April in Figures: Ethereum Hard Fork, Rising Fees and the Regulatory Crisis in the United States

Key takeaways

- Bitcoin and Ethereum hit local highs but posted modest results for the month.

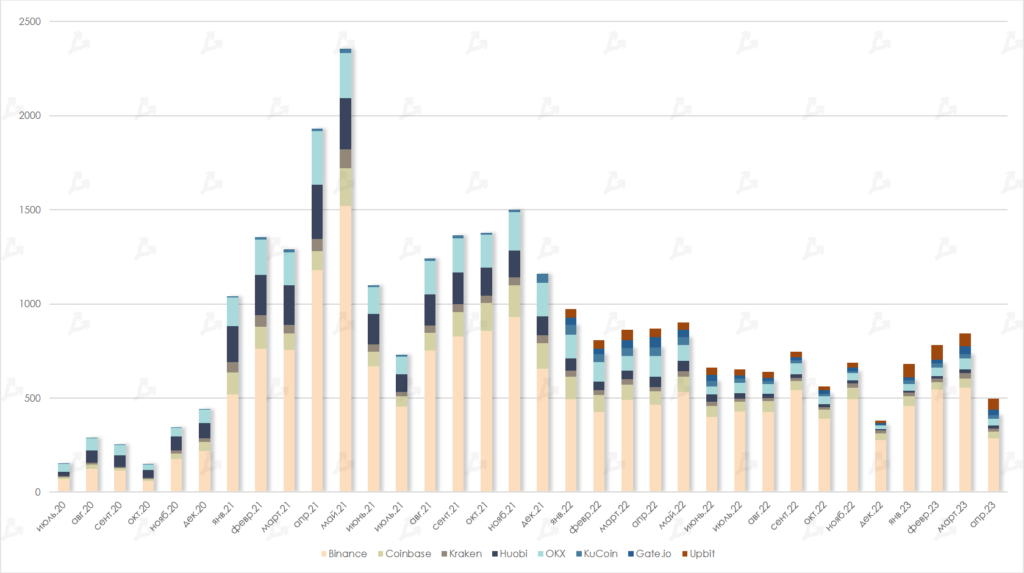

- Uncertainty about the market’s next move led to a collapse in trading volumes on major exchanges — by 40%.

- The Shapella update on Ethereum sparked renewed interest in staking, but did not have a material effect on price.

- Bitcoin’s daily on-chain transactions neared an all-time high.

- On-chain indicators signalled optimism among market participants.

- Hash rate and mining difficulty for digital gold reached new highs again.

- Total revenue of Bitcoin miners for the month rose 6%, surpassing $800 million.

- Arbitrum, an L2 solution, overtook Ethereum in average daily transactions.

- As regulation crisis roils the United States, Hong Kong authorities are actively pursuing crypto initiatives.

Performance of leading assets

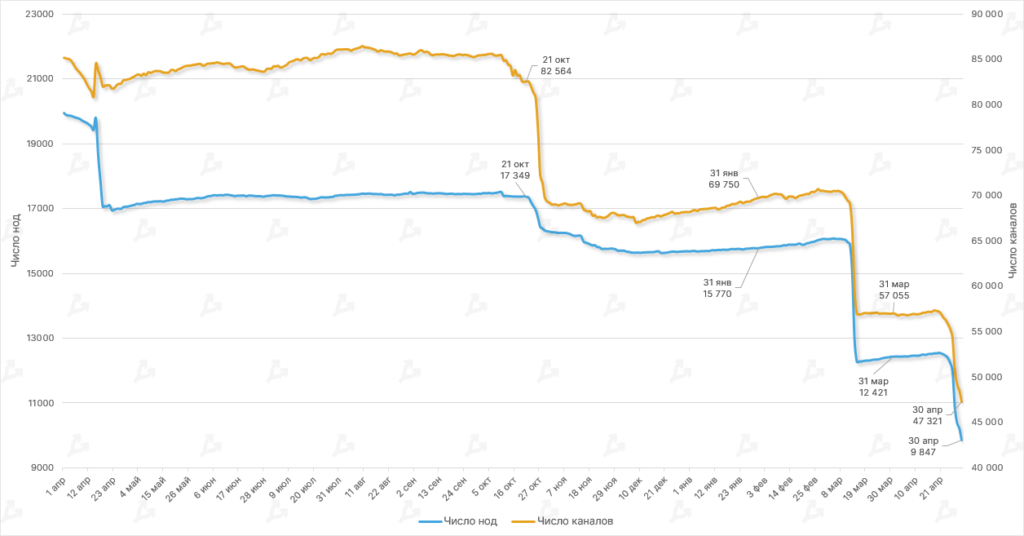

- In April, leading cryptocurrencies hit local highs, reaching levels seen in May 2022 (Terra ecosystem collapse).

- Nevertheless, by month-end Bitcoin and Ethereum returned to early-month levels, posting modest gains of 2.8% and 2.7% respectively.

- Several analysts expect that the current environment is set to push the market toward further gains to $40,000-45,000.

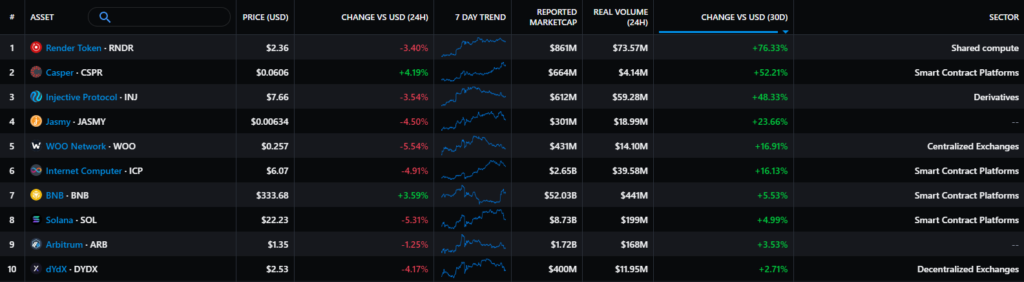

- Among mid-cap projects, Casper (CSPR) and Injective (INJ) performed well, while Render (RNDR), a functional Ethereum-based distributed rendering network, led the gains. As market activity revived, investors returned to speculative plays, with Pepe (PEPE) memes and ArbDoge AI (AIDOGE) token gaining traction in April. ARB airdrops were also distributed to recipients, with ArbSHIB (AISHIB) and LSDOGE (LSDOGE) tokens issued for free over the month.

- Among losers, PancakeSwap (CAKE) struggled as the DEX faces network diversification pressures and competition, despite plans to migrate its native token to a deflationary model. Mask Network (MASK) and SingularityNET (AGIX) corrected after March’s surge.

Market mood, correlations and volatility

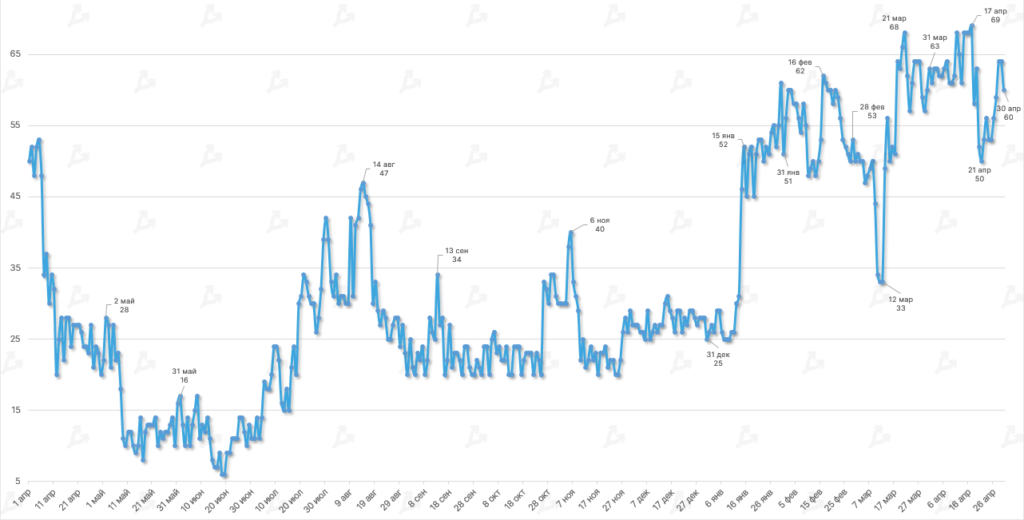

- In April, the Fear and Greed Index remained in the Greed zone. Despite Bitcoin’s struggles to hold above $30,000, the indicator hit a year-to-date high of 69.

- The minimum (50) was recorded on April 21 as prices fell below $28,000. The index’s average value stood at 61.

- The index’s trajectory points to investor optimism and may suggest that April’s consolidation is part of an accumulation phase.

