The year in crypto, 2025: record highs, extreme fear and the biggest hack on record

The year in crypto: highs, fears and a record hack.

In 2025 the crypto industry proved its mettle, while reminding investors of the importance of hedging risk. There was plenty of good news for digital assets, yet caution remained warranted.

Rising institutional demand and regulatory advances coincided with big hacks, reminders of past blow-ups and routine corrections. Even so, the past 12 months made one thing clear: crypto has become a lasting part of the global financial system.

Events

New peaks and extreme fear

The year confounded investors’ expectations, but it was certainly no failure for bitcoin. Markets served up variety: from fresh all-time highs (ATHs) and extreme greed to record liquidations and outright panic.

Bitcoin entered January near December’s close—around $92,000—already in rally mode, fuelled by Donald Trump’s victory in the US presidential election.

The next ATH arrived quickly. On 20 January, on the eve of the US president-elect’s inauguration, bitcoin hit $109,000 (the prior record at $108,000 had been set a little over a month earlier).

After the new high, the coin slid into a drawn-out, five-month correction, bottoming near $74,500 in early April; it never dropped below that level.

The main cause of the stall was likely a “stop sign” from the Fed on rate cuts. At its first meeting of 2025 the central bank halted the easing cycle, leaving its policy rate unchanged at 4.25–4.5%.

Though nearly every Fed meeting injected volatility, the rate stayed put until late July.

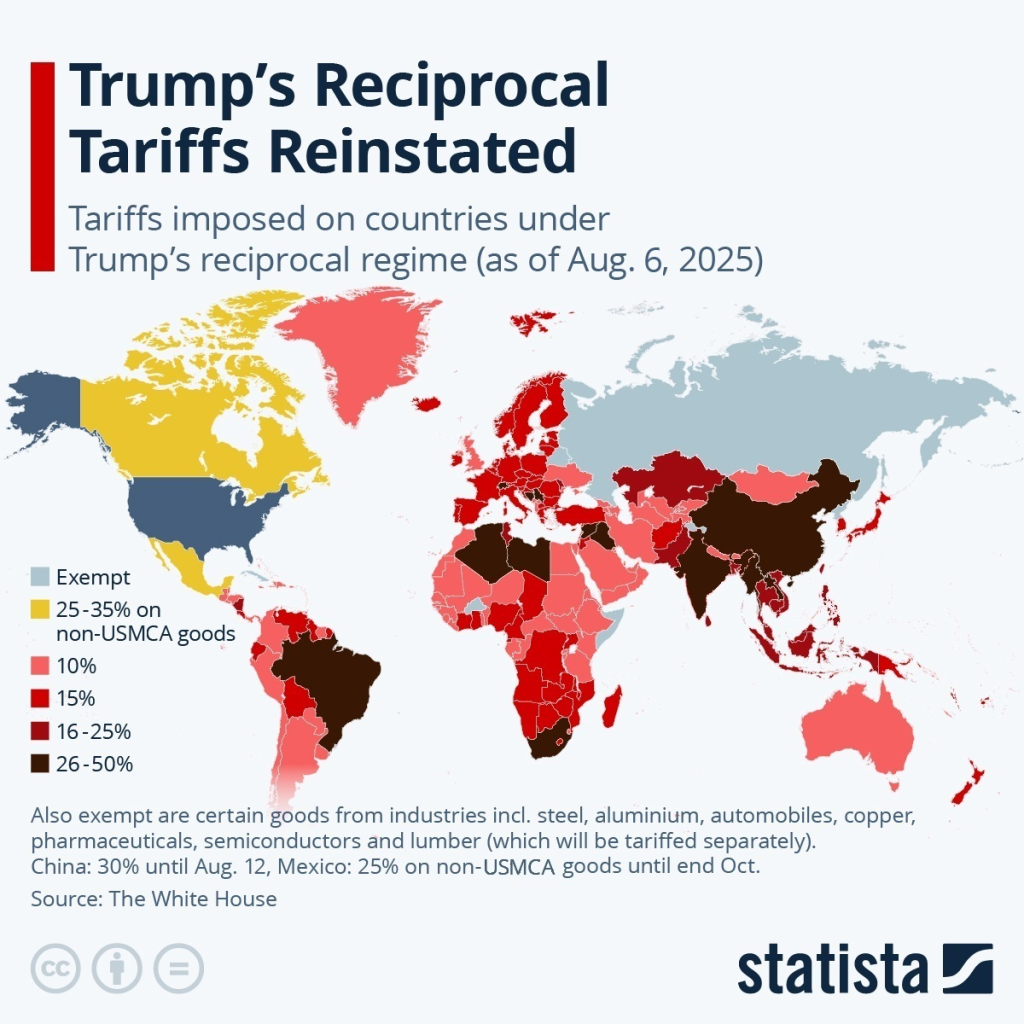

Fed chair Jerome Powell justified the hawkish stance by citing elevated inflation, unemployment and other weak micro data. Fuel was added by Mr Trump’s first big international move of his second term—tariffs on a host of countries.

Even at December’s final meeting, the Fed cited tariffs as a prime cause of America’s economic stagnation.

The “tariff war” weighed on crypto too: each announcement of new countermeasures by Mr Trump triggered corrections.

Despite the headwinds, in April bitcoin returned to a six‑figure price and in May set a new ATH at $112,000. Throughout the year the asset was underpinned by institutions and inflows into ETFs.

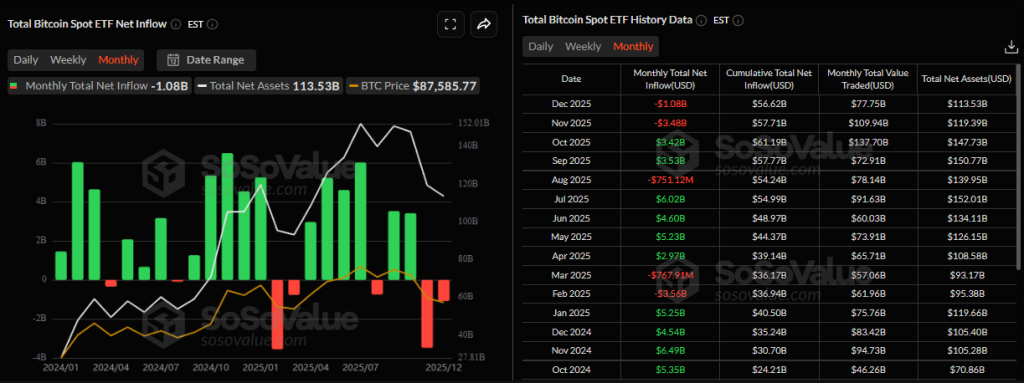

Cumulative net inflows into US spot vehicles since their January 2024 launch reached $56.6bn. All told, the funds absorbed 6.49% of supply.

BlackRock’s IBIT remains the segment’s unchallenged leader, with $67bn under management.

Although there were more negative months for ETFs than in 2024, institutions and corporates showed steady interest in digital gold.

Summer brought another rally, as hopes of US monetary easing built. On 10 July the coin broke through $113,000; days later it reached $123,000. In parallel, total crypto market capitalisation surpassed $4trn for the first time.

