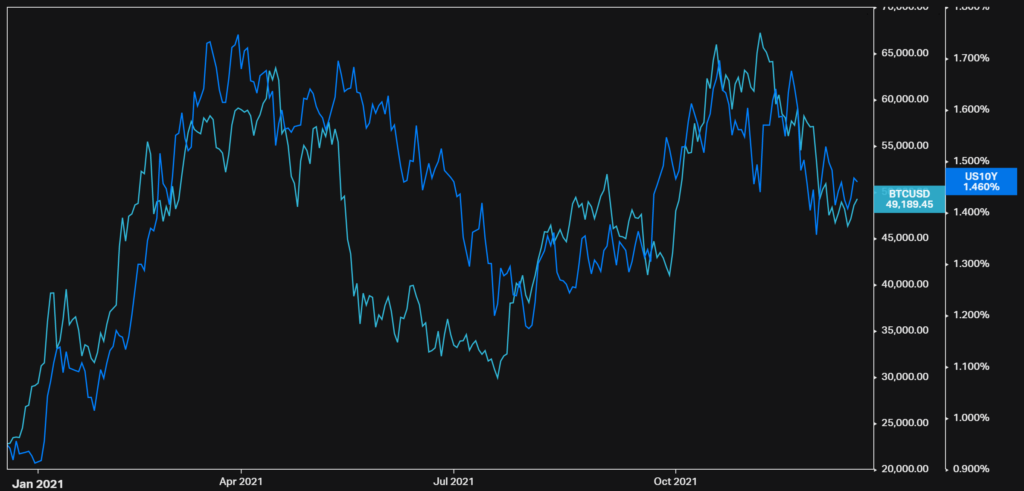

Expert Identifies Correlation Between Bitcoin Price and US Government Bond Yields

The cryptocurrency market largely depends on the behaviour of US stock indices. It has repeatedly collapsed and recovered in tandem with them. However, going forward, crypto investors may want to watch US Treasury yields. For at least a year now there has been a significant correlation between them and Bitcoin’s price. This is explained in a special analysis for ForkLog by Exante analyst Viktor Argonov.

At a yield of 1.1% Bitcoin was around $30,000, at 0.9% – $20,000. This relationship is almost linear for prices from $20,000 to $70,000. If we assume it continues at lower quotes, the Bitcoin price would hit zero at a yield of 0.5%.

Mathematical formula this can be expressed as:

BTC = (Y10 – 0.5) * 50,000, where BTC is the price of Bitcoin in dollars, and Y10 is the yield on 10-year bonds in percent.

Currently US Treasury yields are 1.419%, which by the formula yields a Bitcoin price of $45,950. Yesterday, on December 20, during trading sessions on US stock exchanges it swung in the range $46,000–$46,400.

On Wednesday, December 15, immediately after the Fed decision to delay the timeline for winding down the asset-purchase program, Y10 reached 1.463%, which by the formula means Bitcoin at $48,150. In reality the coin was trading around $49,000 at that moment.

Market Maturity

At first glance this pattern is easy to explain: yields on government bonds correlate with risk appetite, which affects cryptocurrency prices. However, this formula only became valid in spring 2020, perhaps due to the Fed rate cuts. Earlier this pattern did not work.

In January 2020, yields on bonds exceeded 1.8%, though Bitcoin price was much cheaper than today, which does not fit the formula. However by the end of March yields collapsed to 0.587%, which gives a price near $4,350.

In late August 2020, yields rose above 0.721%, which corresponds to a price of $11,050, and by the end of October to 0.86%, promising a price of $18,000. In reality Bitcoin reached such level only in November, but this fits within the error margins that characterize this year as well.

As for previous years, the pattern disappears completely. For example, the multiyear maximum of US debt obligations – more than 3.22% – was observed in October 2018 during a deep crypto market downturn, whereas at the peak of the 2017 bubble yields were only 2.38%.

With zero-rate Fed policy in 2009–2015, these patterns were also not observed. Probably the matter lies not only in them but also in the arrival of institutional players who make purchases with greater care.

The formula started working thanks to the market’s maturation. And if it continues to work in the future, we can expect fairly unexpected effects. After all, if yields can forecast Bitcoin’s price, then the inverse is also true: knowing forecasts of the crypto price, one can estimate yields. At least at zero rates.

Forecast Values

A drop of yields below 0.5% is unlikely: such a scenario would imply a total crash of Bitcoin and even a negative price.

If yields fall below 1.1%, the asset would slump below $30,000. This also seems unlikely, since in summer 2021 there were many negative factors for the first cryptocurrency, but the floor held. Bond yields also did not fall below 1.1% — the formula worked in both directions. The probability of this in the future is low, as the market continues to rise.

Finally, if we extrapolate long-run Bitcoin price trends, in a year the support level would be around $60,000. Bond yields would have to be not lower than 1.6%. And with the 10-year yield at around 2% (end-2019 levels), this formula points to a price near $75,000. However, with the Fed raising rates, the formula could change.

Whether these forecasts come true is hard to say. As history shows, correlations can appear and disappear, and of course they do not guarantee future returns.

In January 2021, billionaire Mark Cuban noted the similarity between stocks and Bitcoin. He urged crypto market participants to monitor interest-rate dynamics and, in the absence of rate hikes, forecast the rise of digital gold.

Read ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!