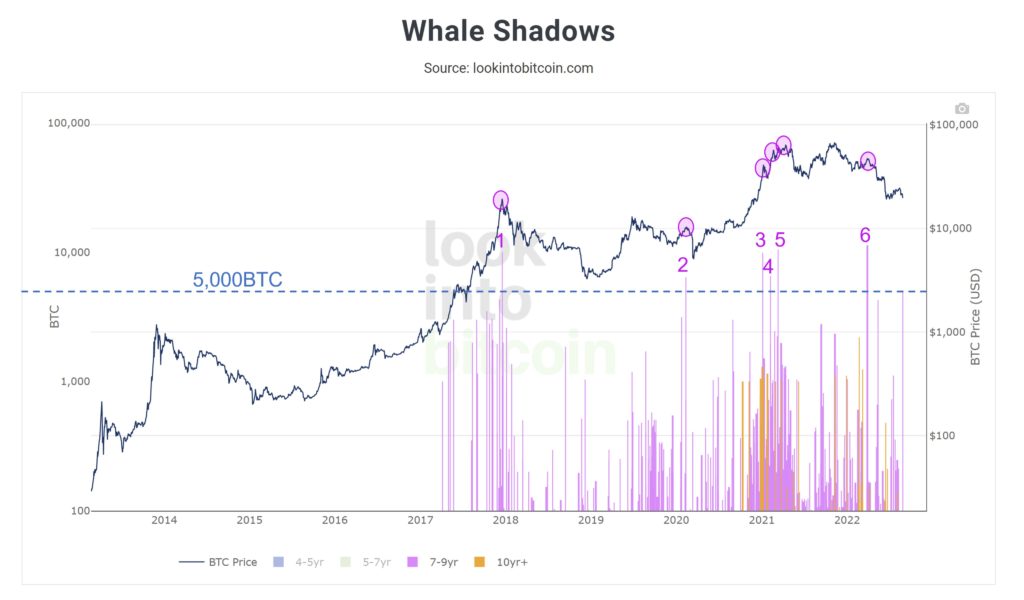

Mt. Gox-linked bitcoin wallets awaken in August

On August 29, a cluster of 10,000 BTC, dormant since 2013, moved into action. Researchers linked it to the bankrupt Mt. Gox exchange, according to ForkLog’s report ForkLog.

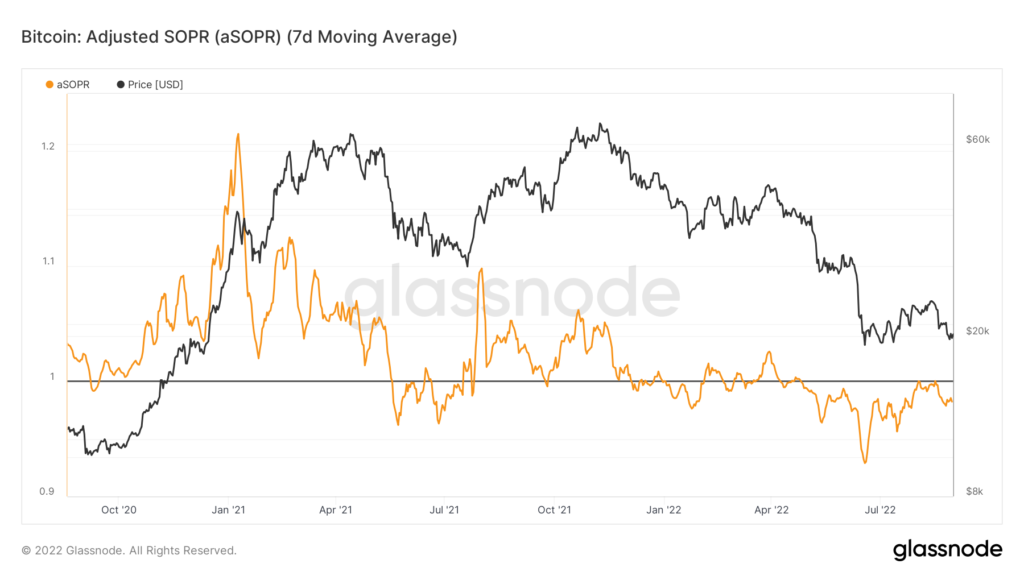

By the end of August, RHODL Ratio and MVRV Z-Score indicated deep oversold conditions for the first cryptocurrency. The ‘Hash Ribbon’ indicator marked the end of miners’ capitulation, which is ‘an excellent buying signal,’ according to Charles Edwards of Capriole Investments.