According to CoinGecko, the peak was $4.3trn, before a retreat to around $3.05trn by year-end.

In August, digital gold set another ATH above $124,000.

Through the summer the Fed held rates at 4.25–4.5%, but on 17 September it voted to cut by 25bp. That bolstered bitcoin’s price, then languishing near $110,000.

The Fed’s turn opened the way to the year’s final record. On 6 October the coin hit a new high above $126,000. Although the US government shutdown that began in late September initially buoyed crypto, “blood-red” days followed the ATH.

11 October entered lore as “black” Saturday. Bitcoin fell below $111,000, printing a $20,000 daily candle for the first time. Liquidations topped $19bn, the most ever. A fresh round of US tariffs on China sparked the sell-off.

By November, the price slipped below the psychologically important $100,000 level.

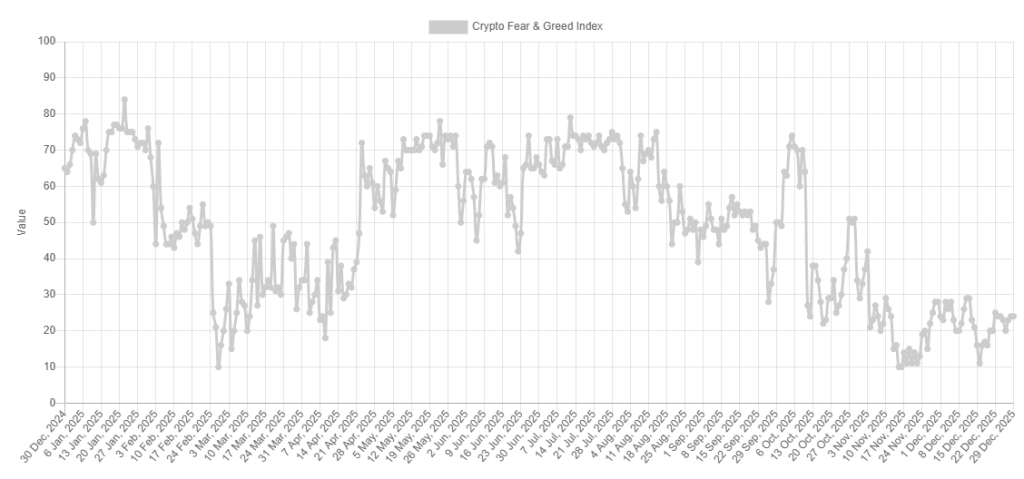

The crypto fear and greed index then fell into “extreme fear” for the second time that year—the first came after Mr Trump’s tariffs in February. The gauge remains near its lows.

Despite the continued easing by the Fed and the end of the 43‑day shutdown, bitcoin failed to recapture $100,000. It ended the year near $87,000.

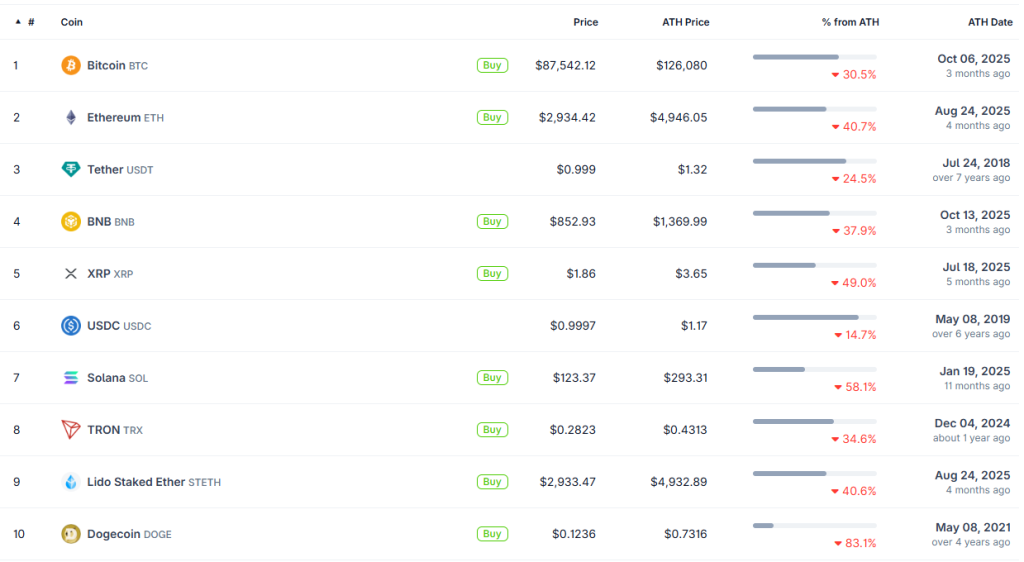

Most other digital assets shadowed the bellwether, though few leading coins set ATHs.

Ethereum’s price stalled around $3,000, losing 12% over 12 months. In August the asset set a marginal record at $4,956—just a few dollars above the previous $4,889 (on Binance).

In early January Solana set its ATH at $293; it now trades near $120.

XRP tested a $3.5 peak in July; BNB hit a record $1,369 in October.

By late 2025 talk of a bear market grew. Some analysts even mooted a slide below $10,000 in 2026; others forecast the rally would resume as institutional support strengthens.

Most market participants agreed the four‑year, halving-based bitcoin cycles have run their course. A steadier, if less explosive, ascent now awaits.

State bitcoin reserves and the GENIUS Act

If 2025’s price action can be debated, its regulatory progress cannot. Much of the good news came from the US, but other countries tried to keep up.

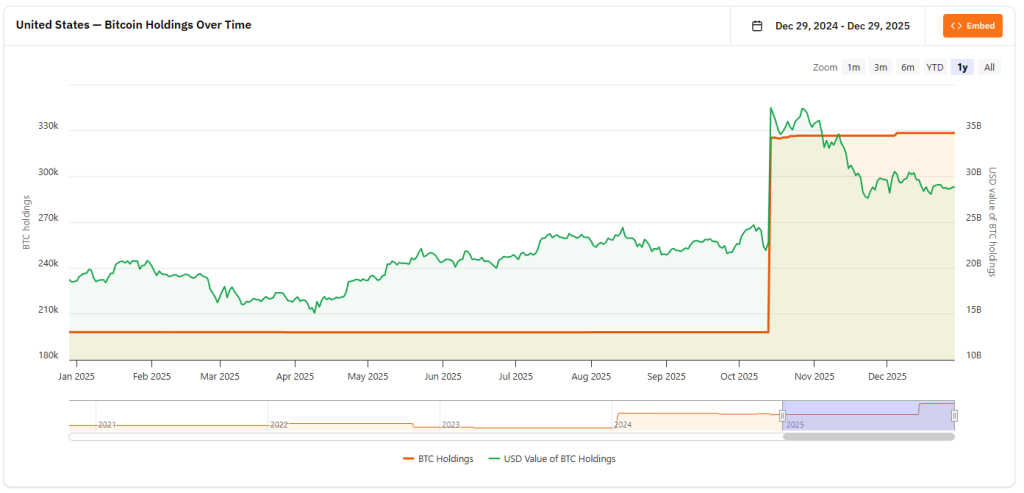

First, Mr Trump partially dispelled doubts that he would renege on crypto promises. On 6 March the US president signed an executive order establishing a national bitcoin reserve (SBR).

