Bitcoin Spot ETFs See Inflows for Tenth Consecutive Day

As of May 28, net inflows into spot exchange-traded funds (ETFs) based on the leading cryptocurrency amounted to $432.62 million.

This positive trend has continued for ten consecutive days.

Net inflows into BlackRock’s IBIT product reached $480.96 million in a single day. Outflows from Fidelity’s FBTC and Arg & 21Shares’ ARKB were $14.05 million and $34.29 million, respectively.

The total assets under management by spot Bitcoin ETF providers have exceeded $130 billion.

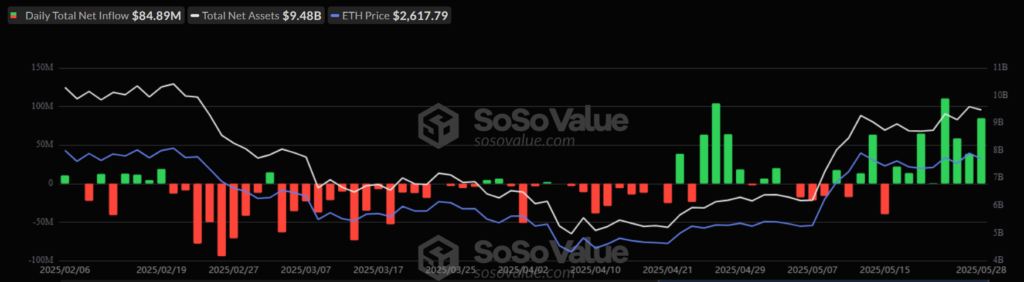

ETH-ETF

The cumulative net inflow into spot Ethereum ETFs as of May 28 was $84.89 million. This positive trend has continued for eight consecutive days.

The largest daily inflow was into BlackRock’s ETHA, amounting to $52.68 million. The figures for FETH, ETH, and QETH were $25.71 million, $4.93 million, and $1.57 million, respectively.

In the past 24 hours, the price of Bitcoin fell by 1% to $107,809, according to CoinGecko. Meanwhile, Ethereum’s value increased by 3.5% to $2,725.

Earlier, Bitwise’s Chief Investment Officer Matt Hougan predicted that BTC-ETFs would be included in the offerings for clients of Merrill Lynch, Morgan Stanley, Wells Fargo, and UBS by the end of 2025.

Previously, Bernstein identified institutional purchases as one of the five key factors driving the continued growth of the leading cryptocurrency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!