

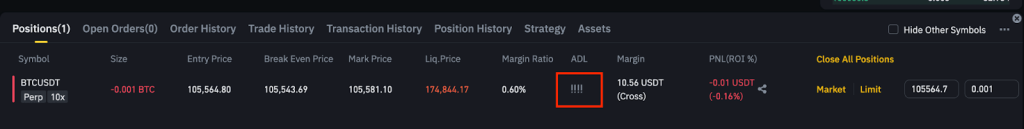

Blum co‑founder Gleb Kostarev noted that many retail traders were shocked by the liquidations: they “had profitable shorts, very few longs, and ended up with 0 on their balance”.

He said there was no scam or fraud here—just standard derivatives‑venue mechanics.

The exchange, he explained, does not shoulder counterparty risk; it merely intermediates longs and shorts. The platform controls margin and liquidates positions as needed. In a sudden sell‑off, the losing side may be unable to close—order‑book liquidity is insufficient and positions go negative.

For example, a trader owes $100,000 against $50,000 collateral—this covers the debt only partially. The shortfall is absorbed by auto‑deleveraging: the exchange partially skims profits from those “in the money” to plug the hole.

Kostarev said that when ADL triggers, the system sorts profitable traders by unrealized PnL and leverage, then forcibly closes their positions. It is a last resort—used when the insurance fund is depleted or during extreme market conditions.

“That’s the harsh truth of life,” he concluded, adding that traders should read an exchange’s terms carefully before trading.

Coin Bureau co‑founder Nic Pukrin also noted that it was not only “longers” who suffered. He added that ADL “wipes out” profitable positions too.

The worst thing about the crash is that it wasn’t only longs who got screwed — shorts did too.

Auto-Deleveraging (ADL) on the exchanges meant that traders in profit also got their positions taken out.

ADL is a required risk management mechanism but its use is incredibly rare.…

— Nic (@nicrypto) October 12, 2025

“Imagine they first close your short and then liquidate your long. Total rout,” the expert said.

However, Pukrin stressed the mechanism is used “extremely rarely”.

What’s under ADL’s hood?

Consider Binance’s implementation. A blog post starts with the premise that auto‑deleveraging is used only as a last resort, when the futures insurance fund cannot cover the positions of a bankrupt client.

“Binance does everything possible to avoid ADL and offers several features such as the ‘Immediate‑or‑Cancel’ limit order,” representatives of the largest crypto exchange noted.

Experts warned that, given crypto’s volatility and the high leverage available to users, “it is impossible to avoid ADL entirely”.

Binance explained that profitable futures positions can be closed via ADL depending on their liquidation‑priority ranking.

The interface shows an indicator for each position that reflects the likelihood of ADL. If it is approaching unavoidable liquidation, this will be “clearly reflected in the interface”.

Queue position for “taking out” is determined by a formula that considers profits and leverage. High‑return, high‑leverage trades are closed first, ahead of less successful ones.

If a profitable futures position is forcibly closed via ADL, the trader immediately receives a notification with the amount and the liquidation price. The operation executes at the bankrupt price of the liquidated order. No fee is charged.

Thus, the bankrupt price is the “limit” at which the liquidation order is actually filled. At this level, the trader’s losses equal their collateral or initial margin. In other words, it is the moment when the user’s margin balance drops to zero.

“All open orders will be canceled: either for all tokens (in cross‑margin mode) or for a specific token (in isolated margin mode),” Binance specialists explained.

Similar mechanisms exist on many other exchanges that offer perpetuals, including Hyperliquid.

How to reduce the risk of auto‑deleveraging

You cannot “turn off” ADL, but you can reduce the risk of triggering it:

- use lower leverage—add margin or reduce borrowing;

- watch the indicator: if the gauge is nearly full, ADL risk is high. Consider trimming or hedging the position;

- avoid “crowded” trades. When most traders are short while longs are being liquidated, the insurance fund depletes quickly and shorts are hit by ADL. Diversify risk;

- assess market depth. Thin liquidity and wide spreads amplify volatility, which often leads to ADL.

Good old‑fashioned sellers

On‑chain analyst James Check is convinced the sharp correction was not about manipulation or “paper bitcoin”. The reason, he said, was “good old‑fashioned sellers”.

The sheer volume of sell-side pressure from existing Bitcoin holders is **still** not widely appreciated, but it has been THE source of resistance.

Not manipulation, not paper Bitcoin, not suppression.

Just good old fashioned sellers.

Also, it won’t become irrelevant. https://t.co/4QnfCn2f7w pic.twitter.com/YiK7gtjkzj

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) October 19, 2025

He stressed that the magnitude of sell‑side pressure from incumbent bitcoin holders remains underappreciated and is the primary source of resistance.

To support his view, he pointed to a chart showing the rising average age of spent coins—suggesting holders are selling.