The order provides for holding assets confiscated by the Treasury in criminal and civil cases. Sales from the new fund are prohibited; the hoard will serve as a long-term store of national assets.

The order also creates a separate altcoin treasury, populated solely from seizures. Those assets may be sold in exceptional cases if the Treasury deems it necessary.

State-level “crypto reserve” laws were also adopted in New Hampshire, Arizona and Texas.

According to BitcoinTreasuries, the US government holds 328,372 BTC worth $28.77bn.

America’s move spurred others to follow. Governments that said they were weighing some form of crypto reserve included:

- Ukraine—where lawmakers filed a bill on holding cryptoassets in state reserves;

- Kyrgyzstan—provisions for an SBR were approved;

- Kazakhstan—will create a bitcoin reserve of up to $1bn;

- Germany—will consider recognising bitcoin as a strategic asset;

- Sweden—the idea of a bitcoin reserve was floated;

- Czechia—the central bank created a $1m test crypto portfolio.

Another US milestone came in July, when Mr Trump signed the GENIUS Act, setting rules for stablecoins and marking the country’s first consequential crypto statute.

Lawmakers passed three significant digital-asset bills in all, including the CLARITY Act and the Anti-CBDC Act.

The GENIUS Act requires full backing of “stablecoins” with liquid assets and annual audits for issuers with market caps above $50bn. It bars the payment of interest or other income to stablecoin holders and sets guiding rules for foreign firms in the segment.

“GENIUS Act creates a clear and simple regulatory framework to build and unlock the enormous potential of dollar-backed stablecoins,” said Trump at the signing ceremony.

Under the law, the Commodity Futures Trading Commission launched a pilot to use digital assets as collateral in derivatives markets.

In parallel, the Federal Deposit Insurance Corporation published the first draft rules governing how banks apply to issue stablecoins. The proposal covers depository institutions that want to set up issuing subsidiaries.

By enacting the GENIUS Act, the world’s biggest economy effectively opened the door to the legal use of dollar stablecoins. Banks and other firms can now issue and use them “in the clear”, a shift that should add momentum to the industry.

The biggest hack on record

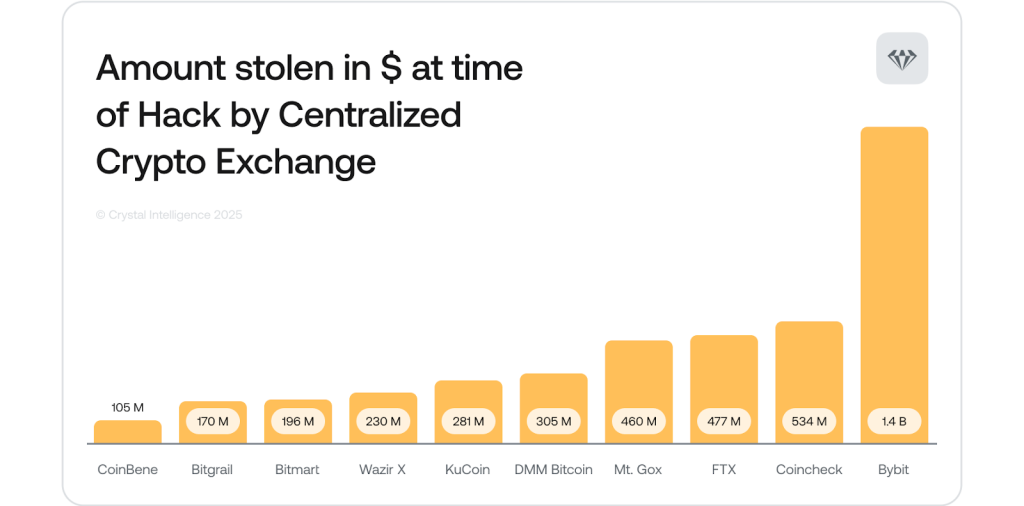

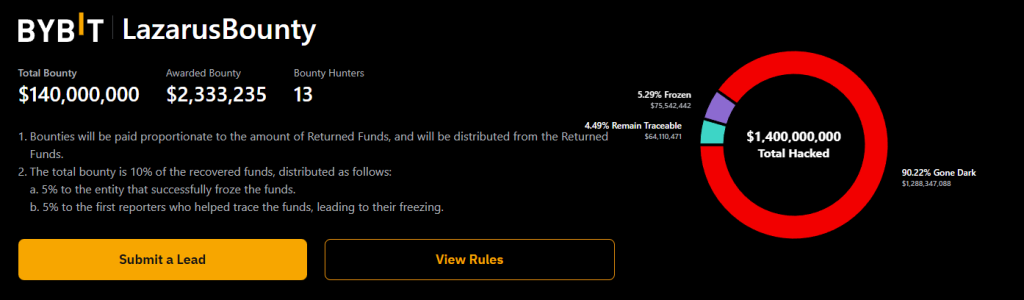

On 21 February the crypto world watched one venue—Bybit. The exchange suffered a breach of nearly $1.5bn, later labelled the largest on record.

On-chain sleuth ZachXBT was among the first to flag a suspicious outflow from Bybit—499,395 ETH.

CEO Ben Zhou soon confirmed the breach. Staff said the incident occurred while moving ETH from cold multisig storage to a hot wallet.

Attackers replaced the signing interface so all participants saw the “right” address. In reality, the hackers gained control of the Ethereum wallet and drained it by altering a smart contract’s logic.

