Why bitcoin is consolidating after testing $105,000

- A lack of momentum-trader activity has led to bitcoin’s consolidation.

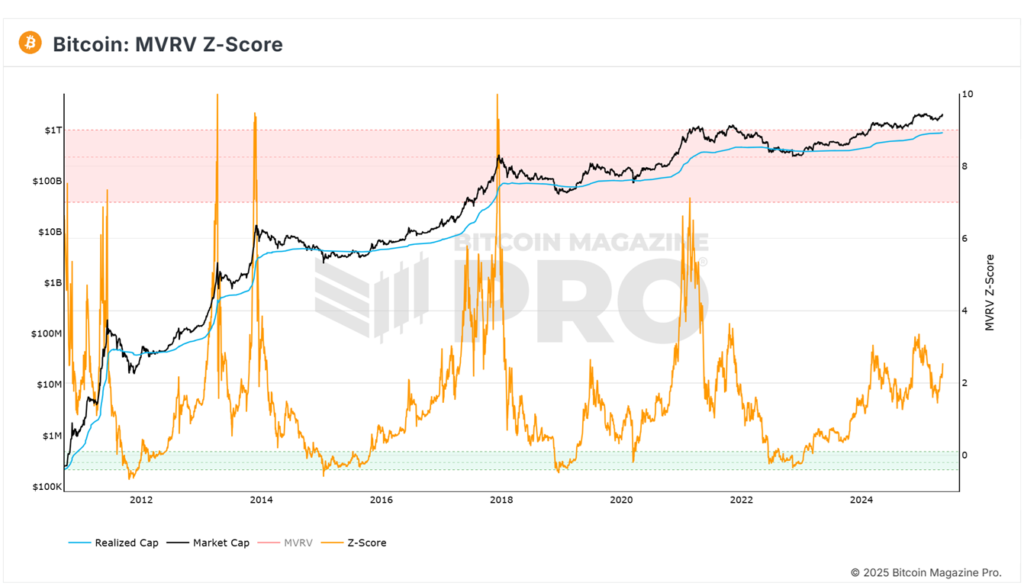

- The MVRV Z-Score sits well below peaks seen in previous bull cycles.

- Global liquidity (M2) is expanding rapidly.

Breaking the $100,000 psychological level drew in “new” bitcoin buyers, while seasoned traders are cautious, Glassnode noted.

$BTC Supply Mapping shows sustained strength in new demand. First-Time Buyers RSI has held at 100 all week. But Momentum Buyers remain weak (RSI ~11), and Profit Takers are rising. If fresh inflows slow, lack of follow-through could lead to consolidation: https://t.co/vHqbU4hrPt pic.twitter.com/Ghqynb296Y

— glassnode (@glassnode) May 12, 2025

“If fresh inflows slow, a lack of follow-through could lead to consolidation,” the specialists warned.

The illustration above segments investor cohorts by behaviour.

The 30-day relative-strength gauge for first-time buyers has held at 100 all week, signalling strong interest from these players.

Momentum-trader demand remains weak—the corresponding indicator sits at 11.

As CoinDesk noted, elevated activity among “new” participants hints at retail FOMO—emotion over measured assessment.

Analysts at CryptoQuant reported continued growth in realised capitalisation, confirming bitcoin’s uptrend.

More market participants, including Strategy and other institutions, as well as clients of BTC-ETF issuers, are buying digital gold at higher prices, the experts said.

Is there more upside?

At Bitcoin Magazine they see no “overheating” in the leading cryptocurrency at current levels.

Analysts point to the MVRV Z-Score at 2.55—well below readings around 7 seen at the peaks of earlier bull cycles.

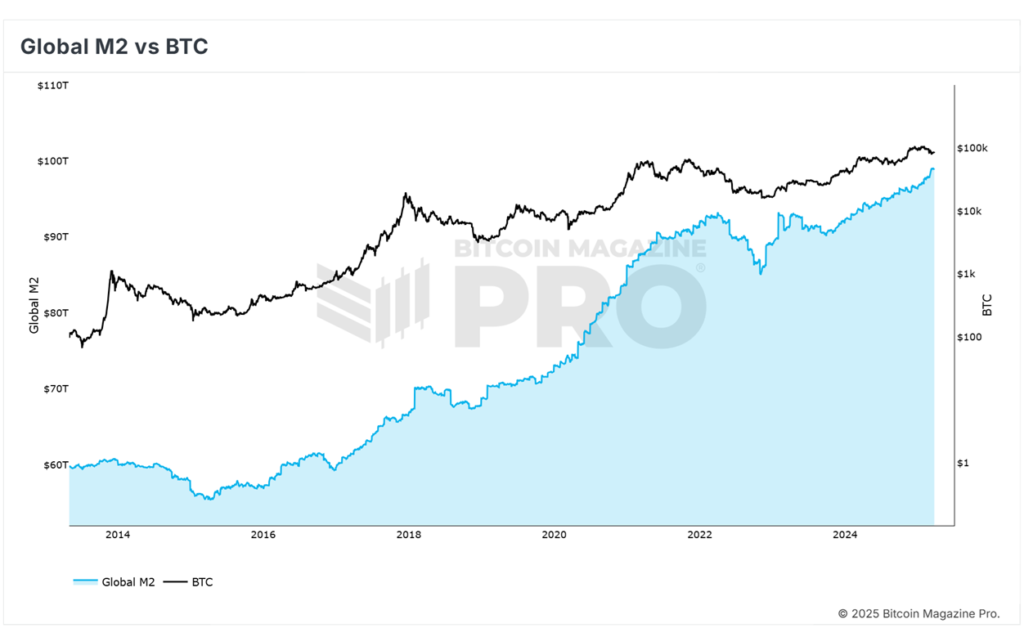

They also note that expansions in global money supply have historically coincided with strength in digital gold. The latest data point to a continued rapid increase in world liquidity.

Whales and sharks in focus

According to Santiment, over the past 30 days wallets with balances of 10 to 10,000 BTC added 83,105 BTC. Aggregate holdings among retail investors with less than 0.1 BTC fell by 387 BTC over the same period.

?? Bitcoin’s key whale & shark tier (holding 10-10K BTC) have now accumulated 83,105 more BTC in the past 30 days. Meanwhile, the smallest retail holders (holding <0.1 BTC) have dumped 387 BTC in the same time period. For both tiers, these are significant movements relative to… pic.twitter.com/Xg5FmF57GQ

— Santiment (@santimentfeed) May 13, 2025

This set-up led the service’s analysts to expect a further rise toward $110,000, especially amid waning uncertainty in trade between the US and China.

Standard Chartered has urged investors to buy the leading cryptocurrency and forecast a rise to $120,000 in the fourth quarter.

Earlier, K33 Research urged bitcoin investors not to fear May, citing expectations of many catalysts prompted by initiatives from US President Donald Trump.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!