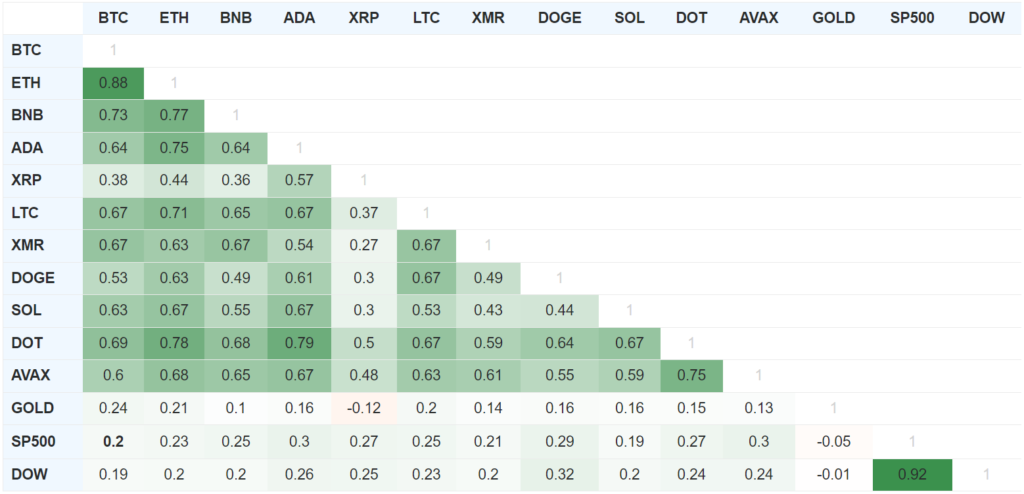

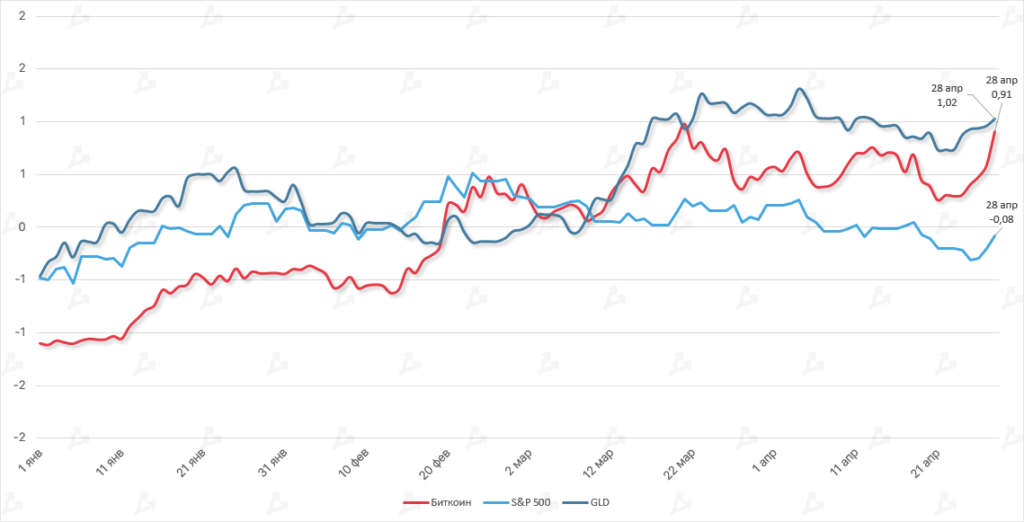

- In April, the Bitcoin correlation with the US stock market weakened slightly. The correlation with the S&P 500 fell to 0.2 (0.27 in March), and with the Dow Jones to 0.19 (0.25 the previous month).

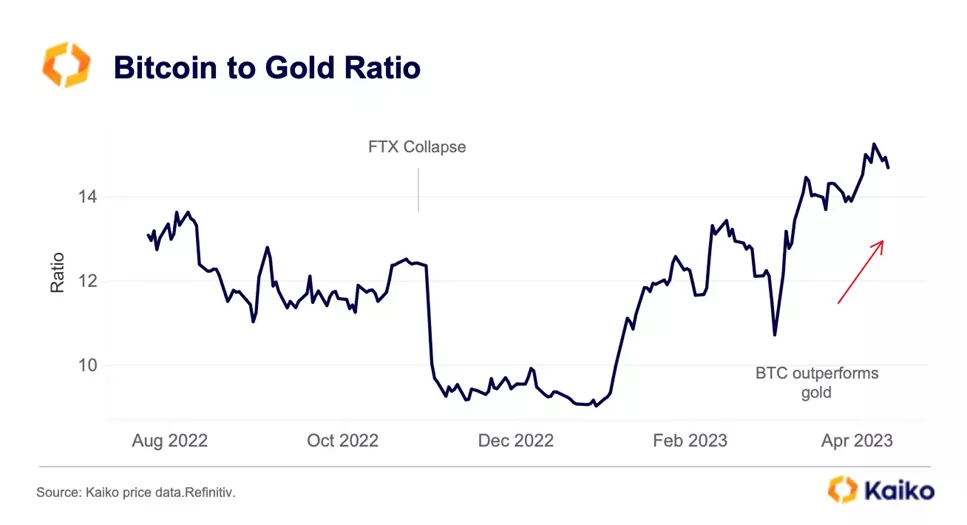

- The movement of Bitcoin and gold prices moved in the same direction, with the correlation also easing — 0.24 versus 0.25 in March.

- Meanwhile, the Sharpe ratio dynamics (for the risk-free asset being two-year US Treasuries at an average 3.9%) suggest that, adjusted for risk, Bitcoin outperforms the S&P 500 and only modestly lags SPDR Gold Trust (GLD).

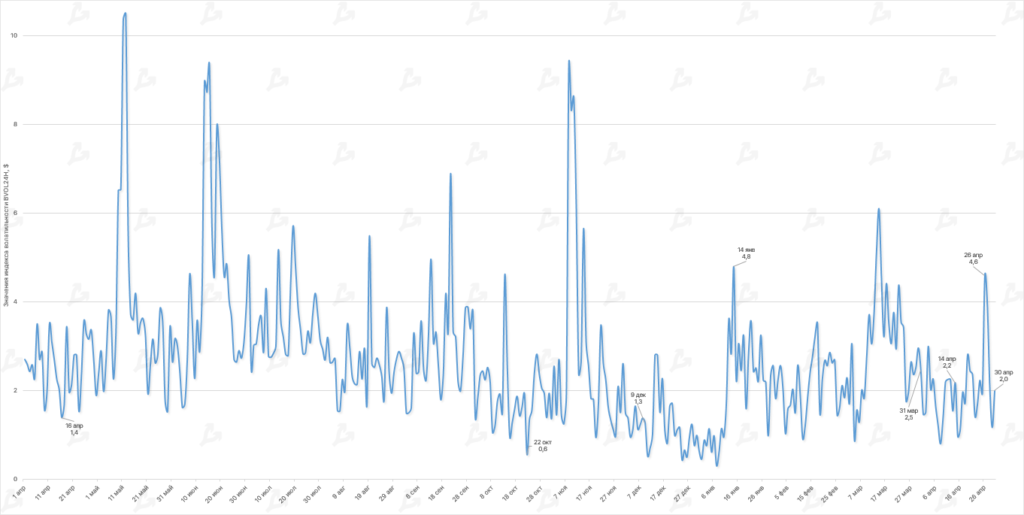

- The average BVOL24H intraday volatility index for Bitcoin over the past month stood at $2, below March’s $3.

- The trend points to a gradual market consolidation, which could signal an upcoming price impulse.

Macroeconomic backdrop

- JPMorgan Chase acquired First Republic Bank with assets of $233 billion. This is the second-largest U.S. bank failure on record after Washington Mutual. The FDIC will provide the buyer with $50 billion in financing for five years at a fixed rate.

- As of end-2022, the FDIC had $128.2 billion in reserves. First Republic Bank became the fourth financial institution after Silicon Valley Bank, Signature Bank and Silvergate Bank to fail in 2023.

- According to the options market, continued banking sector turbulence with a probability of 86.3% at the May 3 meeting will not deter the Fed from raising the target rate by 25 basis points.

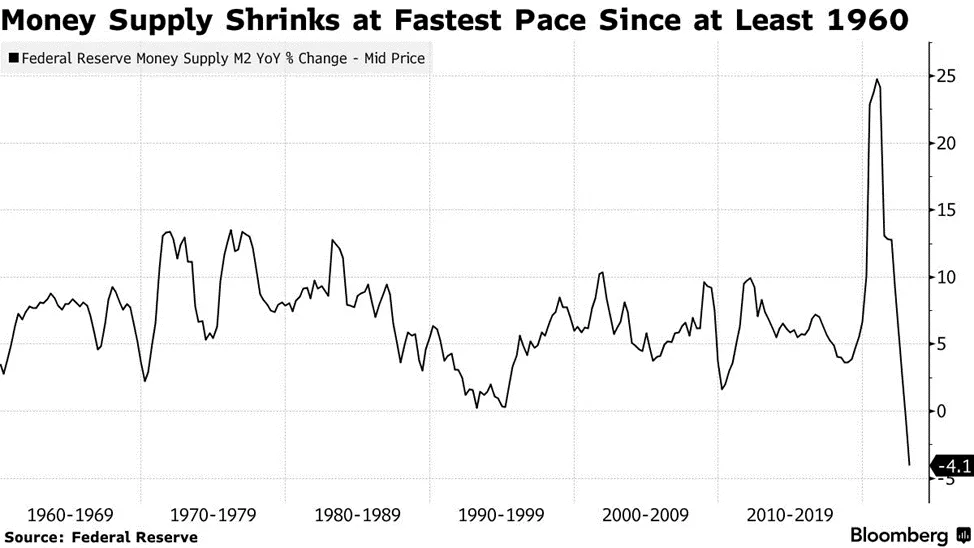

- Further tightening of monetary policy alongside higher lending standards (the money supply M2 fell 4.1% YoY) risks steering the U.S. economy into recession.

- Alongside the Fed’s signals on rate trajectories, business activity in manufacturing and services (May 1 and 3), and the jobs report (May 5) will be significant for investor risk appetite.

- According to a WSJ insider, committee members may keep the decision open, not ruling out the end of the tightening cycle.

- Digital assets recently weakened correlations with equities and are rising faster than gold. Some experts point to Bitcoin’s dependence on liquidity from TradFi, viewing the current strength of the first cryptocurrency as a temporary phenomenon.

On-chain data

- The daily Bitcoin transaction count (30-SMA) approached 350,000. The figure is close to the 379,068 peak reached on 22 December 2017. On-chain activity growth signals market revival and investor confidence in further price rallies.

- Partly this trend is driven by ongoing interest in Ordinals. The number of Bitcoin NFTs surpassed 2.6 million (according to the dgtl_assets dashboard on Dune). The share of Ordinals-related transactions reached about 40% of their volume, according to Glassnode.

- 90-day SMA of the share of fees in miners’ revenue is higher than the 365-day metric. Glassnode analysts call this a sign of new demand emerging in the market.

- Among all, the Bitcoin supply held by long-term investors reached 14.16 million and approached an all-time high. Meanwhile, speculators’ holdings remained largely unchanged since the start of the year. This suggests different market participants expect upside for Bitcoin.