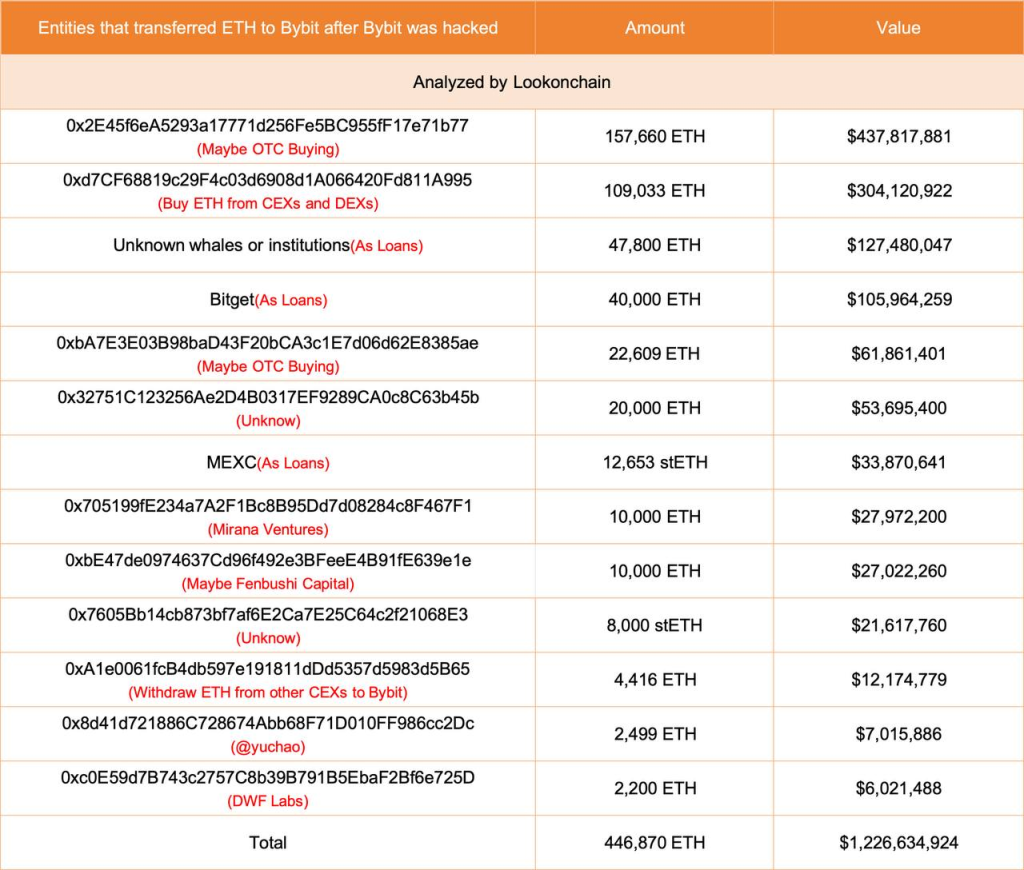

Mr Zhou said the platform remained fully solvent. Bybit continued to process withdrawals, albeit with delays. He also asked partners for ETH credit lines to shore up liquidity during the crisis; more than ten firms obliged.

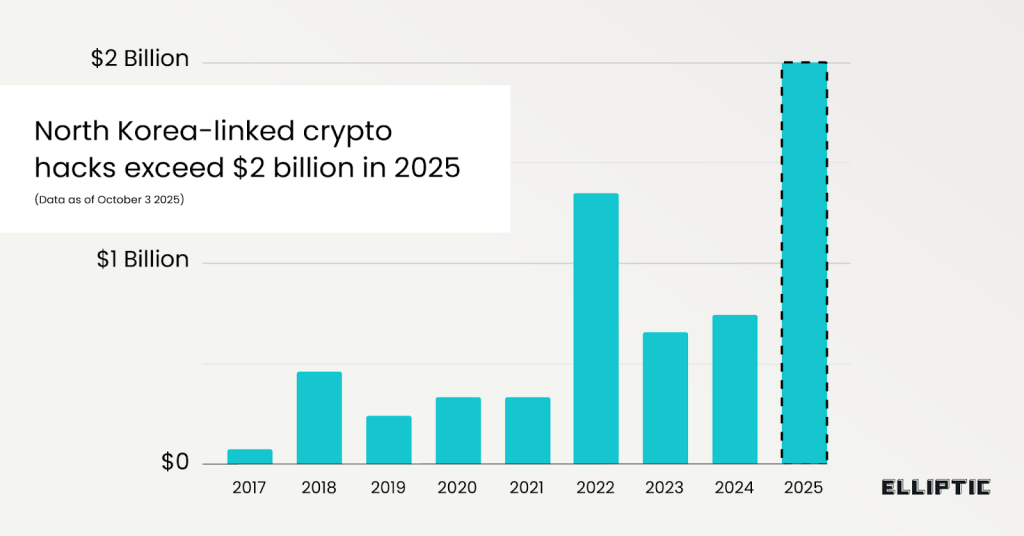

The next day researchers at Arkham Intelligence reported the involvement of North Korea’s Lazarus Group. The FBI confirmed it.

The thieves quickly laundered the proceeds via mixers and other services, swapping some mETH and stETH into ETH on decentralised exchanges. They split 10,000 ETH across 36 addresses and bridged into other networks.

They laundered the lot in roughly ten days.

Thanks largely to Bybit, 2025 was Lazarus’s banner year. Per Elliptic, losses tied to the outfit reached $2bn—more than double 2024’s tally.

Because they “serviced” the stolen Bybit funds, a scandal erupted around the multichain protocols THORChain and ParaSwap—critics demanded they refund fees earned on laundering transactions. Under accusations of links to the hackers, the eXch platform shut down.

In the aftermath, the community floated an Ethereum state “rollback” to restore the loot—inviting comparisons with The DAO’s 2016 hack.

Most opposed a fork, so the funds look lost for good—despite Bybit’s CEO saying they had the ability to trace more than half of the haul.

Per the exchange’s tracker, over 90% of the assets have “gone dark” (~$1.28bn). Roughly 5% are frozen; 4% remain analysable.

The platform paid 13 white-hat hackers a total of $2.33m for help tracking and intercepting flows.

Overall, Bybit weathered the hack: user funds were unharmed, operations continued, and borrowed assets were soon repaid. There were no major collapses or bankruptcies—credit to the exchange and to a market that avoided panic.

Important Ethereum upgrades

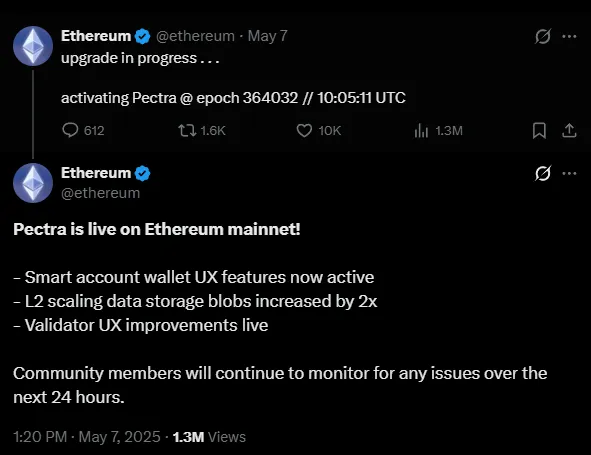

After criticism of 2024’s slow pace, Ethereum’s developers shipped two major upgrades.

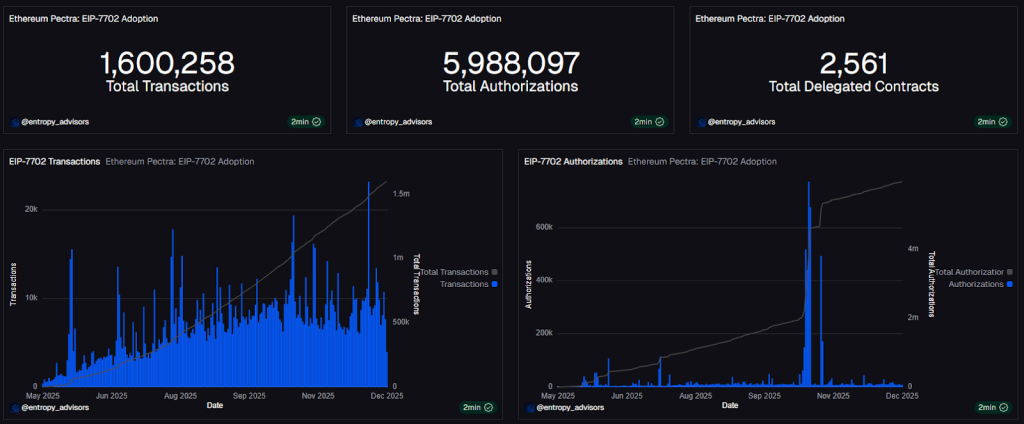

On 7 May the network activated Pectra—the chain’s biggest hard fork by number of proposals. It bundles improvements aimed at usability and efficiency.