Another chart showed realized profits reaching $1.7bn per day, with losses up to $430m—the third‑largest tally this cycle. At the same time, the “revived supply” from old coins rose to $2.9bn in a day.

Investor Will Clemente argues that “bitcoin’s relative weakness over the past year has mostly been a transfer of supply from ‘old hands’ to TradFi”.

Galaxy Digital CEO Mike Novogratz agreed with this assessment.

“Many in the bitcoin world who have held for a very long time have finally decided: ‘I want to buy something,’” he said.

Novogratz confirmed that the only sell‑side his firm sees comes from “old hands” and miners.

What next?

Many analysts remain optimistic. Bitwise CIO Matt Hougan is convinced the sell‑off does not derail the long‑term bull trend.

He said the drop was driven by cascading liquidations rather than fundamentals.

Hougan believes the event had limited lasting effects. He highlighted three factors:

- Blow‑ups among big players. Bitwise data suggest most losses fell on retail investors. Large funds and market makers were largely unscathed.

- Technology resilience. Blockchains passed the stress test. DeFi platforms such as Uniswap and Aave ran smoothly; some centralized exchanges struggled.

- Investor reaction. Hougan saw little panic among professional investors. He noted he received few client messages—unlike journalists.

In his view, the fundamental drivers—regulation, institutional inflows and adoption—remain intact. After a brief period of volatility, he expects the bull market to resume.

Veteran trader Peter Brandt said bitcoin will surpass $125,000 after one more major correction.

He sees two scenarios. The first is a “huge shakeout”, followed by a rapid run to ATH.

“Or [the second scenario] is a violation of the parabola, which in the past every time led to a 75% price collapse. I think the era of 80% corrections is behind us, but it may [return] to $50,000–60,000,” Brandt said.

Former BitMEX CEO Arthur Hayes said the sell‑off created a buying opportunity. He cited Fed chair Jerome Powell’s remarks on the end of quantitative tightening.

There you have it, QT is over. Back up the fucking truck and buy everything. pic.twitter.com/kQbpBSOlOU

— Arthur Hayes (@CryptoHayes) October 14, 2025

XWIN Research analysts concluded that bitcoin has entered a “speculative phase” with larger players taking control.

The NUPL indicator reached +0.52. Historically, this zone marks the transition from optimism to euphoria. In the 2017 and 2021 cycles, readings above 0.5 signalled speculative activity.

At the time of writing, around 97% of the circulating supply is in profit.

Meanwhile, the share of short‑term holders (STH) in bitcoin’s realized capitalization has exceeded 40%. This implies that long‑term investors (LTH) are taking profits while less seasoned participants—“new whales”—step in.

In past cycles, STH dominance coincided with the final leg up. This time the structure differs, the analysts note. Three forces are absorbing sell‑side pressure: spot‑ETF inflows, growing stablecoin liquidity and institutional participation.

On‑chain data point to a “mature speculative phase” fuelled by liquidity and steady capital inflows. Analysts say the next important signal will be a decline in the STH share—marking a shift to a new accumulation phase led by long‑term investors.

The creator of the S2F model and analyst PlanB is confident a dip below $108,000 does not mean the bull market is over—fundamentals point to further upside.

“Bears believe the $126,000 peak is in, bitcoin will fall below $100,000, and 2026 will be a bear market. […] In my view, that’s a serious misconception,” he wrote.

Institutional faith

Coinbase Institutional’s report Navigating Uncertainty states that 67% of institutional investors are positive on bitcoin’s outlook for the next three to six months.

Researcher David Duong highlighted the role of digital‑asset managers. He said they actively “picked up” coins during the dip. For example, BitMine took advantage of the sell‑off and bought more Ethereum worth $417m.

Duong believes the bull phase “has room to run”. He cited resilient liquidity, a supportive macro backdrop and constructive regulatory policy.

Coinbase analysts also pointed to macro factors. An expected Fed rate cut and possible stimulus in China could draw new investors into the market.

***

Liquidations likely acted as the trigger on October 10–11. When orders start filling below loss‑coverage levels as the insurance fund “melts”, ADL backstops the system. The mechanism trims profitable positions on both sides to keep the market in balance.

For that reason, heavy sell‑offs often continue even after the first liquidation wave. For perpetual traders, auto‑deleveraging is like a fire‑safety system: rarely triggered, but decisive in critical moments.

Experts advise keeping leverage moderate, watching the ADL indicator and avoiding “crowded” positions. Always assess market depth alongside other charts and data.

Analysts say a near‑term “reboot” of the rally is uncertain: investor trust has been dented and liquidity has partly migrated from retail venues to ETFs. Yet the long‑term drivers remain: institutional inflows, miners’ steady positioning and macro stimulus.

October’s slump was not a cycle top, but a “release valve” for overheating. After consolidation and de‑risking, the market can recover—especially if many return to more conservative trading and steady accumulation.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!