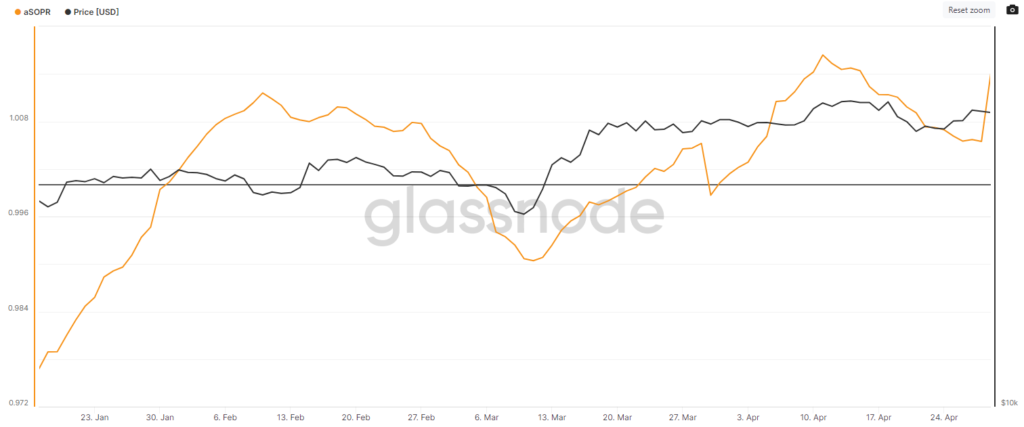

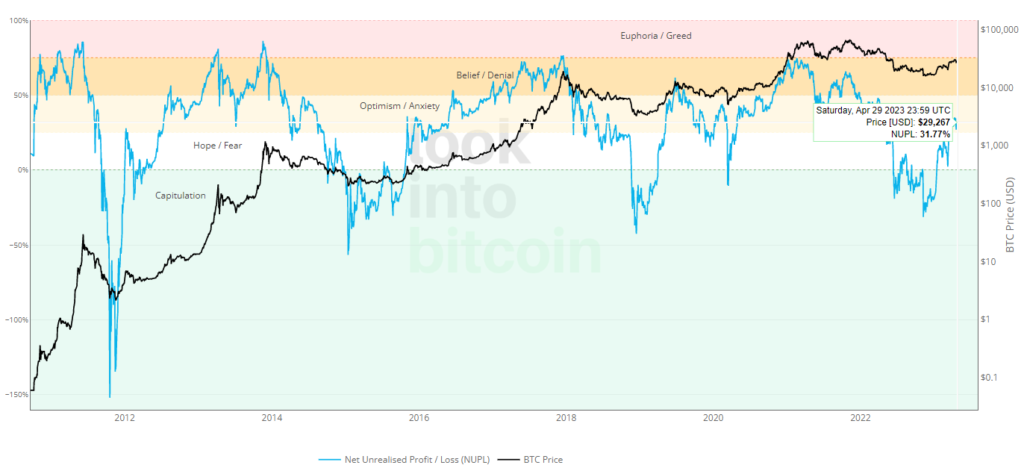

- Throughout April, the aSOPR indicator stayed above 1, signaling overall investor optimism and that most profits were realized rather than losses.

- In January, the Net Unrealized Profit/Loss (NUPL) moved out of negative territory (“Capitulation”). By mid-March the metric moved into the “optimism” zone and continues to trend upward, signaling investors’ confidence in the rally’s continuation.

- The number of Bitcoin addresses with less than 1 BTC continues to grow rapidly, hitting another all-time high. In April, the count increased by roughly 175,500 to about 44.5 million.

- “Shrimp” significantly accelerated accumulation of Bitcoin after the Terra collapse. Since then, their share of the overall Bitcoin supply rose by 1.73%, note Glassnode researchers.

Ethereum

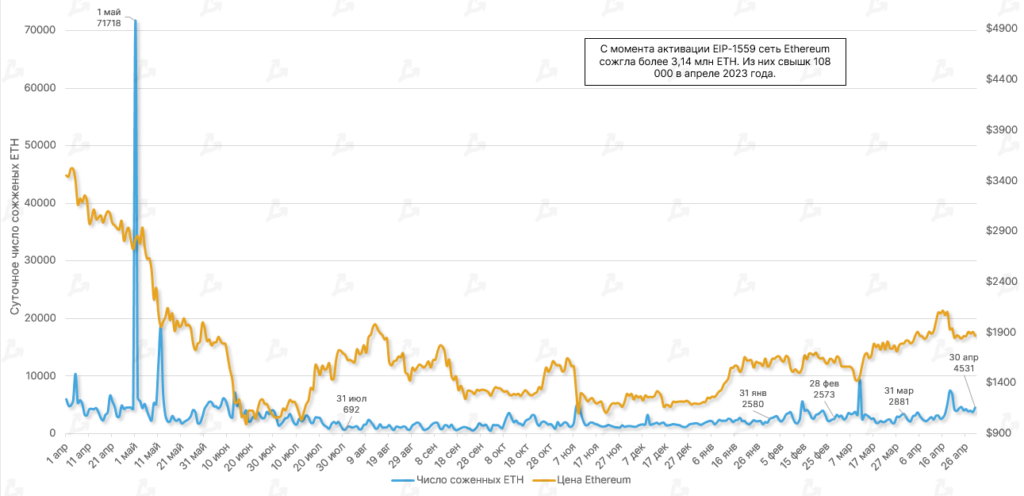

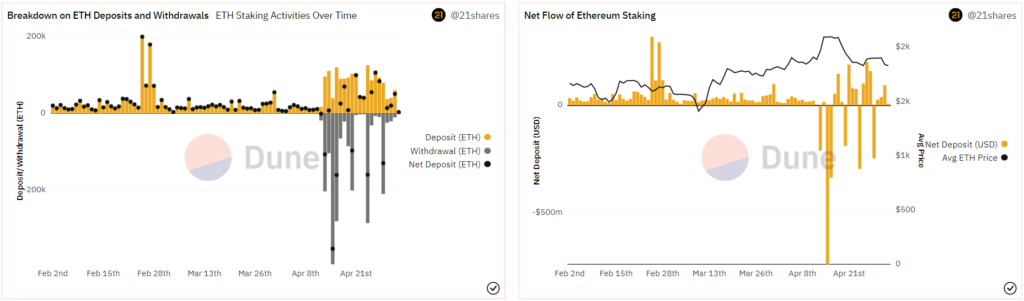

- Since the activation moment of EIP-1559, Ethereum has burned more than 3.14 million ETH. Of these, more than 108,000 ETH were burned in April (92,000 in March). The pace of ETH leaving circulation has accelerated for the fourth month in a row, helped in part by the Shapella hard fork activation on 13 April.

- Thanks to the update, users gained the ability to withdraw ETH from the Beacon Chain deposit contract. The upgrade sparked renewed staking interest, particularly in the liquid staking segment.

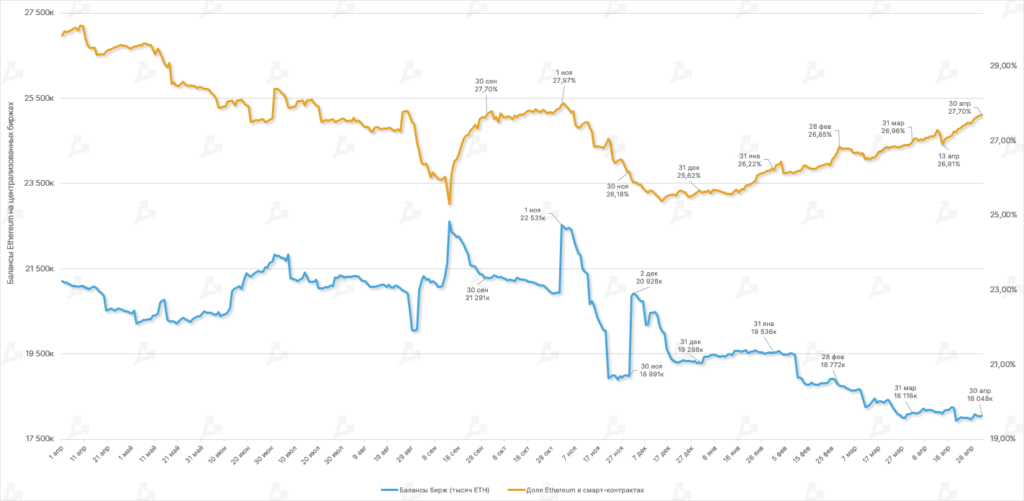

- The share of Ethereum locked in smart contracts of decentralized apps rose by 2.7% over the month.

- During the period, total Ethereum on centralized platforms fell slightly (0.4%). Some crypto exchanges also offer clients services related to liquid staking.

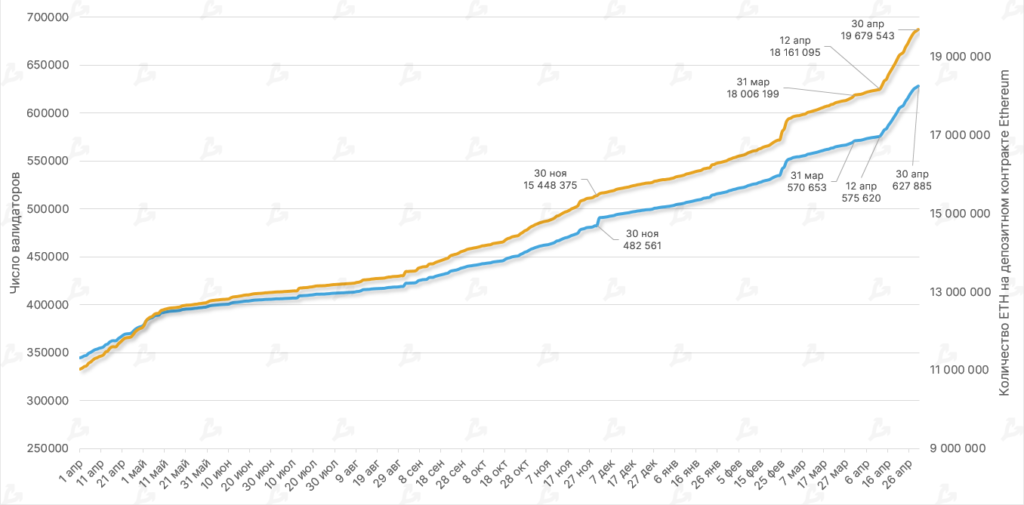

- Thanks to the withdrawal features of staking, a meaningful outflow from deposit contracts did not occur. Instead, April saw a reverse dynamic — net inflows amounted to 9% (~1.5 million ETH), accelerating after Shapella’s activation.

- The number of network validators also rose by 10%, signaling growing trust in staking the second-largest cryptocurrency. The count of active validators has been unchanged since 13 April, according to Beaconcha.in. This is due to the fact that the number of validators connecting and disconnecting from the Beacon Chain in each epoch remains balanced.