The sweeping update contains 11 key EIPs. A notable change is added wallet functionality that simplifies use and recovery.

EIP‑7702 integrates account abstraction (AA) and a new transaction type that temporarily endows addresses with smart‑contract capabilities, reverting to their original state afterwards. That makes Ethereum more approachable for everyday users.

Other highlights include:

- doubling data storage for scaling L2 networks;

- an improved user interface for validators.

By year-end, smart-account authorisations under EIP‑7702 topped 5.9m—evidence of strong interest from exchanges, wallets and dapps.

AA’s arrival, however, also spurred phishing. Criminals mass‑deployed malicious contracts that granted control over victims’ wallets.

On 3 December developers successfully deployed Fusaka on mainnet. It introduces foundational upgrades for scalability, efficiency and security.

Fusaka includes ten proposals. Chief among them is EIP‑7594, which adds the PeerDAS protocol. It lets validators check small fragments rather than whole BLOBs—improving data availability across the ecosystem.

The upgrade also more than doubles the L1 gas limit, which could lift throughput to 12,000 TPS.

Other changes include:

- EIP‑7825: caps gas per transaction at 30m to harden security and prevent overloads;

- EIP‑7939 and EIP‑7951: boost performance and broaden ZK capabilities.

There were hiccups. Soon after Fusaka’s rollout the popular consensus client Prysm crashed, which knocked offline a slice of validators.

Meanwhile the Ethereum Foundation set a course to simplify user experience. Its research finds usability shortcomings to be the sharpest pain point for retail and institutional clients alike.

Vitalik Buterin also pointed to this bottleneck. Ethereum’s roadmap concedes the network remains too hard for mainstream users. The goal: make it as intuitive and seamless as a typical web app.

In December the protocol set a throughput record of 32,950 TPS after including L2 data from the decentralised exchange Lighter.

Even so, price performance underwhelmed many. Despite steady ETF inflows and falling exchange balances, ETH sits well below its peaks.

Bitwise’s call for $7,000 in 2025 missed by a mile. Lofty expectations for ETH’s price not only slowed its momentum but also buried hopes for an altseason.

An IPO cascade

Easier US crypto rules opened equity markets to players long seen as “unwelcome”.

One of the first was Circle. The co‑issuer of USDC took place on 5 June on the NYSE under ticker CRCL. Post‑IPO valuation was $6.9bn. Circle sold 34m shares at $31, raising about $1.05bn.

At the peak the stock traded above $260, putting Circle’s market value above that of USDC—it exceeded the stablecoin’s own.

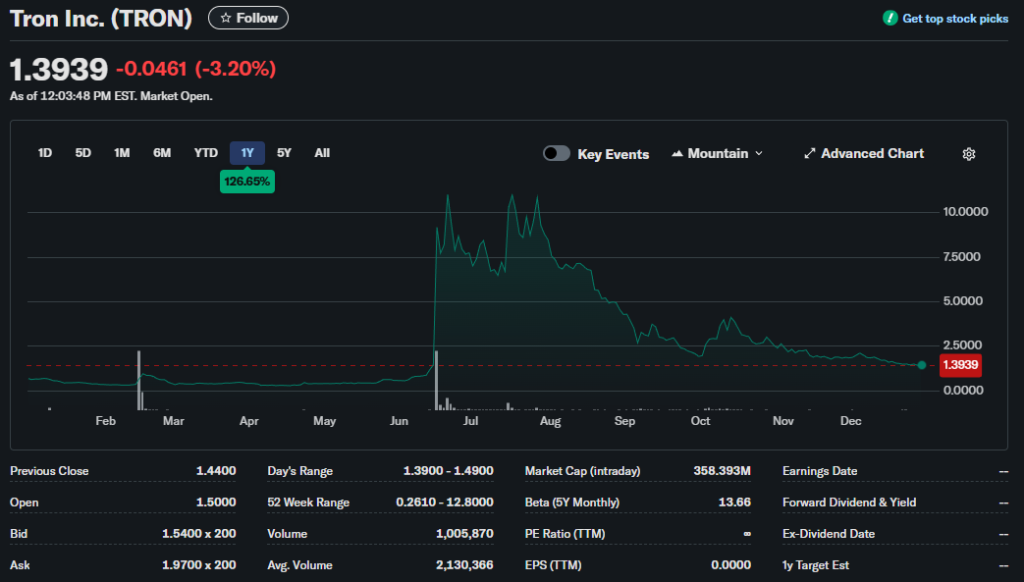

In summer Tron listed on Nasdaq via a reverse merger with already‑listed SRM Entertainment, rather than an IPO.

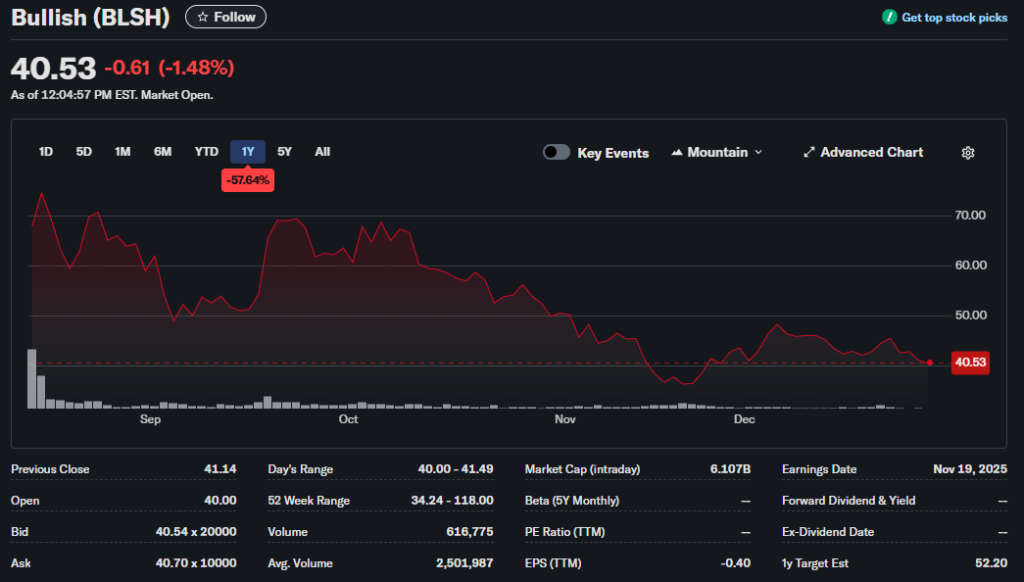

Next, the exchange Bullish went public. On 14 August it sold 30m NYSE‑listed common shares at $37, raising about $1.03bn.