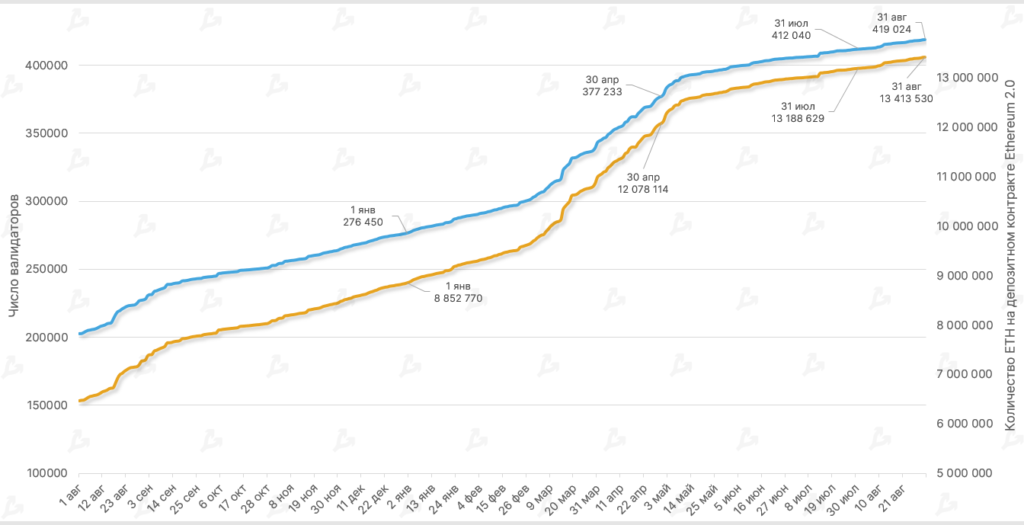

In the Ethereum network the number of users interacting with its second iteration increased by 1.7% during the period (1.6% in July). This was driven by the upcoming The Merge.

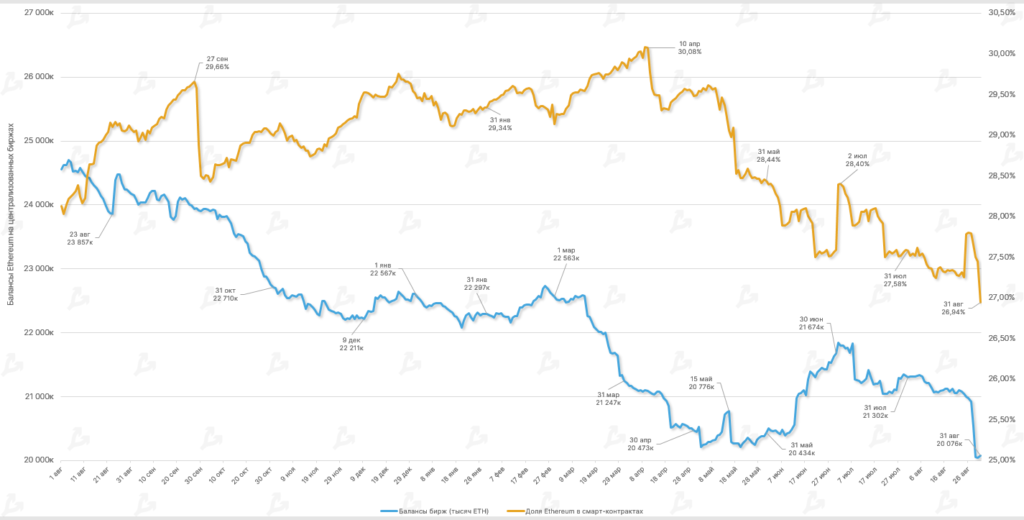

Investors continued moving assets to non-custodial wallets in order to stake them — balances on centralised exchanges and the share of the ETH supply deployed in DeFi smart contracts declined.