- Since Shapella’s activation, validators withdrew over 1.97 million ETH (~$3.62B at the time of writing). Participants withdrew funds in the initial days post-fork, with large net outflows observed. Partial withdrawals dominated the withdrawals.

- At month’s end, the situation shifted — full withdrawals (when a validator exits staking) began to dominate as total withdrawn crypto declined.

- Ultrasound Money reports that Ethereum’s supply contracted by about 59,000 ETH over the last 30 days, leaving the network deflationary. The largest outflows occurred in Uniswap-related operations (roughly 25,100 ETH), followed by transfers between network participants.

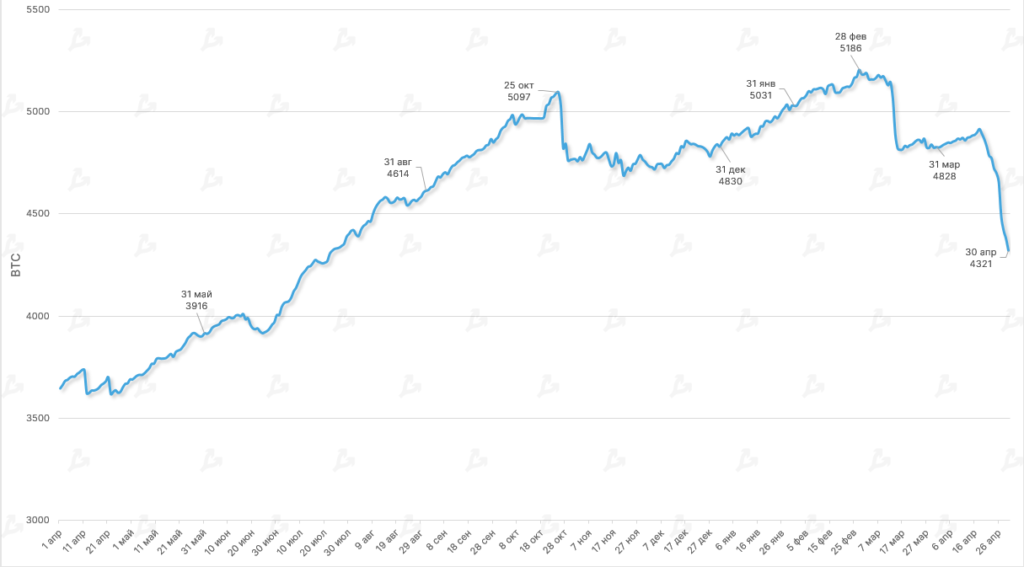

Lightning Network

- By month’s end, Lightning Network capacity declined by 10%. The metric stood at 4,321 BTC, matching July 2022 levels.

- Nodes and channels fell by 20% and 17%, respectively. The trend is partly linked to centralized platforms offering infrastructure for payments. For instance, Coinbase CEO Brian Armstrong stated that the exchange uses the network “in some capacity”.

Mining, hashrate, fees

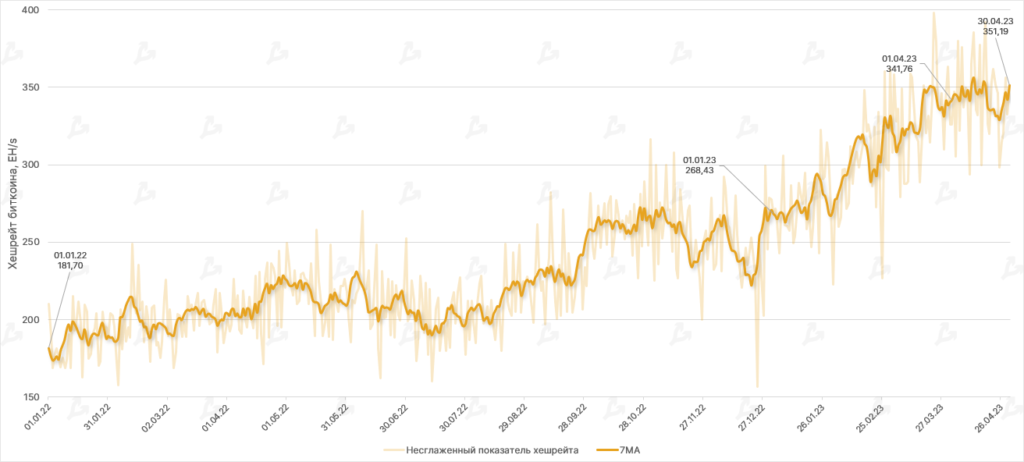

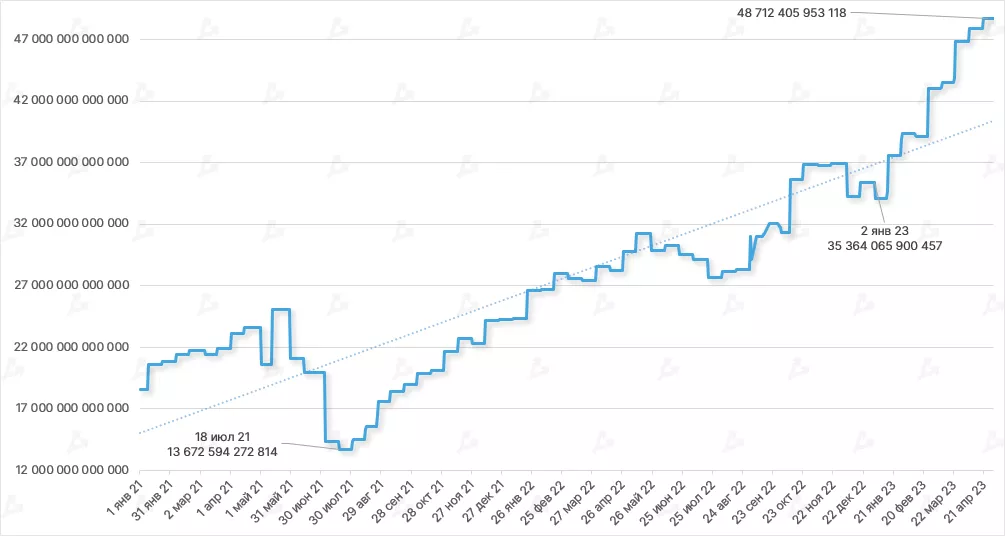

- Amid market recovery, Bitcoin’s hashrate (7-day MA) rose 2.76% over the month, reaching a high of 356.07 EH/s. The uptrend’s resilience underscores industry confidence in Bitcoin’s long-term prospects. This is supported by investments from major players in mining hardware into equipment.

- The rising hashrate was followed by a new peak in the associated mining difficulty — 48.71 T. Since the start of the year, the metric has risen 38%.

- In April, Bitcoin hashprice showed no signs of a sustained uptrend, remaining in a range. This may reflect rising difficulty and squeezed mining profitability. By month-end the figure stood at $0.079, little changed.

- Despite the easing pace of hashprice growth, Marathon Digital reported record Bitcoin production. The company’s results are likely aided by newer, more efficient Bitmain hardware.

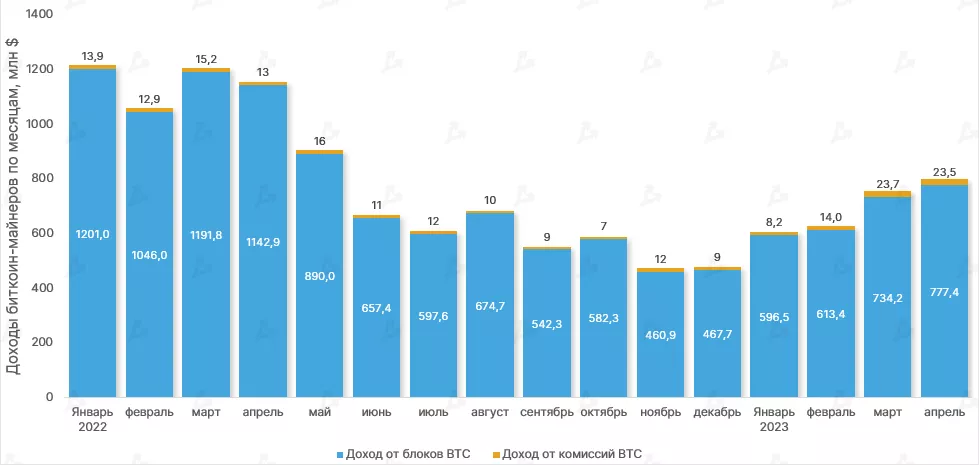

- Total Bitcoin miners’ revenue rose 6% in the past month, crossing the $800 million mark. The metric has been rising steadily since November last year.

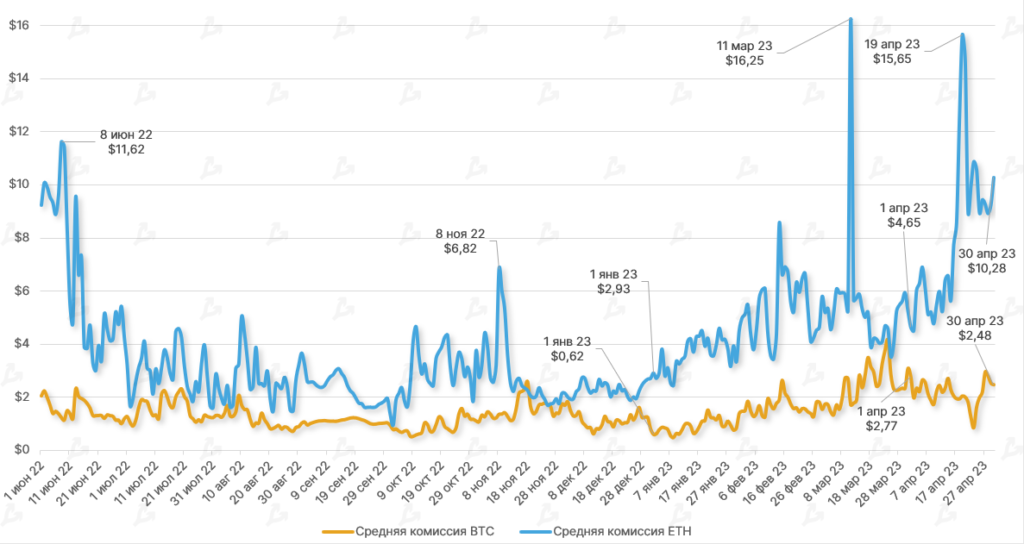

- Block revenues in April were $777.4 million, with fees contributing $23.5 million. The share of fees in miners’ revenue remained high, around 3%, reflecting on-chain activity amid price recovery and Ordinals hype.