At the highs BLSH traded up to $118.

On 12 September Gemini listed via a sale of 31.5m class A shares at $25. The offering totalled about $787.5m; the exchange raised $425m.

Trading under GEMI on Nasdaq, the stock set an ATH at $45.

Firms announcing listing plans included:

- custodian BitGo;

- trading platform Kraken;

- Trump‑linked miner American Bitcoin;

- Galaxy Digital of Mike Novogratz;

- asset manager Grayscale Investments;

- MetaMask maker ConsenSys, which picked JPMorgan as an IPO lead.

With many organisations already mapping their path to market, 2026 will likely see more integration of crypto with public equities—through traditional exchanges too.

Trends

Stablecoinisation

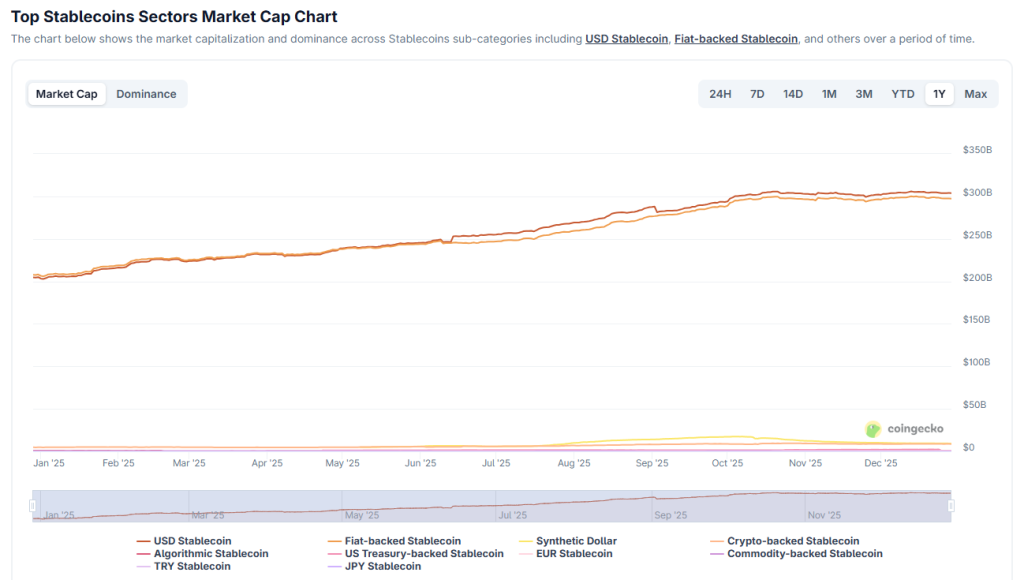

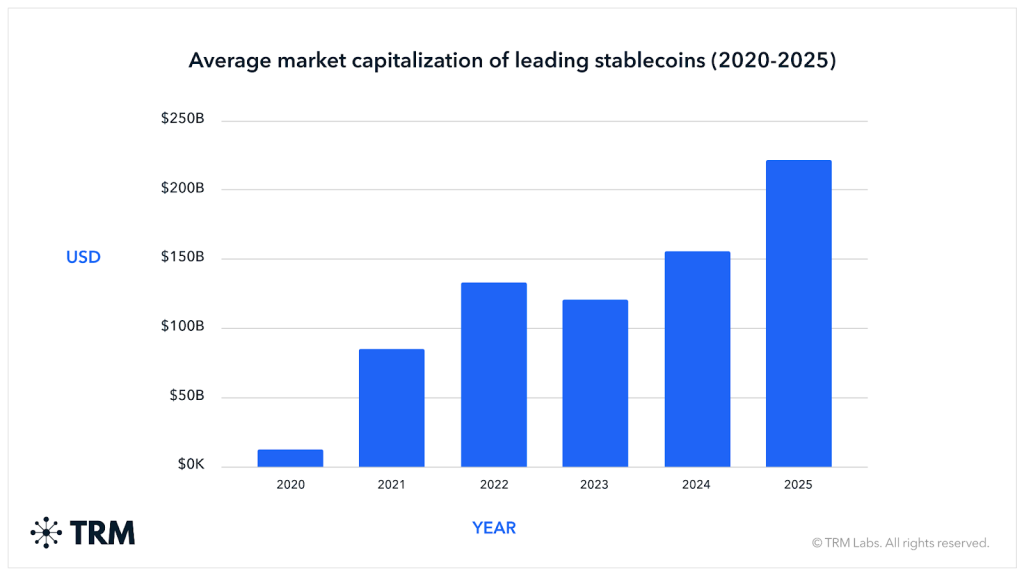

Softer rules globally propelled stablecoins, as institutional legitimisation broadened their appeal. Already sizeable, their market cap set new records in 2025.

Per CoinGecko, the total rose from $205bn to $312bn over 12 months. Dollar‑pegged coins account for $304bn.

According to TRM Labs, stablecoin transfers topped $4trn in 2025, an all‑time high—several times those of Visa or Mastercard.

Illicit crypto use fell by around 60% year on year.

Analysts noted growing retail use of stablecoins; payments giants kept pace:

- Visa announced a range of crypto‑linked initiatives, including adding new blockchains, integrating stablecoins into Visa Direct and direct cross‑border payments in USDC;

- Citi Group will roll out stablecoin settlement using Coinbase;

- JPMorgan began actively deploying JPM Coin and announced pilots using stablecoins for interbank operations.

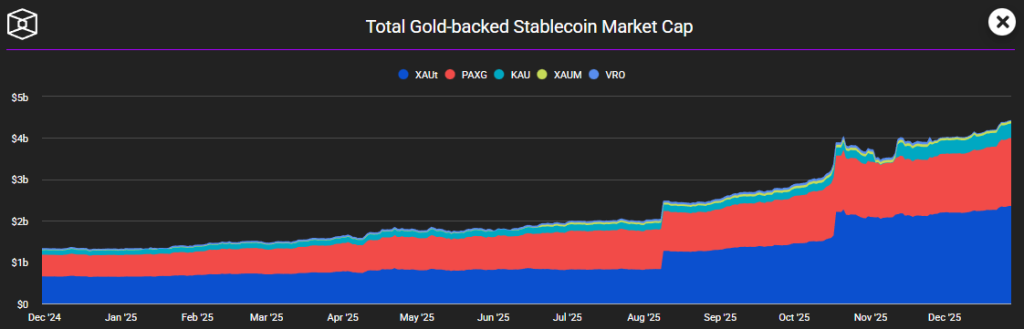

Gold‑backed stablecoins also surged. By December the segment’s market cap surpassed $4bn, up almost $3bn in a year.

The leader is XAUT by Tether at about $2.2bn, or half the market. Paxos Gold (PAXG) holds second with $1.35bn. Together they control nearly 90% of the sector.