By the end of August, the quantity of ETH on the Ethereum 2.0 deposit contract rose above 13.41 million coins. For the month the figure was up 1.7%.

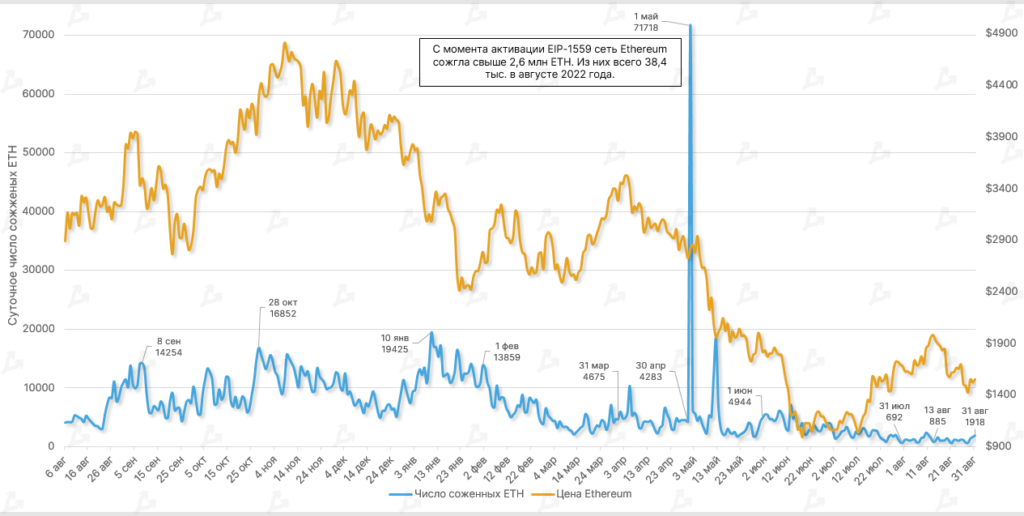

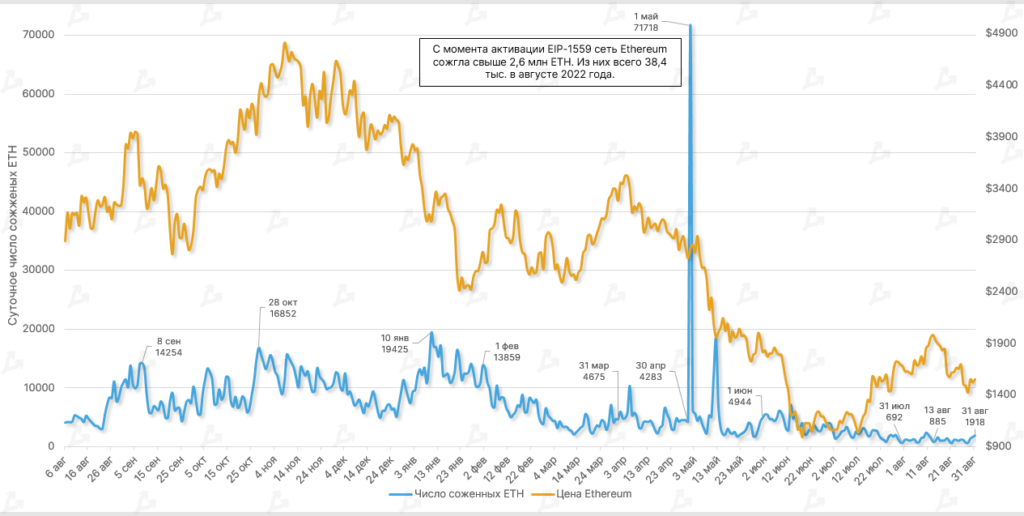

Support for Ethereum’s price continued to be buoyed by the implementation of EIP-1559, though the burn rate declined by nearly half — 38,400 versus 60,000. Since activation of the upgrade, the Ethereum network has burned more than 2.5 million ETH.

As a reminder, Ethereum developers planned migration of the mainnet to a Proof-of-Stake algorithm around September 15.

Earlier, a trader using the pseudonym filbfilb did not rule out a dump after the merge, in line with the axiom “buy the rumor, sell the fact.”

Read ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!