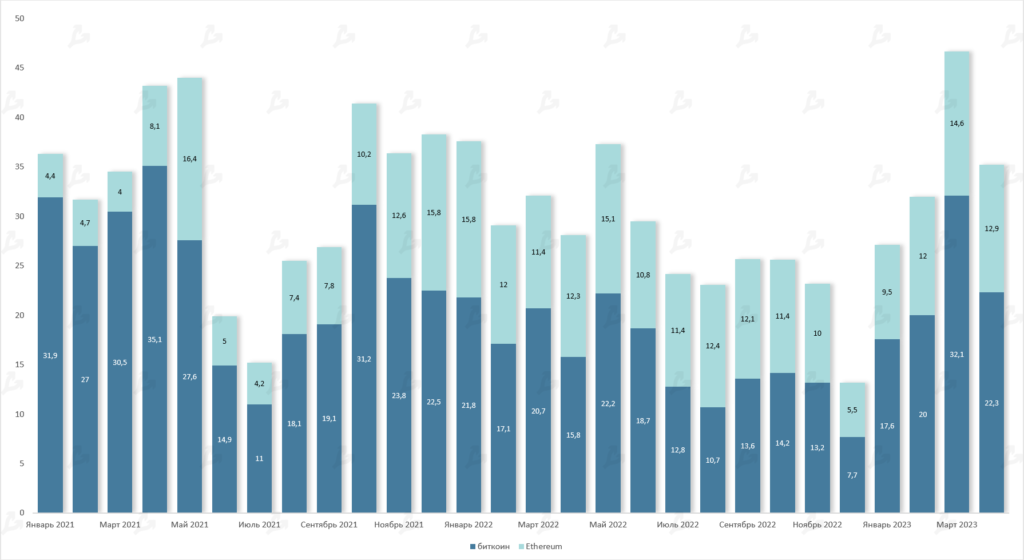

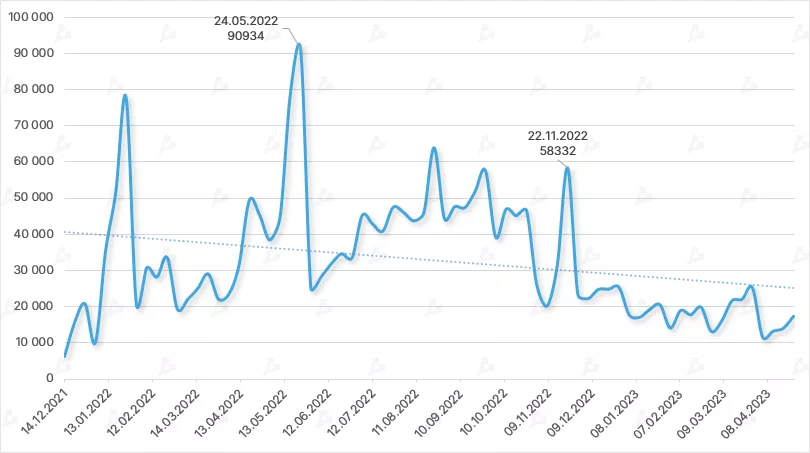

- In April, trading volume on leading spot platforms tracked by ForkLog fell sharply by 40%. The decline was broad-based, likely reflecting ongoing market uncertainty.

- The Binance metric fell by almost 50% (from $556B to $287B) as commission-free trading in top pairs ended.

Futures and options

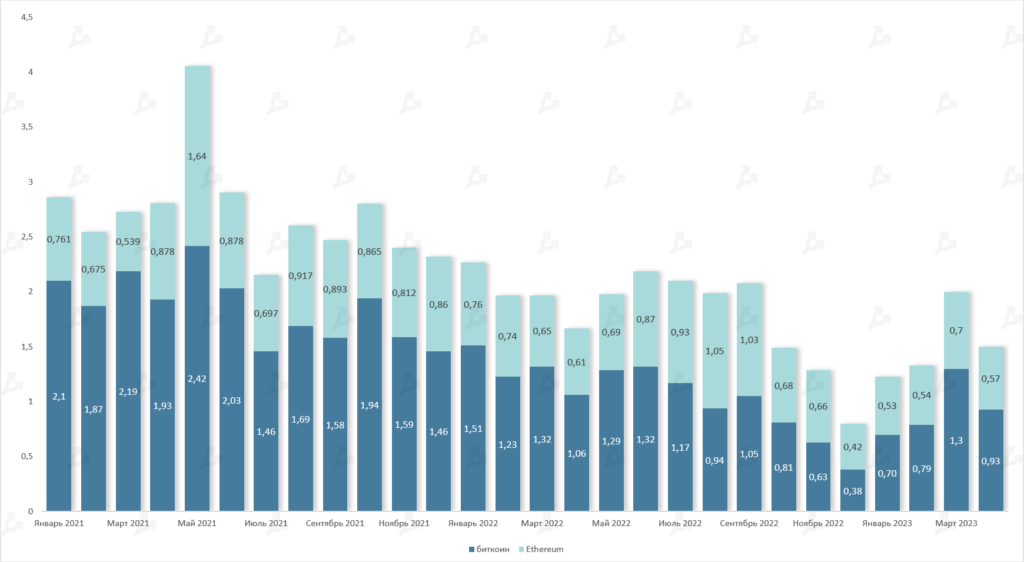

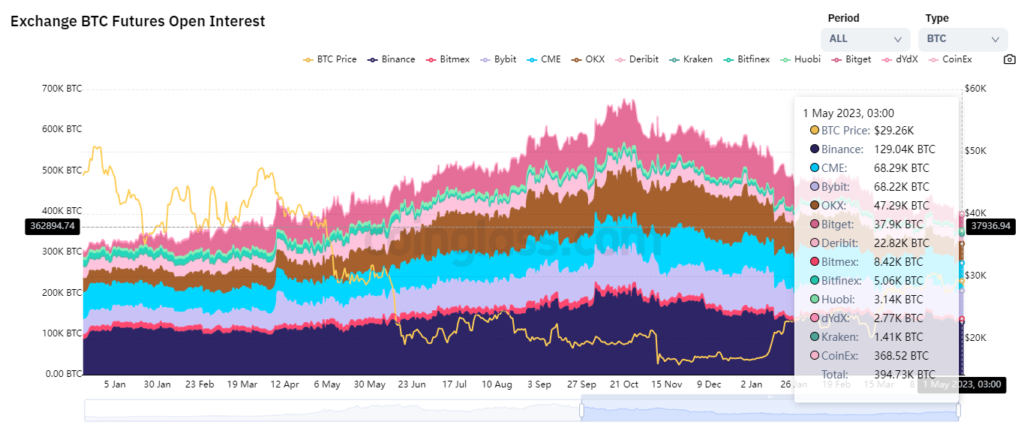

Trading volume of futures and options on leading cryptocurrencies declined somewhat after a strong March (a record for options). Bitcoin futures approached $1 trillion in notional value. Open interest has trended lower since October 2022. In April, total futures open interest stood at about 400,000 BTC. Ethereum futures volume reached $570 billion. No major changes in options were observed.