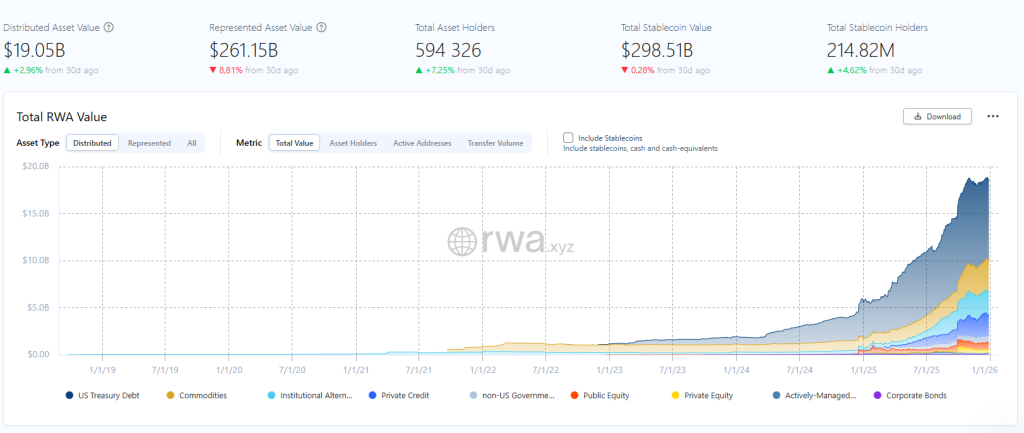

A separate 2025 trend was tokenisation and RWA. The segment’s market cap exceeded $19bn.

Across 429 products there are more than 590,000 holders. The largest niche is private credit, followed by US Treasuries.

Standard Chartered estimates tokenised assets will rise to $2trn by 2028. The bank’s head of research, Geoffrey Kendrick, argues that stablecoins’ rise laid the groundwork.

Strategy’s imitators

In 2025, interest in crypto reserves spread from governments to corporates. The pioneer for five years has been Strategy, Michael Saylor’s firm—with 672,497 BTC worth over $58bn, per BitcoinTreasuries.

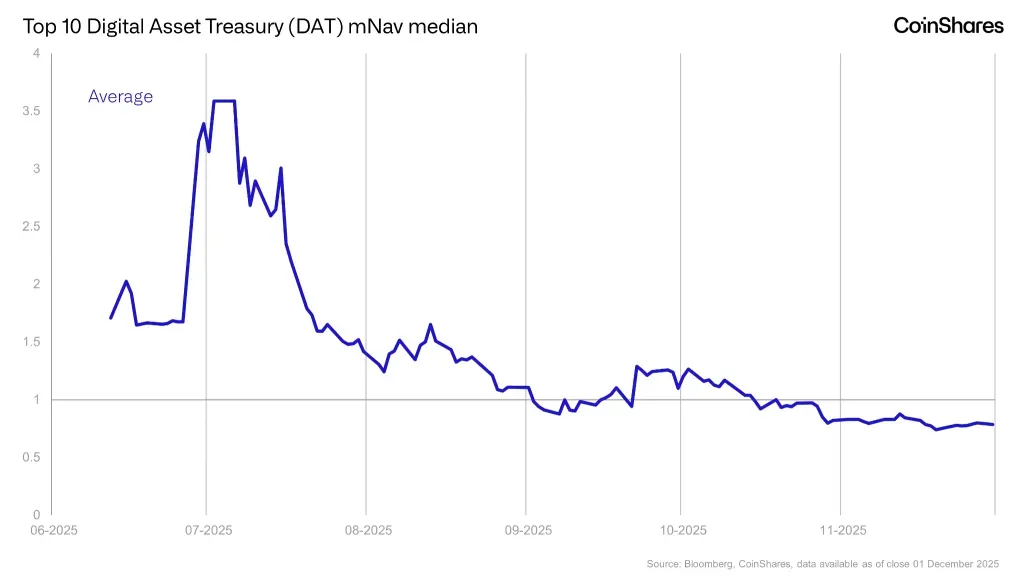

But last year dozens of firms began copying Strategy’s approach. If the pioneer can still justify its buys, newcomers drew plenty of questions.

In all, 211 companies are accumulating bitcoin. They hold about 1.08m BTC—roughly $95.5bn—or 5.1% of supply.

Meanwhile spot bitcoin ETFs hold around 1.37m BTC ($112.5bn), or 6.57% of supply. Institutional vehicles thus control over 11% of the float.

A further 67 firms added Ethereum to their balance sheets, amassing 6.81m ETH worth $19.9bn (5.6% of circulating supply).

ETH ETFs hold 61m coins worth $17.9bn—5.07% of supply.

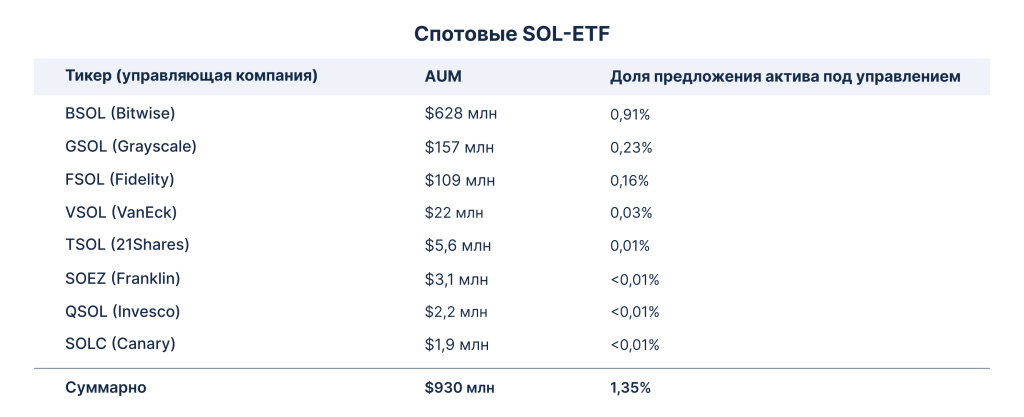

Eighteen organisations also hold Solana: 18.3m SOL worth $2.25bn (2.97% of supply).

Some firms are also accumulating BNB, Chainlink, Dogecoin, Hyperliquid, Sui and other assets.

Problems for DAT companies began after autumn’s correction: summer valuations often traded at 3x or even 10x premia, but the downturn pushed the median mNAV below one. Strategy’s stands near 0.8.

By year-end the growth of corporate crypto reserves slowed sharply; some experts likened the trend to a bubble. Coinbase Institutional called the corporate-bitcoin-reserve boom a key systemic risk.

Concerns over weaker players raised fears of cascading sell-offs, prompting caution.

Some risks have already materialised. In November DAT firm Sequans sold 970 BTC for $94.5m to repay debt after bitcoin fell; its shares slid 16%.

Critics also seized on the botched December debut of Twenty One Capital, backed by Cantor Fitzgerald and Tether. Its stock fell 20% on day one, despite the firm ranking third by bitcoin reserves.

A crash in the DAT segment could hit crypto hard. For now, with big players involved, the sector looks relatively stable—and 2026 does not obviously portend major trouble.

Celebrity memecoins

Of course, 2025 had its meme trend. The “quick” and vapid Solana memecoins faded; celebrity tokens took their place.

The wave was kicked off by the US president himself and TRUMP. On 18 January Mr Trump announced an “official” memecoin on Solana. It jumped 220% in a day.

By 19 January the token reached a $73 ATH, only to plunge soon after. TRUMP now trades near $5.

By NYT’s count, TRUMP investors sustained losses of roughly $2bn, affecting more than 813,000 users.

Beyond disgruntled buyers, the presidential token raised ethical concerns. The US Senate’s Permanent Subcommittee on Investigations opened a probe into possible conflicts of interest.

A subsequent promise of a dinner for TRUMP holders triggered calls for impeachment. No sanction has followed.

A day after TRUMP, Mr Trump’s wife launched another family token. MELANIA launched and traced a similar path on smaller volumes: a sharp pop followed by a collapse. From a $13 peak it trades near $0.10.

A token from Eric Trump, one of the president’s sons, met the same fate. ERICTRUMP’s market cap hit $140m within a day—before crashing 99%.

The saga prompted questions about possible insider trading. Some analysts found a trader group netted nearly $100m on MELANIA’s launch.

The political‑meme era did not end there. Its apex was LIBRA’s debut.

In February Argentina’s president, Javier Milei, promoted the token on social media; within hours it plunged 94%. Pitched as a “private initiative”, the project was touted as a tool to “stimulate Argentina’s economic growth”.

The uproar triggered a probe by the local Anti‑Corruption Office. Mr Milei was cleared, but the US Department of Justice opened its own investigation.

Analytics firm Bubblemaps linked LIBRA to Kelsier Ventures’ CEO, Hayden Davis. He and his team were behind several other memecoins, including MELANIA and YZY from rapper Kanye West.

All fraud charges were laid at Mr Davis’s and associates’ door. Despite an international wanted notice, he spent the year launching celebrity tokens and siphoning leftovers from wallets.

No celebrity tied to promoting the scams has been held to account.

In hindsight every headline celebrity memecoin launch of 2025 ended in failure. Yet star wattage and belief kept retail buying. One hopes the carousel of scams taught some not to trust easy money in crypto—even when promised by a president.

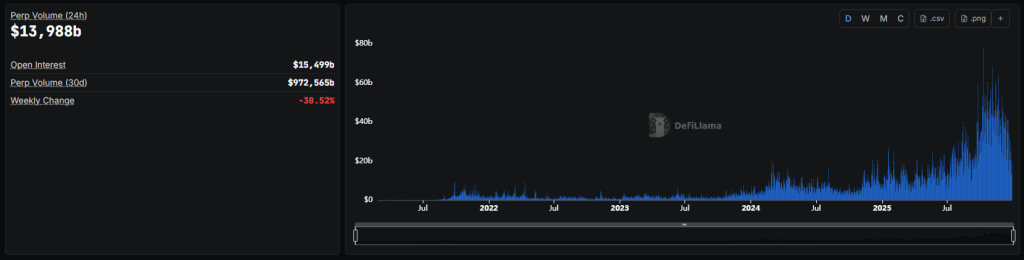

Perp‑DEX

For DeFi, 2025’s breakout was perp-DEX—decentralised derivatives exchanges. In November their volumes reached $1.31trn; for an incomplete December, $972m.

Current leaders are Lighter ($203bn), Aster ($171bn in the past 30 days) and Hyperliquid ($160bn).

Hyperliquid deserves much of the credit for the category’s rise. High transaction speed, no KYC and ample liquidity made it a favoured venue for whales.

It also let the market track big players’ moves, including James Wynn.

Hyperliquid did not keep the volume crown for long. Aster—a decentralised venue for perpetuals—overtook it, helped along by Binance founder Changpeng Zhao.

Points drove user growth, while Mr Zhao’s presence amplified buzz. Within days of its September launch, ASTER’s capitalisation reached several billion dollars, though it fell markedly by year-end.

TRON’s founder, Justin Sun, joined the fray too, announcing the SunPerp futures platform in October.

The frenzy was stoked by Lighter, which uses ZKP technologies for verification. In autumn it launched an L2 mainnet and quickly grabbed top‑tier trading volumes.

There were challenges. Early in the year Hyperliquid faced a string of controversies, including accusations about validator centralisation, DAO governance and contentious leadership decisions.

On 26 March high‑risk positions of about $8m on the DEX also threatened platform stability and the Hyperliquidity Provider Vault’s client funds.

Later Aster, too, was suspected of inflating volume statistics. The negativity failed to dent trader interest. With trust in centralised platforms eroding, perp‑DEXs are grabbing ever more market share.

Altcoin ETFs

The mass launch of altcoin exchange-traded funds was another positive outcome of US rule‑making—specifically, the replacement of the SEC chair from Gary Gensler to Paul Atkins.

Over the year, issuers rolled out products tied to coins previously “unacceptable” to the regulator. These included ETH ETFs with staking and combination funds.

In September the US launched the first spot ETFs on XRP and Dogecoin from REX Shares and Osprey Funds. Both are not classic ETFs, having been registered under the Investment Company Act of 1940 via simplified listing.

In mid‑November “full” XRP ETFs were approved. Canary (XRPC), 21Shares (TOXR), Grayscale (GXRP), Bitwise (XRP) and Franklin Templeton (XRPZ) offer spot products holding $1.1bn—0.98% of XRP supply.

On 28 October Bitwise launched BSOL on the NYSE—the first spot Solana ETF with staking. The firm stakes 100% of assets.

The next day Grayscale rolled out GSOL, converted from a trust, with 77% of coins staked. Six other firms offer SOL funds.

In late autumn Grayscale also launched a DOGE ETF. Bitwise followed with a similar product.

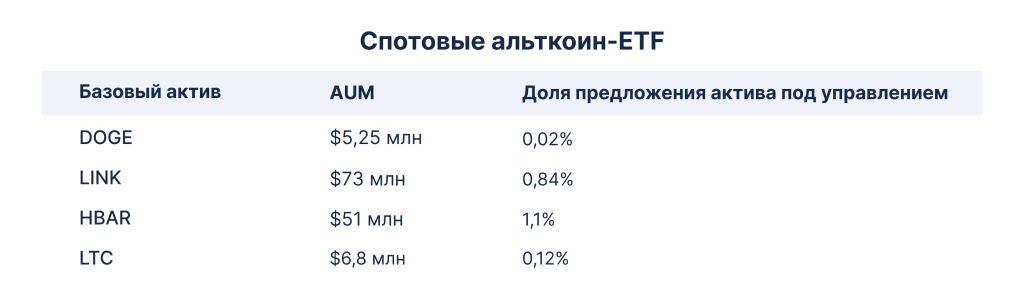

Other US‑listed altcoins include LINK, HBAR and LTC.

Issuers’ activity—and many instruments’ early success—suggest this trend continues into 2026.

Experts reckon traditional investors will soon access a broader suite of crypto products, offering not only exposure to the underlying asset but also features such as staking.

***

Last year cemented digital assets: institutions arrived and rules took shape. Bitcoin is being taken seriously; blockchains are now fixtures of finance.

The road ahead is not perfectly clear—and some see “tradification” as betrayal—but crypto stands firmly and is ready for what comes next.

Stay with ForkLog. Happy New Year!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!