DeFi

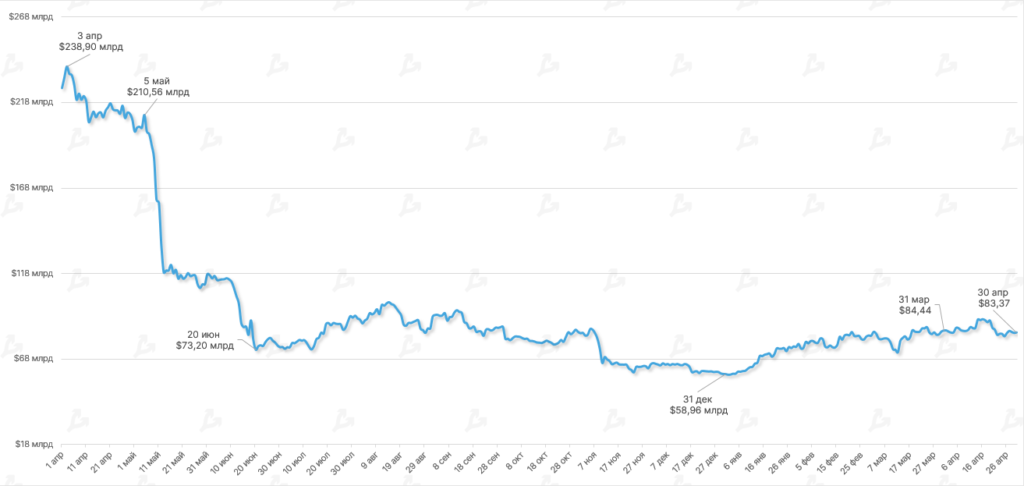

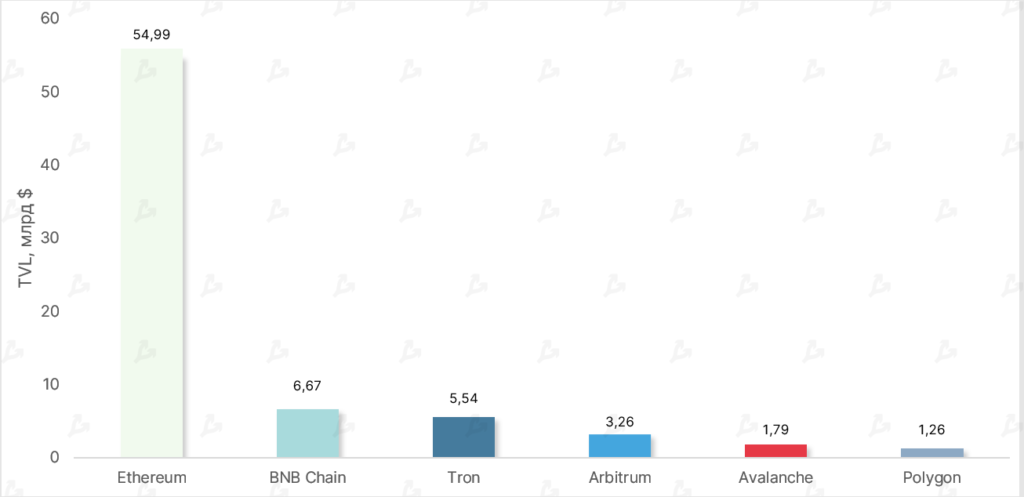

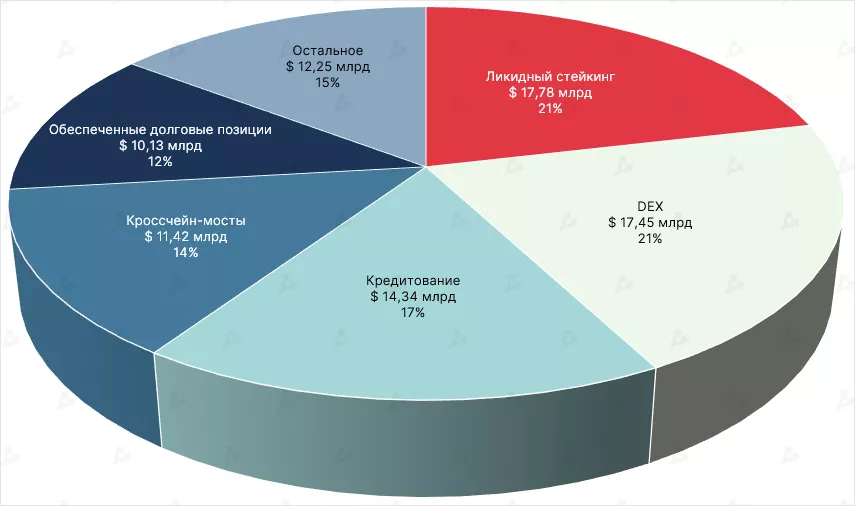

- With the Shapella upgrade activated, TVL in DeFi smart contracts rose above $90 billion in April for the first time since September 2022, finishing the month at $83.37 billion.

- Ethereum remains the undisputed leader, accounting for almost 67% of the sector’s total TVL.

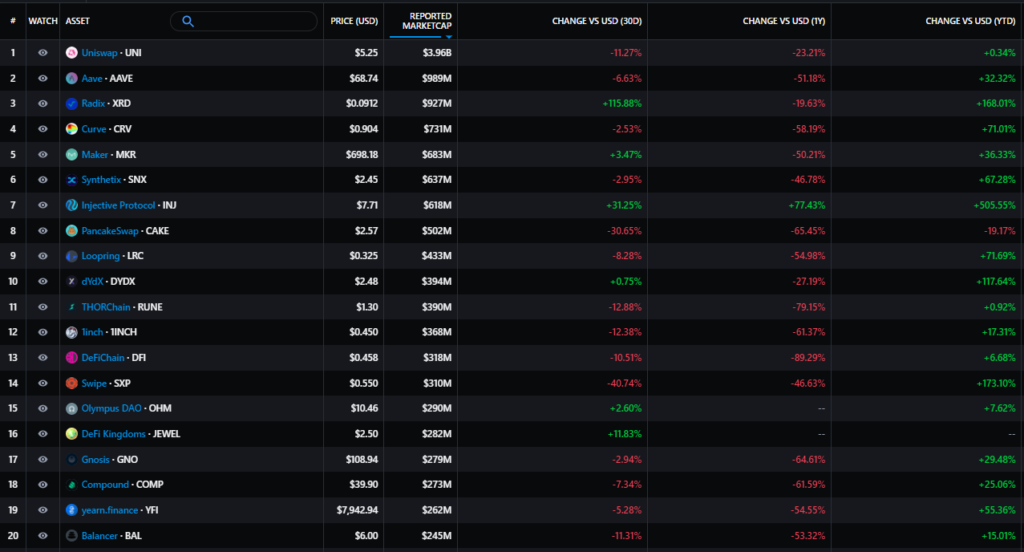

- Most top-20 DeFi assets by market cap were in the red in March. The poorest performer was Solar (SXP), down almost 41%. The drop partly reflects a correction after the asset’s migration to its own blockchain in March 2022.

- The utility token of PancakeSwap (CAKE) fell 31%, despite several major announcements. In particular, the team unveiled a third protocol version and proposed moving tokenomics to a deflationary model. The situation is driven by intensified competition on the BNB Chain DEX space — in March, Uniswap developers deployed the app’s smart contracts on this chain.

- Radix (XRD) posted the strongest gains; the company behind the project was valued at $400 million by the end of March.

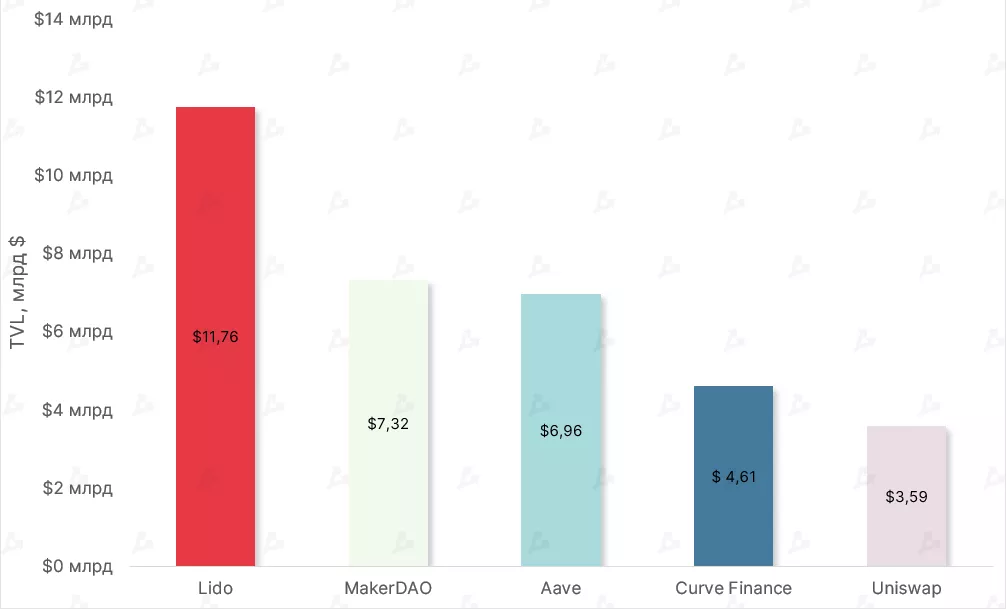

- Among Ethereum-based projects, Lido leads in TVL and has grown for the fourth month in a row — up nearly 9% following Shapella’s April activation.

- Protocols for liquid staking overtook decentralized exchanges in the share of total DeFi TVL for the first time, accounting for over 21% or $17.78B (+7% vs March).

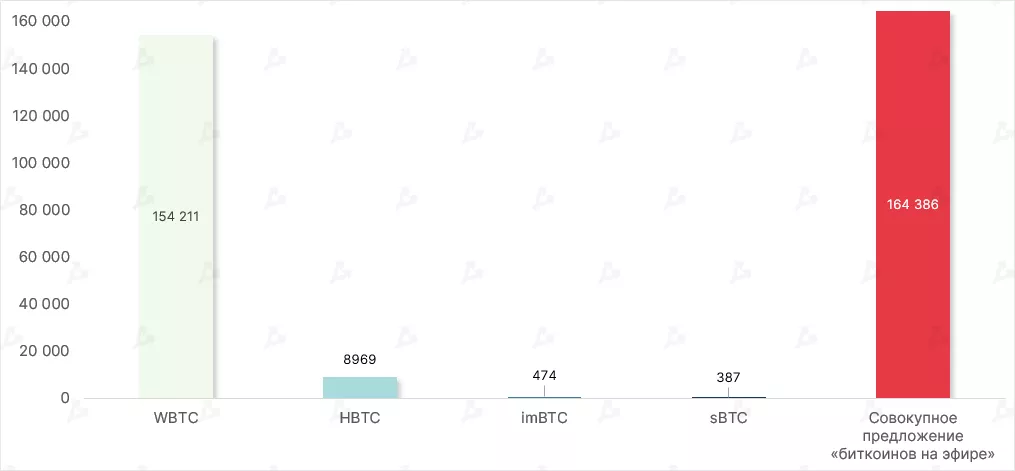

- In April, the total supply of “Bitcoin on Ethereum” reached 164,386 BTC. WBTC remains the leader with a dominance index of 93%.

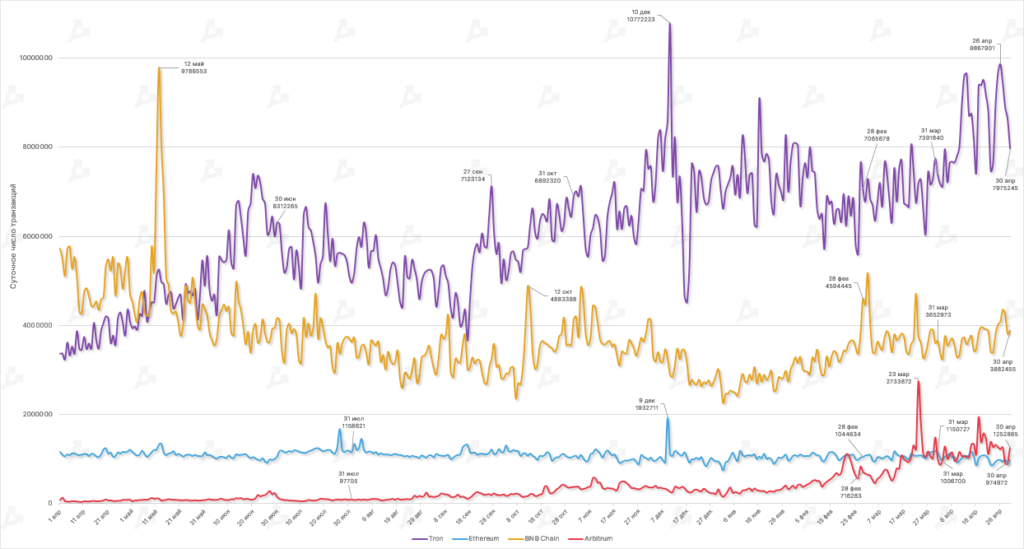

- Tron remains the leader in on-chain activity in April, processing an average of 8.4 million transactions daily, up about 20% from March’s 6.8 million.

- Arbitrum, an L2 solution, overtook Ethereum by average daily transactions — 1.2 million vs. 1.0 million. The project’s figure rose 25% month over month, aided by relatively low fees, numerous integrations and buzz around the ARB utility token.

DEX and L2

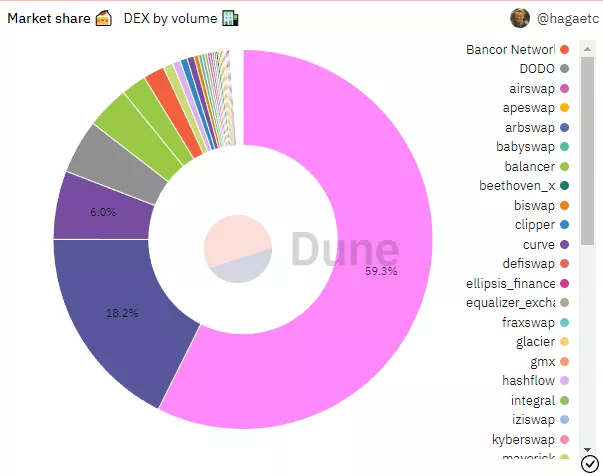

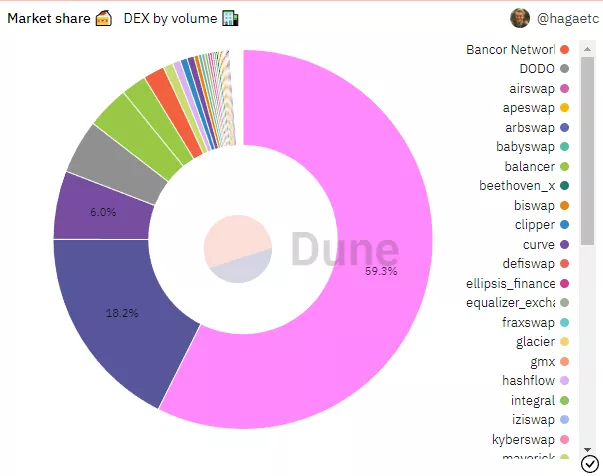

- In April, DEX trading volume stood at $65.8 billion.

- Uniswap remains the leader with nearly 60% market share, led by Ethereum. BNB Chain improved its position (its share rose from 10% to 20%), while hype around Arbitrum cooled (23% to 18%), despite a series of airdrops.

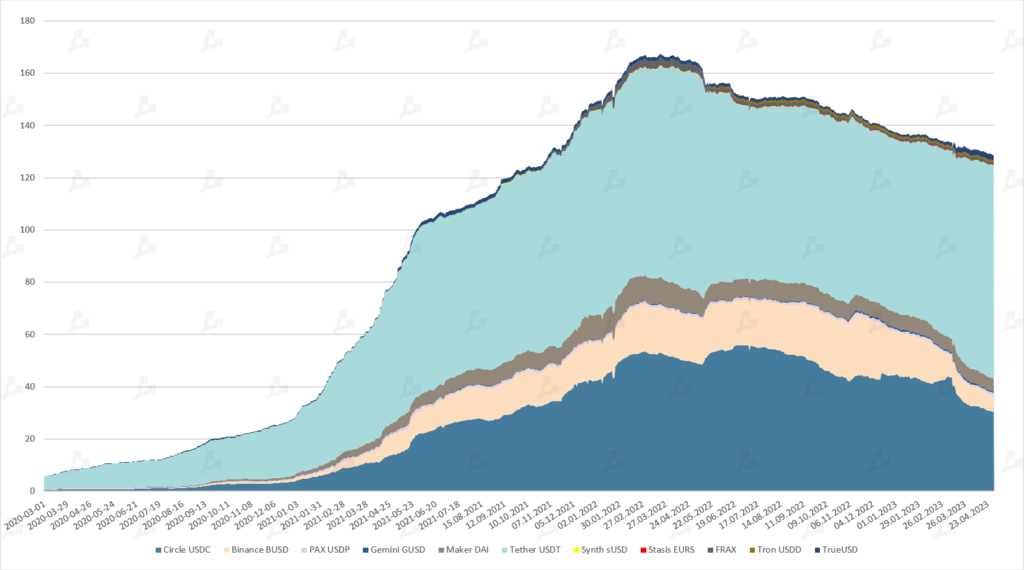

Stablecoins

- Stablecoins’ market cap fell in April to $128.6 billion, continuing a stretch of weak months.

- USD Coin (USDC) supply dropped from $32B to $30B. At the same time, Tether expanded, releasing another $2B USDT (totaling $81.7B).

- This dynamic is likely to persist into a full bull run — we may see USDT strengthen as other players lose share in the space.

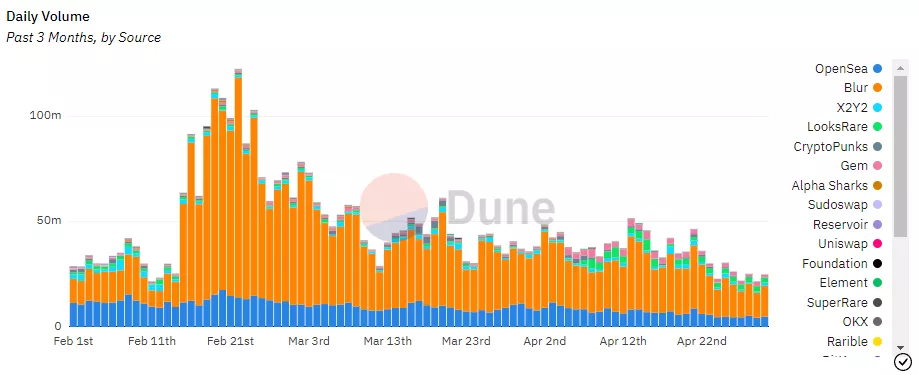

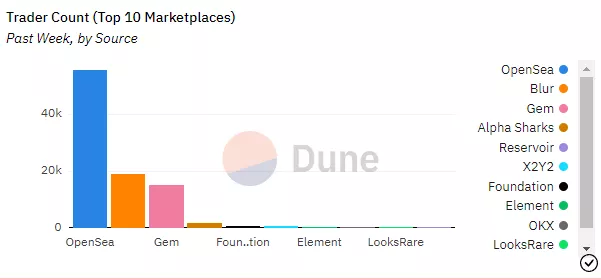

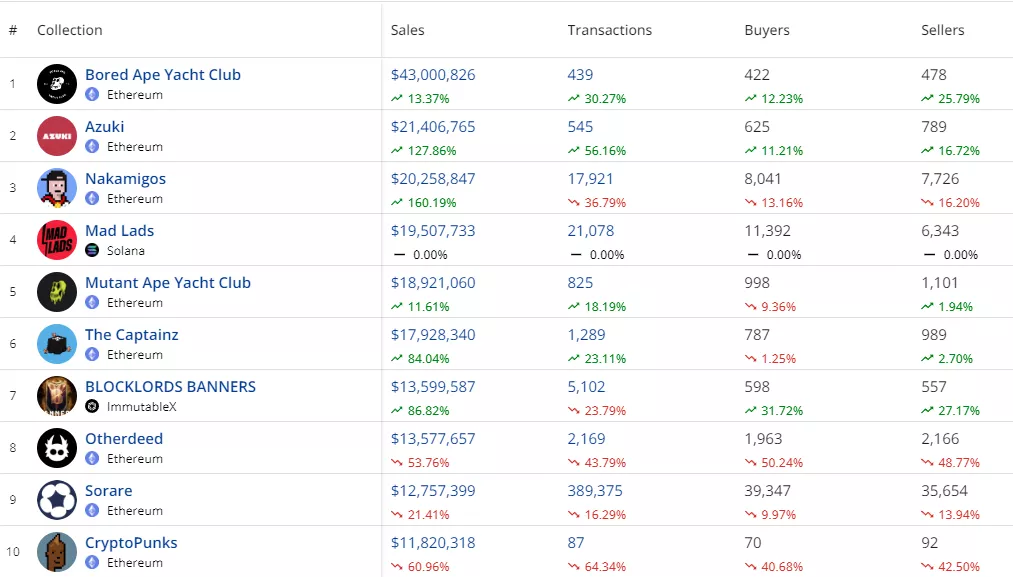

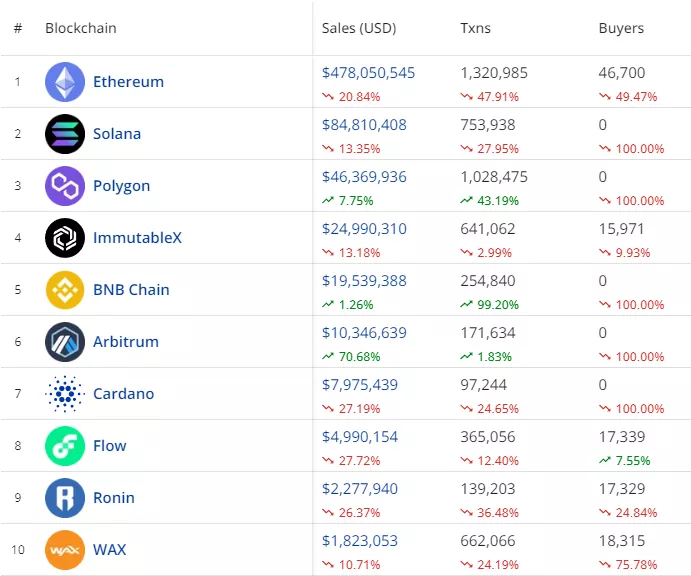

NFT

- Blur remains dominant in terms of trading volumes on leading NFT marketplaces, reinforcing its status as a “platform for professional traders.” OpenSea remains twice as popular as its competitor, indicating a more mass-market orientation.

- Market shares remained largely unchanged. OpenSea has been actively courting professional traders with OpenSea Pro (formerly Gem).

- Premium collection Bored Ape Yacht Club is reaping rewards from its ecosystem development, attracting more users to its community. The top position is largely driven by strong marketing. Conversely, the once-flagship CryptoPunks collection has been failing to spark new initiatives, affecting its metrics.

- Among the top three, Nakamigos’ pixel art collection stands out — despite a low floor price, its April volume reached $20 million, underscoring the speculative nature of the market.

- Overall metrics showed mostly negative dynamics. The Arbitrum ecosystem stood out in terms of on-chain activity. NFT transactions also rose in the Polygon and BNB Chain networks.

Activity of major players

- MicroStrategy added 1,045 BTC between March 24 and April 4, 2023. The average purchase price was $28,016. Bitcoin reserves reached 140,000 BTC ($4.09B as of 29.04.2023).

- After breaking the $30,000 level, the vendor of analytics software reduced its unrealized losses on bought Bitcoins.

Stock movements of crypto-related companies

Mining company stock movement

Marathon Digital (MARA):

+15.4%

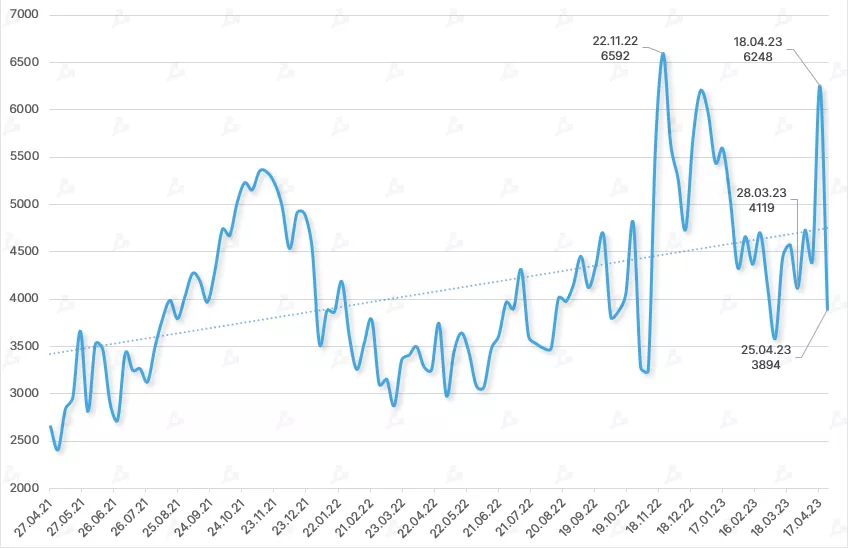

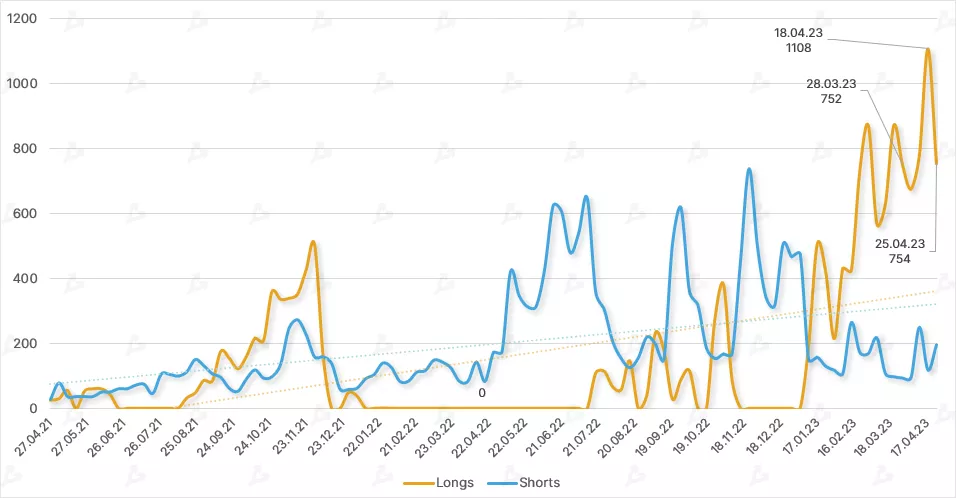

- Against a backdrop of investor optimism following Shapella, open interest in regulated Ethereum futures on CME rose to about 6,248 contracts, approaching late‑November 2022 levels. It later adjusted but the uptrend remains intact.

- Commercials have been notably building long positions ahead of and after the fork.

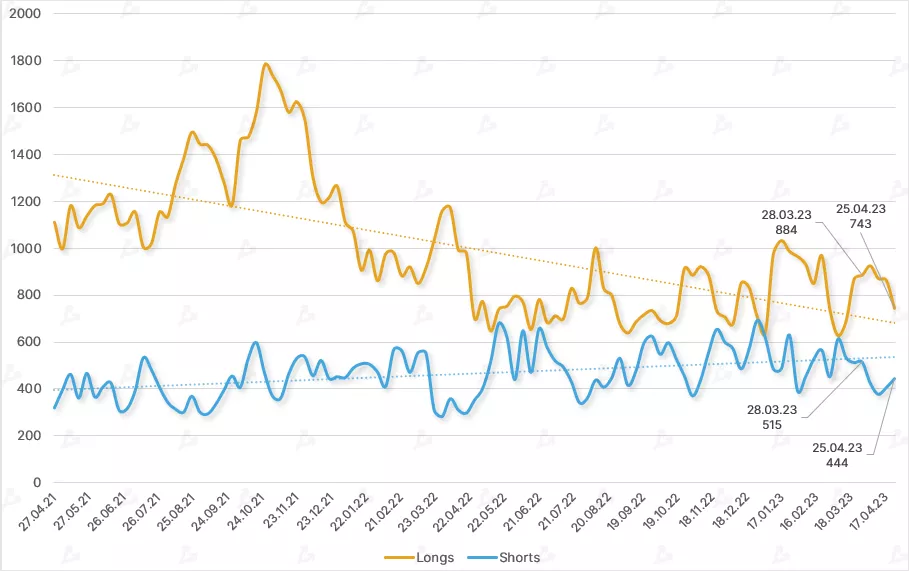

- Small traders have long preferred longs to shorts. Yet the number of long positions has gradually declined.

- Despite the fork, the micro-futures landscape for Ethereum has barely changed — OI continued to fall. The long-to-short ratio among small traders is roughly the same as for larger contracts.

- For Bitcoin futures on CME, there were no notable month‑wide changes.

Venture rounds

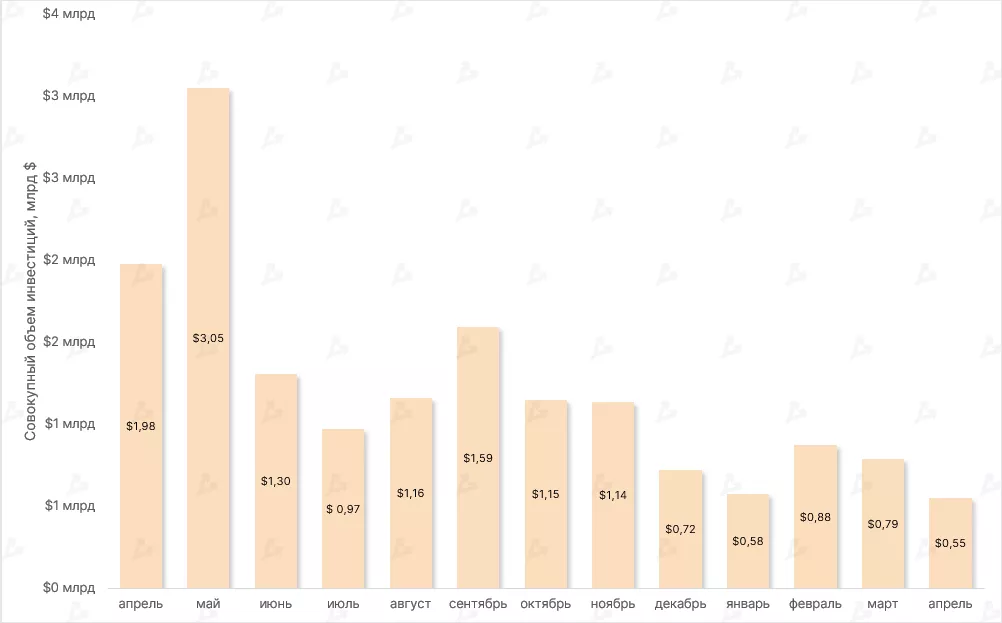

In April, venture investment volume in crypto projects fell 30% to about $550 million.

Berlin-based Bitkraf launches its second fund to invest in the Web3 gaming sector.

LayerZero (cross-chain protocol) in Series B round. Valuation at $3B.

Unchained, a Bitcoin-focused business, completed a Series B led by Valor Equity Partners.

Berachain, a Layer-1 project, valued at $250M with Polychain Capital as lead investor.

Zodia Custody, Standard Chartered’s crypto custody arm.

Sei Network, a blockchain for trading. Project valued at $800M.

Regulation

European Union

In April, after more than two years of discussion and revisions, the Markets in Crypto Assets (MiCA) bill was adopted. The EU thus becomes the first major jurisdiction to implement a comprehensive cryptocurrency regime. The main provisions will apply 12 months after publication in the Official Journal of the European Union.

Main elements of the document:

- Key provisions for cryptoasset issuers and traders (including asset-backed tokens and electronic money tokens) address transparency, disclosure, licensing and supervision of operations;

- Stablecoin operators must obtain a license from the competent authority in their member state and comply with certain rules to ensure the stability of their tokens;

- Anyone seeking to publicly offer a cryptoasset must prepare an official document (white paper) disclosing information about the asset. The document must be approved by the competent authority of the member state;

- MiCA aims to protect consumers and investors and to ensure transparency and stability in the industry.

Read ForkLog’s detailed analysis and the expert opinions via по ссылке“>the link.

United States

In April, campaigners called for boycotting SEC chair Gary Gensler, and the regulator’s target list expanded to include Justin Sun and the exchange Bittrex. During Gensler’s testimony in Congress, lawmakers stressed the agency’s perceived bias toward crypto firms and the head’s alleged incompetence. Some proposals called for the removal of the SEC chair and for greater clarity in statements.

The largest US platform Coinbase filed a lawsuit to obtain a response from the Commission to a petition filed in July 2022. Citing a “hostile and uncertain regulatory climate in the United States,” Binance.US terminated its deal to acquire the bankrupt broker Voyager Digital.

Hong Kong

Meanwhile, Hong Kong is being forecast as the next crypto hub, a prospect actively signalled by its authorities. The jurisdiction is actively implementing necessary initiatives; for instance, licensed crypto companies are now being served by local banks. In May, the Hong Kong Securities and Futures Commission (SFC) will issue guidance on the licensing regime for trading platforms.

Month’s highlights

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!